New Hampshire parents and other supporters gather outside of Senator Hassan's Manchester office to thank her for child tax credit payments and demand they be made permanent on September 14, 2021 in Manchester, New Hampshire. (Photo: Scott Eisen/Getty Images for ParentsTogether)

Child Tax Credit Ends, But Corporate Giveaways Continue

Corporate power—not public assistance or wage gains—is causing price increases.

Last week I suggested that Trump maintains a hold on a large fraction of America because he fills a void created by a system that has left them behind. I followed with the question raised by Frank Capra's iconic film "It's a Wonderful Life," in which the greedy Mr. Potter tries to take over Bedford Falls: Do we join together or let the Potters of America own and run everything?

We're well on the way to the Potterizing of America. To take one example, the expanded child tax credit payments will end next week. (Biden's original "Build Back Better" package had extended it, but the package is on life support in the Senate.)

Republican critics, including Senator Roy Blunt of Missouri, claim that the child tax credit has contributed to inflation by giving people more money to spend when the supply chain is already strained. "Moderate" Democrats, like Joe Manchin, think it's too expensive.

Rubbish. The benefit is tiny compared with the economy. Yet its payments have reduced child poverty by nearly 30 percent and have helped the working class. They've reduced hunger and lowered financial stress, especially in rural states that received the most money per capita (such as Missouri and West Virginia). Families spent the money on essentials like groceries and stashed some away for emergency savings.

Others (including a few prominent economists like Larry Summers) blame inflation on the government's pandemic spending, overall. In yesterday's New York Times, Neil Irwin wrote that because "the government tried overheating the economy" we now have "soaring prices and many goods in short supply. Inflation has reached its highest levels in four decades."

This misses the point. Expanded unemployment benefits ended in September (earlier in some states) and the last round of stimulus payments went out last spring. The spending was a great success story--keeping millions of Americans from falling into poverty. And it hasn't been the major cause of inflation.

Still others (CEOs and business groups) blame inflation on wage increases. This is pure rubbish. Price increases are now running at 6.8 percent annually but wages are growing only between 3-4 percent. So real wages (what those wages can actually purchase) are actually declining for most Americans. This is why programs like the child tax credit and other government assistance are so important.

The biggest single reason prices are rising is the concentration of the American economy into the hands of a few corporate giants with the power to raise prices.

To be sure, supply bottlenecks have raised the prices corporations pay for some raw materials and components. But here's the most important thing: Instead of absorbing these costs, corporations are passing them on to customers in the form of higher prices.

This is because most large corporations face little or no competition. If corporations in the same industry were competing vigorously against each other, they'd keep their prices as low as possible so as not to lose customers. They'd try to avoid passing increased costs to consumers in higher prices, for fear of losing customers to competitors that don't raise prices. They'd absorb the costs, and their profits would fall.

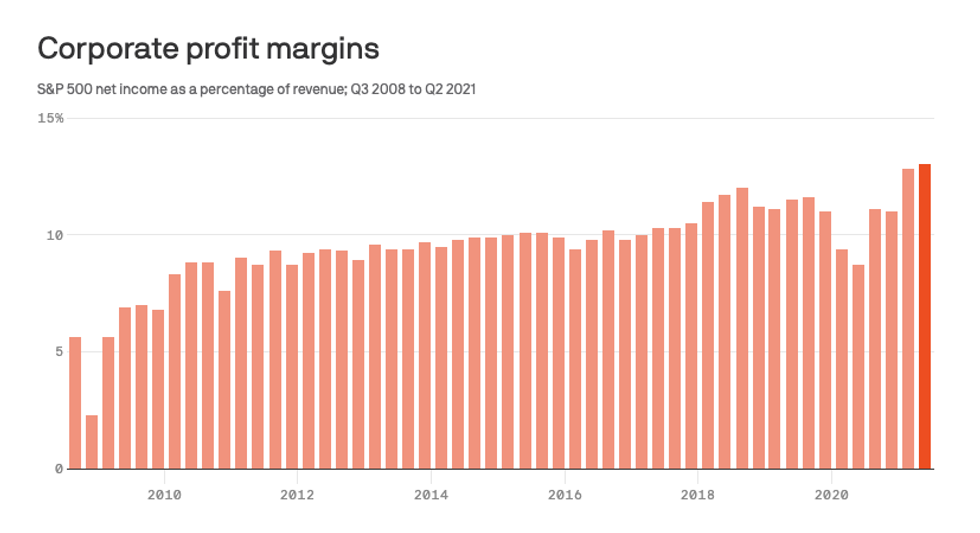

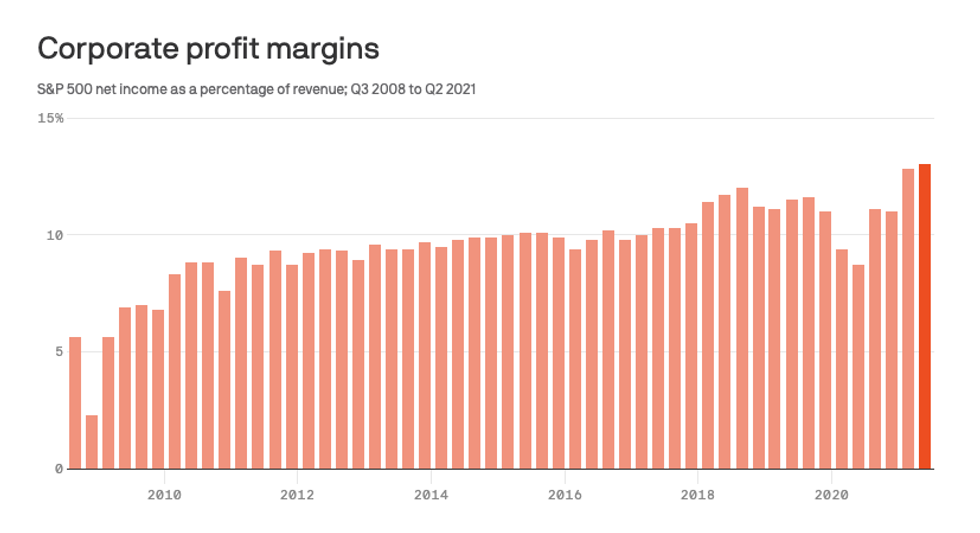

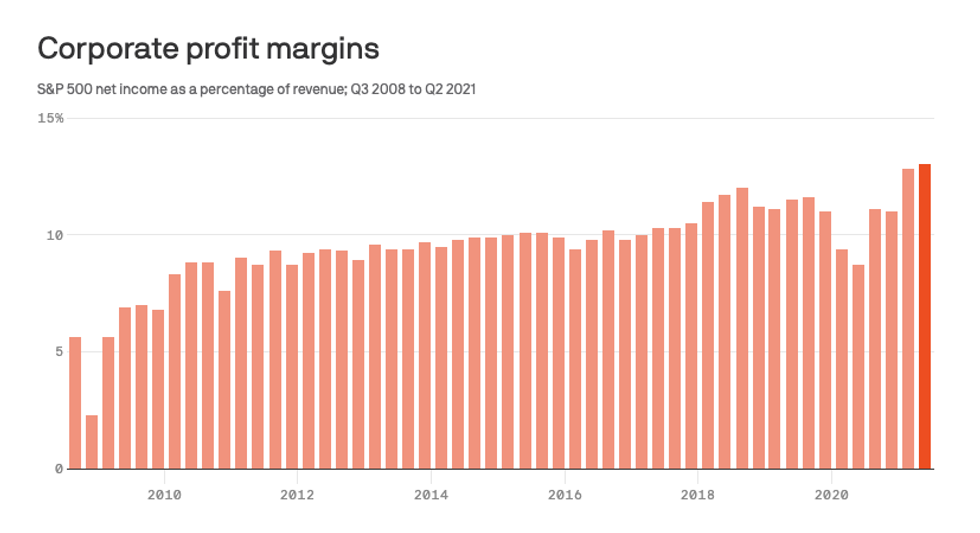

The opposite is occurring. Corporations are raising prices even as they rake in record profits. Profit margins at large corporations are now at a 70-year high. Take a look at the following chart (from Bloomberg):

Big corporations face so little competition they can raise prices with impunity. They simply coordinate their prices increases with the handful of other big corporations in the same industry, who are happy to oblige. That way, all of them stay highly profitable.

Wall Street knows exactly what's going on. Big investors are pouring money into corporations with the power to raise prices. "What we really want to find are companies with pricing power," Giorgio Caputo, senior portfolio manager at J O Hambro Capital Management told Bloomberg. "In an inflationary environment, that's the gift that keeps on giving because companies can pass along their pricing on the way up, and don't necessarily need to get it back on the way down" [emphasis added].

The underlying problem isn't inflation per se. It's lack of competition. Corporations are using the excuse of inflation to raise prices and make fatter profits. (Matt Stoller, who has an excellent Substack on monopolization, calculates that 60 percent of the increase in inflation is going to corporate profits.)

Blaming the child tax credit or pandemic assistance or wage increases is a cruel ruse that disguises what's really going on.

This is what I mean when I say America has been Potterized: People at the top--top corporate executives and big investors--are doing better than ever. Everyone else is being squeezed.

What should be done about all of this? For one thing, raise taxes on big corporations and the wealthy in order to finance all sorts of supports and public investments needed by the majority of Americans (such as the expanded child tax credit). At the very least, repeal the Trump tax cut for big corporations and the wealthy.

But wait. Didn't we just try to do this? Yes, and not even a Congress controlled by Democrats could get it done. Why not? Because in Potterized America, big corporations and the super-wealthy not only have the power to raise prices. They also have the power to get Congress to cut their taxes--and keep them cut.

Your thoughts?

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Last week I suggested that Trump maintains a hold on a large fraction of America because he fills a void created by a system that has left them behind. I followed with the question raised by Frank Capra's iconic film "It's a Wonderful Life," in which the greedy Mr. Potter tries to take over Bedford Falls: Do we join together or let the Potters of America own and run everything?

We're well on the way to the Potterizing of America. To take one example, the expanded child tax credit payments will end next week. (Biden's original "Build Back Better" package had extended it, but the package is on life support in the Senate.)

Republican critics, including Senator Roy Blunt of Missouri, claim that the child tax credit has contributed to inflation by giving people more money to spend when the supply chain is already strained. "Moderate" Democrats, like Joe Manchin, think it's too expensive.

Rubbish. The benefit is tiny compared with the economy. Yet its payments have reduced child poverty by nearly 30 percent and have helped the working class. They've reduced hunger and lowered financial stress, especially in rural states that received the most money per capita (such as Missouri and West Virginia). Families spent the money on essentials like groceries and stashed some away for emergency savings.

Others (including a few prominent economists like Larry Summers) blame inflation on the government's pandemic spending, overall. In yesterday's New York Times, Neil Irwin wrote that because "the government tried overheating the economy" we now have "soaring prices and many goods in short supply. Inflation has reached its highest levels in four decades."

This misses the point. Expanded unemployment benefits ended in September (earlier in some states) and the last round of stimulus payments went out last spring. The spending was a great success story--keeping millions of Americans from falling into poverty. And it hasn't been the major cause of inflation.

Still others (CEOs and business groups) blame inflation on wage increases. This is pure rubbish. Price increases are now running at 6.8 percent annually but wages are growing only between 3-4 percent. So real wages (what those wages can actually purchase) are actually declining for most Americans. This is why programs like the child tax credit and other government assistance are so important.

The biggest single reason prices are rising is the concentration of the American economy into the hands of a few corporate giants with the power to raise prices.

To be sure, supply bottlenecks have raised the prices corporations pay for some raw materials and components. But here's the most important thing: Instead of absorbing these costs, corporations are passing them on to customers in the form of higher prices.

This is because most large corporations face little or no competition. If corporations in the same industry were competing vigorously against each other, they'd keep their prices as low as possible so as not to lose customers. They'd try to avoid passing increased costs to consumers in higher prices, for fear of losing customers to competitors that don't raise prices. They'd absorb the costs, and their profits would fall.

The opposite is occurring. Corporations are raising prices even as they rake in record profits. Profit margins at large corporations are now at a 70-year high. Take a look at the following chart (from Bloomberg):

Big corporations face so little competition they can raise prices with impunity. They simply coordinate their prices increases with the handful of other big corporations in the same industry, who are happy to oblige. That way, all of them stay highly profitable.

Wall Street knows exactly what's going on. Big investors are pouring money into corporations with the power to raise prices. "What we really want to find are companies with pricing power," Giorgio Caputo, senior portfolio manager at J O Hambro Capital Management told Bloomberg. "In an inflationary environment, that's the gift that keeps on giving because companies can pass along their pricing on the way up, and don't necessarily need to get it back on the way down" [emphasis added].

The underlying problem isn't inflation per se. It's lack of competition. Corporations are using the excuse of inflation to raise prices and make fatter profits. (Matt Stoller, who has an excellent Substack on monopolization, calculates that 60 percent of the increase in inflation is going to corporate profits.)

Blaming the child tax credit or pandemic assistance or wage increases is a cruel ruse that disguises what's really going on.

This is what I mean when I say America has been Potterized: People at the top--top corporate executives and big investors--are doing better than ever. Everyone else is being squeezed.

What should be done about all of this? For one thing, raise taxes on big corporations and the wealthy in order to finance all sorts of supports and public investments needed by the majority of Americans (such as the expanded child tax credit). At the very least, repeal the Trump tax cut for big corporations and the wealthy.

But wait. Didn't we just try to do this? Yes, and not even a Congress controlled by Democrats could get it done. Why not? Because in Potterized America, big corporations and the super-wealthy not only have the power to raise prices. They also have the power to get Congress to cut their taxes--and keep them cut.

Your thoughts?

Last week I suggested that Trump maintains a hold on a large fraction of America because he fills a void created by a system that has left them behind. I followed with the question raised by Frank Capra's iconic film "It's a Wonderful Life," in which the greedy Mr. Potter tries to take over Bedford Falls: Do we join together or let the Potters of America own and run everything?

We're well on the way to the Potterizing of America. To take one example, the expanded child tax credit payments will end next week. (Biden's original "Build Back Better" package had extended it, but the package is on life support in the Senate.)

Republican critics, including Senator Roy Blunt of Missouri, claim that the child tax credit has contributed to inflation by giving people more money to spend when the supply chain is already strained. "Moderate" Democrats, like Joe Manchin, think it's too expensive.

Rubbish. The benefit is tiny compared with the economy. Yet its payments have reduced child poverty by nearly 30 percent and have helped the working class. They've reduced hunger and lowered financial stress, especially in rural states that received the most money per capita (such as Missouri and West Virginia). Families spent the money on essentials like groceries and stashed some away for emergency savings.

Others (including a few prominent economists like Larry Summers) blame inflation on the government's pandemic spending, overall. In yesterday's New York Times, Neil Irwin wrote that because "the government tried overheating the economy" we now have "soaring prices and many goods in short supply. Inflation has reached its highest levels in four decades."

This misses the point. Expanded unemployment benefits ended in September (earlier in some states) and the last round of stimulus payments went out last spring. The spending was a great success story--keeping millions of Americans from falling into poverty. And it hasn't been the major cause of inflation.

Still others (CEOs and business groups) blame inflation on wage increases. This is pure rubbish. Price increases are now running at 6.8 percent annually but wages are growing only between 3-4 percent. So real wages (what those wages can actually purchase) are actually declining for most Americans. This is why programs like the child tax credit and other government assistance are so important.

The biggest single reason prices are rising is the concentration of the American economy into the hands of a few corporate giants with the power to raise prices.

To be sure, supply bottlenecks have raised the prices corporations pay for some raw materials and components. But here's the most important thing: Instead of absorbing these costs, corporations are passing them on to customers in the form of higher prices.

This is because most large corporations face little or no competition. If corporations in the same industry were competing vigorously against each other, they'd keep their prices as low as possible so as not to lose customers. They'd try to avoid passing increased costs to consumers in higher prices, for fear of losing customers to competitors that don't raise prices. They'd absorb the costs, and their profits would fall.

The opposite is occurring. Corporations are raising prices even as they rake in record profits. Profit margins at large corporations are now at a 70-year high. Take a look at the following chart (from Bloomberg):

Big corporations face so little competition they can raise prices with impunity. They simply coordinate their prices increases with the handful of other big corporations in the same industry, who are happy to oblige. That way, all of them stay highly profitable.

Wall Street knows exactly what's going on. Big investors are pouring money into corporations with the power to raise prices. "What we really want to find are companies with pricing power," Giorgio Caputo, senior portfolio manager at J O Hambro Capital Management told Bloomberg. "In an inflationary environment, that's the gift that keeps on giving because companies can pass along their pricing on the way up, and don't necessarily need to get it back on the way down" [emphasis added].

The underlying problem isn't inflation per se. It's lack of competition. Corporations are using the excuse of inflation to raise prices and make fatter profits. (Matt Stoller, who has an excellent Substack on monopolization, calculates that 60 percent of the increase in inflation is going to corporate profits.)

Blaming the child tax credit or pandemic assistance or wage increases is a cruel ruse that disguises what's really going on.

This is what I mean when I say America has been Potterized: People at the top--top corporate executives and big investors--are doing better than ever. Everyone else is being squeezed.

What should be done about all of this? For one thing, raise taxes on big corporations and the wealthy in order to finance all sorts of supports and public investments needed by the majority of Americans (such as the expanded child tax credit). At the very least, repeal the Trump tax cut for big corporations and the wealthy.

But wait. Didn't we just try to do this? Yes, and not even a Congress controlled by Democrats could get it done. Why not? Because in Potterized America, big corporations and the super-wealthy not only have the power to raise prices. They also have the power to get Congress to cut their taxes--and keep them cut.

Your thoughts?