Beginning on May 24, the World Economic Forum is gathering in Davos, Switzerland for an in-person meeting, discussing the global tax system and financial inclusion. Thanks to protests and new research, however, participants will not be able to avoid the elephant in the room: the surging inequality of wealth during the pandemic.

National governments should levy both windfall wealth taxes and annual wealth taxes to ensure the wealthy pay their fair share and that societies are able to make urgent investments in health and social protection.

As the Institute for Policy Studies (IPS) and Inequality.org have documented over the last two years of a global pandemic, billionaire assets have surged while millions lost their lives and livelihoods.

A new report from Oxfam dramatizes how hundreds of millions of people around the world have slid further into poverty during this time period. In a detailed examination of the food and agriculture industry, Oxfam found that billionaires in that industry saw their wealth increase by $382 billion during the pandemic. An emergency windfall tax on their wealth increase alone (to say nothing of their pre-pandemic billions) could end world hunger and double the incomes of 545 million small-scale farmers.

In January, an analysis by the Fight Inequality Alliance, Institute for Policy Studies, Oxfam, and the Patriotic Millionaires found that an annual wealth tax starting at just 2 percent for those with more than $5 million, 3 percent for those with over $50 million, and up to 5 percent for billionaires could generate upwards of $2.52 trillion a year. That's enough to lift 2.3 billion people out of poverty, fund vaccines for everyone in the world, and deliver universal healthcare and social protections for all the citizens of low-and lower-middle-income countries.

A group of over 150 millionaires released a strong statement calling on Davos attendees to face the dangers of runaway wealth inequality and speak out in favor of national efforts to levy progressive income and wealth taxes on the ultra-wealthy.

"The truth is that 'Davos' doesn't deserve the world's trust right now," the statement reads. "For all the countless hours spent talking about making the world a better place, the conference has produced little tangible value amidst a torrent of self-congratulations."

"Until participants acknowledge the simple, effective solution staring them in the face--taxing the rich--the people of the world will continue to see their so-called dedication to fixing the world's problems as little more than a performance."

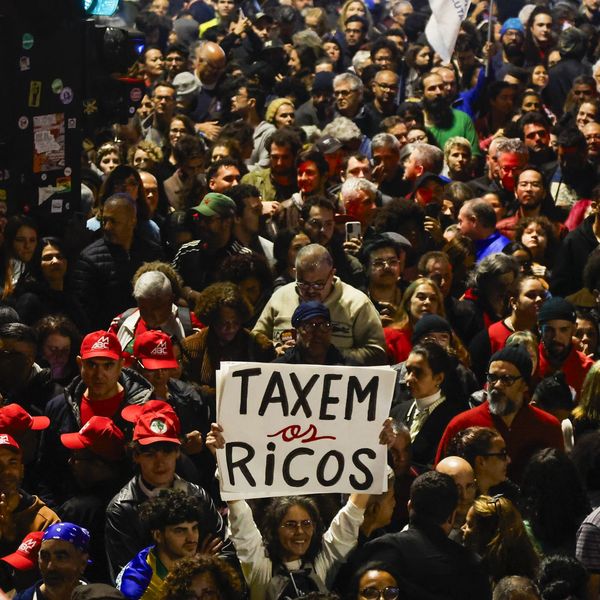

The letter is signed by actor and activist Mark Ruffalo, as well as supporters of the In Tax We Trust movement including Abigail Disney, Morris Pearl, and Nick Hanauer. These millionaires delivered the In Tax We Trust letter directly to the World Economic Forfum offices in New York and Geneva, and attended pro-taxation demonstrations at the outskirts of the elite compound in Davos itself.

The Covid-19 pandemic super-charged the extreme inequality of health and wealth between the global billionaire class and everyone else. National governments should levy both windfall wealth taxes and annual wealth taxes to ensure the wealthy pay their fair share and that societies are able to make urgent investments in health and social protection.