SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A return to "normal" in governments' policies towards fossil fuel production--which were largely still enabling its expansion--is out of the question. To "build back better," governments must exit the unstable boom-bust cycles of extraction, and instead manage its phase-out in a predictable, people-centered, and Paris-proof way. (Photo: Pixabay.com)

Since the Paris Agreement was signed, Oil Change International (OCI) has been making the case that meeting its goals will require governments to proactively manage the phase-out of fossil fuel production. In the wake of the COVID-19 crisis and sudden cratering of the oil economy, that is more true than ever.

Low oil prices and a near-term drop in demand are causing immediate financial and logistical stress for the industry. But current events provide no guarantee that the industry will stay in long-term decline, especially at the pace needed to limit global warming to 1.5 degrees Celsius (degC).

Now is precisely the time for governments to pursue a carefully planned exit from oil and gas production: to systematically disentangle their economies from this volatile and toxic industry in a way that lines up with global climate goals, invests deeply in a just transition for workers and local communities, and builds the clean energy sectors we will need long into the future.

In this post, we analyze five reasons why managing the decline of oil and gas must be a priority for governments as part of a Just Recovery from COVID-19. First, we look at the context behind the recent disarray in oil markets. Then we unpack the case for government action:

As we outline below, the coming period of recovery could be governments' last, best chance to plan for the economy we need to stay within 1.5 degrees and avoid the worst chaos of global warming. That means a return to "normal" in governments' policies towards fossil fuel production - which were largely still enabling its expansion - is out of the question. To "build back better," governments must exit the unstable boom-bust cycles of extraction, and instead manage its phase-out in a predictable, people-centered, and Paris-proof way.

It's unlikely that anybody predicted the particular circumstances the oil industry is in now: prices dipping to historic lows due to a global pandemic driving a sudden, unprecedented collapse in demand. Excess production is running out of places to go, as oil storage sites fill up globally.

As a result, recent news headlines have called this "oil's collapse," an "unprecedented plunge," and a "battle for survival." A headline last month in The Guardianasked, "Will the coronavirus kill the oil industry?"

In reality, the oil industry was already facing growing headwinds and shrinking financial weight. Before the pandemic hit, oil and gas demand continued to creep up year to year, and companies were poised to keep expanding their production. But the industry's appeal to investors was beginning to wane. The sector was already oversupplying global markets. In 2019, its share of the S&P 500 stock index hit its lowest level in four decades. On CNBC, Mad Money's Jim Kramer declared that fossil fuel stocks were in their "death knell" phase.

From a broader view, the oil and gas industry has failed to reconcile its business model with climate reality - doing its best to create new markets for its products and suppress competition from renewables, but ultimately still planning for a future filled with oil and gas. The industry has already invested in pumping out more oil and gas than the world can afford to burn, yet it keeps investing in pumping out even more. None of the options in the flowchart below speak to a bright future for oil and gas companies, albeit the top two pathways would allow business as usual to continue for a while longer.

The coronavirus itself will not kill the industry. But, as The Economistput it, "oil producers should see COVID-19's turmoil for what it is: not an aberration, but a sign of what is to come.

The question to ask is not: Will the oil industry end?

Rather, as OCI has argued for a while now, it is: Will governments manage the industry's decline quickly enough, and in a fair and just way?

That is, wind down the extraction and burning of oil and gas at the pace required to limit global heating to 1.5degC while building a brighter future for workers and communities on the frontlines of the industry now.

The current crisis is a clear warning sign that, if governments leave the "when" and "how" of the end of oil and gas up to tumultuous markets, the outcome will not be good for either people or the planet.

The current situation is what unmanaged decline looks like:

But this does not have to be the way the decline of oil shakes out. It can be predictable, people-centered, and Paris-proof - guided by principles of a just transition and the urgency of the climate crisis - if governments stop letting the industry and financial markets call the shots. The recent collapse in oil prices is not an excuse for governments to sit idle, waiting for the sector to decline, or a reason to squander public resources on new bailouts and subsidies.

For the following reasons, now is the time for governments to develop fossil fuel phase-out plans to manage the decline of oil and gas extraction.

At this stage of the climate crisis, limiting its escalating damage requires rapid, systematic change across our economy and society - transformation that cannot be left up to volatile markets or profit-driven corporations.

The Intergovernmental Panel on Climate Change's (IPCC) landmark 2018 Special Report on Global Warming of 1.5degCemphasized that, "large, immediate and unprecedented global efforts to mitigate greenhouse gases are required" to limit heating to that level. The latest United Nations Emissions Gap report found that global greenhouse gas emissions need to drop by 7.6 percent each year to keep warming below 1.5degC. By contrast, the parallel, UN-sponsored Production Gap report found that the world's top fossil fuel producing countries are on track to produce 120 percent more oil, gas, and coal in 2030 than is consistent with a 1.5-degree warming limit.

Those two criss-crossing trajectories - the large-scale, year-on-year reductions in climate pollution we need and the fossil fuel industry's plans to keep expanding - are not going to magically realign themselves via market signals. History shows that sudden drops in emissions during times of crisis, as is happening now, are typically followed by an even greater "rebound" in pollution.

The International Energy Agency (IEA) projects that the coronavirus lockdowns could lead to an 8 percent drop in global CO2 pollution in 2020, on par with the scale of year-on-year reductions needed to avoid the worst of global warming. But ordering millions of people to shelter in their homes and shutting down most economic activity is not a climate solution. Analysis from Climate Action Tracker finds that, if countries' COVID-19 recovery packages skimp on green investment and stick with fossil fuels, then emissions could rebound to even higher levels than we were headed for before the pandemic (Figure 2).

To avoid that scenario, and get on track to staying within 1.5 degrees, governments must make a managed decline of fossil fuels and large-scale clean energy investments a pillar of their economic recovery plans.

Only governments can ensure a rapid and sustained wind down of fossil fuels that protects people and a livable planet. More specifically, governments can:

Governments did not have much time to plan for the economic chaos of a global pandemic. But now we have seen how quickly they can pivot and materialize trillions of dollars of new investment. Our political leaders know the climate crisis is here and worsening. The coming period of recovery could be their last, best chance to plan for the economy we need to stay within 1.5 degrees and avoid the worst chaos of global warming.

As the Climate Justice Alliance aptly puts it: "Transition is inevitable. Justice is not."

Transitioning to a renewable energy economy at the pace and scale required will mean the phase-out of fossil fuel jobs and related revenue in those regions where extraction is concentrated. Government policy, planning, and investment will be pivotal in determining how this process unfolds. Will it be just and democratic, centering those most impacted, giving power and resources to local communities, and leaving nobody behind? Or will it be cruel and chaotic, replicating harmful power structures, creating social unrest, and deepening inequality?

Unfortunately, up to the current price crash, few governments had been putting in the work needed to plan for a just and democratic transition off fossil fuels, even though overall employment in the sector was already in long-term decline.

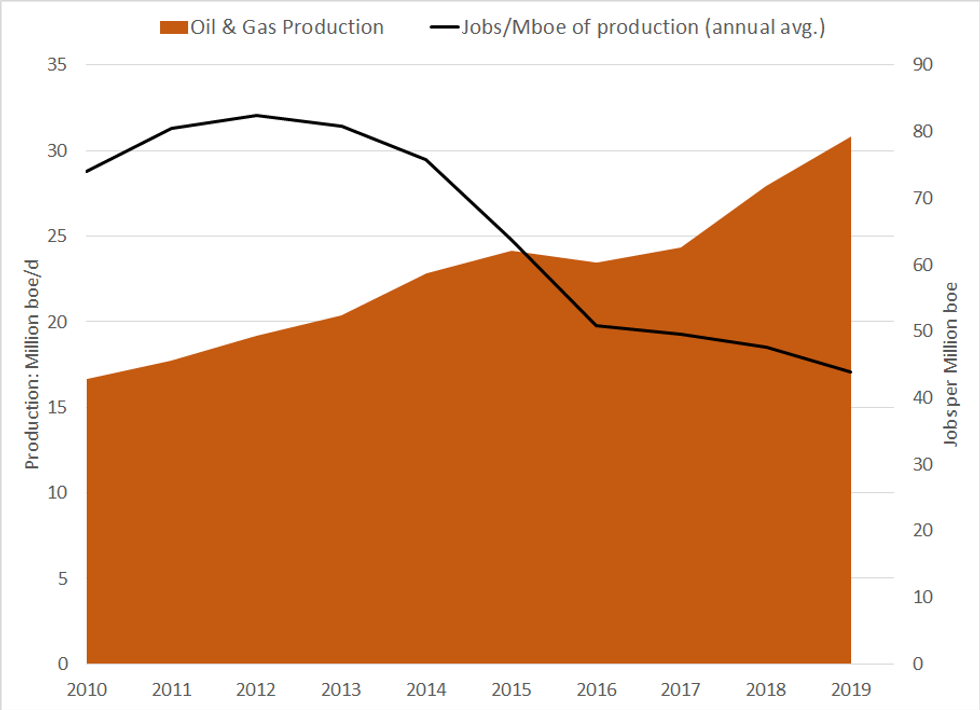

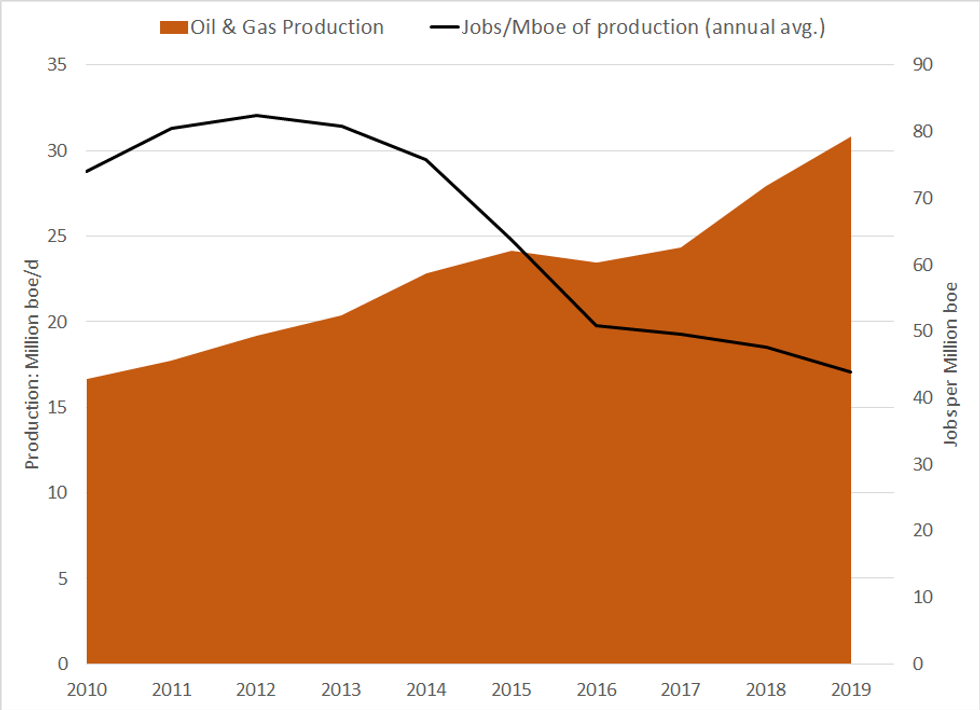

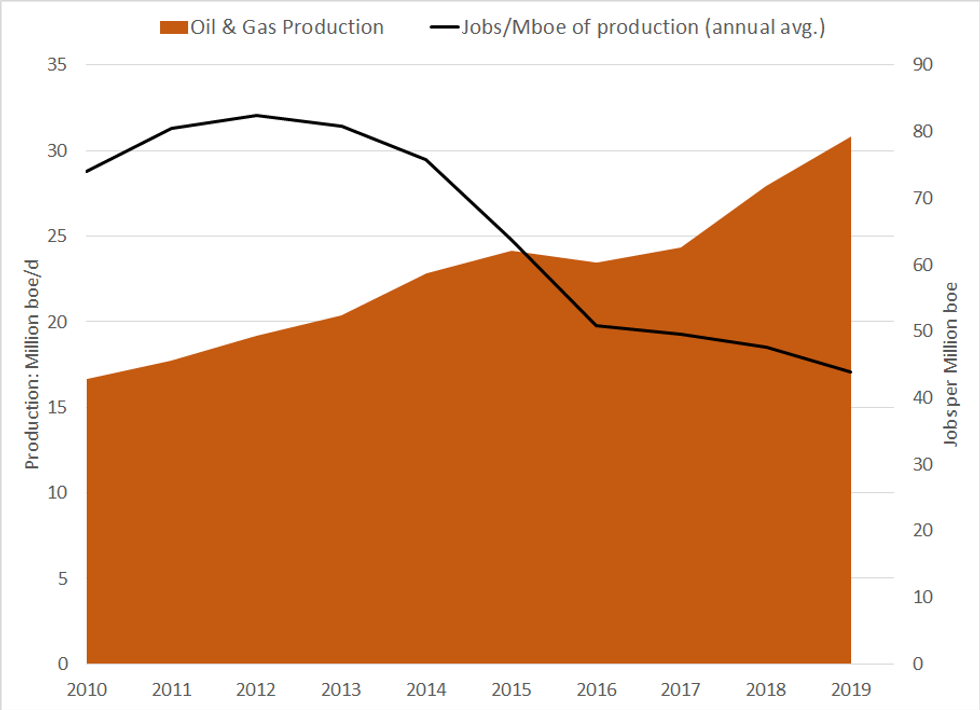

The oil price crash of 2014 pushed companies to produce more oil and gas at lower costs, and overall employment never returned to the same levels. For example, in the UK, the number of workers employed per barrel of oil extracted fell by 30 percent between 2014 and 2017. While U.S. oil and gas production grew by nearly 85 percent over the past decade, the number of workers employed per barrel extracted fell by around 40 percent, as shown in Figure 3 below.

Oil companies are quite willing to sacrifice workers and public health to protect their profit margins. They are reacting to the current financial stress by laying off workers and lobbying to loosen health and safety protections for local communities, even as they take on more debt to pay out dividends promised to investors. In some places, governments' broad coronavirus relief packages will provide temporary support to laid off oil workers. But unlike jobs serving food or driving school buses, many jobs in the oil and gas sector cannot come back.

As governments reimagine their social contracts to pull their economies out of the current pandemic, they must align recovery policies with the long-term reality that fossil fuels need to be a smaller and smaller source of jobs and revenue. Governments should develop robust transition plans that provide supportive off ramps from fossil fuels and guaranteed on ramps to high-quality new jobs and economic opportunities, targeting that support to the regions entangled in the fossil fuel economy now.

While the exact scope and terms of just transition plans will depend on the national and local context, there are principles and models to build from via the International Labour Organisation, International Trade Union Confederation (ITUC), and case studies of past and ongoing transition experiences. Key elements that require government action and investment include:

In some regions, processes and plans are in motion that governments can learn from and build on.

Scotland has a Just Transition Commission that has already begun bringing together affected constituencies in dialogue and released an interim report with recommendations on how to minimize the risks and maximise the economic and social benefits of climate action. New Zealand's Just Transition Unit has adopted a "five pou" (that is, five pillar) approach, based on dialogue between central government, local government, working people, businesses, and Indigenous peoples.

In the United States, the Green New Deal plan put forward by Senator Bernie Sanders maps out a robust package of social support for fossil fuel workers - guaranteeing five years of their current salary, housing assistance, job training, health care, pension support, priority job placement, and the option of early retirement support.

When the Spanish government neared a 2018 deadline for closing its coal mines, it negotiated with trade unions, reaching an agreement to invest EUR 250 million in the regions where coal mines were being phased out in addition to directly supporting workers with retraining, jobs in environmental restoration, and early retirement options.

Critically, governments that choose to pursue energy efficiency and renewable energy development in their recovery and stimulus packages will also secure jobs benefits. Study after study has shown that transitioning to a 100 percent renewable and more energy efficient economy promises to deliver a net gain in jobs, and greater economic and social benefits, compared to investing in fossil fuels. In many jurisdictions, there are already more jobs in renewable energy than fossil fuels. Modelling last year by Friends of the Earth Scotland, OCI, and Platform found that the UK government could create three times more jobs through ambitious investment in clean energy than would be affected by a managed decline of oil and gas.

It is important to note that the quality of jobs in new, clean sectors is not inevitable. Governments also have a key role to play in ensuring that new jobs created provide equal or better pay and benefits and collective bargaining rights.

Just transition processes, plans, and investments are foundational to a managed decline of fossil fuel production. Without long-term, comprehensive, and bottom-up just transition plans, it will be much harder, if not impossible, to phase out extraction at the pace that's needed. The chaotic transition path is likely to fuel political resistance. To be partners in implementing bold climate policies, workers and local communities need a believable path to a brighter future, and a say in what that looks like. A just transition should not only leave nobody behind, but leave everyone better off.

As discussed above, another boom-bust cycle in the oil and gas industry would be a disaster for the climate, workers, and communities on the frontlines of fossil fuel extraction. But that is exactly what the current oil price collapse will lead to without proactive government action to stop another ride up the market roller coaster.

We have no time for another ride because the fossil fuel industry has already dug us into a deep hole. OCI analysis has found that the oil, gas, and coal in already operating or under-construction fields and mines globally would push us well above 1.5degC of global warming and right up to 2degC, beyond the limits set under the Paris Agreement (Figure 4).

The implication is that we cannot afford to develop new reserves of fossil fuels. Moreover, a significant portion of already developed extraction projects will need to be phased out early, to keep us below that dotted green 1.5degC line seen below.

Figure 4: CO2 from developed fossil fuel reserves vs. carbon budgets in range of the Paris Agreement goals

Fundamentally, these conclusions remain the same despite the industry's present nosedive. Fluctuations in oil price have a far greater effect on companies' decisions about what new projects to develop compared to the production they maintain from existing projects. It's the latter that is projected in Figure 4.

In the short term, the collapse of oil prices is leading companies to put a pause on many planned projects. Rystad Energy projects that capital expenditure by oil and gas production companies will fall to its lowest point in 13 years in 2020. Wood Mackenzie projects 10 to 15 large extraction projects have a "reasonable chance" of being approved for development this year, compared to its original 2020 estimate of 50 new final investment decisions.

It's also true that companies are facing unprecedented pressure to shut down production at some already operating oil and gas projects, though this is not necessarily because of low oil prices in themselves.

When prices crashed in 2014, virtually no existing operations shut down. In fact, global oil production continued to rise each year of the past decade. This year, a global pandemic suddenly collapsed demand at a time when companies had been rushing to oversupply the market. As a result, there have been very few places left to physically store unneeded oil that's being produced. This is forcing the shut-in of some production in places like Canada, Venezuela, and Iraq, when producers have run out of other options.

But these near-term pauses to new development and unplanned shutdowns of some already-operating wells will not magically resolve the mismatch in Figure 4 between the fossil fuel reserves already being tapped and the carbon budget limits we need to stay within. Even if coal production were phased out overnight, already developed oil and gas projects alone could push us beyond 1.5degC of warming.

Figure 5 illustrates the decision point that governments face right now. Their policies towards the oil and gas sector, or lack thereof, will determine which trajectory we track towards during this critical decade for climate action.

It's worth acknowledging that the "roller coaster" scenario does not necessarily look pretty for the oil and gas industry and its investors either. But financial pain for the industry does not neatly equate to carbon staying in the ground. Stranded assets can turn into carbon "zombies," oil and gas fields that never turn a profit for investors but nonetheless keep producing fossil fuels.

This can happen for several reasons:

In sum, financial, political, and legal factors create a carbon lock-in effect that low prices alone will not wipe out - at least not on a scale close to what's needed to address the climate crisis.

This is why we at OCI focus attention on developed fossil fuel reserves, and the fact that too much fossil fuel extraction is already set in motion. After companies have gone to the trouble of securing licenses and permits from governments, deposited loans from banks, and sunk capital into an oil or gas field, those projects will not automatically "turn off" when oil prices go down, as typical cost-optimizing models assume.

Instead of reverting to past practice, bailing out financially failing fossil fuel companies, and creating new zombie companies, governments have a chance now to disembark from the roller coaster and manage their decline. As we discuss next, the exact speed and trajectory of that descent should depend on each country's respective capacity and context.

Governments have a long history of intervening in oil markets to control production and prices, and stimulate new production. From the 1930s to the early 1970s, the Texas Railroad Commission set production quotas and thereby influenced oil prices, providing the blueprint for establishing the Organisation of Petroleum Exporting Countries (OPEC).

In 2020, OPEC first opened its taps in a second attempt to undercut the growing flood of production from U.S. fracking operations and corner Russia into cooperation. In response to both political pressure and unprecedented demand destruction from COVID-19, the OPEC+ alliance was forced back to the negotiating table to agree on new production cuts.

The oil market has hardly been a model "free" market for another reason. On top of intervening to stabilise prices, or expand their share of production, governments have long poured public money into subsidizing fossil fuel production. Recently, a study led by the Stockholm Environment Institute found that up to half of new U.S. oil development could be dependent on subsidies through 2050 (at prices of USD 50/bbl).

To achieve an equitable global decline in fossil fuel production in line with climate limits, governments will need to develop new models of cooperation - this time to manage which countries can fairly move fastest or slowest to phase out production, and how to equitably distribute the costs of that transition.

That is the opposite of what is happening now. OPEC+ may have agreed to some production cuts, but not from a view of equitably shouldering the economic burden. Countries like Iraq and Nigeria, both OPEC members, are struggling to plug holes in their budgets for essential social services. Meanwhile, the United States, the world's largest oil and gas producer and its wealthiest by GDP, is more focused on bailing out oil companies. The Texas Railroad Commission, former blueprint for OPEC, recently declined to set its own production cap.

If climate goals are to be met, equity must be a core consideration in how governments manage the decline of fossil fuels. That is not only because it is morally right but also because it could be the difference between global success or failure in realizing the rapid cuts that are needed.

The IPCC Special Report on 1.5degC found that most models "could not construct pathways characterized by lack of international cooperation, inequality and poverty" that were able to limit warming to 1.5degC.

Greg Muttitt, formerly of OCI, and Sivan Kartha of the Stockholm Environment Institute underline in a forthcoming paper in Climate Policy that remaining carbon budgets are simply too small for an unorganized global phase-out of production. The paper, to be published this month, summarizes that, if OECD countries achieve a near-immediate phase out of production and non-OECD countries take 25 years, that pace would largely exhaust the budget for 1.5degC.

So how might an equitable phase-out of extraction be organised between countries.

The Lofoten Declaration, signed by 770 civil society groups across the globe, affirms, "[I]t is the urgent responsibility and moral obligation of wealthy fossil fuel producers to lead in putting an end to fossil fuel development and to manage the decline of existing production."

Muttitt and Kartha put a finer point on why that is so in their paper, entitled "Equity, climate justice and fossil fuel extraction." The transition off fossil fuel production, and the jobs and government revenue tied to it, will inevitably be challenging everywhere, especially given the rapid pace at which the transition must happen. But the social costs will be easiest to manage in countries "where dependence on extraction for providing employment or public revenues is lowest" and "financial or institutional capacity to absorb and overcome transitional difficulties is the greatest." The following figure from the paper provides a framework for comparing the phase-out capacity of oil producers.

Wealthier oil-producing countries with diversified economies - such as the United States, Norway, Canada, and the UK - have the greatest capacity to fund a robust just transition for workers and communities while rapidly winding down extraction. Low-income countries that currently depend on oil revenues to fund public services - such as Iraq, Angola, and Nigeria - must also start the transition process now, but will need more time to complete it.

Because the world as a whole is running out of time, lower-income countries face more rapid transitions than they likely have the capacity to manage alone. Hence, Muttitt and Kartha suggest that wealthier countries should also help shoulder the burden, with finance that is "additional to, rather than competing with, existing climate finance for mitigation and adaptation."

As Ngozi Okonjo-Iweala, a former Finance Minister of Nigeria, wrote in a recent op-ed, "Now more than ever, rich countries must support the developing world in the pursuit of a healthy and prosperous future for all. [...] Low-income regions cannot do this alone."

Of course, translating these principles into a clear path towards multilateral cooperation in an equitable phase-out of fossil fuel extraction will not be easy. Eco-fascism is a rising concern around the world. Some of the same wealthy fossil fuel producers that should be first movers in the transition off extraction are already major blockers to multilateral progress on climate within existing negotiating bodies like the UNFCCC.

But it's clear that if governments compete for their oil to be the last reserves extracted, the whole world will lose. The current free fall in oil markets is only exacerbating global inequality. And oil producers have proven they do know how to cooperate to control production. It's time to reimagine what an OPEC-like body would look like, if the focus were on stabilising not oil markets but the climate.

What if countries united behind an alliance with the goal of organising a cooperative phase-out of extraction?

Doing so would not only be the most equitable and effective way to confront the climate crisis, but also a key pathway to building back better as countries grapple with COVID-19 recovery.

This is a transformational moment in which governments face stark choices. Many are already mobilising unprecedented public finance in stimulus and recovery packages, passing laws under urgency, and stepping in to protect people, communities, and businesses. It is widely recognized that the decisions governments make in responding to the COVID-19 crisis will define not just the immediate recovery, but shape the global energy economy for years or decades to come.

The head of the UN Development Programme, Achim Steiner, says this crisis presents "a fork in the road for every country," a chance to break free from "irrational" dependence on fossil fuels and "insert the DNA of a low-carbon transition and recovery strategy" into economies.

In a recent study assessing the potential climate implications of COVID-19 responses, a group of prominent economists underscore that recovery packages represent "life and death decisions about future generations, including through their impact on the climate."

Will governments build back better, crafting a Just Recovery, or attempt to return to an unstable, unsustainable, unjust status quo? In part, the answer will depend on who politicians listen to at this moment.

The oil and gas industry and its lobby associations are some of the most active in pushing for government bailouts, keeping with the industry's long legacy of undermining climate solutions and prolonging its unsustainable business model for as long as possible. While many oil companies now claim to be "committed" to climate action, not a single one has actually committed to stop drilling more fossil fuels out of the ground.

On the other hand, civil society organisations, people's movements, and researchers in numerous different countries have argued for a Just Recovery: one that puts health first, provides relief directly to people, centers workers and communities not corporate executives, builds solidarity across borders, and --crucially--builds a foundation of resilience for the multiple, interlocking crises we face.

If governments listen to the fossil fuel lobby, revive a volatile industry, and further entangle economies and workers in oil and gas, then they are setting our communities up for escalating climate and economic chaos in the decades to come.

The better choice is to make policies for a just transition off oil and gas a pillar of Just Recovery. As we've unpacked above, markets will not lead this process. Governments must drive it, and there are plenty of policy tools at their disposal, from initiating Just Transition planning processes, to putting a stop to new fossil fuel licensing, to mobilizing finance to help poorer, fossil fuel-dependent countries transition while meeting people's human needs.

Ultimately, these two goals - a Just Recovery and a fair and equitable exit from oil and gas extraction - are inseparable:

Prioritizing health includes phasing out oil wells operating next to schools in Los Angeles, or through Indigenous lands in the Amazon.

Centering workers requires providing those working now in fossil fuels, whether in Alberta or Angola, with guaranteed protection and on ramps to new, clean sectors.

Building solidarity across borders requires wealthier countries like Norway recognizing that they must move much faster than Nigeria to phase out their fossil fuel production, rather than fighting for their oil to be the last extracted.

Building a foundation of resilience means recognizing that the oil and gas industry cannot survive on a livable planet, and investing instead in a regenerative, renewable future.

Written with contributions from David Tong.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Since the Paris Agreement was signed, Oil Change International (OCI) has been making the case that meeting its goals will require governments to proactively manage the phase-out of fossil fuel production. In the wake of the COVID-19 crisis and sudden cratering of the oil economy, that is more true than ever.

Low oil prices and a near-term drop in demand are causing immediate financial and logistical stress for the industry. But current events provide no guarantee that the industry will stay in long-term decline, especially at the pace needed to limit global warming to 1.5 degrees Celsius (degC).

Now is precisely the time for governments to pursue a carefully planned exit from oil and gas production: to systematically disentangle their economies from this volatile and toxic industry in a way that lines up with global climate goals, invests deeply in a just transition for workers and local communities, and builds the clean energy sectors we will need long into the future.

In this post, we analyze five reasons why managing the decline of oil and gas must be a priority for governments as part of a Just Recovery from COVID-19. First, we look at the context behind the recent disarray in oil markets. Then we unpack the case for government action:

As we outline below, the coming period of recovery could be governments' last, best chance to plan for the economy we need to stay within 1.5 degrees and avoid the worst chaos of global warming. That means a return to "normal" in governments' policies towards fossil fuel production - which were largely still enabling its expansion - is out of the question. To "build back better," governments must exit the unstable boom-bust cycles of extraction, and instead manage its phase-out in a predictable, people-centered, and Paris-proof way.

It's unlikely that anybody predicted the particular circumstances the oil industry is in now: prices dipping to historic lows due to a global pandemic driving a sudden, unprecedented collapse in demand. Excess production is running out of places to go, as oil storage sites fill up globally.

As a result, recent news headlines have called this "oil's collapse," an "unprecedented plunge," and a "battle for survival." A headline last month in The Guardianasked, "Will the coronavirus kill the oil industry?"

In reality, the oil industry was already facing growing headwinds and shrinking financial weight. Before the pandemic hit, oil and gas demand continued to creep up year to year, and companies were poised to keep expanding their production. But the industry's appeal to investors was beginning to wane. The sector was already oversupplying global markets. In 2019, its share of the S&P 500 stock index hit its lowest level in four decades. On CNBC, Mad Money's Jim Kramer declared that fossil fuel stocks were in their "death knell" phase.

From a broader view, the oil and gas industry has failed to reconcile its business model with climate reality - doing its best to create new markets for its products and suppress competition from renewables, but ultimately still planning for a future filled with oil and gas. The industry has already invested in pumping out more oil and gas than the world can afford to burn, yet it keeps investing in pumping out even more. None of the options in the flowchart below speak to a bright future for oil and gas companies, albeit the top two pathways would allow business as usual to continue for a while longer.

The coronavirus itself will not kill the industry. But, as The Economistput it, "oil producers should see COVID-19's turmoil for what it is: not an aberration, but a sign of what is to come.

The question to ask is not: Will the oil industry end?

Rather, as OCI has argued for a while now, it is: Will governments manage the industry's decline quickly enough, and in a fair and just way?

That is, wind down the extraction and burning of oil and gas at the pace required to limit global heating to 1.5degC while building a brighter future for workers and communities on the frontlines of the industry now.

The current crisis is a clear warning sign that, if governments leave the "when" and "how" of the end of oil and gas up to tumultuous markets, the outcome will not be good for either people or the planet.

The current situation is what unmanaged decline looks like:

But this does not have to be the way the decline of oil shakes out. It can be predictable, people-centered, and Paris-proof - guided by principles of a just transition and the urgency of the climate crisis - if governments stop letting the industry and financial markets call the shots. The recent collapse in oil prices is not an excuse for governments to sit idle, waiting for the sector to decline, or a reason to squander public resources on new bailouts and subsidies.

For the following reasons, now is the time for governments to develop fossil fuel phase-out plans to manage the decline of oil and gas extraction.

At this stage of the climate crisis, limiting its escalating damage requires rapid, systematic change across our economy and society - transformation that cannot be left up to volatile markets or profit-driven corporations.

The Intergovernmental Panel on Climate Change's (IPCC) landmark 2018 Special Report on Global Warming of 1.5degCemphasized that, "large, immediate and unprecedented global efforts to mitigate greenhouse gases are required" to limit heating to that level. The latest United Nations Emissions Gap report found that global greenhouse gas emissions need to drop by 7.6 percent each year to keep warming below 1.5degC. By contrast, the parallel, UN-sponsored Production Gap report found that the world's top fossil fuel producing countries are on track to produce 120 percent more oil, gas, and coal in 2030 than is consistent with a 1.5-degree warming limit.

Those two criss-crossing trajectories - the large-scale, year-on-year reductions in climate pollution we need and the fossil fuel industry's plans to keep expanding - are not going to magically realign themselves via market signals. History shows that sudden drops in emissions during times of crisis, as is happening now, are typically followed by an even greater "rebound" in pollution.

The International Energy Agency (IEA) projects that the coronavirus lockdowns could lead to an 8 percent drop in global CO2 pollution in 2020, on par with the scale of year-on-year reductions needed to avoid the worst of global warming. But ordering millions of people to shelter in their homes and shutting down most economic activity is not a climate solution. Analysis from Climate Action Tracker finds that, if countries' COVID-19 recovery packages skimp on green investment and stick with fossil fuels, then emissions could rebound to even higher levels than we were headed for before the pandemic (Figure 2).

To avoid that scenario, and get on track to staying within 1.5 degrees, governments must make a managed decline of fossil fuels and large-scale clean energy investments a pillar of their economic recovery plans.

Only governments can ensure a rapid and sustained wind down of fossil fuels that protects people and a livable planet. More specifically, governments can:

Governments did not have much time to plan for the economic chaos of a global pandemic. But now we have seen how quickly they can pivot and materialize trillions of dollars of new investment. Our political leaders know the climate crisis is here and worsening. The coming period of recovery could be their last, best chance to plan for the economy we need to stay within 1.5 degrees and avoid the worst chaos of global warming.

As the Climate Justice Alliance aptly puts it: "Transition is inevitable. Justice is not."

Transitioning to a renewable energy economy at the pace and scale required will mean the phase-out of fossil fuel jobs and related revenue in those regions where extraction is concentrated. Government policy, planning, and investment will be pivotal in determining how this process unfolds. Will it be just and democratic, centering those most impacted, giving power and resources to local communities, and leaving nobody behind? Or will it be cruel and chaotic, replicating harmful power structures, creating social unrest, and deepening inequality?

Unfortunately, up to the current price crash, few governments had been putting in the work needed to plan for a just and democratic transition off fossil fuels, even though overall employment in the sector was already in long-term decline.

The oil price crash of 2014 pushed companies to produce more oil and gas at lower costs, and overall employment never returned to the same levels. For example, in the UK, the number of workers employed per barrel of oil extracted fell by 30 percent between 2014 and 2017. While U.S. oil and gas production grew by nearly 85 percent over the past decade, the number of workers employed per barrel extracted fell by around 40 percent, as shown in Figure 3 below.

Oil companies are quite willing to sacrifice workers and public health to protect their profit margins. They are reacting to the current financial stress by laying off workers and lobbying to loosen health and safety protections for local communities, even as they take on more debt to pay out dividends promised to investors. In some places, governments' broad coronavirus relief packages will provide temporary support to laid off oil workers. But unlike jobs serving food or driving school buses, many jobs in the oil and gas sector cannot come back.

As governments reimagine their social contracts to pull their economies out of the current pandemic, they must align recovery policies with the long-term reality that fossil fuels need to be a smaller and smaller source of jobs and revenue. Governments should develop robust transition plans that provide supportive off ramps from fossil fuels and guaranteed on ramps to high-quality new jobs and economic opportunities, targeting that support to the regions entangled in the fossil fuel economy now.

While the exact scope and terms of just transition plans will depend on the national and local context, there are principles and models to build from via the International Labour Organisation, International Trade Union Confederation (ITUC), and case studies of past and ongoing transition experiences. Key elements that require government action and investment include:

In some regions, processes and plans are in motion that governments can learn from and build on.

Scotland has a Just Transition Commission that has already begun bringing together affected constituencies in dialogue and released an interim report with recommendations on how to minimize the risks and maximise the economic and social benefits of climate action. New Zealand's Just Transition Unit has adopted a "five pou" (that is, five pillar) approach, based on dialogue between central government, local government, working people, businesses, and Indigenous peoples.

In the United States, the Green New Deal plan put forward by Senator Bernie Sanders maps out a robust package of social support for fossil fuel workers - guaranteeing five years of their current salary, housing assistance, job training, health care, pension support, priority job placement, and the option of early retirement support.

When the Spanish government neared a 2018 deadline for closing its coal mines, it negotiated with trade unions, reaching an agreement to invest EUR 250 million in the regions where coal mines were being phased out in addition to directly supporting workers with retraining, jobs in environmental restoration, and early retirement options.

Critically, governments that choose to pursue energy efficiency and renewable energy development in their recovery and stimulus packages will also secure jobs benefits. Study after study has shown that transitioning to a 100 percent renewable and more energy efficient economy promises to deliver a net gain in jobs, and greater economic and social benefits, compared to investing in fossil fuels. In many jurisdictions, there are already more jobs in renewable energy than fossil fuels. Modelling last year by Friends of the Earth Scotland, OCI, and Platform found that the UK government could create three times more jobs through ambitious investment in clean energy than would be affected by a managed decline of oil and gas.

It is important to note that the quality of jobs in new, clean sectors is not inevitable. Governments also have a key role to play in ensuring that new jobs created provide equal or better pay and benefits and collective bargaining rights.

Just transition processes, plans, and investments are foundational to a managed decline of fossil fuel production. Without long-term, comprehensive, and bottom-up just transition plans, it will be much harder, if not impossible, to phase out extraction at the pace that's needed. The chaotic transition path is likely to fuel political resistance. To be partners in implementing bold climate policies, workers and local communities need a believable path to a brighter future, and a say in what that looks like. A just transition should not only leave nobody behind, but leave everyone better off.

As discussed above, another boom-bust cycle in the oil and gas industry would be a disaster for the climate, workers, and communities on the frontlines of fossil fuel extraction. But that is exactly what the current oil price collapse will lead to without proactive government action to stop another ride up the market roller coaster.

We have no time for another ride because the fossil fuel industry has already dug us into a deep hole. OCI analysis has found that the oil, gas, and coal in already operating or under-construction fields and mines globally would push us well above 1.5degC of global warming and right up to 2degC, beyond the limits set under the Paris Agreement (Figure 4).

The implication is that we cannot afford to develop new reserves of fossil fuels. Moreover, a significant portion of already developed extraction projects will need to be phased out early, to keep us below that dotted green 1.5degC line seen below.

Figure 4: CO2 from developed fossil fuel reserves vs. carbon budgets in range of the Paris Agreement goals

Fundamentally, these conclusions remain the same despite the industry's present nosedive. Fluctuations in oil price have a far greater effect on companies' decisions about what new projects to develop compared to the production they maintain from existing projects. It's the latter that is projected in Figure 4.

In the short term, the collapse of oil prices is leading companies to put a pause on many planned projects. Rystad Energy projects that capital expenditure by oil and gas production companies will fall to its lowest point in 13 years in 2020. Wood Mackenzie projects 10 to 15 large extraction projects have a "reasonable chance" of being approved for development this year, compared to its original 2020 estimate of 50 new final investment decisions.

It's also true that companies are facing unprecedented pressure to shut down production at some already operating oil and gas projects, though this is not necessarily because of low oil prices in themselves.

When prices crashed in 2014, virtually no existing operations shut down. In fact, global oil production continued to rise each year of the past decade. This year, a global pandemic suddenly collapsed demand at a time when companies had been rushing to oversupply the market. As a result, there have been very few places left to physically store unneeded oil that's being produced. This is forcing the shut-in of some production in places like Canada, Venezuela, and Iraq, when producers have run out of other options.

But these near-term pauses to new development and unplanned shutdowns of some already-operating wells will not magically resolve the mismatch in Figure 4 between the fossil fuel reserves already being tapped and the carbon budget limits we need to stay within. Even if coal production were phased out overnight, already developed oil and gas projects alone could push us beyond 1.5degC of warming.

Figure 5 illustrates the decision point that governments face right now. Their policies towards the oil and gas sector, or lack thereof, will determine which trajectory we track towards during this critical decade for climate action.

It's worth acknowledging that the "roller coaster" scenario does not necessarily look pretty for the oil and gas industry and its investors either. But financial pain for the industry does not neatly equate to carbon staying in the ground. Stranded assets can turn into carbon "zombies," oil and gas fields that never turn a profit for investors but nonetheless keep producing fossil fuels.

This can happen for several reasons:

In sum, financial, political, and legal factors create a carbon lock-in effect that low prices alone will not wipe out - at least not on a scale close to what's needed to address the climate crisis.

This is why we at OCI focus attention on developed fossil fuel reserves, and the fact that too much fossil fuel extraction is already set in motion. After companies have gone to the trouble of securing licenses and permits from governments, deposited loans from banks, and sunk capital into an oil or gas field, those projects will not automatically "turn off" when oil prices go down, as typical cost-optimizing models assume.

Instead of reverting to past practice, bailing out financially failing fossil fuel companies, and creating new zombie companies, governments have a chance now to disembark from the roller coaster and manage their decline. As we discuss next, the exact speed and trajectory of that descent should depend on each country's respective capacity and context.

Governments have a long history of intervening in oil markets to control production and prices, and stimulate new production. From the 1930s to the early 1970s, the Texas Railroad Commission set production quotas and thereby influenced oil prices, providing the blueprint for establishing the Organisation of Petroleum Exporting Countries (OPEC).

In 2020, OPEC first opened its taps in a second attempt to undercut the growing flood of production from U.S. fracking operations and corner Russia into cooperation. In response to both political pressure and unprecedented demand destruction from COVID-19, the OPEC+ alliance was forced back to the negotiating table to agree on new production cuts.

The oil market has hardly been a model "free" market for another reason. On top of intervening to stabilise prices, or expand their share of production, governments have long poured public money into subsidizing fossil fuel production. Recently, a study led by the Stockholm Environment Institute found that up to half of new U.S. oil development could be dependent on subsidies through 2050 (at prices of USD 50/bbl).

To achieve an equitable global decline in fossil fuel production in line with climate limits, governments will need to develop new models of cooperation - this time to manage which countries can fairly move fastest or slowest to phase out production, and how to equitably distribute the costs of that transition.

That is the opposite of what is happening now. OPEC+ may have agreed to some production cuts, but not from a view of equitably shouldering the economic burden. Countries like Iraq and Nigeria, both OPEC members, are struggling to plug holes in their budgets for essential social services. Meanwhile, the United States, the world's largest oil and gas producer and its wealthiest by GDP, is more focused on bailing out oil companies. The Texas Railroad Commission, former blueprint for OPEC, recently declined to set its own production cap.

If climate goals are to be met, equity must be a core consideration in how governments manage the decline of fossil fuels. That is not only because it is morally right but also because it could be the difference between global success or failure in realizing the rapid cuts that are needed.

The IPCC Special Report on 1.5degC found that most models "could not construct pathways characterized by lack of international cooperation, inequality and poverty" that were able to limit warming to 1.5degC.

Greg Muttitt, formerly of OCI, and Sivan Kartha of the Stockholm Environment Institute underline in a forthcoming paper in Climate Policy that remaining carbon budgets are simply too small for an unorganized global phase-out of production. The paper, to be published this month, summarizes that, if OECD countries achieve a near-immediate phase out of production and non-OECD countries take 25 years, that pace would largely exhaust the budget for 1.5degC.

So how might an equitable phase-out of extraction be organised between countries.

The Lofoten Declaration, signed by 770 civil society groups across the globe, affirms, "[I]t is the urgent responsibility and moral obligation of wealthy fossil fuel producers to lead in putting an end to fossil fuel development and to manage the decline of existing production."

Muttitt and Kartha put a finer point on why that is so in their paper, entitled "Equity, climate justice and fossil fuel extraction." The transition off fossil fuel production, and the jobs and government revenue tied to it, will inevitably be challenging everywhere, especially given the rapid pace at which the transition must happen. But the social costs will be easiest to manage in countries "where dependence on extraction for providing employment or public revenues is lowest" and "financial or institutional capacity to absorb and overcome transitional difficulties is the greatest." The following figure from the paper provides a framework for comparing the phase-out capacity of oil producers.

Wealthier oil-producing countries with diversified economies - such as the United States, Norway, Canada, and the UK - have the greatest capacity to fund a robust just transition for workers and communities while rapidly winding down extraction. Low-income countries that currently depend on oil revenues to fund public services - such as Iraq, Angola, and Nigeria - must also start the transition process now, but will need more time to complete it.

Because the world as a whole is running out of time, lower-income countries face more rapid transitions than they likely have the capacity to manage alone. Hence, Muttitt and Kartha suggest that wealthier countries should also help shoulder the burden, with finance that is "additional to, rather than competing with, existing climate finance for mitigation and adaptation."

As Ngozi Okonjo-Iweala, a former Finance Minister of Nigeria, wrote in a recent op-ed, "Now more than ever, rich countries must support the developing world in the pursuit of a healthy and prosperous future for all. [...] Low-income regions cannot do this alone."

Of course, translating these principles into a clear path towards multilateral cooperation in an equitable phase-out of fossil fuel extraction will not be easy. Eco-fascism is a rising concern around the world. Some of the same wealthy fossil fuel producers that should be first movers in the transition off extraction are already major blockers to multilateral progress on climate within existing negotiating bodies like the UNFCCC.

But it's clear that if governments compete for their oil to be the last reserves extracted, the whole world will lose. The current free fall in oil markets is only exacerbating global inequality. And oil producers have proven they do know how to cooperate to control production. It's time to reimagine what an OPEC-like body would look like, if the focus were on stabilising not oil markets but the climate.

What if countries united behind an alliance with the goal of organising a cooperative phase-out of extraction?

Doing so would not only be the most equitable and effective way to confront the climate crisis, but also a key pathway to building back better as countries grapple with COVID-19 recovery.

This is a transformational moment in which governments face stark choices. Many are already mobilising unprecedented public finance in stimulus and recovery packages, passing laws under urgency, and stepping in to protect people, communities, and businesses. It is widely recognized that the decisions governments make in responding to the COVID-19 crisis will define not just the immediate recovery, but shape the global energy economy for years or decades to come.

The head of the UN Development Programme, Achim Steiner, says this crisis presents "a fork in the road for every country," a chance to break free from "irrational" dependence on fossil fuels and "insert the DNA of a low-carbon transition and recovery strategy" into economies.

In a recent study assessing the potential climate implications of COVID-19 responses, a group of prominent economists underscore that recovery packages represent "life and death decisions about future generations, including through their impact on the climate."

Will governments build back better, crafting a Just Recovery, or attempt to return to an unstable, unsustainable, unjust status quo? In part, the answer will depend on who politicians listen to at this moment.

The oil and gas industry and its lobby associations are some of the most active in pushing for government bailouts, keeping with the industry's long legacy of undermining climate solutions and prolonging its unsustainable business model for as long as possible. While many oil companies now claim to be "committed" to climate action, not a single one has actually committed to stop drilling more fossil fuels out of the ground.

On the other hand, civil society organisations, people's movements, and researchers in numerous different countries have argued for a Just Recovery: one that puts health first, provides relief directly to people, centers workers and communities not corporate executives, builds solidarity across borders, and --crucially--builds a foundation of resilience for the multiple, interlocking crises we face.

If governments listen to the fossil fuel lobby, revive a volatile industry, and further entangle economies and workers in oil and gas, then they are setting our communities up for escalating climate and economic chaos in the decades to come.

The better choice is to make policies for a just transition off oil and gas a pillar of Just Recovery. As we've unpacked above, markets will not lead this process. Governments must drive it, and there are plenty of policy tools at their disposal, from initiating Just Transition planning processes, to putting a stop to new fossil fuel licensing, to mobilizing finance to help poorer, fossil fuel-dependent countries transition while meeting people's human needs.

Ultimately, these two goals - a Just Recovery and a fair and equitable exit from oil and gas extraction - are inseparable:

Prioritizing health includes phasing out oil wells operating next to schools in Los Angeles, or through Indigenous lands in the Amazon.

Centering workers requires providing those working now in fossil fuels, whether in Alberta or Angola, with guaranteed protection and on ramps to new, clean sectors.

Building solidarity across borders requires wealthier countries like Norway recognizing that they must move much faster than Nigeria to phase out their fossil fuel production, rather than fighting for their oil to be the last extracted.

Building a foundation of resilience means recognizing that the oil and gas industry cannot survive on a livable planet, and investing instead in a regenerative, renewable future.

Written with contributions from David Tong.

Since the Paris Agreement was signed, Oil Change International (OCI) has been making the case that meeting its goals will require governments to proactively manage the phase-out of fossil fuel production. In the wake of the COVID-19 crisis and sudden cratering of the oil economy, that is more true than ever.

Low oil prices and a near-term drop in demand are causing immediate financial and logistical stress for the industry. But current events provide no guarantee that the industry will stay in long-term decline, especially at the pace needed to limit global warming to 1.5 degrees Celsius (degC).

Now is precisely the time for governments to pursue a carefully planned exit from oil and gas production: to systematically disentangle their economies from this volatile and toxic industry in a way that lines up with global climate goals, invests deeply in a just transition for workers and local communities, and builds the clean energy sectors we will need long into the future.

In this post, we analyze five reasons why managing the decline of oil and gas must be a priority for governments as part of a Just Recovery from COVID-19. First, we look at the context behind the recent disarray in oil markets. Then we unpack the case for government action:

As we outline below, the coming period of recovery could be governments' last, best chance to plan for the economy we need to stay within 1.5 degrees and avoid the worst chaos of global warming. That means a return to "normal" in governments' policies towards fossil fuel production - which were largely still enabling its expansion - is out of the question. To "build back better," governments must exit the unstable boom-bust cycles of extraction, and instead manage its phase-out in a predictable, people-centered, and Paris-proof way.

It's unlikely that anybody predicted the particular circumstances the oil industry is in now: prices dipping to historic lows due to a global pandemic driving a sudden, unprecedented collapse in demand. Excess production is running out of places to go, as oil storage sites fill up globally.

As a result, recent news headlines have called this "oil's collapse," an "unprecedented plunge," and a "battle for survival." A headline last month in The Guardianasked, "Will the coronavirus kill the oil industry?"

In reality, the oil industry was already facing growing headwinds and shrinking financial weight. Before the pandemic hit, oil and gas demand continued to creep up year to year, and companies were poised to keep expanding their production. But the industry's appeal to investors was beginning to wane. The sector was already oversupplying global markets. In 2019, its share of the S&P 500 stock index hit its lowest level in four decades. On CNBC, Mad Money's Jim Kramer declared that fossil fuel stocks were in their "death knell" phase.

From a broader view, the oil and gas industry has failed to reconcile its business model with climate reality - doing its best to create new markets for its products and suppress competition from renewables, but ultimately still planning for a future filled with oil and gas. The industry has already invested in pumping out more oil and gas than the world can afford to burn, yet it keeps investing in pumping out even more. None of the options in the flowchart below speak to a bright future for oil and gas companies, albeit the top two pathways would allow business as usual to continue for a while longer.

The coronavirus itself will not kill the industry. But, as The Economistput it, "oil producers should see COVID-19's turmoil for what it is: not an aberration, but a sign of what is to come.

The question to ask is not: Will the oil industry end?

Rather, as OCI has argued for a while now, it is: Will governments manage the industry's decline quickly enough, and in a fair and just way?

That is, wind down the extraction and burning of oil and gas at the pace required to limit global heating to 1.5degC while building a brighter future for workers and communities on the frontlines of the industry now.

The current crisis is a clear warning sign that, if governments leave the "when" and "how" of the end of oil and gas up to tumultuous markets, the outcome will not be good for either people or the planet.

The current situation is what unmanaged decline looks like:

But this does not have to be the way the decline of oil shakes out. It can be predictable, people-centered, and Paris-proof - guided by principles of a just transition and the urgency of the climate crisis - if governments stop letting the industry and financial markets call the shots. The recent collapse in oil prices is not an excuse for governments to sit idle, waiting for the sector to decline, or a reason to squander public resources on new bailouts and subsidies.

For the following reasons, now is the time for governments to develop fossil fuel phase-out plans to manage the decline of oil and gas extraction.

At this stage of the climate crisis, limiting its escalating damage requires rapid, systematic change across our economy and society - transformation that cannot be left up to volatile markets or profit-driven corporations.

The Intergovernmental Panel on Climate Change's (IPCC) landmark 2018 Special Report on Global Warming of 1.5degCemphasized that, "large, immediate and unprecedented global efforts to mitigate greenhouse gases are required" to limit heating to that level. The latest United Nations Emissions Gap report found that global greenhouse gas emissions need to drop by 7.6 percent each year to keep warming below 1.5degC. By contrast, the parallel, UN-sponsored Production Gap report found that the world's top fossil fuel producing countries are on track to produce 120 percent more oil, gas, and coal in 2030 than is consistent with a 1.5-degree warming limit.

Those two criss-crossing trajectories - the large-scale, year-on-year reductions in climate pollution we need and the fossil fuel industry's plans to keep expanding - are not going to magically realign themselves via market signals. History shows that sudden drops in emissions during times of crisis, as is happening now, are typically followed by an even greater "rebound" in pollution.

The International Energy Agency (IEA) projects that the coronavirus lockdowns could lead to an 8 percent drop in global CO2 pollution in 2020, on par with the scale of year-on-year reductions needed to avoid the worst of global warming. But ordering millions of people to shelter in their homes and shutting down most economic activity is not a climate solution. Analysis from Climate Action Tracker finds that, if countries' COVID-19 recovery packages skimp on green investment and stick with fossil fuels, then emissions could rebound to even higher levels than we were headed for before the pandemic (Figure 2).

To avoid that scenario, and get on track to staying within 1.5 degrees, governments must make a managed decline of fossil fuels and large-scale clean energy investments a pillar of their economic recovery plans.

Only governments can ensure a rapid and sustained wind down of fossil fuels that protects people and a livable planet. More specifically, governments can:

Governments did not have much time to plan for the economic chaos of a global pandemic. But now we have seen how quickly they can pivot and materialize trillions of dollars of new investment. Our political leaders know the climate crisis is here and worsening. The coming period of recovery could be their last, best chance to plan for the economy we need to stay within 1.5 degrees and avoid the worst chaos of global warming.

As the Climate Justice Alliance aptly puts it: "Transition is inevitable. Justice is not."

Transitioning to a renewable energy economy at the pace and scale required will mean the phase-out of fossil fuel jobs and related revenue in those regions where extraction is concentrated. Government policy, planning, and investment will be pivotal in determining how this process unfolds. Will it be just and democratic, centering those most impacted, giving power and resources to local communities, and leaving nobody behind? Or will it be cruel and chaotic, replicating harmful power structures, creating social unrest, and deepening inequality?

Unfortunately, up to the current price crash, few governments had been putting in the work needed to plan for a just and democratic transition off fossil fuels, even though overall employment in the sector was already in long-term decline.

The oil price crash of 2014 pushed companies to produce more oil and gas at lower costs, and overall employment never returned to the same levels. For example, in the UK, the number of workers employed per barrel of oil extracted fell by 30 percent between 2014 and 2017. While U.S. oil and gas production grew by nearly 85 percent over the past decade, the number of workers employed per barrel extracted fell by around 40 percent, as shown in Figure 3 below.

Oil companies are quite willing to sacrifice workers and public health to protect their profit margins. They are reacting to the current financial stress by laying off workers and lobbying to loosen health and safety protections for local communities, even as they take on more debt to pay out dividends promised to investors. In some places, governments' broad coronavirus relief packages will provide temporary support to laid off oil workers. But unlike jobs serving food or driving school buses, many jobs in the oil and gas sector cannot come back.

As governments reimagine their social contracts to pull their economies out of the current pandemic, they must align recovery policies with the long-term reality that fossil fuels need to be a smaller and smaller source of jobs and revenue. Governments should develop robust transition plans that provide supportive off ramps from fossil fuels and guaranteed on ramps to high-quality new jobs and economic opportunities, targeting that support to the regions entangled in the fossil fuel economy now.

While the exact scope and terms of just transition plans will depend on the national and local context, there are principles and models to build from via the International Labour Organisation, International Trade Union Confederation (ITUC), and case studies of past and ongoing transition experiences. Key elements that require government action and investment include:

In some regions, processes and plans are in motion that governments can learn from and build on.

Scotland has a Just Transition Commission that has already begun bringing together affected constituencies in dialogue and released an interim report with recommendations on how to minimize the risks and maximise the economic and social benefits of climate action. New Zealand's Just Transition Unit has adopted a "five pou" (that is, five pillar) approach, based on dialogue between central government, local government, working people, businesses, and Indigenous peoples.

In the United States, the Green New Deal plan put forward by Senator Bernie Sanders maps out a robust package of social support for fossil fuel workers - guaranteeing five years of their current salary, housing assistance, job training, health care, pension support, priority job placement, and the option of early retirement support.

When the Spanish government neared a 2018 deadline for closing its coal mines, it negotiated with trade unions, reaching an agreement to invest EUR 250 million in the regions where coal mines were being phased out in addition to directly supporting workers with retraining, jobs in environmental restoration, and early retirement options.

Critically, governments that choose to pursue energy efficiency and renewable energy development in their recovery and stimulus packages will also secure jobs benefits. Study after study has shown that transitioning to a 100 percent renewable and more energy efficient economy promises to deliver a net gain in jobs, and greater economic and social benefits, compared to investing in fossil fuels. In many jurisdictions, there are already more jobs in renewable energy than fossil fuels. Modelling last year by Friends of the Earth Scotland, OCI, and Platform found that the UK government could create three times more jobs through ambitious investment in clean energy than would be affected by a managed decline of oil and gas.

It is important to note that the quality of jobs in new, clean sectors is not inevitable. Governments also have a key role to play in ensuring that new jobs created provide equal or better pay and benefits and collective bargaining rights.

Just transition processes, plans, and investments are foundational to a managed decline of fossil fuel production. Without long-term, comprehensive, and bottom-up just transition plans, it will be much harder, if not impossible, to phase out extraction at the pace that's needed. The chaotic transition path is likely to fuel political resistance. To be partners in implementing bold climate policies, workers and local communities need a believable path to a brighter future, and a say in what that looks like. A just transition should not only leave nobody behind, but leave everyone better off.

As discussed above, another boom-bust cycle in the oil and gas industry would be a disaster for the climate, workers, and communities on the frontlines of fossil fuel extraction. But that is exactly what the current oil price collapse will lead to without proactive government action to stop another ride up the market roller coaster.

We have no time for another ride because the fossil fuel industry has already dug us into a deep hole. OCI analysis has found that the oil, gas, and coal in already operating or under-construction fields and mines globally would push us well above 1.5degC of global warming and right up to 2degC, beyond the limits set under the Paris Agreement (Figure 4).

The implication is that we cannot afford to develop new reserves of fossil fuels. Moreover, a significant portion of already developed extraction projects will need to be phased out early, to keep us below that dotted green 1.5degC line seen below.

Figure 4: CO2 from developed fossil fuel reserves vs. carbon budgets in range of the Paris Agreement goals

Fundamentally, these conclusions remain the same despite the industry's present nosedive. Fluctuations in oil price have a far greater effect on companies' decisions about what new projects to develop compared to the production they maintain from existing projects. It's the latter that is projected in Figure 4.

In the short term, the collapse of oil prices is leading companies to put a pause on many planned projects. Rystad Energy projects that capital expenditure by oil and gas production companies will fall to its lowest point in 13 years in 2020. Wood Mackenzie projects 10 to 15 large extraction projects have a "reasonable chance" of being approved for development this year, compared to its original 2020 estimate of 50 new final investment decisions.

It's also true that companies are facing unprecedented pressure to shut down production at some already operating oil and gas projects, though this is not necessarily because of low oil prices in themselves.

When prices crashed in 2014, virtually no existing operations shut down. In fact, global oil production continued to rise each year of the past decade. This year, a global pandemic suddenly collapsed demand at a time when companies had been rushing to oversupply the market. As a result, there have been very few places left to physically store unneeded oil that's being produced. This is forcing the shut-in of some production in places like Canada, Venezuela, and Iraq, when producers have run out of other options.

But these near-term pauses to new development and unplanned shutdowns of some already-operating wells will not magically resolve the mismatch in Figure 4 between the fossil fuel reserves already being tapped and the carbon budget limits we need to stay within. Even if coal production were phased out overnight, already developed oil and gas projects alone could push us beyond 1.5degC of warming.

Figure 5 illustrates the decision point that governments face right now. Their policies towards the oil and gas sector, or lack thereof, will determine which trajectory we track towards during this critical decade for climate action.

It's worth acknowledging that the "roller coaster" scenario does not necessarily look pretty for the oil and gas industry and its investors either. But financial pain for the industry does not neatly equate to carbon staying in the ground. Stranded assets can turn into carbon "zombies," oil and gas fields that never turn a profit for investors but nonetheless keep producing fossil fuels.

This can happen for several reasons:

In sum, financial, political, and legal factors create a carbon lock-in effect that low prices alone will not wipe out - at least not on a scale close to what's needed to address the climate crisis.

This is why we at OCI focus attention on developed fossil fuel reserves, and the fact that too much fossil fuel extraction is already set in motion. After companies have gone to the trouble of securing licenses and permits from governments, deposited loans from banks, and sunk capital into an oil or gas field, those projects will not automatically "turn off" when oil prices go down, as typical cost-optimizing models assume.

Instead of reverting to past practice, bailing out financially failing fossil fuel companies, and creating new zombie companies, governments have a chance now to disembark from the roller coaster and manage their decline. As we discuss next, the exact speed and trajectory of that descent should depend on each country's respective capacity and context.

Governments have a long history of intervening in oil markets to control production and prices, and stimulate new production. From the 1930s to the early 1970s, the Texas Railroad Commission set production quotas and thereby influenced oil prices, providing the blueprint for establishing the Organisation of Petroleum Exporting Countries (OPEC).

In 2020, OPEC first opened its taps in a second attempt to undercut the growing flood of production from U.S. fracking operations and corner Russia into cooperation. In response to both political pressure and unprecedented demand destruction from COVID-19, the OPEC+ alliance was forced back to the negotiating table to agree on new production cuts.

The oil market has hardly been a model "free" market for another reason. On top of intervening to stabilise prices, or expand their share of production, governments have long poured public money into subsidizing fossil fuel production. Recently, a study led by the Stockholm Environment Institute found that up to half of new U.S. oil development could be dependent on subsidies through 2050 (at prices of USD 50/bbl).

To achieve an equitable global decline in fossil fuel production in line with climate limits, governments will need to develop new models of cooperation - this time to manage which countries can fairly move fastest or slowest to phase out production, and how to equitably distribute the costs of that transition.

That is the opposite of what is happening now. OPEC+ may have agreed to some production cuts, but not from a view of equitably shouldering the economic burden. Countries like Iraq and Nigeria, both OPEC members, are struggling to plug holes in their budgets for essential social services. Meanwhile, the United States, the world's largest oil and gas producer and its wealthiest by GDP, is more focused on bailing out oil companies. The Texas Railroad Commission, former blueprint for OPEC, recently declined to set its own production cap.

If climate goals are to be met, equity must be a core consideration in how governments manage the decline of fossil fuels. That is not only because it is morally right but also because it could be the difference between global success or failure in realizing the rapid cuts that are needed.

The IPCC Special Report on 1.5degC found that most models "could not construct pathways characterized by lack of international cooperation, inequality and poverty" that were able to limit warming to 1.5degC.

Greg Muttitt, formerly of OCI, and Sivan Kartha of the Stockholm Environment Institute underline in a forthcoming paper in Climate Policy that remaining carbon budgets are simply too small for an unorganized global phase-out of production. The paper, to be published this month, summarizes that, if OECD countries achieve a near-immediate phase out of production and non-OECD countries take 25 years, that pace would largely exhaust the budget for 1.5degC.

So how might an equitable phase-out of extraction be organised between countries.

The Lofoten Declaration, signed by 770 civil society groups across the globe, affirms, "[I]t is the urgent responsibility and moral obligation of wealthy fossil fuel producers to lead in putting an end to fossil fuel development and to manage the decline of existing production."