SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

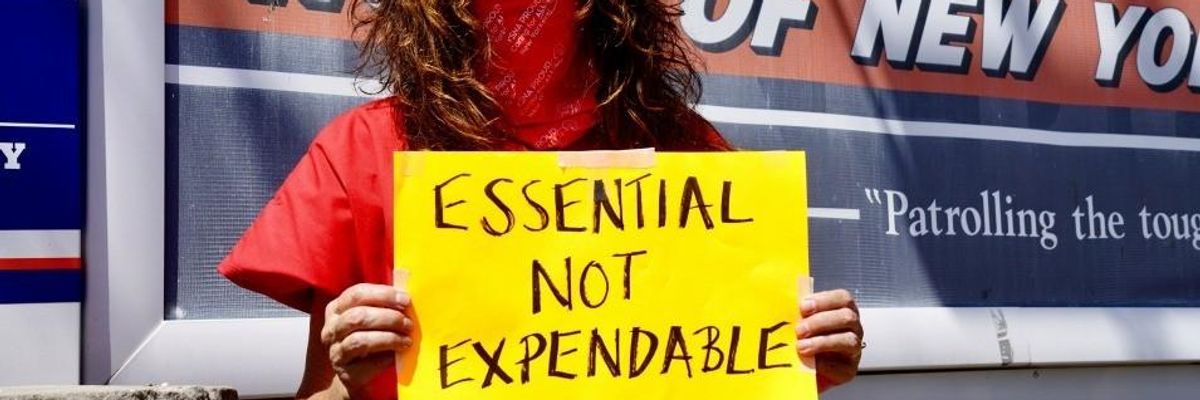

Due to the impact of historic and current systemic racism, Black and Latinx communities have seen more job loss in this recession and have less wealth to fall back on. (Photo: Giles Clarke/Getty Images)

Another 1.1 million people applied for unemployment insurance (UI) benefits last week. That includes 787,000 people who applied for regular state UI and 345,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program for workers who are not eligible for regular unemployment insurance, like gig workers. It provides up to 39 weeks of benefits, but it is set to expire at the end of this year. The 1.1 million who applied for UI last week was a decline of 47,000 from the prior week's revised figures (revisions from prior weeks were substantial due to California having completed its pause in the processing of initial claims and updating its numbers).

Last week was the 31st straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims--because we didn't have PUA in the Great Recession--initial claims last week were still well over three times their pre-recession levels.)

Most states provide 26 weeks (six months) of regular benefits, and October marks the eighth month of this crisis. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by more than a million, from 9.40 million to 8.37 million.

Fortunately, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which provides an additional 13 weeks of benefits to people who have exhausted regular state UI. However, in the latest data available for PEUC, (the week ending October 3,) PEUC rose by "just" 510,000 to 3.3 million, offsetting only 41.8% of the 1.2 million decline in continuing claims for regular state benefits for the same week. The small increase in PEUC relative to the decline in continuing claims for regular state UI is likely due largely to delays workers are facing getting on to PEUC, including workers either not being told about PEUC or not being told that they have to apply for it (states are required to notify eligible workers, but it may not be happening).

DOL data suggest that right now, 24.0 million workers are either on unemployment benefits or have applied recently and are waiting to get approved (see Figure A). But importantly, that number is an overestimate. For one thing, initial claims for regular state UI and PUA should be nonoverlapping--that is how DOL has directed state agencies to report them--but some individuals are erroneously being counted as being in both programs. An even bigger issue is that states are including retroactive payments in their continuing PUA claims, which would also lead to double-counting. All this means nobody knows exactly how many people are receiving unemployment insurance benefits right now, which is another reminder that we need to invest heavily in our UI infrastructure and technology.

Figure B shows continuing claims in all programs over time (the latest data are for October 3). Continuing claims are nearly 22 million above where they were a year ago. However, the above caveat about continuing PUA claims applies here too, which means the trends over time since March may be distorted.

Republicans in the Senate allowed the across-the-board $600 increase in weekly UI benefits to expire at the end of July, so last week was the 12th week of unemployment in this pandemic for which recipients did not get the extra $600. And without congressional action, PUA and PEUC will also expire at the end of the year. Millions of workers are depending on these programs (DOL reports 13.5 million workers are on PUA or PEUC during the week ending October 3). When these programs expire, millions of these workers and their families will be financially devastated. But there is little hope for another stimulus bill before next year. The House passed a $2.2 trillion relief package, but Senate Majority leader Mitch McConnell told Republican senators on Tuesday that he has advised the White House not to strike a deal with Speaker of the House Nancy Pelosi prior to the election.

Blocking more stimulus is not just cruel, it's terrible economics. For example, the spending made possible by the extra $600 in UI was supporting millions of jobs. Letting the $600 expire means cutting those jobs. Not providing stimulus in the form of aid to state and local governments will also cost millions of jobs. The labor market is still more than 12 million jobs below where we would be if the recession hadn't happened, and job growth is slowing. Senate Republicans should be embracing, not blocking, stimulus. Blocking more stimulus also means no additional housing and nutrition assistance, no COVID-related health and safety measures for workers, no aid to the Postal Service during this critical time, and no additional support for virus testing, tracing, and isolation measures or virus treatment and support for hospitals and other health providers. All of these things would have helped our economy and the people in it recover from the COVID-19 crisis.

Blocking stimulus is also exacerbating racial inequality. Due to the impact of historic and current systemic racism, Black and Latinx communities have seen more job loss in this recession and have less wealth to fall back on. The lack of stimulus hits these workers the hardest. Further, workers in this pandemic aren't just losing their jobs--an estimated 12 million workers and their family members have lost employer-provided health insurance due to COVID-19.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Another 1.1 million people applied for unemployment insurance (UI) benefits last week. That includes 787,000 people who applied for regular state UI and 345,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program for workers who are not eligible for regular unemployment insurance, like gig workers. It provides up to 39 weeks of benefits, but it is set to expire at the end of this year. The 1.1 million who applied for UI last week was a decline of 47,000 from the prior week's revised figures (revisions from prior weeks were substantial due to California having completed its pause in the processing of initial claims and updating its numbers).

Last week was the 31st straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims--because we didn't have PUA in the Great Recession--initial claims last week were still well over three times their pre-recession levels.)

Most states provide 26 weeks (six months) of regular benefits, and October marks the eighth month of this crisis. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by more than a million, from 9.40 million to 8.37 million.

Fortunately, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which provides an additional 13 weeks of benefits to people who have exhausted regular state UI. However, in the latest data available for PEUC, (the week ending October 3,) PEUC rose by "just" 510,000 to 3.3 million, offsetting only 41.8% of the 1.2 million decline in continuing claims for regular state benefits for the same week. The small increase in PEUC relative to the decline in continuing claims for regular state UI is likely due largely to delays workers are facing getting on to PEUC, including workers either not being told about PEUC or not being told that they have to apply for it (states are required to notify eligible workers, but it may not be happening).

DOL data suggest that right now, 24.0 million workers are either on unemployment benefits or have applied recently and are waiting to get approved (see Figure A). But importantly, that number is an overestimate. For one thing, initial claims for regular state UI and PUA should be nonoverlapping--that is how DOL has directed state agencies to report them--but some individuals are erroneously being counted as being in both programs. An even bigger issue is that states are including retroactive payments in their continuing PUA claims, which would also lead to double-counting. All this means nobody knows exactly how many people are receiving unemployment insurance benefits right now, which is another reminder that we need to invest heavily in our UI infrastructure and technology.

Figure B shows continuing claims in all programs over time (the latest data are for October 3). Continuing claims are nearly 22 million above where they were a year ago. However, the above caveat about continuing PUA claims applies here too, which means the trends over time since March may be distorted.

Republicans in the Senate allowed the across-the-board $600 increase in weekly UI benefits to expire at the end of July, so last week was the 12th week of unemployment in this pandemic for which recipients did not get the extra $600. And without congressional action, PUA and PEUC will also expire at the end of the year. Millions of workers are depending on these programs (DOL reports 13.5 million workers are on PUA or PEUC during the week ending October 3). When these programs expire, millions of these workers and their families will be financially devastated. But there is little hope for another stimulus bill before next year. The House passed a $2.2 trillion relief package, but Senate Majority leader Mitch McConnell told Republican senators on Tuesday that he has advised the White House not to strike a deal with Speaker of the House Nancy Pelosi prior to the election.

Blocking more stimulus is not just cruel, it's terrible economics. For example, the spending made possible by the extra $600 in UI was supporting millions of jobs. Letting the $600 expire means cutting those jobs. Not providing stimulus in the form of aid to state and local governments will also cost millions of jobs. The labor market is still more than 12 million jobs below where we would be if the recession hadn't happened, and job growth is slowing. Senate Republicans should be embracing, not blocking, stimulus. Blocking more stimulus also means no additional housing and nutrition assistance, no COVID-related health and safety measures for workers, no aid to the Postal Service during this critical time, and no additional support for virus testing, tracing, and isolation measures or virus treatment and support for hospitals and other health providers. All of these things would have helped our economy and the people in it recover from the COVID-19 crisis.

Blocking stimulus is also exacerbating racial inequality. Due to the impact of historic and current systemic racism, Black and Latinx communities have seen more job loss in this recession and have less wealth to fall back on. The lack of stimulus hits these workers the hardest. Further, workers in this pandemic aren't just losing their jobs--an estimated 12 million workers and their family members have lost employer-provided health insurance due to COVID-19.

Another 1.1 million people applied for unemployment insurance (UI) benefits last week. That includes 787,000 people who applied for regular state UI and 345,000 who applied for Pandemic Unemployment Assistance (PUA). PUA is the federal program for workers who are not eligible for regular unemployment insurance, like gig workers. It provides up to 39 weeks of benefits, but it is set to expire at the end of this year. The 1.1 million who applied for UI last week was a decline of 47,000 from the prior week's revised figures (revisions from prior weeks were substantial due to California having completed its pause in the processing of initial claims and updating its numbers).

Last week was the 31st straight week total initial claims were far greater than the worst week of the Great Recession. (If that comparison is restricted to regular state claims--because we didn't have PUA in the Great Recession--initial claims last week were still well over three times their pre-recession levels.)

Most states provide 26 weeks (six months) of regular benefits, and October marks the eighth month of this crisis. That means many workers are exhausting their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by more than a million, from 9.40 million to 8.37 million.

Fortunately, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which provides an additional 13 weeks of benefits to people who have exhausted regular state UI. However, in the latest data available for PEUC, (the week ending October 3,) PEUC rose by "just" 510,000 to 3.3 million, offsetting only 41.8% of the 1.2 million decline in continuing claims for regular state benefits for the same week. The small increase in PEUC relative to the decline in continuing claims for regular state UI is likely due largely to delays workers are facing getting on to PEUC, including workers either not being told about PEUC or not being told that they have to apply for it (states are required to notify eligible workers, but it may not be happening).

DOL data suggest that right now, 24.0 million workers are either on unemployment benefits or have applied recently and are waiting to get approved (see Figure A). But importantly, that number is an overestimate. For one thing, initial claims for regular state UI and PUA should be nonoverlapping--that is how DOL has directed state agencies to report them--but some individuals are erroneously being counted as being in both programs. An even bigger issue is that states are including retroactive payments in their continuing PUA claims, which would also lead to double-counting. All this means nobody knows exactly how many people are receiving unemployment insurance benefits right now, which is another reminder that we need to invest heavily in our UI infrastructure and technology.

Figure B shows continuing claims in all programs over time (the latest data are for October 3). Continuing claims are nearly 22 million above where they were a year ago. However, the above caveat about continuing PUA claims applies here too, which means the trends over time since March may be distorted.

Republicans in the Senate allowed the across-the-board $600 increase in weekly UI benefits to expire at the end of July, so last week was the 12th week of unemployment in this pandemic for which recipients did not get the extra $600. And without congressional action, PUA and PEUC will also expire at the end of the year. Millions of workers are depending on these programs (DOL reports 13.5 million workers are on PUA or PEUC during the week ending October 3). When these programs expire, millions of these workers and their families will be financially devastated. But there is little hope for another stimulus bill before next year. The House passed a $2.2 trillion relief package, but Senate Majority leader Mitch McConnell told Republican senators on Tuesday that he has advised the White House not to strike a deal with Speaker of the House Nancy Pelosi prior to the election.

Blocking more stimulus is not just cruel, it's terrible economics. For example, the spending made possible by the extra $600 in UI was supporting millions of jobs. Letting the $600 expire means cutting those jobs. Not providing stimulus in the form of aid to state and local governments will also cost millions of jobs. The labor market is still more than 12 million jobs below where we would be if the recession hadn't happened, and job growth is slowing. Senate Republicans should be embracing, not blocking, stimulus. Blocking more stimulus also means no additional housing and nutrition assistance, no COVID-related health and safety measures for workers, no aid to the Postal Service during this critical time, and no additional support for virus testing, tracing, and isolation measures or virus treatment and support for hospitals and other health providers. All of these things would have helped our economy and the people in it recover from the COVID-19 crisis.

Blocking stimulus is also exacerbating racial inequality. Due to the impact of historic and current systemic racism, Black and Latinx communities have seen more job loss in this recession and have less wealth to fall back on. The lack of stimulus hits these workers the hardest. Further, workers in this pandemic aren't just losing their jobs--an estimated 12 million workers and their family members have lost employer-provided health insurance due to COVID-19.