Sara Nelson, the dynamic president of the Association of Flight Attendants-CWA, has made a powerful case for direct payroll subsidies to the employees who keep our airline industry passengers flying and safe, everyone from flight attendants and pilots to security screeners and wheelchair attendants. (Photo: Andrew Caballero-Reynolds/AFP/Getty Images)

How to Make the Airline Bailout Work for Workers, Not Just CEOs

The government should provide direct wage subsidies to airline workers while restricting CEO pay to no more than 50 times median wages.

The U.S. airline industry is asking for nearly $60 billion in taxpayer-funded direct assistance and loan guarantees. The industry clearly needs extraordinary help. The pandemic is grounding flights the world over. But who within the industry should get that help? Will the imminent airline bailout mostly benefit top executives and shareholders or center on protecting the industry's most vulnerable workers?

Sara Nelson, the dynamic president of the Association of Flight Attendants-CWA, has made a powerful case for direct payroll subsidies to the employees who keep our airline industry passengers flying and safe, everyone from flight attendants and pilots to security screeners and wheelchair attendants.

"Absent payroll subsidies, mass layoffs and furloughs are inevitable," Nelson notes. "This will have long-term consequences because nearly all aviation-related workers have to pass background checks and security and safety training requirements. If these lapse or people need to be rehired, it will slow aviation's return to service. If airlines are slow to recover, other industries will be too. Travel to business conferences, Disneyland, cruises, and casinos is dependent on a functioning aviation industry."

Sara Nelson, President of the Association of Flight Attendants-CWA

To keep our tax dollars from padding the pockets of executives and shareholders, Nelson is also demanding a ban on executive bonuses and stock buybacks, and we should all share her well-founded concerns about how airline executives would spend taxpayer bailouts if left to their own devices. Over the past decade, the airlines have taken profits that could have gone into long-term investments and squandered these earnings on stock buybacks, a legal form of stock manipulation that artificially inflates the value of company shares.

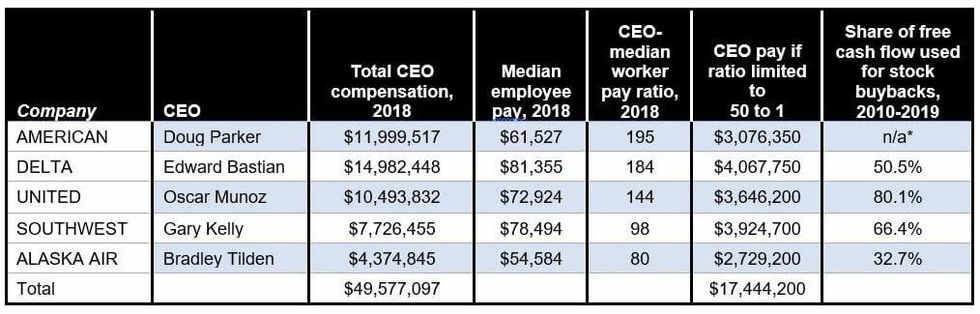

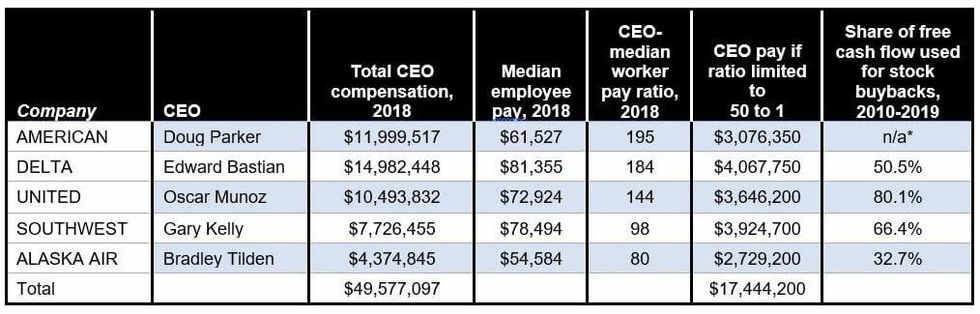

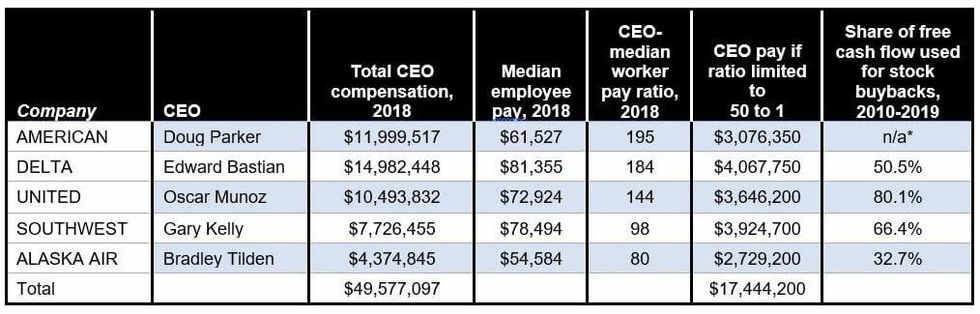

The table below shows how much the five biggest U.S. carriers spent on stock buybacks between 2010 and 2019 as a share of their "free cash flow" (the money left over after a company pays for its operating expenses and capital expenditures). The nation's largest carrier, American Airlines, had a negative free cash flow during this period and yet still spent $12.5 billion on buybacks.

Why have so many corporations been on a buyback spree? One major reason: This financial maneuver inflates the value of executive stock-based pay. In 2018, the CEOs of the five largest U.S. airlines averaged nearly $10 million in total compensation. Thanks to data the SEC now requires publicly held corporations to report, we know just how much larger these CEO paychecks run compared to the pay that each firm's typical workers receive. In 2018, the ratio between CEO and median employee pay at the five largest airlines ranged from 80 to 1 at Alaska Air to 195 to 1 at American.

Top 5 U.S. Airlines

* American Airlines had negative cumulative free cash flow over the decade, but spent $12.5 billion on buybacks. Source: Bloomberg. All other data from corporate proxy statements.

These numbers suggest that limiting the overall obscene pay rewards within the airline industry would neatly complement Nelson's proposals on banning executive bonuses and stock buybacks. We could accomplish that goal by conditioning crisis response assistance to the ratio between the pay that goes to CEOs and their most typical workers.

If we restricted CEO pay to no more than 50 times median worker pay, as the table above shows, and if these five airlines kept median worker pay at current levels, their CEOs could earn $2.7 million to $4.1 million and still stay below this 50:1 ratio threshold. Linking CEO pay to a multiple of worker pay would prevent taxpayer subsidies from pumping up executive pay and, at the same time, create an incentive to narrow internal pay divides by lifting up the bottom of the wage scale.

This pay ratio limit on bailout assistance should accompany other proposed pro-worker conditions, such as setting a $15 per hour wage minimum, requiring worker representation on boards, and banning anti-union activity.

In these worrisome times, taxpayers should not have to worry about their money flowing into the pockets of overpaid corporate executives.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The U.S. airline industry is asking for nearly $60 billion in taxpayer-funded direct assistance and loan guarantees. The industry clearly needs extraordinary help. The pandemic is grounding flights the world over. But who within the industry should get that help? Will the imminent airline bailout mostly benefit top executives and shareholders or center on protecting the industry's most vulnerable workers?

Sara Nelson, the dynamic president of the Association of Flight Attendants-CWA, has made a powerful case for direct payroll subsidies to the employees who keep our airline industry passengers flying and safe, everyone from flight attendants and pilots to security screeners and wheelchair attendants.

"Absent payroll subsidies, mass layoffs and furloughs are inevitable," Nelson notes. "This will have long-term consequences because nearly all aviation-related workers have to pass background checks and security and safety training requirements. If these lapse or people need to be rehired, it will slow aviation's return to service. If airlines are slow to recover, other industries will be too. Travel to business conferences, Disneyland, cruises, and casinos is dependent on a functioning aviation industry."

Sara Nelson, President of the Association of Flight Attendants-CWA

To keep our tax dollars from padding the pockets of executives and shareholders, Nelson is also demanding a ban on executive bonuses and stock buybacks, and we should all share her well-founded concerns about how airline executives would spend taxpayer bailouts if left to their own devices. Over the past decade, the airlines have taken profits that could have gone into long-term investments and squandered these earnings on stock buybacks, a legal form of stock manipulation that artificially inflates the value of company shares.

The table below shows how much the five biggest U.S. carriers spent on stock buybacks between 2010 and 2019 as a share of their "free cash flow" (the money left over after a company pays for its operating expenses and capital expenditures). The nation's largest carrier, American Airlines, had a negative free cash flow during this period and yet still spent $12.5 billion on buybacks.

Why have so many corporations been on a buyback spree? One major reason: This financial maneuver inflates the value of executive stock-based pay. In 2018, the CEOs of the five largest U.S. airlines averaged nearly $10 million in total compensation. Thanks to data the SEC now requires publicly held corporations to report, we know just how much larger these CEO paychecks run compared to the pay that each firm's typical workers receive. In 2018, the ratio between CEO and median employee pay at the five largest airlines ranged from 80 to 1 at Alaska Air to 195 to 1 at American.

Top 5 U.S. Airlines

* American Airlines had negative cumulative free cash flow over the decade, but spent $12.5 billion on buybacks. Source: Bloomberg. All other data from corporate proxy statements.

These numbers suggest that limiting the overall obscene pay rewards within the airline industry would neatly complement Nelson's proposals on banning executive bonuses and stock buybacks. We could accomplish that goal by conditioning crisis response assistance to the ratio between the pay that goes to CEOs and their most typical workers.

If we restricted CEO pay to no more than 50 times median worker pay, as the table above shows, and if these five airlines kept median worker pay at current levels, their CEOs could earn $2.7 million to $4.1 million and still stay below this 50:1 ratio threshold. Linking CEO pay to a multiple of worker pay would prevent taxpayer subsidies from pumping up executive pay and, at the same time, create an incentive to narrow internal pay divides by lifting up the bottom of the wage scale.

This pay ratio limit on bailout assistance should accompany other proposed pro-worker conditions, such as setting a $15 per hour wage minimum, requiring worker representation on boards, and banning anti-union activity.

In these worrisome times, taxpayers should not have to worry about their money flowing into the pockets of overpaid corporate executives.

The U.S. airline industry is asking for nearly $60 billion in taxpayer-funded direct assistance and loan guarantees. The industry clearly needs extraordinary help. The pandemic is grounding flights the world over. But who within the industry should get that help? Will the imminent airline bailout mostly benefit top executives and shareholders or center on protecting the industry's most vulnerable workers?

Sara Nelson, the dynamic president of the Association of Flight Attendants-CWA, has made a powerful case for direct payroll subsidies to the employees who keep our airline industry passengers flying and safe, everyone from flight attendants and pilots to security screeners and wheelchair attendants.

"Absent payroll subsidies, mass layoffs and furloughs are inevitable," Nelson notes. "This will have long-term consequences because nearly all aviation-related workers have to pass background checks and security and safety training requirements. If these lapse or people need to be rehired, it will slow aviation's return to service. If airlines are slow to recover, other industries will be too. Travel to business conferences, Disneyland, cruises, and casinos is dependent on a functioning aviation industry."

Sara Nelson, President of the Association of Flight Attendants-CWA

To keep our tax dollars from padding the pockets of executives and shareholders, Nelson is also demanding a ban on executive bonuses and stock buybacks, and we should all share her well-founded concerns about how airline executives would spend taxpayer bailouts if left to their own devices. Over the past decade, the airlines have taken profits that could have gone into long-term investments and squandered these earnings on stock buybacks, a legal form of stock manipulation that artificially inflates the value of company shares.

The table below shows how much the five biggest U.S. carriers spent on stock buybacks between 2010 and 2019 as a share of their "free cash flow" (the money left over after a company pays for its operating expenses and capital expenditures). The nation's largest carrier, American Airlines, had a negative free cash flow during this period and yet still spent $12.5 billion on buybacks.

Why have so many corporations been on a buyback spree? One major reason: This financial maneuver inflates the value of executive stock-based pay. In 2018, the CEOs of the five largest U.S. airlines averaged nearly $10 million in total compensation. Thanks to data the SEC now requires publicly held corporations to report, we know just how much larger these CEO paychecks run compared to the pay that each firm's typical workers receive. In 2018, the ratio between CEO and median employee pay at the five largest airlines ranged from 80 to 1 at Alaska Air to 195 to 1 at American.

Top 5 U.S. Airlines

* American Airlines had negative cumulative free cash flow over the decade, but spent $12.5 billion on buybacks. Source: Bloomberg. All other data from corporate proxy statements.

These numbers suggest that limiting the overall obscene pay rewards within the airline industry would neatly complement Nelson's proposals on banning executive bonuses and stock buybacks. We could accomplish that goal by conditioning crisis response assistance to the ratio between the pay that goes to CEOs and their most typical workers.

If we restricted CEO pay to no more than 50 times median worker pay, as the table above shows, and if these five airlines kept median worker pay at current levels, their CEOs could earn $2.7 million to $4.1 million and still stay below this 50:1 ratio threshold. Linking CEO pay to a multiple of worker pay would prevent taxpayer subsidies from pumping up executive pay and, at the same time, create an incentive to narrow internal pay divides by lifting up the bottom of the wage scale.

This pay ratio limit on bailout assistance should accompany other proposed pro-worker conditions, such as setting a $15 per hour wage minimum, requiring worker representation on boards, and banning anti-union activity.

In these worrisome times, taxpayers should not have to worry about their money flowing into the pockets of overpaid corporate executives.