SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

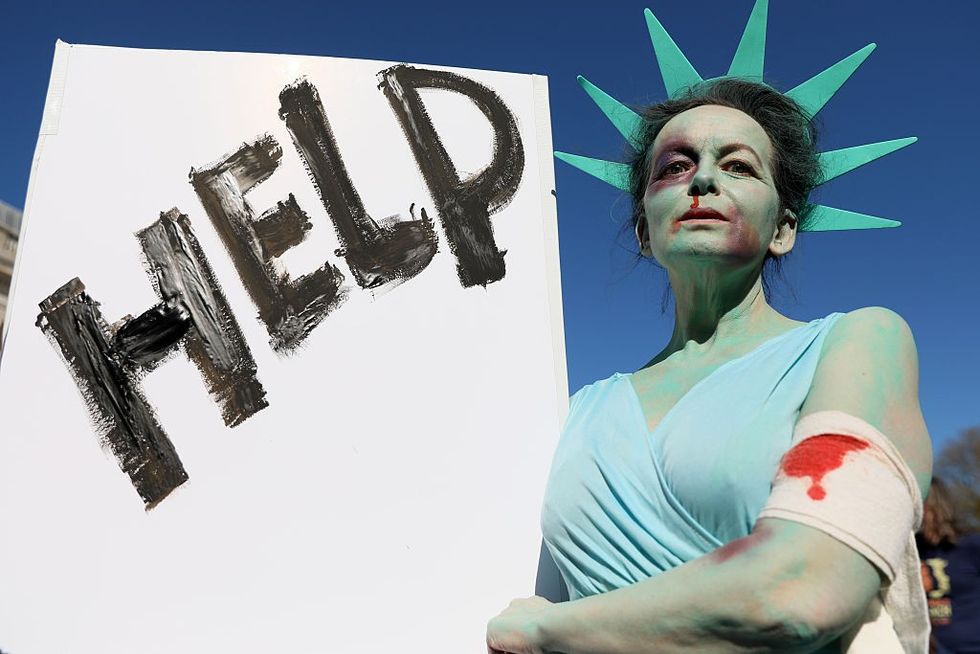

How policymakers respond now will determine the level of pain working families experience and the speed at which the economy can get back on track after the shutdown period is over. (Photo: Spencer Platt/Getty Images)

In the last two weeks, nearly 10 million people applied for unemployment insurance. The March jobs report revealed a loss of 701,000 jobs--the first monthly job loss in nearly 10 years and already one of the worst monthly losses on record. Further, March's job loss numbers are just the tip of the iceberg, as they do not capture the entire month of March, but only refer to the payroll period containing March 12, before the shutdowns accelerated significantly.

How policymakers respond now will determine the level of pain working families experience and the speed at which the economy can get back on track after the shutdown period is over. The relief and recovery packages passed since the crisis began included many good measures, but they are still too little and some provisions in these packages represent policy missteps. More relief and recovery aid will certainly be needed.

The biggest misstep taken in the earlier relief and recovery packages was allocating so much of the aid to financial rescues of large firms with insufficient conditions to ensure that jobs and wages of workers were saved. Policymakers approved over $450 billion in direct fiscal aid to this effort, with more potentially forthcoming in subsidized loans from the Federal Reserve. Yet this aid (apart from the stronger stipulations for the airline industry) is largely not tied to preserving rank-and-file workers on payrolls.

Another large tranche of aid ($350 billion) was better targeted in preserving the payroll of small firms. But this aid will likely underperform in actually saving jobs because the administrative capacity of the Small Business Administration and banks servicing small and medium-sized firms are too poor to ensure the full amount of aid reaches employers and preserves payroll.

These two tranches of aid could have been bundled and made into more direct and better administered financial relief that hinged entirely on the willingness of employers to preserve workers on payroll with the federal government financing their pay during the shutdown. This would have allowed workers to remain in the jobs they held before the coronavirus shock, and this would have helped ensure a rapid economic recovery once the public health crisis had subsided.

Even given this initial misstep, however, the relief and recovery packages passed to fight the coronavirus shock have contained valuable provisions. Policymakers should now take additional steps to mitigate the disaster, including, but not limited to, directly tying any additional industry aid to preserving workers on payroll. Democratic leadership has made it clear that they are committed to working on another relief measure to address the economic impact of the pandemic. This bill must be passed quickly and must be sufficient in scope and magnitude to address the severity of the economic and public health crisis we are experiencing.

Any additional relief bill must:

Provide substantially more aid--and aid that is more open-ended--to state and local governments: So far, the aid provided to state and local governments in relief and recovery legislation has not been large enough and too much of it has required states to use it for direct coronavirus-related expenses. But the collapse of economic activity will cause a collapse in state and local revenues, even apart from demands for new spending imposed by the public health crisis. When the economy is ready to restart in a few months, state and local budget shortfalls will lead to large drags on recovery absent federal action. New aid should be at least $500 billion by the end of 2021 to avoid this drag on recovery.

Make additional investments in unemployment insurance (UI): The CARES Act included a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program that will be available to many workers who are not eligible for regular unemployment insurance. These provisions are very important and will help millions of people. However, the end dates of both the additional compensation and expanded eligibility criteria are arbitrary. The phase four bill must include triggers that allow the expanded UI programs to phase out slowly and only as economic conditions warrant. This is particularly pressing given that the additional $600 per week in PUA compensation expires at the end of July 2020. For reference, it should be noted that the Goldman Sachs macroeconomic forecasting team estimates that the national unemployment rate will average 14.7% in June, July, and August of 2020. This is almost 50% higher than it reached at its peak during the Great Financial Crisis of 2008-2010, and yet the additional UI compensation in the CARES Act is set to turn off automatically during this period. The expanded eligibility criteria in PUA turn off at the end of 2020. Yet Goldman Sachs estimates that unemployment in the first three months of 2021--after the expanded criteria expire--will average 8%, or well over double what unemployment averaged in the first three months of 2020.

Further, the PUA eligibility expansions still leave some workers falling through the cracks. This should be fixed by expanding eligibility to undocumented immigrants and new labor market entrants unable to find work. Finally, new money to help states quickly build up their UI system administrative capacity is crucial for ensuring the key elements of UI (like the ability to compensate workers for hours that have been cut due to the economic downturn) are used to maximum effect.

Disburse another direct cash payment: Even with expanded PUA, some households facing economic distress due to the coronavirus shock may fall through the cracks, and recovery may be delayed if households feel insecure about their financial situation. To help remedy this, the CARES Act provided for a one-time direct cash payment to the bottom 93% of U.S. tax units. But this cash payment is insufficient to carry all households through the relief period unscathed and to ensure a robust recovery once the all-clear sounds. Further, it is too restrictive about which households are eligible to receive it. Another direct cash payment should be provided, and it should be available to all income-eligible households regardless of tax filing or immigration status.

Provide full funding for testing, treatment, and front-line worker personal protective equipment (PPE): While substantial money for medical investments has been allocated in previous relief and recovery bills, an open-ended commitment by the federal government to fully fund any testing and treatment of coronavirus expenses should be made. Further, a similar commitment should be made to purchase and disburse PPE to front-line workers (including but not limited to health care workers).

Include strong worker protections: This crisis has revealed the lack of power far too many U.S. workers experience in the workplace. Many workers are required to work without protective equipment. They have no effective right to refuse dangerous assignments and are not even being granted hazard pay, despite working in difficult and dangerous conditions. Policymakers must include enhanced protections for all workers performing essential work during this crisis.

Beyond the next relief bill, a number of policymakers have indicated that infrastructure investments need to be made to promote economic recovery. There is some real economic sense in this, particularly in the service of ensuring that recovery in the year following the coronavirus shutdowns is rapid and broad-based.

However, to maximize effectiveness, the infrastructure investments need to meet the following criteria:

They should largely be deficit-financed. If policymakers want to shore up the long-run dedicated revenue source for the Highway Trust Fund (HTF) as part of an infrastructure package, that would be welcome. But for new infrastructure investments over and above the baseline HTF spending, the most sensible source of finance would be debt. Infrastructure spending is an investment that provides long-lived economic benefits--it is exactly the sort of spending that debt is meant for. Further, even before the coronavirus shock, ample evidence existed that a chronic shortfall of economywide spending relative to productive capacity was a restraint on economic growth. Financing infrastructure spending with debt is the best way to relieve this constraint.

The investments should be financed by public spending and be democratically accountable. Public investments should be directed toward priorities decided upon by democratically accountable policymakers, not private financial markets. In short, they should be financed with public money and not involve the use of private-public partnerships (PPPs), or they should use limited amounts of federal money to "leverage" private investment or money from state and local governments.

A substantial portion of the investments should be "green." A particular emphasis should be placed on investments that mitigate the emissions of greenhouse gases. Recent months have shown decisively that planning for future crises is hugely important. The crisis we all know is building is the climate crisis. We should get out in front of this crisis, unlike the coronavirus. Further, until an internationally harmonized increase in the price of greenhouse gas emissions is imposed, the private sector will radically underinvest in mitigating these emissions. Public investments do not have to wait for a price signal from private markets--they can be put to work right way in greenhouse gas mitigation.

Child care services should be considered infrastructure. These services provide future benefits by preparing children better for success in schooling, but also provide immediate benefits in boosting the labor market participation opportunities of parents (particularly women). Due to the public health requirements associated with "social distancing," child care providers have been profoundly damaged by the recent shutdowns. In the debate surrounding the CARES Act, some have suggested $50 billion in investment to aid child care providers. This funding was not included in the final act--but should be included in any phase four legislation.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

In the last two weeks, nearly 10 million people applied for unemployment insurance. The March jobs report revealed a loss of 701,000 jobs--the first monthly job loss in nearly 10 years and already one of the worst monthly losses on record. Further, March's job loss numbers are just the tip of the iceberg, as they do not capture the entire month of March, but only refer to the payroll period containing March 12, before the shutdowns accelerated significantly.

How policymakers respond now will determine the level of pain working families experience and the speed at which the economy can get back on track after the shutdown period is over. The relief and recovery packages passed since the crisis began included many good measures, but they are still too little and some provisions in these packages represent policy missteps. More relief and recovery aid will certainly be needed.

The biggest misstep taken in the earlier relief and recovery packages was allocating so much of the aid to financial rescues of large firms with insufficient conditions to ensure that jobs and wages of workers were saved. Policymakers approved over $450 billion in direct fiscal aid to this effort, with more potentially forthcoming in subsidized loans from the Federal Reserve. Yet this aid (apart from the stronger stipulations for the airline industry) is largely not tied to preserving rank-and-file workers on payrolls.

Another large tranche of aid ($350 billion) was better targeted in preserving the payroll of small firms. But this aid will likely underperform in actually saving jobs because the administrative capacity of the Small Business Administration and banks servicing small and medium-sized firms are too poor to ensure the full amount of aid reaches employers and preserves payroll.

These two tranches of aid could have been bundled and made into more direct and better administered financial relief that hinged entirely on the willingness of employers to preserve workers on payroll with the federal government financing their pay during the shutdown. This would have allowed workers to remain in the jobs they held before the coronavirus shock, and this would have helped ensure a rapid economic recovery once the public health crisis had subsided.

Even given this initial misstep, however, the relief and recovery packages passed to fight the coronavirus shock have contained valuable provisions. Policymakers should now take additional steps to mitigate the disaster, including, but not limited to, directly tying any additional industry aid to preserving workers on payroll. Democratic leadership has made it clear that they are committed to working on another relief measure to address the economic impact of the pandemic. This bill must be passed quickly and must be sufficient in scope and magnitude to address the severity of the economic and public health crisis we are experiencing.

Any additional relief bill must:

Provide substantially more aid--and aid that is more open-ended--to state and local governments: So far, the aid provided to state and local governments in relief and recovery legislation has not been large enough and too much of it has required states to use it for direct coronavirus-related expenses. But the collapse of economic activity will cause a collapse in state and local revenues, even apart from demands for new spending imposed by the public health crisis. When the economy is ready to restart in a few months, state and local budget shortfalls will lead to large drags on recovery absent federal action. New aid should be at least $500 billion by the end of 2021 to avoid this drag on recovery.

Make additional investments in unemployment insurance (UI): The CARES Act included a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program that will be available to many workers who are not eligible for regular unemployment insurance. These provisions are very important and will help millions of people. However, the end dates of both the additional compensation and expanded eligibility criteria are arbitrary. The phase four bill must include triggers that allow the expanded UI programs to phase out slowly and only as economic conditions warrant. This is particularly pressing given that the additional $600 per week in PUA compensation expires at the end of July 2020. For reference, it should be noted that the Goldman Sachs macroeconomic forecasting team estimates that the national unemployment rate will average 14.7% in June, July, and August of 2020. This is almost 50% higher than it reached at its peak during the Great Financial Crisis of 2008-2010, and yet the additional UI compensation in the CARES Act is set to turn off automatically during this period. The expanded eligibility criteria in PUA turn off at the end of 2020. Yet Goldman Sachs estimates that unemployment in the first three months of 2021--after the expanded criteria expire--will average 8%, or well over double what unemployment averaged in the first three months of 2020.

Further, the PUA eligibility expansions still leave some workers falling through the cracks. This should be fixed by expanding eligibility to undocumented immigrants and new labor market entrants unable to find work. Finally, new money to help states quickly build up their UI system administrative capacity is crucial for ensuring the key elements of UI (like the ability to compensate workers for hours that have been cut due to the economic downturn) are used to maximum effect.

Disburse another direct cash payment: Even with expanded PUA, some households facing economic distress due to the coronavirus shock may fall through the cracks, and recovery may be delayed if households feel insecure about their financial situation. To help remedy this, the CARES Act provided for a one-time direct cash payment to the bottom 93% of U.S. tax units. But this cash payment is insufficient to carry all households through the relief period unscathed and to ensure a robust recovery once the all-clear sounds. Further, it is too restrictive about which households are eligible to receive it. Another direct cash payment should be provided, and it should be available to all income-eligible households regardless of tax filing or immigration status.

Provide full funding for testing, treatment, and front-line worker personal protective equipment (PPE): While substantial money for medical investments has been allocated in previous relief and recovery bills, an open-ended commitment by the federal government to fully fund any testing and treatment of coronavirus expenses should be made. Further, a similar commitment should be made to purchase and disburse PPE to front-line workers (including but not limited to health care workers).

Include strong worker protections: This crisis has revealed the lack of power far too many U.S. workers experience in the workplace. Many workers are required to work without protective equipment. They have no effective right to refuse dangerous assignments and are not even being granted hazard pay, despite working in difficult and dangerous conditions. Policymakers must include enhanced protections for all workers performing essential work during this crisis.

Beyond the next relief bill, a number of policymakers have indicated that infrastructure investments need to be made to promote economic recovery. There is some real economic sense in this, particularly in the service of ensuring that recovery in the year following the coronavirus shutdowns is rapid and broad-based.

However, to maximize effectiveness, the infrastructure investments need to meet the following criteria:

They should largely be deficit-financed. If policymakers want to shore up the long-run dedicated revenue source for the Highway Trust Fund (HTF) as part of an infrastructure package, that would be welcome. But for new infrastructure investments over and above the baseline HTF spending, the most sensible source of finance would be debt. Infrastructure spending is an investment that provides long-lived economic benefits--it is exactly the sort of spending that debt is meant for. Further, even before the coronavirus shock, ample evidence existed that a chronic shortfall of economywide spending relative to productive capacity was a restraint on economic growth. Financing infrastructure spending with debt is the best way to relieve this constraint.

The investments should be financed by public spending and be democratically accountable. Public investments should be directed toward priorities decided upon by democratically accountable policymakers, not private financial markets. In short, they should be financed with public money and not involve the use of private-public partnerships (PPPs), or they should use limited amounts of federal money to "leverage" private investment or money from state and local governments.

A substantial portion of the investments should be "green." A particular emphasis should be placed on investments that mitigate the emissions of greenhouse gases. Recent months have shown decisively that planning for future crises is hugely important. The crisis we all know is building is the climate crisis. We should get out in front of this crisis, unlike the coronavirus. Further, until an internationally harmonized increase in the price of greenhouse gas emissions is imposed, the private sector will radically underinvest in mitigating these emissions. Public investments do not have to wait for a price signal from private markets--they can be put to work right way in greenhouse gas mitigation.

Child care services should be considered infrastructure. These services provide future benefits by preparing children better for success in schooling, but also provide immediate benefits in boosting the labor market participation opportunities of parents (particularly women). Due to the public health requirements associated with "social distancing," child care providers have been profoundly damaged by the recent shutdowns. In the debate surrounding the CARES Act, some have suggested $50 billion in investment to aid child care providers. This funding was not included in the final act--but should be included in any phase four legislation.

In the last two weeks, nearly 10 million people applied for unemployment insurance. The March jobs report revealed a loss of 701,000 jobs--the first monthly job loss in nearly 10 years and already one of the worst monthly losses on record. Further, March's job loss numbers are just the tip of the iceberg, as they do not capture the entire month of March, but only refer to the payroll period containing March 12, before the shutdowns accelerated significantly.

How policymakers respond now will determine the level of pain working families experience and the speed at which the economy can get back on track after the shutdown period is over. The relief and recovery packages passed since the crisis began included many good measures, but they are still too little and some provisions in these packages represent policy missteps. More relief and recovery aid will certainly be needed.

The biggest misstep taken in the earlier relief and recovery packages was allocating so much of the aid to financial rescues of large firms with insufficient conditions to ensure that jobs and wages of workers were saved. Policymakers approved over $450 billion in direct fiscal aid to this effort, with more potentially forthcoming in subsidized loans from the Federal Reserve. Yet this aid (apart from the stronger stipulations for the airline industry) is largely not tied to preserving rank-and-file workers on payrolls.

Another large tranche of aid ($350 billion) was better targeted in preserving the payroll of small firms. But this aid will likely underperform in actually saving jobs because the administrative capacity of the Small Business Administration and banks servicing small and medium-sized firms are too poor to ensure the full amount of aid reaches employers and preserves payroll.

These two tranches of aid could have been bundled and made into more direct and better administered financial relief that hinged entirely on the willingness of employers to preserve workers on payroll with the federal government financing their pay during the shutdown. This would have allowed workers to remain in the jobs they held before the coronavirus shock, and this would have helped ensure a rapid economic recovery once the public health crisis had subsided.

Even given this initial misstep, however, the relief and recovery packages passed to fight the coronavirus shock have contained valuable provisions. Policymakers should now take additional steps to mitigate the disaster, including, but not limited to, directly tying any additional industry aid to preserving workers on payroll. Democratic leadership has made it clear that they are committed to working on another relief measure to address the economic impact of the pandemic. This bill must be passed quickly and must be sufficient in scope and magnitude to address the severity of the economic and public health crisis we are experiencing.

Any additional relief bill must:

Provide substantially more aid--and aid that is more open-ended--to state and local governments: So far, the aid provided to state and local governments in relief and recovery legislation has not been large enough and too much of it has required states to use it for direct coronavirus-related expenses. But the collapse of economic activity will cause a collapse in state and local revenues, even apart from demands for new spending imposed by the public health crisis. When the economy is ready to restart in a few months, state and local budget shortfalls will lead to large drags on recovery absent federal action. New aid should be at least $500 billion by the end of 2021 to avoid this drag on recovery.

Make additional investments in unemployment insurance (UI): The CARES Act included a $250 billion expansion of unemployment insurance, including an increase in the level of benefits and the creation of a Pandemic Unemployment Assistance (PUA) program that will be available to many workers who are not eligible for regular unemployment insurance. These provisions are very important and will help millions of people. However, the end dates of both the additional compensation and expanded eligibility criteria are arbitrary. The phase four bill must include triggers that allow the expanded UI programs to phase out slowly and only as economic conditions warrant. This is particularly pressing given that the additional $600 per week in PUA compensation expires at the end of July 2020. For reference, it should be noted that the Goldman Sachs macroeconomic forecasting team estimates that the national unemployment rate will average 14.7% in June, July, and August of 2020. This is almost 50% higher than it reached at its peak during the Great Financial Crisis of 2008-2010, and yet the additional UI compensation in the CARES Act is set to turn off automatically during this period. The expanded eligibility criteria in PUA turn off at the end of 2020. Yet Goldman Sachs estimates that unemployment in the first three months of 2021--after the expanded criteria expire--will average 8%, or well over double what unemployment averaged in the first three months of 2020.

Further, the PUA eligibility expansions still leave some workers falling through the cracks. This should be fixed by expanding eligibility to undocumented immigrants and new labor market entrants unable to find work. Finally, new money to help states quickly build up their UI system administrative capacity is crucial for ensuring the key elements of UI (like the ability to compensate workers for hours that have been cut due to the economic downturn) are used to maximum effect.

Disburse another direct cash payment: Even with expanded PUA, some households facing economic distress due to the coronavirus shock may fall through the cracks, and recovery may be delayed if households feel insecure about their financial situation. To help remedy this, the CARES Act provided for a one-time direct cash payment to the bottom 93% of U.S. tax units. But this cash payment is insufficient to carry all households through the relief period unscathed and to ensure a robust recovery once the all-clear sounds. Further, it is too restrictive about which households are eligible to receive it. Another direct cash payment should be provided, and it should be available to all income-eligible households regardless of tax filing or immigration status.

Provide full funding for testing, treatment, and front-line worker personal protective equipment (PPE): While substantial money for medical investments has been allocated in previous relief and recovery bills, an open-ended commitment by the federal government to fully fund any testing and treatment of coronavirus expenses should be made. Further, a similar commitment should be made to purchase and disburse PPE to front-line workers (including but not limited to health care workers).

Include strong worker protections: This crisis has revealed the lack of power far too many U.S. workers experience in the workplace. Many workers are required to work without protective equipment. They have no effective right to refuse dangerous assignments and are not even being granted hazard pay, despite working in difficult and dangerous conditions. Policymakers must include enhanced protections for all workers performing essential work during this crisis.

Beyond the next relief bill, a number of policymakers have indicated that infrastructure investments need to be made to promote economic recovery. There is some real economic sense in this, particularly in the service of ensuring that recovery in the year following the coronavirus shutdowns is rapid and broad-based.

However, to maximize effectiveness, the infrastructure investments need to meet the following criteria:

They should largely be deficit-financed. If policymakers want to shore up the long-run dedicated revenue source for the Highway Trust Fund (HTF) as part of an infrastructure package, that would be welcome. But for new infrastructure investments over and above the baseline HTF spending, the most sensible source of finance would be debt. Infrastructure spending is an investment that provides long-lived economic benefits--it is exactly the sort of spending that debt is meant for. Further, even before the coronavirus shock, ample evidence existed that a chronic shortfall of economywide spending relative to productive capacity was a restraint on economic growth. Financing infrastructure spending with debt is the best way to relieve this constraint.

The investments should be financed by public spending and be democratically accountable. Public investments should be directed toward priorities decided upon by democratically accountable policymakers, not private financial markets. In short, they should be financed with public money and not involve the use of private-public partnerships (PPPs), or they should use limited amounts of federal money to "leverage" private investment or money from state and local governments.

A substantial portion of the investments should be "green." A particular emphasis should be placed on investments that mitigate the emissions of greenhouse gases. Recent months have shown decisively that planning for future crises is hugely important. The crisis we all know is building is the climate crisis. We should get out in front of this crisis, unlike the coronavirus. Further, until an internationally harmonized increase in the price of greenhouse gas emissions is imposed, the private sector will radically underinvest in mitigating these emissions. Public investments do not have to wait for a price signal from private markets--they can be put to work right way in greenhouse gas mitigation.

Child care services should be considered infrastructure. These services provide future benefits by preparing children better for success in schooling, but also provide immediate benefits in boosting the labor market participation opportunities of parents (particularly women). Due to the public health requirements associated with "social distancing," child care providers have been profoundly damaged by the recent shutdowns. In the debate surrounding the CARES Act, some have suggested $50 billion in investment to aid child care providers. This funding was not included in the final act--but should be included in any phase four legislation.

"Thank you to the hundreds of thousands of Americans across the country who are standing up and speaking out for our voting rights, fundamental freedoms, and essential services like Social Security and Medicare."

In communities large and small across the United States on Saturday, hundreds of thousands of people collectively took to the streets to make their opposition to President Donald Trump heard.

The people who took part in the organized protests ranged from very young children to the elderly and their message was scrawled on signs of all sizes and colors—many of them angry, some of them funny, but all in line with the "Hands Off" message that brought them together.

"Thank you to the hundreds of thousands of Americans across the country who are standing up and speaking out for our voting rights, fundamental freedoms, and essential services like Social Security and Medicare," said the group Stand Up America as word of the turnout poured in from across the country.

A relatively small, but representative sample of photographs from various demonstrations that took place follows.

Demonstrators gather on Boston Common, cheering and chanting slogans, during the nationwide "Hands Off!" protest against US President Donald Trump and his advisor, Tesla CEO Elon Musk, in Boston, Massachusetts on April 5, 2025. (Photo by Joseph Prezioso / AFP)

"Everyone involved in this crime against humanity, and everyone who covered it up, would face prosecution in a world that had any shred of dignity left."

A video presented to officials at the United Nations on Friday and first made public Saturday by the New York Times provides more evidence that the recent massacre of Palestinian medics in Gaza did not happen the way Israeli government claimed—the latest in a long line of deception when it comes to violence against civilians that have led to repeated accusations of war crimes.

The video, according to the Palestine Red Crescent Society (PRCS), was found on the phone of a paramedic found in a mass grave with a bullet in his head after being killed, along with seven other medics, by Israeli forces on March 23. The eight medics, buried in the shallow grave with the bodies riddled with bullets, were: Mustafa Khafaja, Ezz El-Din Shaat, Saleh Muammar, Refaat Radwan, Muhammad Bahloul, Ashraf Abu Libda, Muhammad Al-Hila, and Raed Al-Sharif. The video reportedly belonged to Radwan. A ninth medic, identified as Asaad Al-Nasasra, who was at the scene of the massacre, which took place near the southern city of Rafah, is still missing.

The PRCS said it presented the video—which refutes the explanation of the killings offered by Israeli officials—to members of the UN Security Council on Friday.

"They were killed in their uniforms. Driving their clearly marked vehicles. Wearing their gloves. On their way to save lives," Jonathan Whittall, head of the UN's humanitarian affairs office in Palestine, said last week after the bodies were discovered. Some of the victims, according to Gaza officials, were found with handcuffs still on them and appeared to have been shot in the head, execution-style.

The Israeli military initially said its soldiers "did not randomly attack" any ambulances, but rather claimed they fired on "terrorists" who approached them in "suspicious vehicles." Lt. Col. Nadav Shoshani, an IDF spokesperson, said the vehicles that the soldiers opened fire on were driving with their lights off and did not have clearance to be in the area. The video evidence directly contradicts the IDF's version of events.

As the Times reports:

The Times obtained the video from a senior diplomat at the United Nations who asked not to be identified to be able to share sensitive information.

The Times verified the location and timing of the video, which was taken in the southern city of Rafah early on March 23. Filmed from what appears to be the front interior of a moving vehicle, it shows a convoy of ambulances and a fire truck, clearly marked, with headlights and flashing lights turned on, driving south on a road to the north of Rafah in the early morning. The first rays of sun can be seen, and birds are chirping.

In an interview with Drop Site News published Friday, the only known paramedic to survive the attack, Munther Abed, explained that he and his colleagues "were directly and deliberately shot at" by the IDF. "The car is clearly marked with 'Palestinian Red Crescent Society 101.' The car's number was clear and the crews' uniform was clear, so why were we directly shot at? That is the question."

The video's release sparked fresh outrage and demands for accountability on Saturday.

"The IDF denied access to the site for days; they sent in diggers to cover up the massacre and intentionally lied about it," said podcast producer Hamza M. Syed in reaction to the new revelations. "The entire leadership of the Israeli army is implicated in this unconscionable war crime. And they must be prosecuted."

"Everyone involved in this crime against humanity, and everyone who covered it up, would face prosecution in a world that had any shred of dignity left," said journalist Ryan Grim of DropSite News.

"They're dismantling our country. They're looting our government. And they think we'll just watch."

In communities across the United States and also overseas, coordinated "Hands Off" protests are taking place far and wide Saturday in the largest public rebuke yet to President Donald Trump and top henchman Elon Musk's assault on the workings of the federal government and their program of economic sabotage that is sacrificing the needs of working families to authoritarianism and the greed of right-wing oligarchs.

Indivisible, one of the key organizing groups behind the day's protests, said millions participated in more than 1,300 individual rallies as they demanded "an end to Trump's authoritarian power grab" and condemning all those aiding and abetting it.

"We expected hundreds of thousands. But at virtually every single event, the crowds eclipsed our estimates," the group said in a statement Saturday evening.

"Hands off our healthcare, hands off our civil rights, hands off our schools, our freedoms, and our democracy."

"This is the largest day of protest since Trump retook office," the group added. "And in many small towns and cities, activists are reporting the biggest protests their communities have ever seen as everyday people send a clear, unmistakable message to Trump and Musk: Hands off our healthcare, hands off our civil rights, hands off our schools, our freedoms, and our democracy."

According to the organizers' call to action:

They're dismantling our country. They’re looting our government. And they think we'll just watch.

On Saturday, April 5th, we rise up with one demand: Hands Off!

This is a nationwide mobilization to stop the most brazen power grab in modern history. Trump, Musk, and their billionaire cronies are orchestrating an all-out assault on our government, our economy, and our basic rights—enabled by Congress every step of the way. They want to strip America for parts—shuttering Social Security offices, firing essential workers, eliminating consumer protections, and gutting Medicaid—all to bankroll their billionaire tax scam.

They're handing over our tax dollars, our public services, and our democracy to the ultra-rich. If we don't fight now, there won’t be anything left to save.

The more than 1,300 "Hands Off!" demonstrations—organized by a large coalition of unions, progressive advocacy groups, and pro-democracy watchdogs—first kicked off Saturday in Europe, followed by East Coast communities in the U.S., and continued throughout the day at various times, depending on location. See here for a list of scheduled "Hands Off" events.

"The United States has a president, not a king," said the progressive advocacy group People's Action, one of the group's involved in the actions, in an email to supporters Saturday morning just as protest events kicked off in hundreds of cities and communities. "Donald Trump has, by every measure, been working to make himself a king. He has become unanswerable to the courts, Congress, and the American people."

In its Saturday evening statement, Indivisible said the actions far exceeded their expectations and should be seen as a turning point in the battle to stop Trump and his minions:

The Trump administration has spent its first 75 days in office trying to overwhelm us, to make us feel powerless, so that we will fall in line, accept the ransacking of our government, the raiding of our social safety net, and the dismantling of our democracy.

And too often, the response from our leaders and those in positions to resist has been abject cowardice. Compliance. Obeying in advance.

But not today. Today we've demonstrated a different path forward. We've modeled the courage and action that we want to see from our leaders, and showed all those who've been standing on the sidelines who share our values that they are not alone.

Citing the Republican president's thirst for "power and greed," People's Action earlier explained why organized pressure must be built and sustained against the administration, especially at the conclusion of a week in which the global economy was spun into disarray by Trump's tariff announcement, his attack on the rule of law continued, and the twice-elected president admitted he was "not joking" about the possibility of seeking a third term, which is barred by the constitution.

"He is destroying the economy with tariffs in order to pay for the tax cuts he wants to push through to enrich himself and his billionaire buddies," warned People's Action. "He has ordered the government to round up innocent people off of the streets and put them in detention centers without due process because they dared to speak out using their First Amendment rights. And he is not close to being done—by his own admission, he is planning to run for a third term, which the Constitution does not allow."

Live stream of Hands Off rally in Washington, D.C.:

Below are photo or video dispatches from demonstrations around the world on Saturday. Check back for updates...

United Kingdom

France

Germany

Belgium:

Massachusetts:

Maine:

Washington, D.C.:

New York:

Minnesota:

Michigan:

Ohio:

Colorado:

Pennsylvania:

North Carolina:

The protest organizers warn that what Trump and Musk are up to "is not just corruption" and "not just mismanagement," but something far more sinister.

"This is a hostile takeover," they said, but vowed to fight back. "This is the moment where we say NO. No more looting, no more stealing, no more billionaires raiding our government while working people struggle to survive."