The 10 biggest "Pandemic Profiteers" saw the greatest percentage increase in their wealth--at least 300 percent.(Photo: Getty/Stock Photo/Anton Petrus)

To donate by check, phone, or other method, see our More Ways to Give page.

The 10 biggest "Pandemic Profiteers" saw the greatest percentage increase in their wealth--at least 300 percent.(Photo: Getty/Stock Photo/Anton Petrus)

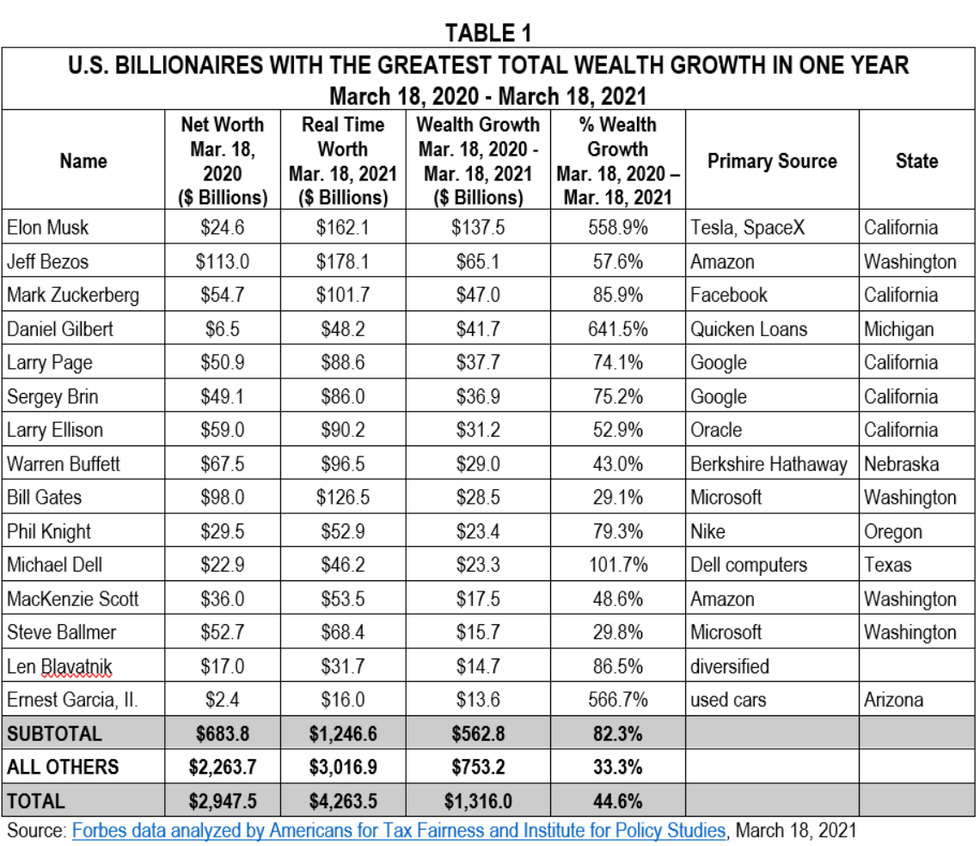

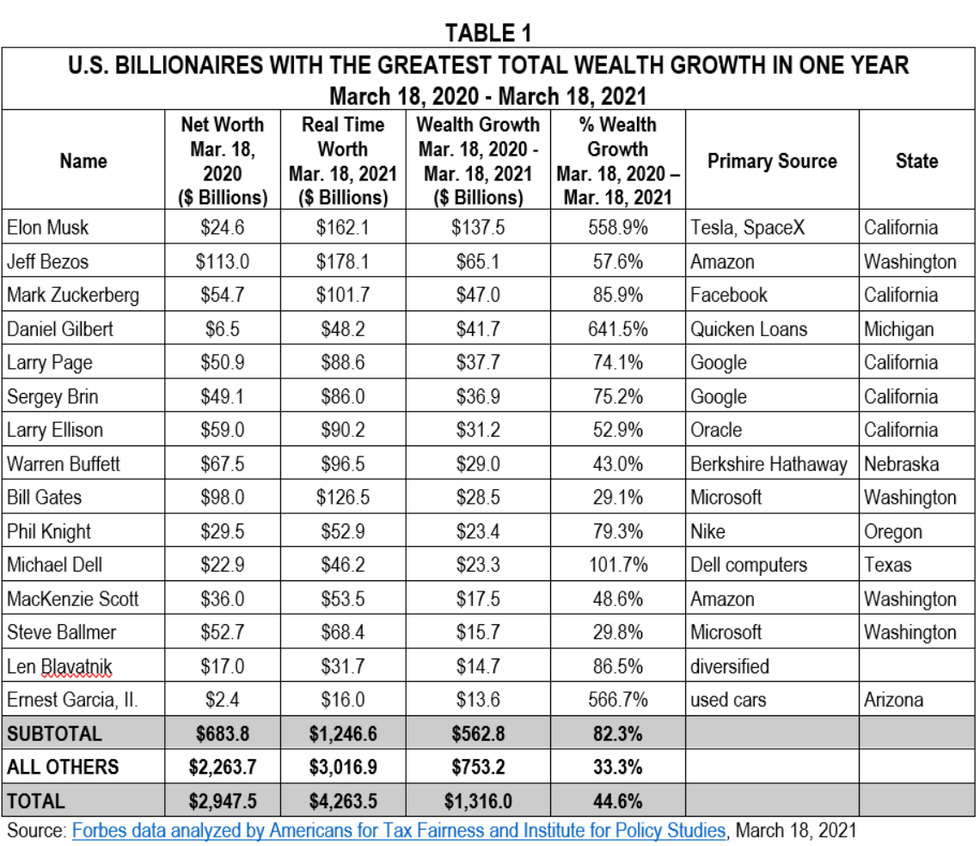

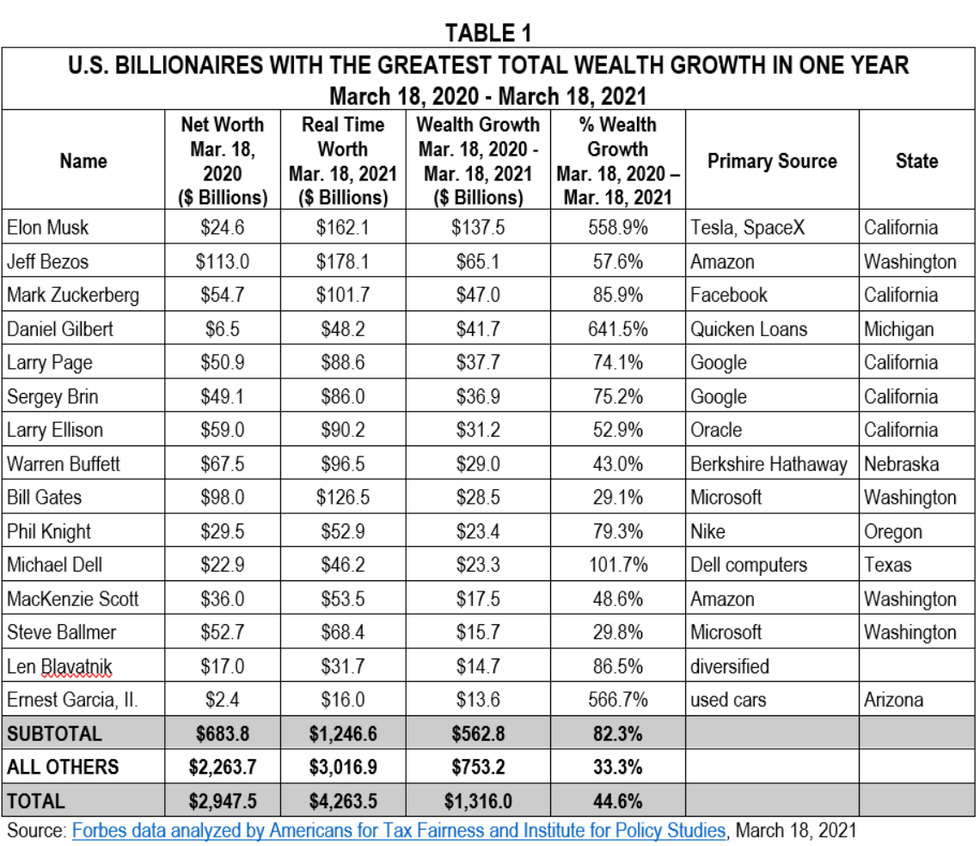

A year ago, the Institute for Policy Studies published "Billionaire Bonanza 2020: Wealth Windfalls, Tumbling Taxes and Pandemic Profiteers," and began tracking billionaire wealth gains as unemployment surged. We teamed up with Americans for Tax Fairness (ATF) to track the wealth growth of America's billionaires over the last year. This report summarizes the extraordinary growth in wealth of those now 657 billionaires based on real-time data from Forbes on March 18, 2021.

Here are highlights from the last 12 months of billionaire wealth growth:

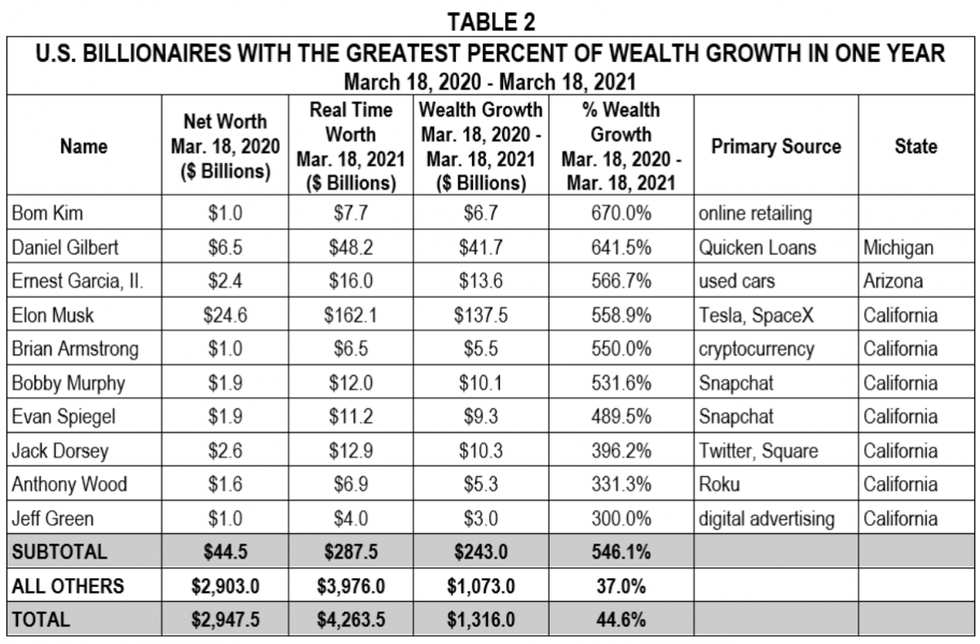

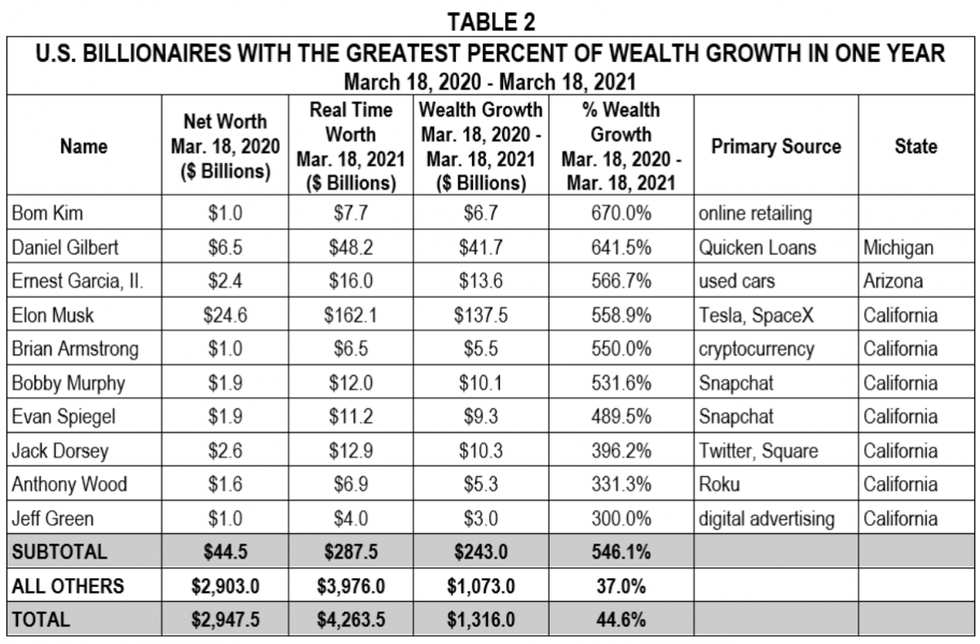

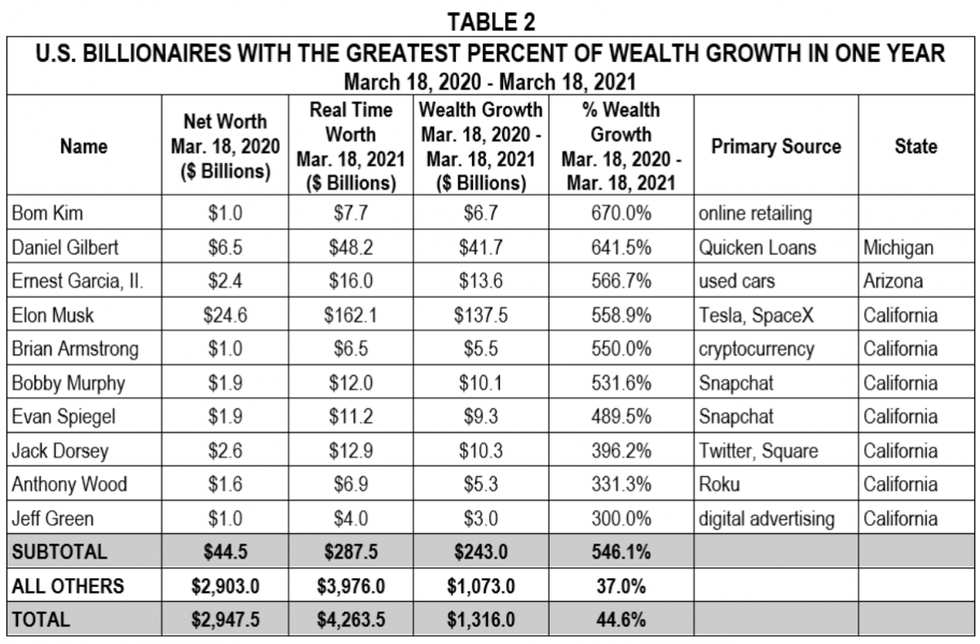

The 10 biggest "Pandemic Profiteers" saw the greatest percentage increase in their wealth--at least 300 percent. [See Table 2]

They mostly multiplied their fortunes in the world of online goods, services and entertainment, as forcibly homebound Americans shopped, invested and diverted themselves in isolation. They include the owners of ecommerce leaders Quicken Loans, Square, Carvana, and cryptocurrency exchange Coinbase; social media sites Snapchat and Twitter; online streaming platform Roku; and digital ad agency Trade Desk. 19 other billionaires experienced increases of over 200% while 48 others more than doubled their fortunes with 100%+ gains.

Other notable billionaire wealth gains during the pandemic

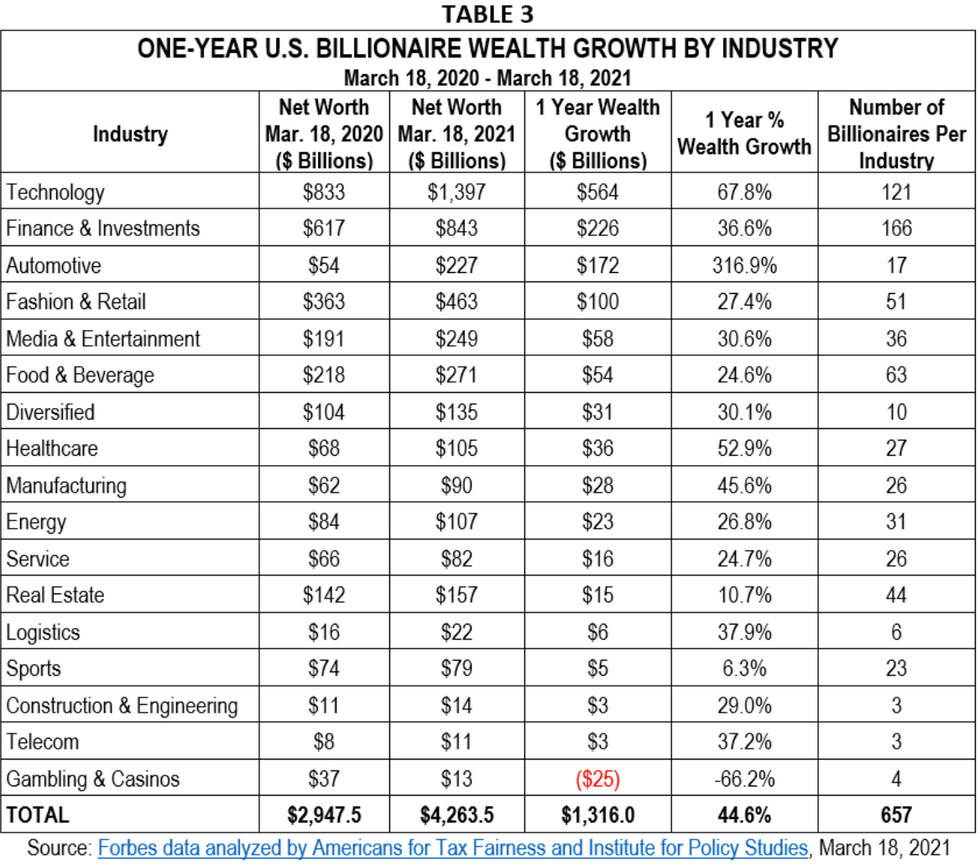

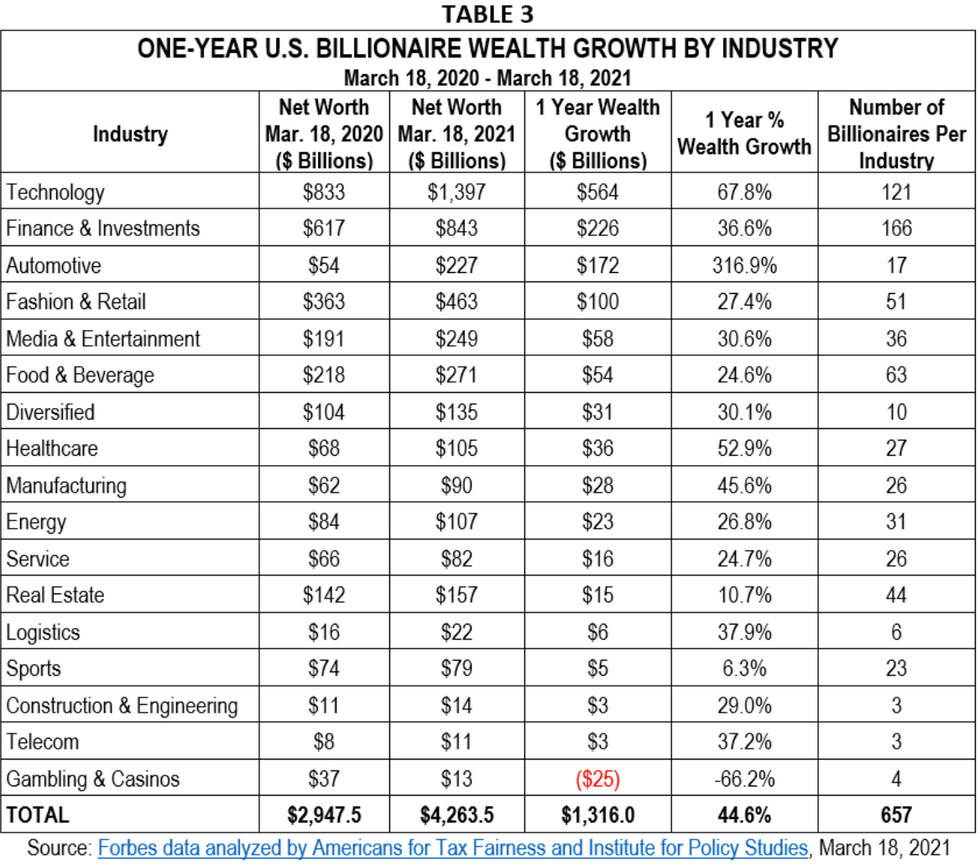

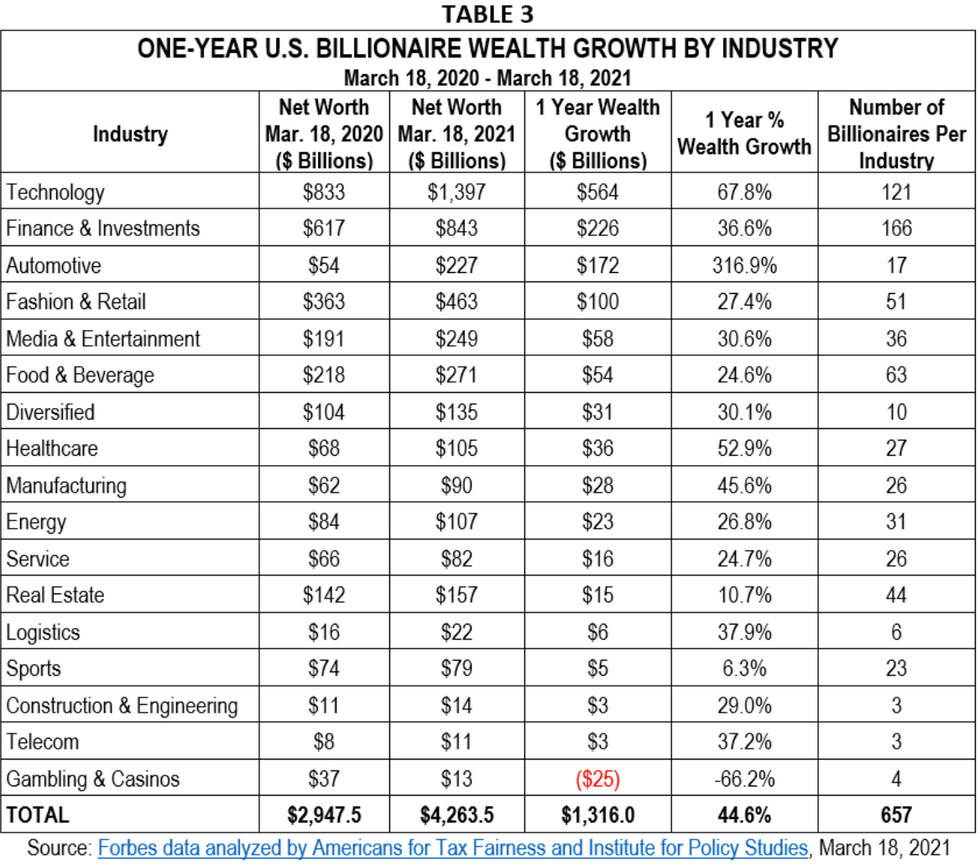

Of 17 industry categories, billionaires in the technology industry had the greatest collective wealth growth--$564 billion, or nearly 68 percent. [See Table 3]

They were worth $1.4 trillion on March 18, 2021, or one-third of the billionaires' total. The titans of Wall Street--the Finance & Investment industries--saw their wealth grow by $226 billion--a nearly 37 percent increase. Automotive industry billionaires had the biggest percentage point increase in wealth--317 percent based on an increase in wealth of $172 billion. That was largely driven by the extraordinary rise in Elon Musk's wealth--$137.5 billion or 559 percent.

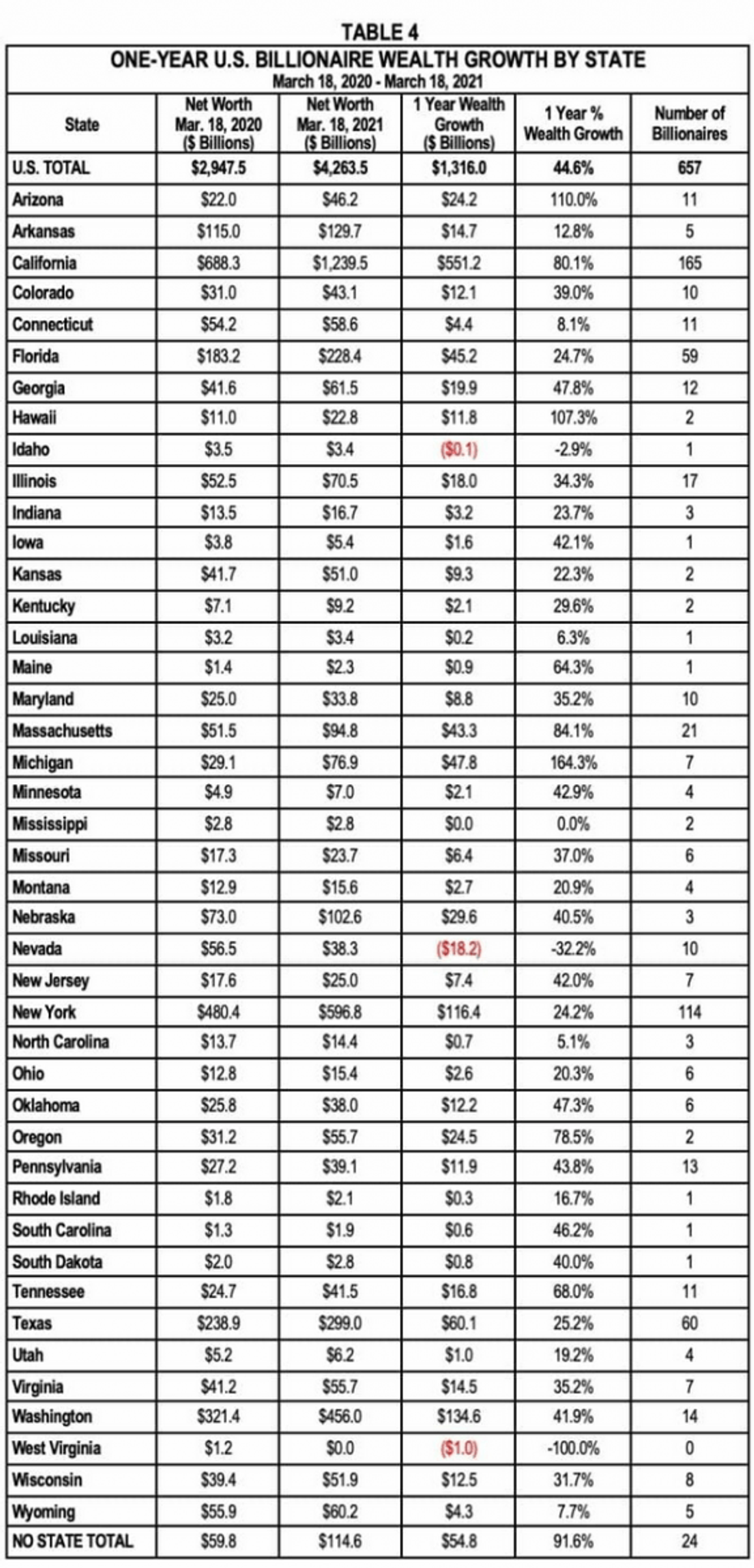

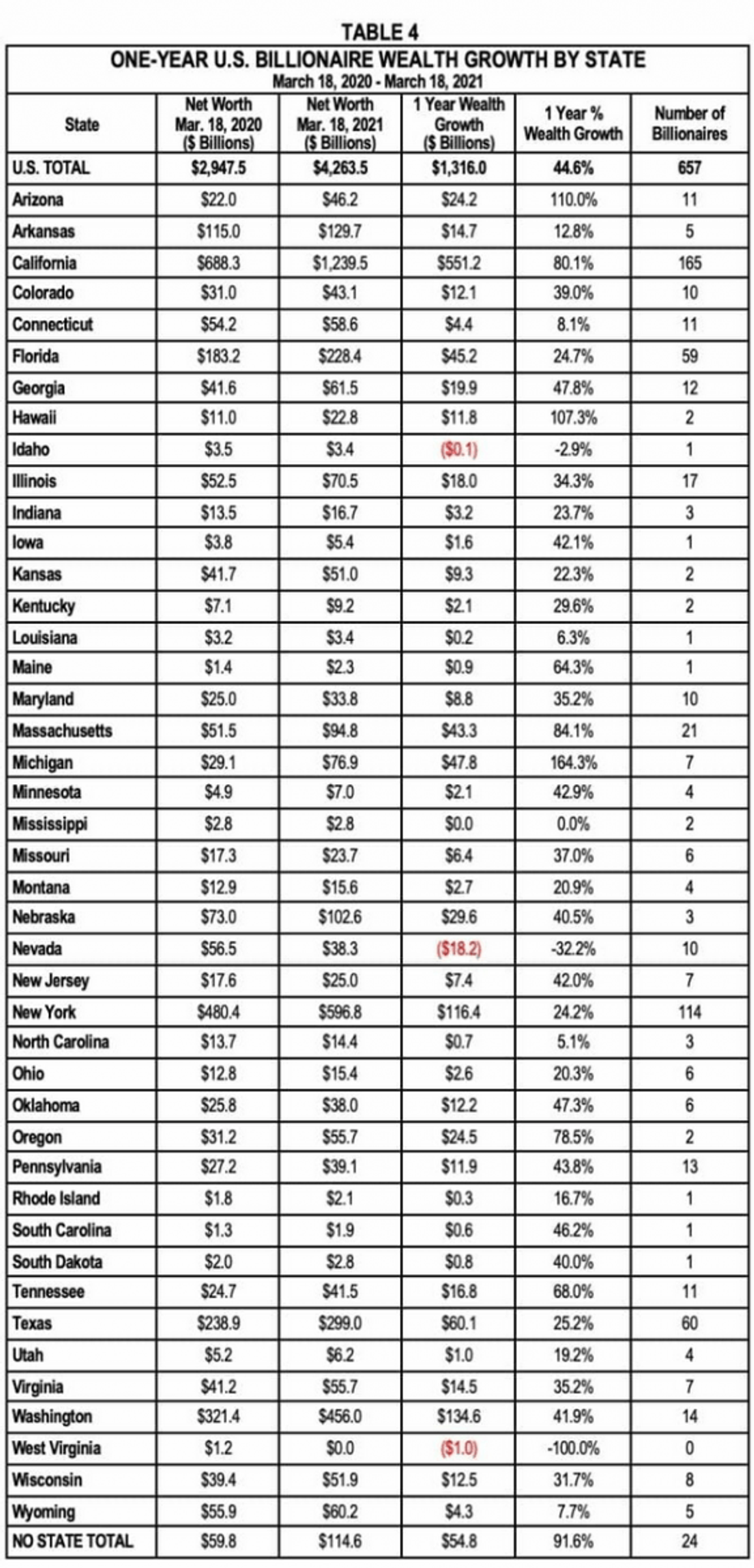

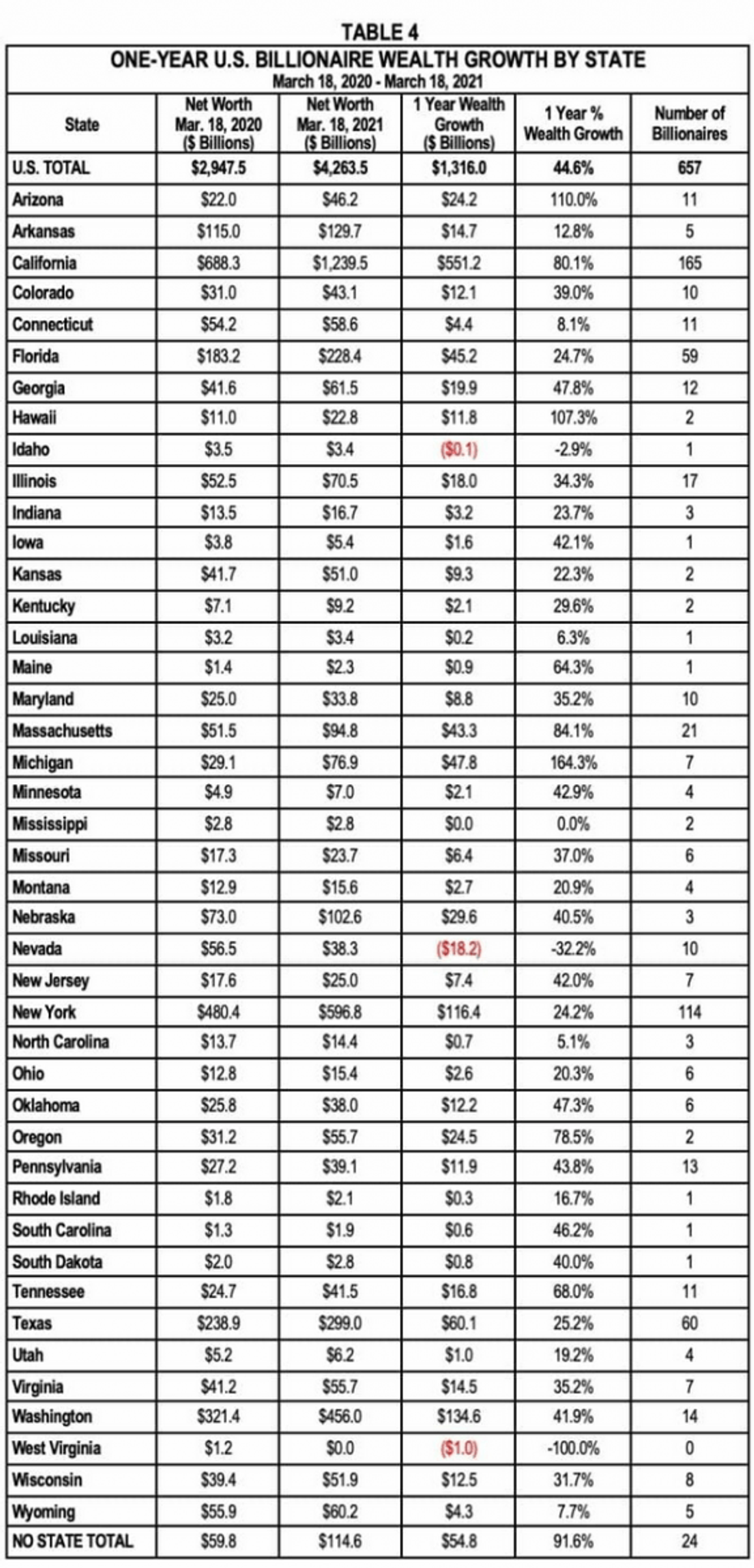

All but three states saw the wealth of their billionaire residents increase. [See Table 4]

Topping the list in total wealth growth are California at $551 billion, Washington at $134.6 billion, and New York at $116.4 billion. The top three states with the greatest percentage increase in wealth are Michigan at 164 percent, Arizona at 110 percent, and Hawaii at 107 percent.

Billionaire wealth growth is calculated between March 18, 2020 and March 18, 2021, based on Forbes data compiled in this report by ATF and IPS. March 18 is used as the unofficial beginning of the crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires' report, which provided a baseline that ATF and IPS compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Chuck Collins is a senior scholar at the Institute for Policy Studies where he co-edits Inequality.org. His near future novel "Altar to An Erupting Sun” explores one community’s response to climate disruption. He is author of numerous books and reports on inequality and the racial wealth divide, including “The Wealth Hoarders: How Billionaires Spend Millions to Hide Trillions,” “Born on Third Base,” and, with Bill Gates Sr., of “Wealth and Our Commonwealth: Why American Should Tax Accumulated Fortunes.” See more of his writing at www.chuckcollinswrites.com

A year ago, the Institute for Policy Studies published "Billionaire Bonanza 2020: Wealth Windfalls, Tumbling Taxes and Pandemic Profiteers," and began tracking billionaire wealth gains as unemployment surged. We teamed up with Americans for Tax Fairness (ATF) to track the wealth growth of America's billionaires over the last year. This report summarizes the extraordinary growth in wealth of those now 657 billionaires based on real-time data from Forbes on March 18, 2021.

Here are highlights from the last 12 months of billionaire wealth growth:

The 10 biggest "Pandemic Profiteers" saw the greatest percentage increase in their wealth--at least 300 percent. [See Table 2]

They mostly multiplied their fortunes in the world of online goods, services and entertainment, as forcibly homebound Americans shopped, invested and diverted themselves in isolation. They include the owners of ecommerce leaders Quicken Loans, Square, Carvana, and cryptocurrency exchange Coinbase; social media sites Snapchat and Twitter; online streaming platform Roku; and digital ad agency Trade Desk. 19 other billionaires experienced increases of over 200% while 48 others more than doubled their fortunes with 100%+ gains.

Other notable billionaire wealth gains during the pandemic

Of 17 industry categories, billionaires in the technology industry had the greatest collective wealth growth--$564 billion, or nearly 68 percent. [See Table 3]

They were worth $1.4 trillion on March 18, 2021, or one-third of the billionaires' total. The titans of Wall Street--the Finance & Investment industries--saw their wealth grow by $226 billion--a nearly 37 percent increase. Automotive industry billionaires had the biggest percentage point increase in wealth--317 percent based on an increase in wealth of $172 billion. That was largely driven by the extraordinary rise in Elon Musk's wealth--$137.5 billion or 559 percent.

All but three states saw the wealth of their billionaire residents increase. [See Table 4]

Topping the list in total wealth growth are California at $551 billion, Washington at $134.6 billion, and New York at $116.4 billion. The top three states with the greatest percentage increase in wealth are Michigan at 164 percent, Arizona at 110 percent, and Hawaii at 107 percent.

Billionaire wealth growth is calculated between March 18, 2020 and March 18, 2021, based on Forbes data compiled in this report by ATF and IPS. March 18 is used as the unofficial beginning of the crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires' report, which provided a baseline that ATF and IPS compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.

Chuck Collins is a senior scholar at the Institute for Policy Studies where he co-edits Inequality.org. His near future novel "Altar to An Erupting Sun” explores one community’s response to climate disruption. He is author of numerous books and reports on inequality and the racial wealth divide, including “The Wealth Hoarders: How Billionaires Spend Millions to Hide Trillions,” “Born on Third Base,” and, with Bill Gates Sr., of “Wealth and Our Commonwealth: Why American Should Tax Accumulated Fortunes.” See more of his writing at www.chuckcollinswrites.com

A year ago, the Institute for Policy Studies published "Billionaire Bonanza 2020: Wealth Windfalls, Tumbling Taxes and Pandemic Profiteers," and began tracking billionaire wealth gains as unemployment surged. We teamed up with Americans for Tax Fairness (ATF) to track the wealth growth of America's billionaires over the last year. This report summarizes the extraordinary growth in wealth of those now 657 billionaires based on real-time data from Forbes on March 18, 2021.

Here are highlights from the last 12 months of billionaire wealth growth:

The 10 biggest "Pandemic Profiteers" saw the greatest percentage increase in their wealth--at least 300 percent. [See Table 2]

They mostly multiplied their fortunes in the world of online goods, services and entertainment, as forcibly homebound Americans shopped, invested and diverted themselves in isolation. They include the owners of ecommerce leaders Quicken Loans, Square, Carvana, and cryptocurrency exchange Coinbase; social media sites Snapchat and Twitter; online streaming platform Roku; and digital ad agency Trade Desk. 19 other billionaires experienced increases of over 200% while 48 others more than doubled their fortunes with 100%+ gains.

Other notable billionaire wealth gains during the pandemic

Of 17 industry categories, billionaires in the technology industry had the greatest collective wealth growth--$564 billion, or nearly 68 percent. [See Table 3]

They were worth $1.4 trillion on March 18, 2021, or one-third of the billionaires' total. The titans of Wall Street--the Finance & Investment industries--saw their wealth grow by $226 billion--a nearly 37 percent increase. Automotive industry billionaires had the biggest percentage point increase in wealth--317 percent based on an increase in wealth of $172 billion. That was largely driven by the extraordinary rise in Elon Musk's wealth--$137.5 billion or 559 percent.

All but three states saw the wealth of their billionaire residents increase. [See Table 4]

Topping the list in total wealth growth are California at $551 billion, Washington at $134.6 billion, and New York at $116.4 billion. The top three states with the greatest percentage increase in wealth are Michigan at 164 percent, Arizona at 110 percent, and Hawaii at 107 percent.

Billionaire wealth growth is calculated between March 18, 2020 and March 18, 2021, based on Forbes data compiled in this report by ATF and IPS. March 18 is used as the unofficial beginning of the crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires' report, which provided a baseline that ATF and IPS compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.