Bernie Sanders and Elizabeth Warren have both offered proposals to cancel student debt, a nearly $1.6 trillion burden on borrowers and a major drag on the economy. While both are aggressive attempts to address the student debt crisis, there is a major difference between the two plans: the Sanders plan is likely to create at least one million more jobs than Warren's, since it cancels roughly $1 trillion more in outstanding debt.

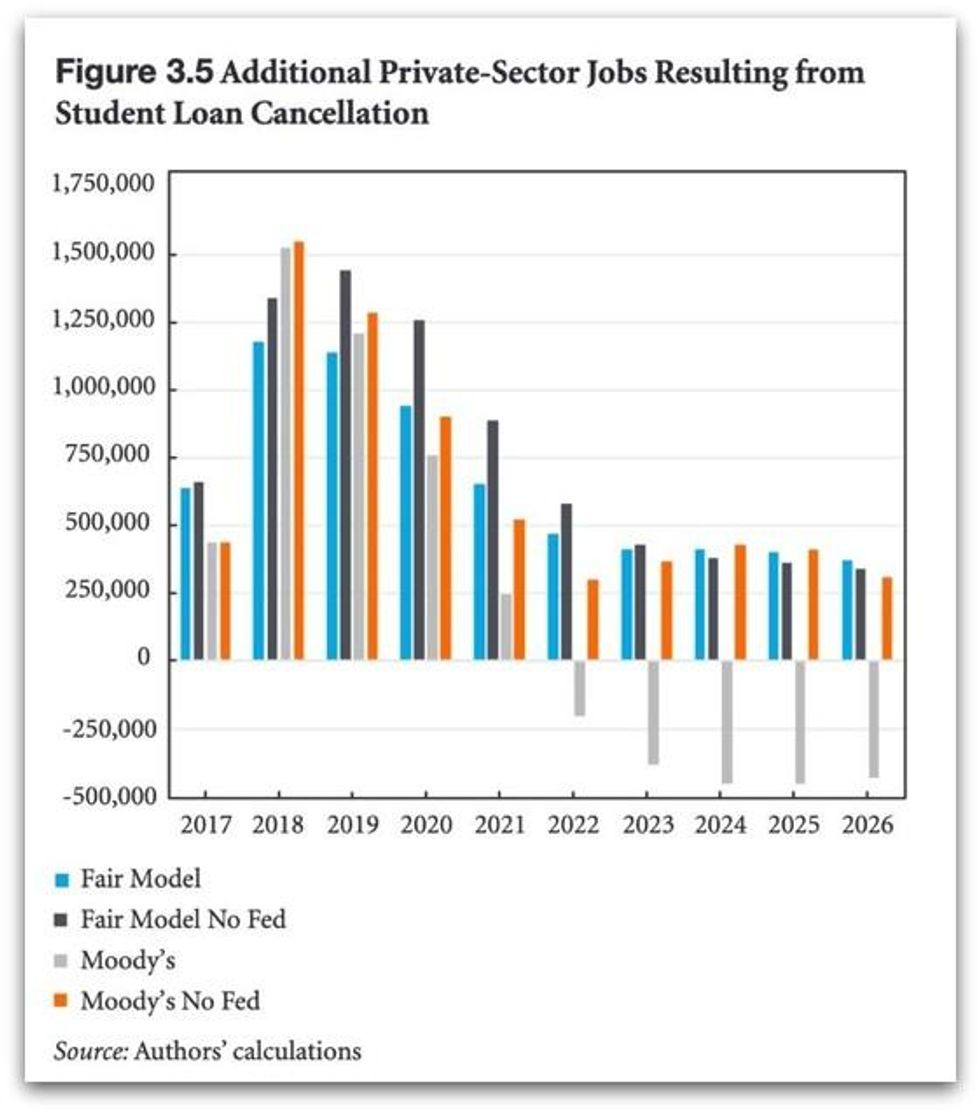

The figure of one million additional jobs was derived from the conclusions of a 2018 report from the Levy Economics Institute at Bard College, which used widely accepted macroeconomic models (the Fair and Moody's models) to project the macroeconomic effect of canceling all student debt. The Levy report used a start date in 2017 for its projections.

As the graph below shows, the models used in the Levy report show that several million jobs are created by the cancellation of all student debt (the exact amount varies, depending on the economic model used):

Averaging these figures, the report shows that approximately 4.4 million jobs would be created by full cancellation in the first five years. Using these figures, it's possible to approximate the differing effects of the Warren and Sanders plan with the following steps:

First, reducing the Levy report's numbers by 60 percent gives us something in the neighborhood of 2.6 million fewer jobs under Warren's plan. Given that the debt is now larger than it was in the Levy study, that number could be bumped by 10 or 15 percent.

That calculation is, however, too crude. It's fair to assume that the stimulus effect of cancellation is greater on the lower end of the income spectrum, where urgent needs are going unmet, and would be somewhat smaller for the relatively well-off (although not wealthy) households included in the Sanders plan. The multiplier effect of government stimulus measures is also likely to be smaller in the current economy. To ensure that these factors are considered, I have cut the job difference by nearly half to arrive at the figure of one million more jobs created with full cancellation.

The idea that student debt cancellation creates jobs is intuitive, as well. If 44 million student debt holders are relieved of their debt burden, they will have more money to spend each month for food, entertainment, and other purchases. Studies have shown that student debt is also keeping younger people from forming households (which, ironically, means a lower benefit under the Warren plan if they're living with their parents). Household formation, which is the result of longer-term thinking about affordability, in turn means the purchase of home items, cars, and houses.

With those factors in mind, I asked the lead author of the Levy report whether it would be safe to say that the Sanders plan would create a million more jobs than the Warren plan. Professor Stephanie Kelton, of Stony Brook University, replied that a full study would be required to answer the question with confidence. But Kelton said the one-million-jobs figure "looks reasonable." (Kelton, an adviser to Sen. Sanders, is also a macroeconomist and professor. She is not employed by the campaign.)

Why It Matters

Both proposals would create jobs for working people, and the additional one million from Sanders' plan would be useful. Despite today's "excellent" job numbers, the working economy isn't as good as the headlines would have us believe. The number of open jobs (7.2 million) is essentially unchanged from last year's, and is declining slightly. That means there is relatively little pressure to pay workers more. Wage growth remains weak. It's not a great time to be a working person in this country.

The biggest losers in this job economy are millennials, the same group that bears the heaviest burden of student debt. (Student debt affects all adult age groups, including seniors, but falls heaviest on younger adults.) Millennials have become the largest generation in the American workforce, and are still suffering the economic consequences of entering the workforce during the Great Recession.

At $1.6 trillion, full student debt cancellation rivals Trump's tax cut in its scope. It would, however, be far more effective at creating jobs and stimulating the economy. Because the benefits of Trump's cut were directed toward higher earners, who have much less pressure to spend, the Trump cut left the trajectory of job growth essentially unchanged.

Muddled Debate

That distinction has been obscured in what has been, at least so far, a muddled debate.

Headlines like Vice's "Elizabeth Warren Is Taking Her Plan to Cancel 75% of Student Debt to Congress" have added to public confusion over the two candidates' plans. Warren's $640 billion proposal would, in fact, cancel only 40 percent of all outstanding student debt. The confusion has also been compounded, no doubt unintentionally, by Sen. Warren's remark during her second presidential debate that her plan would "cancel student debt for 95 percent of the people who have it."

That statement, while true, could leave some listeners with the wrong impression. Warren's plan would cancel at least some student debt for 95 percent of debt holders, and all debt for 75 percent of borrowers (the source of Vice's erroneous headline). But some borrowers owe more than others, which is why the Warren plan leaves roughly $1 trillion in student debt in place. Twenty-five percent of borrowers, more than 10 million people, would still have student debt under Warren's plan.

Warren's plan, unlike Sanders', caps the amount to be canceled at $50,000 per person. That figure is progressively reduced for income above $100,000 per year per household until it reaches $250,000, at which point no cancellation is offered. But households making $100,000 year aren't necessarily prosperous. While they are not impoverished, a working couple--say, a bus driver and schoolteacher making $51,000 each--aren't especially well-off by most standards, especially if they're raising children. If one or more children with student debt lives and works at home, their added income would further reduce the debt relief to a family that may well be struggling.

The desire to limit debt reductions for these households may have some tactical vote-seeking value, especially in a political culture that has directed intra-middle-class resentment toward better-off workers rather than the wealthy. That doesn't make it the best policy for working people of any age, race, or income level. In fact, because of its limits, Warren's plan would have a significantly smaller stimulus effect and would therefore help all workers somewhat less.

The Roots of Opposition

The point needs to be reiterated: Full student debt cancellation, of the kind Sanders is proposing, would create at least a million more jobs than the Warren plan. Why, then, would progressives oppose it?

Some of the liberal opposition is often grounded in the mistaken belief that Warren's plan would do more to reduce the racial wealth gap than Warren's. The opposite is true: full cancellation would reduce the racial wealth gap more than Warren's plan would. As economist Marshall Steinbaum, a co-author of the Levy report, later concluded: "The more debt cancellation there is, the more racial wealth inequality is reduced--at least among the plans that have actually been proposed."

There is also a deep attachment to targeted economic programs in certain liberal circles, based on the sense that government programs should be focused solely on individuals in dire need. (I wrote an essay in The American Prospect on that topic.) For student debt cancellation, this is often framed as a desire to avoid helping the "wealthy." But truly wealthy individuals are unlikely to hold student debt. If they have family wealth, there would have been no need to borrow for college. If they have subsequently become wealthy, their advisers have almost certainly told them to pay off student debt, which normally charges high interest rates.

It's true that there are some mildly prosperous professionals who hold a large amount of student debt. But it takes a strange moral logic to deny jobs for a million working people out of fear that, say, a well-to-do orthodontist on Long Island might get a break she doesn't deserve. There is no such liberal compunction about infrastructure programs, for example, even though they could make a few construction executives wealthy as they create jobs for working people.

The million-plus additional jobs created by full cancellation would go to a broad array of working people in a range of fields, in industries that range from restaurants to sales, and from auto manufacturing to construction. A large percentage of them would go to people of color, which would further reduce the racial wealth gap at a time when the African American unemployment rate remains roughly double that of whites.

Summary

To sum up:

- Full cancellation creates at least a million more jobs than Warren's partial cancellation

- Full cancellation does more to reduce the racial wealth gap than Warren's plan does

- Full cancellation will almost certainly do much more to benefit millennials, the generation that's been hardest hit by student debt and is the largest percentage of the workforce

- Full cancellation will almost certainly do much more to help black workers, who are experiencing twice the unemployment of white workers

There are other benefits to full cancellation, too. It's easier to explain to voters. Its million-job advantage makes it easier to build support among people who have never gone to college or acquired student debt, groups that might otherwise resent student debt cancellation. It would stimulate more economic growth, with greater advantages for the entire economy (including investors). And it wouldn't be subject to gaming, the way Warren's plan would be. (Children would claim to live elsewhere, people would move taxable income from year to year, couples would defer marriage, etc.)

Elizabeth Warren has many impressive policy proposals, and is very possibly unaware of the differing impact of her means-tested student debt plan on working people. There is every reason to hope she will reconsider after reviewing the advantages of a broader proposal, and join with Sen. Sanders in supporting full student debt cancellation.

This article was produced by Economy for All, a project of the Independent Media Institute.