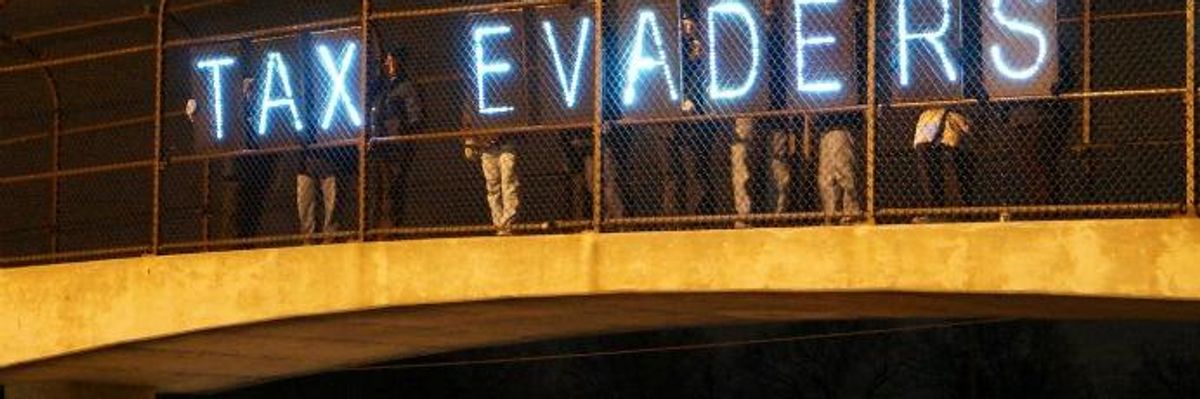

Nations "turbocharge their inequality" when they "let their wealthiest carve generous loopholes in their tax codes," the author writes. (Photo: Joe Brusky/flickr/cc)

A Bigger Welcome Mat for America's Tax Evaders

The GOP tax cut enacted in December and the just-passed federal budget give would-be affluent tax cheats both motive and plenty of opportunity.

Every nation levies taxes. Some nations levy well. In these admirable nations, tax systems spread the tax burden fairly. Those who can readily afford to pay more in taxes do pay more.

Other nations tax poorly. They set low tax rates on high incomes. Officials in these nations let their wealthiest carve generous loopholes in their tax codes. They wink at outright tax evasion.

Nations that go down this sorry second path don't just lose out on revenue they ought to be raising. They turbocharge their inequality. They invite corruption. They poison their civic culture -- and eventually, once enough poison takes hold, crash their economies.

This crashing played out earlier this century most notably in Greece. That nation's economic life essentially collapsed, the Economist business magazine noted six years ago, amid a tax evasion that had evolved into "less an under-the-radar activity, more a social norm."

The Greek wealthy, the Economist observed, established that norm. Greece's most "egregious" tax cheating, researchers had found, "happens higher up the wealth ladder."

The United States hasn't hit -- yet -- the levels of tax evasion that leveled Greece. But we're moving in that direction, ever more deliberately. This past winter saw lawmakers shove us further down this perilous path in two major pieces of legislation.

The first shove came this past December when Congress passed and the President signed into law the GOP" Tax Cuts and Jobs Act." The legislation created no jobs. It did cut tax rates, and munificently so for America's rich and the corporations they own and manage.

But this tax-cut legislation, largely under the radar, also made changes that openly welcome tax evasion.

How so? We know from IRS research that tax evasion flourishes outside the world of W-2s. Only 1 percent of income subject to paycheck withholding, the agency calculates, goes unreported at tax time. By contrast, the share of income that goes unreported from taxpayers who basically self-report their earnings ranges from 16 percent for partnerships to 63 percent for nonfarm proprietors.

That shouldn't surprise anyone. Self-reporting entities, as the Boston Globe's Evan Horowitz points out, have no third party around -- no employer or investment manager -- with a responsibility to pass on income details to the IRS "in a non-self-interested way."

The new GOP tax legislation creates a complex new tax break for these sole proprietorships and other "pass-through" businesses. Pass-throughs -- outfits where profits go directly to owners and get added, at least in theory, to their personal income -- can now deduct 20 percent of their business income before calculating how much they owe Uncle Sam.

This sweet deduction will, naturally, encourage many more taxpayers to reorganize themselves as pass-through operations. By claiming "pass-through" status, they'll get that 20 percent discount. Some will get more. They'll get all sorts of opportunities for underreporting their overall income.

Critics of the GOP tax-cut legislation brought up these underreporting dangers before the bill's passage, and the bill's supporters did insert into the final legislation various clauses designed to prevent richer Americans from exploiting the new pass-through deduction.

But these clauses need to be enforced to be effective, and GOP lawmakers have been doing their best, for quite some time now, to make that enforcement impossible. For almost a quarter-century, they've been demonizing the IRS as a den of thuggish storm troopers out to gouge average Americans, and these relentless GOP attacks have had a major budget impact. Over the past eight years, lawmakers have squeezed about $1 billion -- and 18,000 staff positions -- out of the IRS.

And that brings us to the second step Congress took this winter to keep tax evaders safe and nurture new ones. Earlier this month, with spring fast approaching, lawmakers put the finishing touches on an omnibus federal budget package that leaves the woefully underfinanced IRS woefully underfinanced.

The new budget legislation gives the IRS $77 million less than what the agency requested to implement the tax legislation passed in December. The new budget does increase overall IRS funding, after years of GOP cuts to the agency, but funding for the IRS remains, the Washington Post reports, "down from the $12.1 billion the IRS received in 2010, a year in which the tax collection agency was not tasked with enforcing the biggest overhaul of the federal tax code in several decades."

The most recent IRS study on taxpayer income that's going unreported covers the years 2008 through 2010. That study put the "overall voluntary compliance rate" of American taxpayers at 81.7 percent. Or, to put the matter more starkly, over 18 percent of income nearly a decade ago was evading taxes.

That figure will now likely get significantly worse, and so will inequality, unless we undo what this past winter has wrought.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Every nation levies taxes. Some nations levy well. In these admirable nations, tax systems spread the tax burden fairly. Those who can readily afford to pay more in taxes do pay more.

Other nations tax poorly. They set low tax rates on high incomes. Officials in these nations let their wealthiest carve generous loopholes in their tax codes. They wink at outright tax evasion.

Nations that go down this sorry second path don't just lose out on revenue they ought to be raising. They turbocharge their inequality. They invite corruption. They poison their civic culture -- and eventually, once enough poison takes hold, crash their economies.

This crashing played out earlier this century most notably in Greece. That nation's economic life essentially collapsed, the Economist business magazine noted six years ago, amid a tax evasion that had evolved into "less an under-the-radar activity, more a social norm."

The Greek wealthy, the Economist observed, established that norm. Greece's most "egregious" tax cheating, researchers had found, "happens higher up the wealth ladder."

The United States hasn't hit -- yet -- the levels of tax evasion that leveled Greece. But we're moving in that direction, ever more deliberately. This past winter saw lawmakers shove us further down this perilous path in two major pieces of legislation.

The first shove came this past December when Congress passed and the President signed into law the GOP" Tax Cuts and Jobs Act." The legislation created no jobs. It did cut tax rates, and munificently so for America's rich and the corporations they own and manage.

But this tax-cut legislation, largely under the radar, also made changes that openly welcome tax evasion.

How so? We know from IRS research that tax evasion flourishes outside the world of W-2s. Only 1 percent of income subject to paycheck withholding, the agency calculates, goes unreported at tax time. By contrast, the share of income that goes unreported from taxpayers who basically self-report their earnings ranges from 16 percent for partnerships to 63 percent for nonfarm proprietors.

That shouldn't surprise anyone. Self-reporting entities, as the Boston Globe's Evan Horowitz points out, have no third party around -- no employer or investment manager -- with a responsibility to pass on income details to the IRS "in a non-self-interested way."

The new GOP tax legislation creates a complex new tax break for these sole proprietorships and other "pass-through" businesses. Pass-throughs -- outfits where profits go directly to owners and get added, at least in theory, to their personal income -- can now deduct 20 percent of their business income before calculating how much they owe Uncle Sam.

This sweet deduction will, naturally, encourage many more taxpayers to reorganize themselves as pass-through operations. By claiming "pass-through" status, they'll get that 20 percent discount. Some will get more. They'll get all sorts of opportunities for underreporting their overall income.

Critics of the GOP tax-cut legislation brought up these underreporting dangers before the bill's passage, and the bill's supporters did insert into the final legislation various clauses designed to prevent richer Americans from exploiting the new pass-through deduction.

But these clauses need to be enforced to be effective, and GOP lawmakers have been doing their best, for quite some time now, to make that enforcement impossible. For almost a quarter-century, they've been demonizing the IRS as a den of thuggish storm troopers out to gouge average Americans, and these relentless GOP attacks have had a major budget impact. Over the past eight years, lawmakers have squeezed about $1 billion -- and 18,000 staff positions -- out of the IRS.

And that brings us to the second step Congress took this winter to keep tax evaders safe and nurture new ones. Earlier this month, with spring fast approaching, lawmakers put the finishing touches on an omnibus federal budget package that leaves the woefully underfinanced IRS woefully underfinanced.

The new budget legislation gives the IRS $77 million less than what the agency requested to implement the tax legislation passed in December. The new budget does increase overall IRS funding, after years of GOP cuts to the agency, but funding for the IRS remains, the Washington Post reports, "down from the $12.1 billion the IRS received in 2010, a year in which the tax collection agency was not tasked with enforcing the biggest overhaul of the federal tax code in several decades."

The most recent IRS study on taxpayer income that's going unreported covers the years 2008 through 2010. That study put the "overall voluntary compliance rate" of American taxpayers at 81.7 percent. Or, to put the matter more starkly, over 18 percent of income nearly a decade ago was evading taxes.

That figure will now likely get significantly worse, and so will inequality, unless we undo what this past winter has wrought.

Every nation levies taxes. Some nations levy well. In these admirable nations, tax systems spread the tax burden fairly. Those who can readily afford to pay more in taxes do pay more.

Other nations tax poorly. They set low tax rates on high incomes. Officials in these nations let their wealthiest carve generous loopholes in their tax codes. They wink at outright tax evasion.

Nations that go down this sorry second path don't just lose out on revenue they ought to be raising. They turbocharge their inequality. They invite corruption. They poison their civic culture -- and eventually, once enough poison takes hold, crash their economies.

This crashing played out earlier this century most notably in Greece. That nation's economic life essentially collapsed, the Economist business magazine noted six years ago, amid a tax evasion that had evolved into "less an under-the-radar activity, more a social norm."

The Greek wealthy, the Economist observed, established that norm. Greece's most "egregious" tax cheating, researchers had found, "happens higher up the wealth ladder."

The United States hasn't hit -- yet -- the levels of tax evasion that leveled Greece. But we're moving in that direction, ever more deliberately. This past winter saw lawmakers shove us further down this perilous path in two major pieces of legislation.

The first shove came this past December when Congress passed and the President signed into law the GOP" Tax Cuts and Jobs Act." The legislation created no jobs. It did cut tax rates, and munificently so for America's rich and the corporations they own and manage.

But this tax-cut legislation, largely under the radar, also made changes that openly welcome tax evasion.

How so? We know from IRS research that tax evasion flourishes outside the world of W-2s. Only 1 percent of income subject to paycheck withholding, the agency calculates, goes unreported at tax time. By contrast, the share of income that goes unreported from taxpayers who basically self-report their earnings ranges from 16 percent for partnerships to 63 percent for nonfarm proprietors.

That shouldn't surprise anyone. Self-reporting entities, as the Boston Globe's Evan Horowitz points out, have no third party around -- no employer or investment manager -- with a responsibility to pass on income details to the IRS "in a non-self-interested way."

The new GOP tax legislation creates a complex new tax break for these sole proprietorships and other "pass-through" businesses. Pass-throughs -- outfits where profits go directly to owners and get added, at least in theory, to their personal income -- can now deduct 20 percent of their business income before calculating how much they owe Uncle Sam.

This sweet deduction will, naturally, encourage many more taxpayers to reorganize themselves as pass-through operations. By claiming "pass-through" status, they'll get that 20 percent discount. Some will get more. They'll get all sorts of opportunities for underreporting their overall income.

Critics of the GOP tax-cut legislation brought up these underreporting dangers before the bill's passage, and the bill's supporters did insert into the final legislation various clauses designed to prevent richer Americans from exploiting the new pass-through deduction.

But these clauses need to be enforced to be effective, and GOP lawmakers have been doing their best, for quite some time now, to make that enforcement impossible. For almost a quarter-century, they've been demonizing the IRS as a den of thuggish storm troopers out to gouge average Americans, and these relentless GOP attacks have had a major budget impact. Over the past eight years, lawmakers have squeezed about $1 billion -- and 18,000 staff positions -- out of the IRS.

And that brings us to the second step Congress took this winter to keep tax evaders safe and nurture new ones. Earlier this month, with spring fast approaching, lawmakers put the finishing touches on an omnibus federal budget package that leaves the woefully underfinanced IRS woefully underfinanced.

The new budget legislation gives the IRS $77 million less than what the agency requested to implement the tax legislation passed in December. The new budget does increase overall IRS funding, after years of GOP cuts to the agency, but funding for the IRS remains, the Washington Post reports, "down from the $12.1 billion the IRS received in 2010, a year in which the tax collection agency was not tasked with enforcing the biggest overhaul of the federal tax code in several decades."

The most recent IRS study on taxpayer income that's going unreported covers the years 2008 through 2010. That study put the "overall voluntary compliance rate" of American taxpayers at 81.7 percent. Or, to put the matter more starkly, over 18 percent of income nearly a decade ago was evading taxes.

That figure will now likely get significantly worse, and so will inequality, unless we undo what this past winter has wrought.