With surprising bipartisan support, the Senate recently approved a $1trillion infrastructure bill to improve America's crumbling roads, bridges, and transit systems. It faces a tough road in the House though, where the Progressive Caucus has said it will not vote on the bill unless the Senate also passes a separate $3.5 trillion piece of social legislation that would invest in education, childcare, and paid family leave.

At this point, it is unclear whether the plan will pass, but if Congress wanted to pull an easy bipartisan win out of all this, it would do well to coalesce around making the child tax credit permanent.

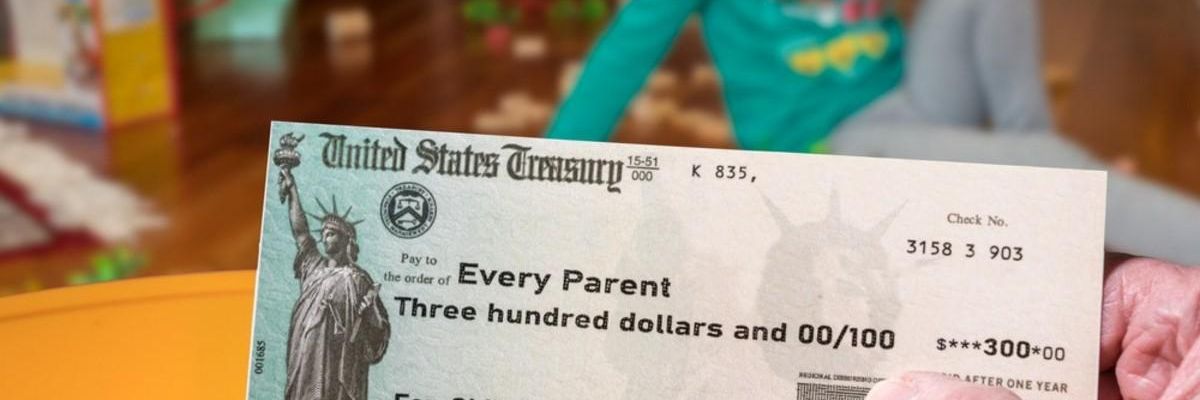

Legislation to make a permanent child tax credit deserves renewed attention with the recently enacted Child Tax Credit part of the America Recovery Plan through which eligible families will receive up to $3,600 per child for the rest of this year. But basic needs such as housing, food, diapers, and other essentials won't expire alongside this tax credit in 2022. Now is the time to discuss the actual costs a working-class family faces to make it in America and what we are willing to do to help.

The Urban Institute recently concluded that a permanent expansion would reduce child poverty by 5.9 percentage points--that's more than 4.3 million children--and a 40 percent decrease in overall child poverty. Making the child tax credit permanent will stimulate generational change not seen in this country for fifty years, establishing the financial groundwork for many young Americans to pursue ambitious goals.

A permanent child tax credit would better replicate what we know these annual tax credits already provide: improved infant and maternal health and higher performance in school leading to better educational outcomes, better paying jobs, and a higher quality of life. Indeed, Columbia University's Poverty Center published a study in March 2021 analyzing a tax credit for children in New York City and concluded that "cash and near-cash benefits increase children's health, education, and future earnings and decrease health, child protection, and criminal justice costs."

Though some Republicans view the child tax credit as a permanent handout, they may be more likely to support it if government could trim down redundancies elsewhere. With his Family Security Act, Republican Senator Mitt Romney has suggested reducing child poverty by simplifying our many disjointed welfare programs, providing up to $1,250 per month for non-rich households with children. One analysis found that under Romney's plan, a child born in 2022 could receive up to $62,600 in child support from the federal government by that child's eighteenth birthday--substantially more generous than Biden's plan. Romney's proposal failed, but it demonstrates that people in both parties may find common ground if they choose to look for it.

Senators Sherrod Brown (D-Ohio), Michael Bennet (D-CO) and others have signaled their own desire to see the child tax credit become permanent. There's no reason why these two groups couldn't find common ground on this issue.

Dealing with child poverty correctly is costly, but if we throw money at underperforming programs it's even more expensive for the overall economy. Consider the Low Income Home Energy Assistance Program (LIHEAP). In the winter, this program helps qualified applicants pay for heat, but on average, only 20 percent of households that qualify receive benefits. What do we say to the remaining 80 percent? Wear layers? That's unacceptable. Interestingly, Romney's plan would have simplified and streamlined LIHEAP.

As expensive as child poverty is, addressing it holistically would benefit the entire American economy. A 2018 study by Michael McLaughlin and Mark R. Ranke of Washington University in St. Louis estimated the economic cost of childhood poverty in the United States and found that "the annual aggregate cost of U.S. child poverty is $1.0298 trillion, representing 5.4 percent of the gross domestic product."

Americans want their elected officials to work together. A recent YouGov poll found two-thirds of respondents saying they want members of Congress to compromise to get things done. A permanent child tax credit is hardly a panacea to the larger issue of child poverty and the rupture between our institutions and the people they serve. Fewer Americans earn more money today than their parents did. Assisting American families to meet their basic needs fosters the conditions for families to thrive and to participate in the greater economy, which they can't do if they're debating between serving dinner or staying warm. Shouldn't our goal as a modern industrialized nation be for our fellow Americans to have enough money to live? Making the child tax credit permanent would be a down payment on creating a more prosperous future for all.

Every day we wait is another day a child remains mired in the morass of American poverty and caught up in the tangled web of social welfare programs.