It's now after one o'clock in the morning. The streetlights cast long shadows. It's dark and cold. There are about forty of us still standing outside the King County jailhouse, drinking surreptitious beers and cold coffees as we bounce on our toes to try and stay warm. We've been here for hours, waiting on our friends being released. Earlier in the day, twenty-six of our comrades had been arrested for using nonviolent civil disobedience to shut down thirteen branches of JPMorgan Chase, the world's largest funder of fossil fuels. Activists had occupied one branch with a giant inflatable pipeline, at another Native American drummers led us in song, at another activists laid out a mock oil spill and locked themselves to the doors of the bank using chains and bicycle locks.

Our demand that day was simple: JPMorgan Chase must stop funding the fossil fuel corporations driving the climate crisis and committing human rights abuses around the world.

Fast forward three and a half years--to yesterday in fact--and a rather remarkable thing happened: JPMorgan Chase committed to align its business model, including all of the loans that it makes, with the Paris Agreement. "Climate change is a critical issue of our time," said Daniel Pinto, the bank's Co-President, as he announced that the bank will be working with "clients, policymakers and advocates to transition our economy and turn the goals of Paris into a reality."

When reporting on how Wall Street's largest bank came to this announcement, few will start their story outside of a jailhouse. Even if the Wall Street Journal and the Financial Times acknowledge the work of climate activists in their reports, neither will go so far as saying that the only reason that JPMorgan Chase is making this move is activist pressure.

But here's the thing: the only reason that the fossil fuel industry's largest financial backer is committing to align its business model with the Paris Agreement is activist pressure.

"By committing itself to aligning its business with the Paris Agreement, the world's largest lender to the fossil fuel industry has essentially just said that one day, in the not too distant future, it will stop giving money to the fossil fuel industry. There can be few clearer signals that the fossil fuel game is nearly up."A few months after our twenty-six friends were released from the King County jail, Rainforest Action Network launched their campaign on JPMorgan Chase with a rally, banner drop and disruption of an event that Chase CEO, Jamie Dimon, was speaking at. A month later, Mazaska Talks, an Indigenous-led grassroots group, organized Divest the Globe, and climate and Indigenous rights activists were protesting outside of bank branches in a dozen countries and fifty cities. By May 2018, there were simultaneous protests at Chase branches in over twenty cities, including one that shut down a major downtown street in Seattle outside of the bank's regional HQ.

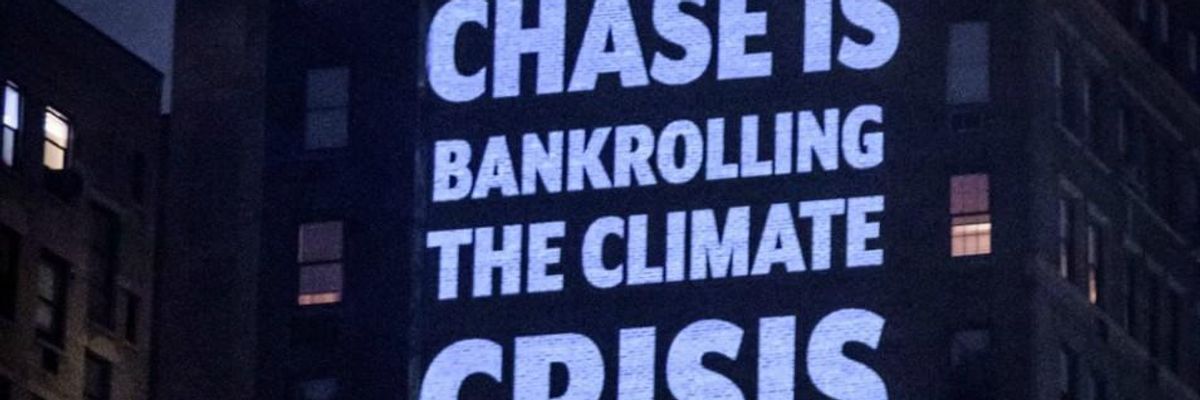

Over the last three years, climate activists have organized many hundreds of actions to force Chase to act on climate. They have organized house demos and disruptions of corporate events. They have organized banner drops, beamed thirty-foot projections outside of Jamie Dimon's house, and sent hundreds of letters (and subversive birthday cards) to Jamie Dimon's home address. Activists have protested at Chase branches in Providence, Denver, Boston, Madison, New York, Oakland, San Francisco, Chico, Wenatchee, Salem, Corvallis, Eugene, Colorado Springs, El Paso, Minneapolis, and dozens of more cities around the nation. In Seattle alone, eighty people have been arrested in protests at Chase bank branches in the last few years. In January, a dozen were arrested for occupying a Chase bank next to the White House.

Until the pandemic hit, Jamie Dimon was being confronted by climate activists so frequently that he was shocked when he spoke publicly and wasn't heckled by climate activists: "I'm surprised that there are not people here yelling that we should not be invested in fossil fuel companies," Dimon told a crowd at the Pennsylvania Convention Center in 2019.

This relentless campaigning translated into a steady drumbeat of media coverage: Bloomberg, Rolling Stone, The New York Times, The New Yorker, (and, of course, Common Dreams) are only a few of the outlets that reported on the climate movement's pressure on Chase in recent years--which is to say that the activists' campaigning got sections of the media to start telling the real story: JPMorgan Chase is bankrolling climate chaos.

In May, the media coverage and activist pressure translated into serious shareholder pressure. At their 2020 shareholder meeting, Chase bowed to pressure and removed former Exxon CEO Lee Raymond from his lead director role on the bank's board, and 49.6% of shareholders voted to require Chase to produce a plan to align its business with the goals of the Paris Agreement.

As a result of all of this, there is not a single Board Member or executive at JPMorgan Chase who has not heard the demands of the climate movement. And that, in short, is how we got here. This is the story of how the world's largest funder of fossil fuels has been forced to begin acting on climate change. This is how change happens.

Unfortunately, I have to pause here and point out that this is very far from a total victory. Chase's announcement is wholly aspirational. This announcement doesn't stop Chase providing loans to coal companies. It doesn't stop Chase doing business with tar sands companies that are violating Indigenous peoples' rights. It doesn't stop Chase from loaning to fossil fuel companies that are still aggressively expanding their operations. This campaign is very far from over. And it won't be over until Chase has completely stopped doing business with the fossil fuel industry that is hell-bent on destroying our planet.

Yet, this is a significant moment. By committing itself to aligning its business with the Paris Agreement, the world's largest lender to the fossil fuel industry has essentially just said that one day, in the not too distant future, it will stop giving money to the fossil fuel industry. There can be few clearer signals that the fossil fuel game is nearly up.

And now that we know we have the power to make the Wall Street beast blink, all we have to do is keep it up until Chase's actions match its lofty words.