SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A gas flare is seen at an oil well site on outside Williston, North Dakota. (Photo: Andrew Burton/Getty Images)

As global leaders struggle to tackle the climate crisis, and as ordinary people worldwide are increasingly whiplashed by high fuel costs, the US government is promising policymakers, industrialists, and investors that there will be decades of growing supplies of fracked oil and natural gas. However, an independent earth scientist with 32 years of experience with the Geological Service of Canada is using the industry's and government's own data to show why that's a dangerous fallacy.

Hughes has just issued his latest, Shale Reality Check 2021, and it provides an invaluable, comprehensive, yet detailed view of the past, present, and future of tight oil and shale gas.

During the past decade, Post Carbon Institute has published a series of reports by earth scientist J. David Hughes on the status of US shale gas and tight oil resources and production (i.e. natural gas and oil that are extracted using hydraulic fracturing, also known as fracking). These reports are remarkable for their technical depth and thoroughness, and are frequently referenced by climate activists, energy investors, and industry insiders. Hughes has provided a necessary counter to the US Energy Information Administration's (EIA) typically over-optimistic projections, which often echo hyperbolic claims by the industry. Indeed, Hughes's reports, which address forecasts contained in the widely-cited EIA Annual Energy Outlook, may justify calling him "the people's shadow EIA." Hughes has just issued his latest, Shale Reality Check 2021, and it provides an invaluable, comprehensive, yet detailed view of the past, present, and future of tight oil and shale gas.

Should we believe the government barrel counters when they tell us the US will have plenty of oil and gas for decades to come? A lot rides on that question--including climate policy, the economy, and the fate of an array of industries. Lest we forget: energy is essential to everything we do, and fossil fuels supply over 80 percent of the energy the world currently uses. The status of our energy supplies is a top priority both nationally and globally.

Worldwide, the rate of production of conventional oil and gas has been largely stagnant since 2005--except for one bright spot. The burgeoning production of US unconventional shale gas and tight oil has made most of the difference between scarcity and sufficiency, with tight oil supplying roughly 90 percent of production growth in petroleum globally during the past decade; meanwhile, as the world's top natural gas producer and consumer, the US has been able to expand supplies to the point where it is now a net exporter of the fuel--both by pipeline (to Mexico) and, by LNG tanker, to Europe.

But, as Hughes has noted in each of his reports, tight oil and shale gas are drilling-intensive, given the high production decline rates of new wells. In order to recover the abundance of these fuels that the EIA claims will be there for the taking, between now and 2050 the industry will need to drill something on the order of 700,000 new wells at a total cost of over $5 trillion. (Hughes calculated 643,105 wells, at a cost of $4.36T, would need to be drilled to meet the EIA's 2050 forecast for tight oil and shale gas within the plays he analyzed in his report; some additional production would come from other plays, elsewhere in the US.)

Will that happen? For purely geological reasons, it is exceedingly unlikely (see the report for details); but, even if it could, the financial hurdles and environmental impacts would be daunting and frightening. On average, each of those wells would be several thousand feet vertically and over a mile horizontally in length, would use up to 20 million gallons of water and 20 million pounds of proppant (a well in Louisiana used 50 million pounds of proppant), and would produce localized pollution as well as massive carbon emissions.

Meanwhile, is there possibly something better we could do with five trillion dollars? Just by way of example, that's enough money to pay for 25 solar panels and a heat pump (for indoor heating and cooling) for every housing unit in the US, with hundreds of billions of dollars left over for other social or environmental programs.

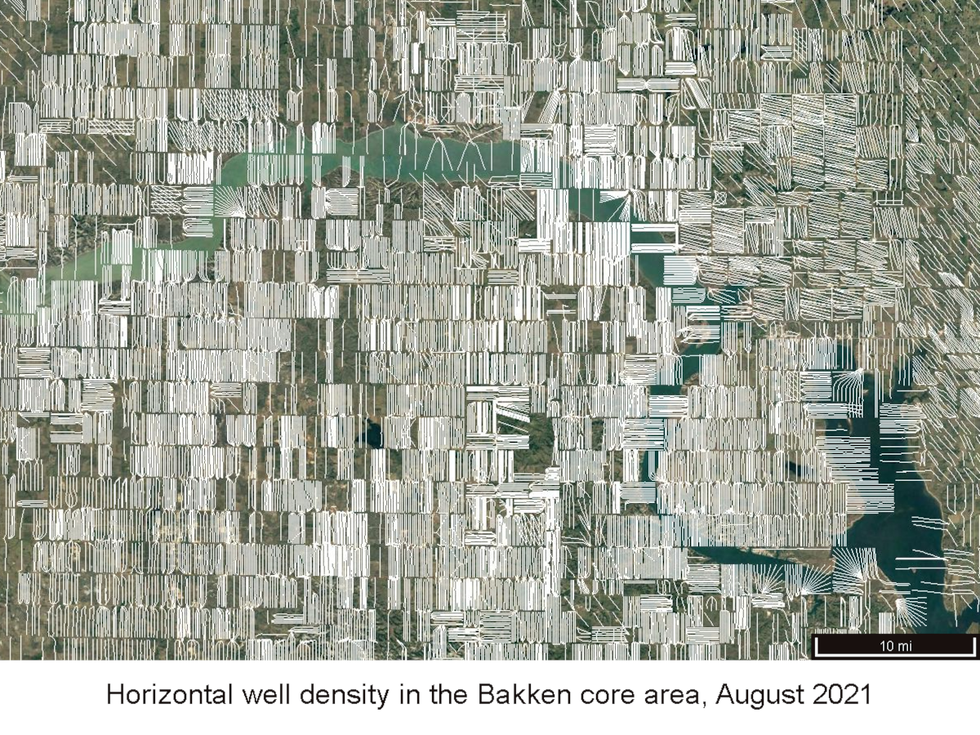

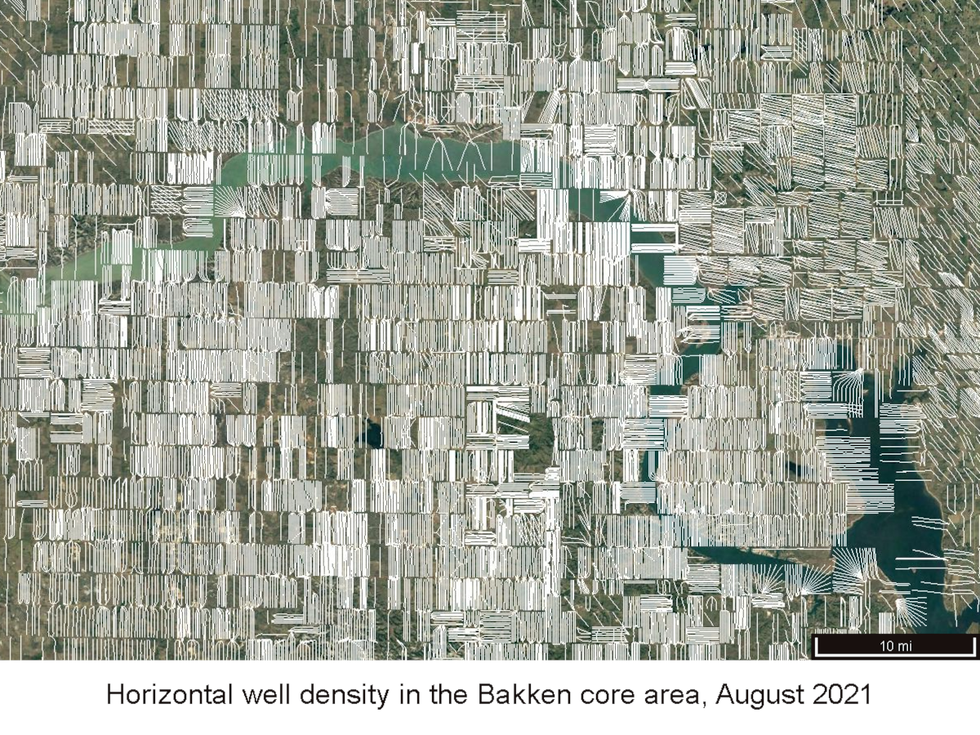

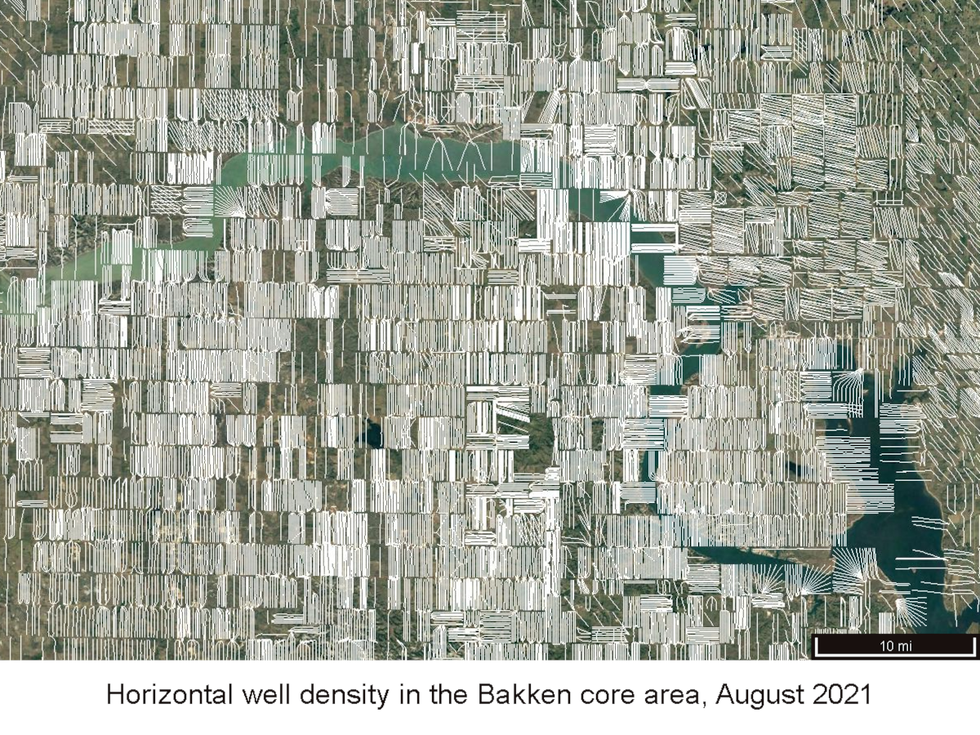

Let's sample some of Hughes's latest findings in a bit more detail. With regard to tight oil, six of the seven main plays have peaked in production and, without a significant increase in drilling rates, are in permanent decline. Five of these were producing at 15.7% to 40.6% below peak levels as of July 2021. This is partly the result of a reduction in drilling rates due to the COVID-19 pandemic, but in some of the plays (such as the Bakken in North Dakota) it is mostly due to depletion, with future production unlikely ever to exceed the already-achieved peak.

Take a look at this map of horizontal oil well traces in the core area of the Bakken. Do you see room for many more such wells? Apparently the industry doesn't. Drilling rates and investment were already down prior to the pandemic. Yet the EIA somehow believes that the Bakken still holds vast untapped resources that can be produced over the next 30 years--with much more still to come even then.

Our collective choices about energy investments are, from a long-range perspective, utterly insane. We have bet the fate of our civilization--and the lives of our children and grandchildren--on energy resources that are depleting and polluting.

A few years ago, it was widely expected (and not just by the EIA) that the country's seven primary tight oil plays would produce bountifully for a long time to come. But now most of the action is restricted to the large Permian Basin region of northwest Texas and southeast New Mexico. It encompasses a spectacular set of plays. But even here, when carefully examining the statistics for the Spraberry, Wolfcamp, and Bone Spring plays, which together account for the lion's share of Permian production, Hughes rates EIA expectations for the future as "optimistic to highly optimistic."

Over all, tight oil production is down over 12% since the start of the pandemic. With continued high oil prices, lots of investment, and a ferocious pace of drilling, production levels could increase again. But to assert, as the EIA does, that the boom will continue for thirty years or more at higher production levels than today, is, to use Hughes's carefully chosen terms, "highly optimistic."

With regard to shale gas, the story is similar. Five of the six main plays have peaked and were producing at 12% to 66% below peak levels as of August 2021. Two of these, the Barnett and Fayetteville, peaked in 2011 and 2012, respectively, and are in terminal decline with production more than 60% below peak rates. Hughes writes: "Whether or not the other three, where production is down between 11.9% and 20.3%, can exceed their peak production rates with more drilling, as forecast by the EIA, remains to be seen."

Again, with high prices, investment, and higher drilling rates, shale gas production can still grow in some regions, such as the Marcellus play in America's Northeast. But the EIA's expectations are rated as "moderately to highly optimistic" on a play-by-play basis.

Hughes uses polite, scientific language and lets the numbers speak for themselves. But those numbers tell a tale that everyone should find riveting.

Our collective choices about energy investments are, from a long-range perspective, utterly insane. We have bet the fate of our civilization--and the lives of our children and grandchildren--on energy resources that are depleting and polluting. And our public agencies, tasked with keeping track of these resources, have chosen to offer, in Greta Thunberg's words, "fairy tales of economic growth" instead of a sober assessment of what lies in store. They have failed to prepare our society for the end of cheap fossil energy, and many people will suffer as a result.

David Hughes, working for the last decade from a modest home on a beautiful island off the coast of British Columbia, has done what dozens of well-paid Washington agency analysts have failed to do--tell us the truth about America's last fossil-fueled hurrah. He has put plain numbers in front of politicians and the public with no motive other than a dim hope that rationality can prevail. Hughes deserves hearty thanks from all who have benefitted from his generous and expert work.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As global leaders struggle to tackle the climate crisis, and as ordinary people worldwide are increasingly whiplashed by high fuel costs, the US government is promising policymakers, industrialists, and investors that there will be decades of growing supplies of fracked oil and natural gas. However, an independent earth scientist with 32 years of experience with the Geological Service of Canada is using the industry's and government's own data to show why that's a dangerous fallacy.

Hughes has just issued his latest, Shale Reality Check 2021, and it provides an invaluable, comprehensive, yet detailed view of the past, present, and future of tight oil and shale gas.

During the past decade, Post Carbon Institute has published a series of reports by earth scientist J. David Hughes on the status of US shale gas and tight oil resources and production (i.e. natural gas and oil that are extracted using hydraulic fracturing, also known as fracking). These reports are remarkable for their technical depth and thoroughness, and are frequently referenced by climate activists, energy investors, and industry insiders. Hughes has provided a necessary counter to the US Energy Information Administration's (EIA) typically over-optimistic projections, which often echo hyperbolic claims by the industry. Indeed, Hughes's reports, which address forecasts contained in the widely-cited EIA Annual Energy Outlook, may justify calling him "the people's shadow EIA." Hughes has just issued his latest, Shale Reality Check 2021, and it provides an invaluable, comprehensive, yet detailed view of the past, present, and future of tight oil and shale gas.

Should we believe the government barrel counters when they tell us the US will have plenty of oil and gas for decades to come? A lot rides on that question--including climate policy, the economy, and the fate of an array of industries. Lest we forget: energy is essential to everything we do, and fossil fuels supply over 80 percent of the energy the world currently uses. The status of our energy supplies is a top priority both nationally and globally.

Worldwide, the rate of production of conventional oil and gas has been largely stagnant since 2005--except for one bright spot. The burgeoning production of US unconventional shale gas and tight oil has made most of the difference between scarcity and sufficiency, with tight oil supplying roughly 90 percent of production growth in petroleum globally during the past decade; meanwhile, as the world's top natural gas producer and consumer, the US has been able to expand supplies to the point where it is now a net exporter of the fuel--both by pipeline (to Mexico) and, by LNG tanker, to Europe.

But, as Hughes has noted in each of his reports, tight oil and shale gas are drilling-intensive, given the high production decline rates of new wells. In order to recover the abundance of these fuels that the EIA claims will be there for the taking, between now and 2050 the industry will need to drill something on the order of 700,000 new wells at a total cost of over $5 trillion. (Hughes calculated 643,105 wells, at a cost of $4.36T, would need to be drilled to meet the EIA's 2050 forecast for tight oil and shale gas within the plays he analyzed in his report; some additional production would come from other plays, elsewhere in the US.)

Will that happen? For purely geological reasons, it is exceedingly unlikely (see the report for details); but, even if it could, the financial hurdles and environmental impacts would be daunting and frightening. On average, each of those wells would be several thousand feet vertically and over a mile horizontally in length, would use up to 20 million gallons of water and 20 million pounds of proppant (a well in Louisiana used 50 million pounds of proppant), and would produce localized pollution as well as massive carbon emissions.

Meanwhile, is there possibly something better we could do with five trillion dollars? Just by way of example, that's enough money to pay for 25 solar panels and a heat pump (for indoor heating and cooling) for every housing unit in the US, with hundreds of billions of dollars left over for other social or environmental programs.

Let's sample some of Hughes's latest findings in a bit more detail. With regard to tight oil, six of the seven main plays have peaked in production and, without a significant increase in drilling rates, are in permanent decline. Five of these were producing at 15.7% to 40.6% below peak levels as of July 2021. This is partly the result of a reduction in drilling rates due to the COVID-19 pandemic, but in some of the plays (such as the Bakken in North Dakota) it is mostly due to depletion, with future production unlikely ever to exceed the already-achieved peak.

Take a look at this map of horizontal oil well traces in the core area of the Bakken. Do you see room for many more such wells? Apparently the industry doesn't. Drilling rates and investment were already down prior to the pandemic. Yet the EIA somehow believes that the Bakken still holds vast untapped resources that can be produced over the next 30 years--with much more still to come even then.

Our collective choices about energy investments are, from a long-range perspective, utterly insane. We have bet the fate of our civilization--and the lives of our children and grandchildren--on energy resources that are depleting and polluting.

A few years ago, it was widely expected (and not just by the EIA) that the country's seven primary tight oil plays would produce bountifully for a long time to come. But now most of the action is restricted to the large Permian Basin region of northwest Texas and southeast New Mexico. It encompasses a spectacular set of plays. But even here, when carefully examining the statistics for the Spraberry, Wolfcamp, and Bone Spring plays, which together account for the lion's share of Permian production, Hughes rates EIA expectations for the future as "optimistic to highly optimistic."

Over all, tight oil production is down over 12% since the start of the pandemic. With continued high oil prices, lots of investment, and a ferocious pace of drilling, production levels could increase again. But to assert, as the EIA does, that the boom will continue for thirty years or more at higher production levels than today, is, to use Hughes's carefully chosen terms, "highly optimistic."

With regard to shale gas, the story is similar. Five of the six main plays have peaked and were producing at 12% to 66% below peak levels as of August 2021. Two of these, the Barnett and Fayetteville, peaked in 2011 and 2012, respectively, and are in terminal decline with production more than 60% below peak rates. Hughes writes: "Whether or not the other three, where production is down between 11.9% and 20.3%, can exceed their peak production rates with more drilling, as forecast by the EIA, remains to be seen."

Again, with high prices, investment, and higher drilling rates, shale gas production can still grow in some regions, such as the Marcellus play in America's Northeast. But the EIA's expectations are rated as "moderately to highly optimistic" on a play-by-play basis.

Hughes uses polite, scientific language and lets the numbers speak for themselves. But those numbers tell a tale that everyone should find riveting.

Our collective choices about energy investments are, from a long-range perspective, utterly insane. We have bet the fate of our civilization--and the lives of our children and grandchildren--on energy resources that are depleting and polluting. And our public agencies, tasked with keeping track of these resources, have chosen to offer, in Greta Thunberg's words, "fairy tales of economic growth" instead of a sober assessment of what lies in store. They have failed to prepare our society for the end of cheap fossil energy, and many people will suffer as a result.

David Hughes, working for the last decade from a modest home on a beautiful island off the coast of British Columbia, has done what dozens of well-paid Washington agency analysts have failed to do--tell us the truth about America's last fossil-fueled hurrah. He has put plain numbers in front of politicians and the public with no motive other than a dim hope that rationality can prevail. Hughes deserves hearty thanks from all who have benefitted from his generous and expert work.

As global leaders struggle to tackle the climate crisis, and as ordinary people worldwide are increasingly whiplashed by high fuel costs, the US government is promising policymakers, industrialists, and investors that there will be decades of growing supplies of fracked oil and natural gas. However, an independent earth scientist with 32 years of experience with the Geological Service of Canada is using the industry's and government's own data to show why that's a dangerous fallacy.

Hughes has just issued his latest, Shale Reality Check 2021, and it provides an invaluable, comprehensive, yet detailed view of the past, present, and future of tight oil and shale gas.

During the past decade, Post Carbon Institute has published a series of reports by earth scientist J. David Hughes on the status of US shale gas and tight oil resources and production (i.e. natural gas and oil that are extracted using hydraulic fracturing, also known as fracking). These reports are remarkable for their technical depth and thoroughness, and are frequently referenced by climate activists, energy investors, and industry insiders. Hughes has provided a necessary counter to the US Energy Information Administration's (EIA) typically over-optimistic projections, which often echo hyperbolic claims by the industry. Indeed, Hughes's reports, which address forecasts contained in the widely-cited EIA Annual Energy Outlook, may justify calling him "the people's shadow EIA." Hughes has just issued his latest, Shale Reality Check 2021, and it provides an invaluable, comprehensive, yet detailed view of the past, present, and future of tight oil and shale gas.

Should we believe the government barrel counters when they tell us the US will have plenty of oil and gas for decades to come? A lot rides on that question--including climate policy, the economy, and the fate of an array of industries. Lest we forget: energy is essential to everything we do, and fossil fuels supply over 80 percent of the energy the world currently uses. The status of our energy supplies is a top priority both nationally and globally.

Worldwide, the rate of production of conventional oil and gas has been largely stagnant since 2005--except for one bright spot. The burgeoning production of US unconventional shale gas and tight oil has made most of the difference between scarcity and sufficiency, with tight oil supplying roughly 90 percent of production growth in petroleum globally during the past decade; meanwhile, as the world's top natural gas producer and consumer, the US has been able to expand supplies to the point where it is now a net exporter of the fuel--both by pipeline (to Mexico) and, by LNG tanker, to Europe.

But, as Hughes has noted in each of his reports, tight oil and shale gas are drilling-intensive, given the high production decline rates of new wells. In order to recover the abundance of these fuels that the EIA claims will be there for the taking, between now and 2050 the industry will need to drill something on the order of 700,000 new wells at a total cost of over $5 trillion. (Hughes calculated 643,105 wells, at a cost of $4.36T, would need to be drilled to meet the EIA's 2050 forecast for tight oil and shale gas within the plays he analyzed in his report; some additional production would come from other plays, elsewhere in the US.)

Will that happen? For purely geological reasons, it is exceedingly unlikely (see the report for details); but, even if it could, the financial hurdles and environmental impacts would be daunting and frightening. On average, each of those wells would be several thousand feet vertically and over a mile horizontally in length, would use up to 20 million gallons of water and 20 million pounds of proppant (a well in Louisiana used 50 million pounds of proppant), and would produce localized pollution as well as massive carbon emissions.

Meanwhile, is there possibly something better we could do with five trillion dollars? Just by way of example, that's enough money to pay for 25 solar panels and a heat pump (for indoor heating and cooling) for every housing unit in the US, with hundreds of billions of dollars left over for other social or environmental programs.

Let's sample some of Hughes's latest findings in a bit more detail. With regard to tight oil, six of the seven main plays have peaked in production and, without a significant increase in drilling rates, are in permanent decline. Five of these were producing at 15.7% to 40.6% below peak levels as of July 2021. This is partly the result of a reduction in drilling rates due to the COVID-19 pandemic, but in some of the plays (such as the Bakken in North Dakota) it is mostly due to depletion, with future production unlikely ever to exceed the already-achieved peak.

Take a look at this map of horizontal oil well traces in the core area of the Bakken. Do you see room for many more such wells? Apparently the industry doesn't. Drilling rates and investment were already down prior to the pandemic. Yet the EIA somehow believes that the Bakken still holds vast untapped resources that can be produced over the next 30 years--with much more still to come even then.

Our collective choices about energy investments are, from a long-range perspective, utterly insane. We have bet the fate of our civilization--and the lives of our children and grandchildren--on energy resources that are depleting and polluting.

A few years ago, it was widely expected (and not just by the EIA) that the country's seven primary tight oil plays would produce bountifully for a long time to come. But now most of the action is restricted to the large Permian Basin region of northwest Texas and southeast New Mexico. It encompasses a spectacular set of plays. But even here, when carefully examining the statistics for the Spraberry, Wolfcamp, and Bone Spring plays, which together account for the lion's share of Permian production, Hughes rates EIA expectations for the future as "optimistic to highly optimistic."

Over all, tight oil production is down over 12% since the start of the pandemic. With continued high oil prices, lots of investment, and a ferocious pace of drilling, production levels could increase again. But to assert, as the EIA does, that the boom will continue for thirty years or more at higher production levels than today, is, to use Hughes's carefully chosen terms, "highly optimistic."

With regard to shale gas, the story is similar. Five of the six main plays have peaked and were producing at 12% to 66% below peak levels as of August 2021. Two of these, the Barnett and Fayetteville, peaked in 2011 and 2012, respectively, and are in terminal decline with production more than 60% below peak rates. Hughes writes: "Whether or not the other three, where production is down between 11.9% and 20.3%, can exceed their peak production rates with more drilling, as forecast by the EIA, remains to be seen."

Again, with high prices, investment, and higher drilling rates, shale gas production can still grow in some regions, such as the Marcellus play in America's Northeast. But the EIA's expectations are rated as "moderately to highly optimistic" on a play-by-play basis.

Hughes uses polite, scientific language and lets the numbers speak for themselves. But those numbers tell a tale that everyone should find riveting.

Our collective choices about energy investments are, from a long-range perspective, utterly insane. We have bet the fate of our civilization--and the lives of our children and grandchildren--on energy resources that are depleting and polluting. And our public agencies, tasked with keeping track of these resources, have chosen to offer, in Greta Thunberg's words, "fairy tales of economic growth" instead of a sober assessment of what lies in store. They have failed to prepare our society for the end of cheap fossil energy, and many people will suffer as a result.

David Hughes, working for the last decade from a modest home on a beautiful island off the coast of British Columbia, has done what dozens of well-paid Washington agency analysts have failed to do--tell us the truth about America's last fossil-fueled hurrah. He has put plain numbers in front of politicians and the public with no motive other than a dim hope that rationality can prevail. Hughes deserves hearty thanks from all who have benefitted from his generous and expert work.