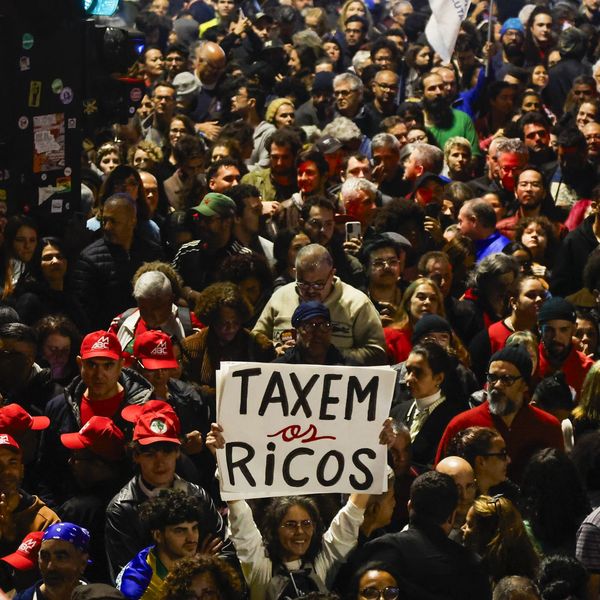

Once the law is fully in effect eight years from now, the imbalance will get even worse: 83% of the benefits will go to One Percenters. (J. Scott Applewhite / AP)

Tax Day 2019 Finds A Tax System Skewed to the Rich and Powerful

Congress can begin by repealing the tax cuts for the rich and corporations in the recent GOP tax law. Then it can start closing all the other special loopholes inserted in our tax code over the years by the wealthy and well-connected.

Tax Day, when we settle our personal accounts with Uncle Sam, is also a good day to take account of our tax system overall. That's especially true this year, when the first tax returns prepared under the new rules of the Trump-GOP tax law are due. We should be asking whether our system is fair, whether it raises the revenue we need, whether it promotes economic growth and equality.

The answer to all three questions is, unfortunately, no. The tax code, already full of loopholes for the wealthy and corporations, was laden with even more by the new tax law. That law will also add nearly $2 trillion to the national debt, endangering services like Medicare, Medicaid and education, as well as vital new initiatives like lowering healthcare costs and improving road and bridges.

The Trump-GOP tax cuts is doing little to promote economic growth, but a lot to promote economic inequality, even as the gap between rich and poor reaches Gilded Age proportions.

And the Trump-GOP tax cuts is doing little to promote economic growth, but a lot to promote economic inequality, even as the gap between rich and poor reaches Gilded Age proportions.

Over 20% of the Trump-GOP tax cuts are estimated to have gone to the wealthiest 1% of Americans last year. And once the law is fully in effect eight years from now, the imbalance will get even worse: 83% of the benefits will go to One Percenters. Big profitable corporations got a 40% cut in their tax rate. And the new tax rate on the foreign profits of U.S. companies is only half the domestic rate, creating big incentives to shift jobs and profits offshore.

Republicans desperate to enact their skewed-to-the-rich tax plan assured the American people the tax cuts would pay for themselves. Wrong. The federal budget deficit jumped by almost $100 billion in the first quarter of the current fiscal year alone compared to the same period last year, before the Republican tax law went into effect. Contributing to that growing budget gap was a nearly one-third drop in corporate tax receipts.

Rather than reverse all their tax giveaways to the wealthy, Republicans want to make up the shortfall by cutting public services working families rely on--while, incredibly, cutting taxes on the wealthy even more. In his recently released budget, President Trump proposed slashing $1.4 trillion from Medicare, Medicaid and the Affordable Care Act (ACA), while cutting taxes by $1.1 trillion, once again mostly to the benefit of the rich.

Trump doesn't just want to cut the ACA's budget--he wants to eliminate it altogether. That would cost 20 million Americans their health insurance, while taking away the protection for 130 million people with pre-existing medical conditions who would pay more or not be able to afford insurance without the ACA.

Big winners from the ACA repeal are the wealthy, along with prescription drug firms and health insurers, whose steadily rising prices squeeze the same families facing reduced public services. That's because they'd no longer pay $600 billion in taxes to help people afford insurance.

President Trump promised workers would benefit from the corporate tax cuts, guaranteeing that working families would get a $4,000 boost in wages. Nearly a year-and-a-half later, according to a tally by Americans for Tax Fairness, only 4% of employees have seen any increase in their compensation tied to the tax cuts, and the great majority of those payouts have been one-time bonuses, not permanent raises.

Corporations aren't spending their tax savings in any significant way on increased investment, either. Where the dollars are really going, predictably, is into the bank accounts of powerful CEOs and wealthy shareholders. Corporations have announced over $1 trillion in stock buybacks since the Republican plan was signed into law. These boost the price of stocks, and most stock is owned by the wealthy.

So, a Tax Day review of our tax system yields troubling results. But we can fix that. Congress can begin by repealing the tax cuts for the rich and corporations in the recent GOP tax law. Then it can start closing all the other special loopholes inserted in our tax code over the years by the wealthy and well-connected.

Those cost us trillions of dollars in public revenue we need to fulfill solemn promises we've made to ourselves, like Social Security and Medicare, as well as invest in our future through bold new investments. Once those loopholes are closed, on some future Tax Day we can count ourselves proud participants in a fair share tax system.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Tax Day, when we settle our personal accounts with Uncle Sam, is also a good day to take account of our tax system overall. That's especially true this year, when the first tax returns prepared under the new rules of the Trump-GOP tax law are due. We should be asking whether our system is fair, whether it raises the revenue we need, whether it promotes economic growth and equality.

The answer to all three questions is, unfortunately, no. The tax code, already full of loopholes for the wealthy and corporations, was laden with even more by the new tax law. That law will also add nearly $2 trillion to the national debt, endangering services like Medicare, Medicaid and education, as well as vital new initiatives like lowering healthcare costs and improving road and bridges.

The Trump-GOP tax cuts is doing little to promote economic growth, but a lot to promote economic inequality, even as the gap between rich and poor reaches Gilded Age proportions.

And the Trump-GOP tax cuts is doing little to promote economic growth, but a lot to promote economic inequality, even as the gap between rich and poor reaches Gilded Age proportions.

Over 20% of the Trump-GOP tax cuts are estimated to have gone to the wealthiest 1% of Americans last year. And once the law is fully in effect eight years from now, the imbalance will get even worse: 83% of the benefits will go to One Percenters. Big profitable corporations got a 40% cut in their tax rate. And the new tax rate on the foreign profits of U.S. companies is only half the domestic rate, creating big incentives to shift jobs and profits offshore.

Republicans desperate to enact their skewed-to-the-rich tax plan assured the American people the tax cuts would pay for themselves. Wrong. The federal budget deficit jumped by almost $100 billion in the first quarter of the current fiscal year alone compared to the same period last year, before the Republican tax law went into effect. Contributing to that growing budget gap was a nearly one-third drop in corporate tax receipts.

Rather than reverse all their tax giveaways to the wealthy, Republicans want to make up the shortfall by cutting public services working families rely on--while, incredibly, cutting taxes on the wealthy even more. In his recently released budget, President Trump proposed slashing $1.4 trillion from Medicare, Medicaid and the Affordable Care Act (ACA), while cutting taxes by $1.1 trillion, once again mostly to the benefit of the rich.

Trump doesn't just want to cut the ACA's budget--he wants to eliminate it altogether. That would cost 20 million Americans their health insurance, while taking away the protection for 130 million people with pre-existing medical conditions who would pay more or not be able to afford insurance without the ACA.

Big winners from the ACA repeal are the wealthy, along with prescription drug firms and health insurers, whose steadily rising prices squeeze the same families facing reduced public services. That's because they'd no longer pay $600 billion in taxes to help people afford insurance.

President Trump promised workers would benefit from the corporate tax cuts, guaranteeing that working families would get a $4,000 boost in wages. Nearly a year-and-a-half later, according to a tally by Americans for Tax Fairness, only 4% of employees have seen any increase in their compensation tied to the tax cuts, and the great majority of those payouts have been one-time bonuses, not permanent raises.

Corporations aren't spending their tax savings in any significant way on increased investment, either. Where the dollars are really going, predictably, is into the bank accounts of powerful CEOs and wealthy shareholders. Corporations have announced over $1 trillion in stock buybacks since the Republican plan was signed into law. These boost the price of stocks, and most stock is owned by the wealthy.

So, a Tax Day review of our tax system yields troubling results. But we can fix that. Congress can begin by repealing the tax cuts for the rich and corporations in the recent GOP tax law. Then it can start closing all the other special loopholes inserted in our tax code over the years by the wealthy and well-connected.

Those cost us trillions of dollars in public revenue we need to fulfill solemn promises we've made to ourselves, like Social Security and Medicare, as well as invest in our future through bold new investments. Once those loopholes are closed, on some future Tax Day we can count ourselves proud participants in a fair share tax system.

Tax Day, when we settle our personal accounts with Uncle Sam, is also a good day to take account of our tax system overall. That's especially true this year, when the first tax returns prepared under the new rules of the Trump-GOP tax law are due. We should be asking whether our system is fair, whether it raises the revenue we need, whether it promotes economic growth and equality.

The answer to all three questions is, unfortunately, no. The tax code, already full of loopholes for the wealthy and corporations, was laden with even more by the new tax law. That law will also add nearly $2 trillion to the national debt, endangering services like Medicare, Medicaid and education, as well as vital new initiatives like lowering healthcare costs and improving road and bridges.

The Trump-GOP tax cuts is doing little to promote economic growth, but a lot to promote economic inequality, even as the gap between rich and poor reaches Gilded Age proportions.

And the Trump-GOP tax cuts is doing little to promote economic growth, but a lot to promote economic inequality, even as the gap between rich and poor reaches Gilded Age proportions.

Over 20% of the Trump-GOP tax cuts are estimated to have gone to the wealthiest 1% of Americans last year. And once the law is fully in effect eight years from now, the imbalance will get even worse: 83% of the benefits will go to One Percenters. Big profitable corporations got a 40% cut in their tax rate. And the new tax rate on the foreign profits of U.S. companies is only half the domestic rate, creating big incentives to shift jobs and profits offshore.

Republicans desperate to enact their skewed-to-the-rich tax plan assured the American people the tax cuts would pay for themselves. Wrong. The federal budget deficit jumped by almost $100 billion in the first quarter of the current fiscal year alone compared to the same period last year, before the Republican tax law went into effect. Contributing to that growing budget gap was a nearly one-third drop in corporate tax receipts.

Rather than reverse all their tax giveaways to the wealthy, Republicans want to make up the shortfall by cutting public services working families rely on--while, incredibly, cutting taxes on the wealthy even more. In his recently released budget, President Trump proposed slashing $1.4 trillion from Medicare, Medicaid and the Affordable Care Act (ACA), while cutting taxes by $1.1 trillion, once again mostly to the benefit of the rich.

Trump doesn't just want to cut the ACA's budget--he wants to eliminate it altogether. That would cost 20 million Americans their health insurance, while taking away the protection for 130 million people with pre-existing medical conditions who would pay more or not be able to afford insurance without the ACA.

Big winners from the ACA repeal are the wealthy, along with prescription drug firms and health insurers, whose steadily rising prices squeeze the same families facing reduced public services. That's because they'd no longer pay $600 billion in taxes to help people afford insurance.

President Trump promised workers would benefit from the corporate tax cuts, guaranteeing that working families would get a $4,000 boost in wages. Nearly a year-and-a-half later, according to a tally by Americans for Tax Fairness, only 4% of employees have seen any increase in their compensation tied to the tax cuts, and the great majority of those payouts have been one-time bonuses, not permanent raises.

Corporations aren't spending their tax savings in any significant way on increased investment, either. Where the dollars are really going, predictably, is into the bank accounts of powerful CEOs and wealthy shareholders. Corporations have announced over $1 trillion in stock buybacks since the Republican plan was signed into law. These boost the price of stocks, and most stock is owned by the wealthy.

So, a Tax Day review of our tax system yields troubling results. But we can fix that. Congress can begin by repealing the tax cuts for the rich and corporations in the recent GOP tax law. Then it can start closing all the other special loopholes inserted in our tax code over the years by the wealthy and well-connected.

Those cost us trillions of dollars in public revenue we need to fulfill solemn promises we've made to ourselves, like Social Security and Medicare, as well as invest in our future through bold new investments. Once those loopholes are closed, on some future Tax Day we can count ourselves proud participants in a fair share tax system.