Fresh off passing massive tax cuts for corporations and the wealthy, Trump and congressional Republicans want to use the deficit they've created to justify huge cuts to Social Security, Medicare, and Medicaid.

As House Speaker Paul Ryan says "We're going to have to get... at entitlement reform, which is how you tackle the debt and the deficit."

Don't let them get away with it.

Social Security and Medicare are critical safety-nets for working and middle-class families.

Before they existed, Americans faced grim prospects. In 1935, the year Social Security was enacted, roughly half of America's seniors lived in poverty. By the 1960s poverty among seniors had dropped significantly, but medical costs were still a major financial burden and only half of Americans aged 65 and over had health insurance. Medicare fixed that, guaranteeing health care for older Americans.

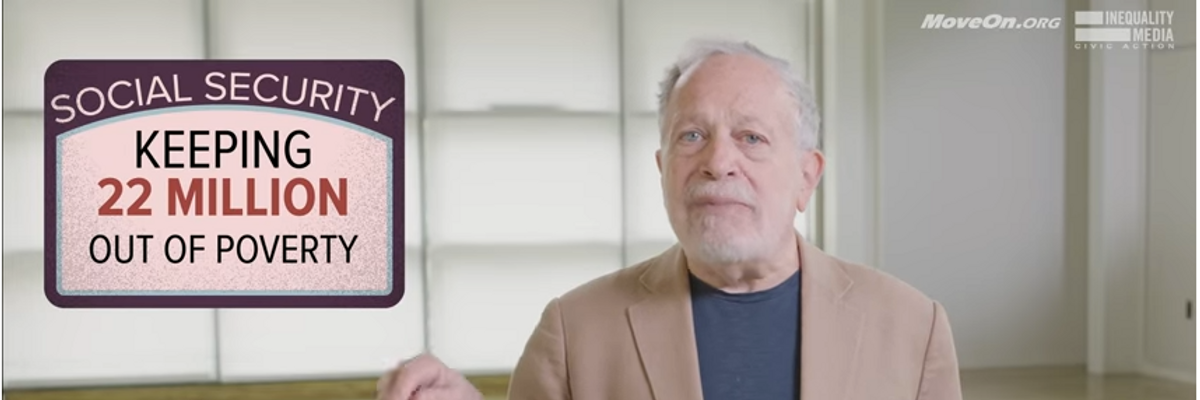

Today less than 10 percent of seniors live in poverty and almost all have access to health care. According to an analysis of census data, Social Security payments keep an estimated 22 million Americans from slipping into poverty.

Medicaid is also a vital lifeline for America's elderly and the poor. Yet the Trump administration has already started whittling it away by encouraging states to impose work requirements on Medicaid recipients.

Republicans like to call these programs "entitlements," as if they're some kind of giveaway. But Americans pay into Social Security and Medicare throughout their entire working lives. It's Americans' own money they're getting back through these programs.

These vital safety nets should be strengthened, not weakened. How?

1. Lift the ceiling on income subject to the Social Security tax. Currently, top earners only pay Social Security taxes on the first $120,000 of their yearly income. So the rich end up, in effect, paying a lower Social Security tax rate than everyone else. Lifting the ceiling on what wealthy Americans contribute would help pay for the Baby Boomers retirements and leave Social Security in good shape for Millennials.

2. Allow Medicare to negotiate with drug companies for lower prescription drug prices. As the nation's largest insurer, Medicare has tremendous bargaining power. Why should Americans pay far more for drugs than people in any other country?

3. Finally, reduce overall health costs and create a stronger workforce by making Medicare available to all. There's no excuse for the richest nation in the world to have 28 million Americans still uninsured.

We need to not just secure, but revitalize Social Security and these other programs for our children, and for our children's children. Millennials just overtook Baby Boomers as our nation's largest demographic. For them -- for all of us -- we need to say loud and clear to all of our members of congress: Hands off Medicare, Medicaid, and Social Security. Expand and improve these programs: don't cut them.