When a business publication posted an article several years ago called "Weird Things Top Billionaires Have in Common" -- eg., less likely to wear glasses, more likely to be bald -- Rep. Mark Pocan responded on social media with an addition to the list: "Another weird thing billionaires have in common? Not paying their taxes."

The progressive Democratic representative from the town of Vermont makes a good point.

Elon Musk, the ultra-billionaire and amateur rocketeer who is so rich ($273.6 billion) that he's angling to buy Twitter on a $43-billion lark, has enjoyed a tax rate of 3.27%, according to a 2021 ProPublica report.

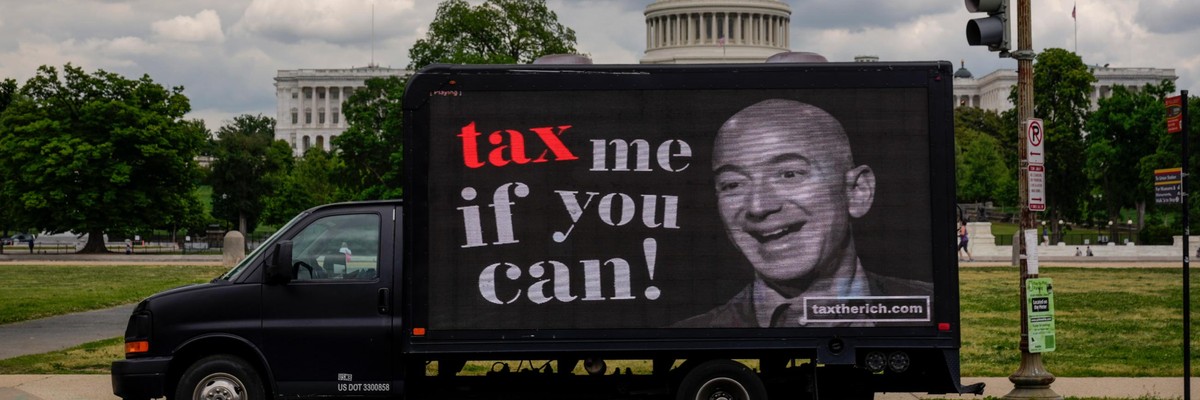

Amazon's Jeff Bezos, who is worth $181.3 billion, has been paying 0.98%.

For Americans who just want their fair share on April 15, that's a jarring reminder that our tax system is set up to make the very wealthy very much wealthier -- while the rest of us shoulder the burden for keeping the federal government afloat. Pocan's got an idea for making things fairer. For years, the congressman has responded to reports of growing economic inequality in America with a three-word mantra: "Tax the rich!"

Now, Pocan's got a president on his side.

President Joe Biden has proposed a billionaire minimum income tax, which the White House argues will eliminate "the inefficient sheltering of income for decades or generations," a White House fact sheet explains. "In 2021 alone, America's more than 700 billionaires saw their wealth increase by $1 trillion, yet in a typical year, billionaires like these would pay just 8% of their total realized and unrealized income in taxes. A firefighter or teacher can pay double that tax rate."

The proposal seeks to address that reality by requiring households with assets valued in excess of $100 million to provide the Internal Revenue Service with annual accountings of how those fortunes increased. Billionaires and uber-millionaires who paid less than 20% on their gains would have to write a check to the IRS to get their rate of payment up to 20%.

That's not a "wealth tax" in the sense that Pocan and Sen. Elizabeth Warren and Bernie Sanders have championed. But arguing about semantics misses the point. The tax targets the very rich with a very necessary income tax adjustment.

Former Wisconsin legislative aide Amy Hanauer, who now leads the Institute on Taxation and Economic Policy, sums up the argument for the new tax, saying:

"Creating a billionaire minimum income tax would ensure for the first time that the very wealthiest people in this country, those who have gained the most from our economic system, would finally begin to pay tax on their full income, just as regular working people do on their earnings. It would affect only the richest .01% of households and it would raise hundreds of billions of dollars for the essential priorities that face all of us as a nation. It will help us address the soaring inequality we see in this country and make the tax code fairer, more adequate, and more sustainable. This plan offers a transformational and long-overdue change."

Pocan puts things more succinctly: "Just took a DNA test, turns out I'm 100% in favor of taxing the rich."