Inflation is a cover corporations are using to squeeze more money out of you. But as I'll explain, there are five things we can do to fight back.

Corporations are using inflation as an excuse to raise their prices, hurting workers and consumers while they enjoy record profits. Prices are surging--but let's be clear: corporations are not raising prices simply because of the increasing costs of supplies and labor. They could easily absorb these higher costs, but instead they are passing them on to consumers and even raising prices higher than those cost increases.

So what are corporations doing with their record profits? Using them to boost share prices by buying back a record amount of their own shares of stock.

Corporations are getting away with this because they face little or no competition. If markets were competitive, companies would keep their prices down to prevent competitors from grabbing away customers. But in a market with only a few competitors able to coordinate prices, consumers have no real choice.

As a result, corporations are raking in their highest profits in 70 years.

Are they using these record profits to raise their workers' real wages? No. They're handing out meager wage increases to attract or keep workers with one hand, but effectively eliminating those wage increases by raising prices with the other. Wages grew 5.6 percent over the past year--but prices rose 8.5 percent. That means, adjusted for inflation, workers actually got a 2.9 percent pay cut.

So what are corporations doing with their record profits? Using them to boost share prices by buying back a record amount of their own shares of stock.

Goldman Sachs expects buybacks to reach $1 trillion

this year--an all-time high.

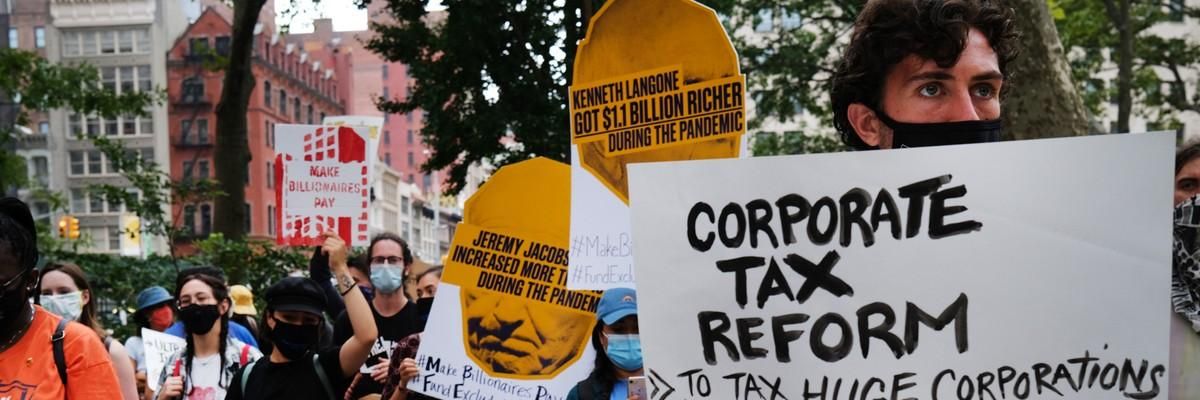

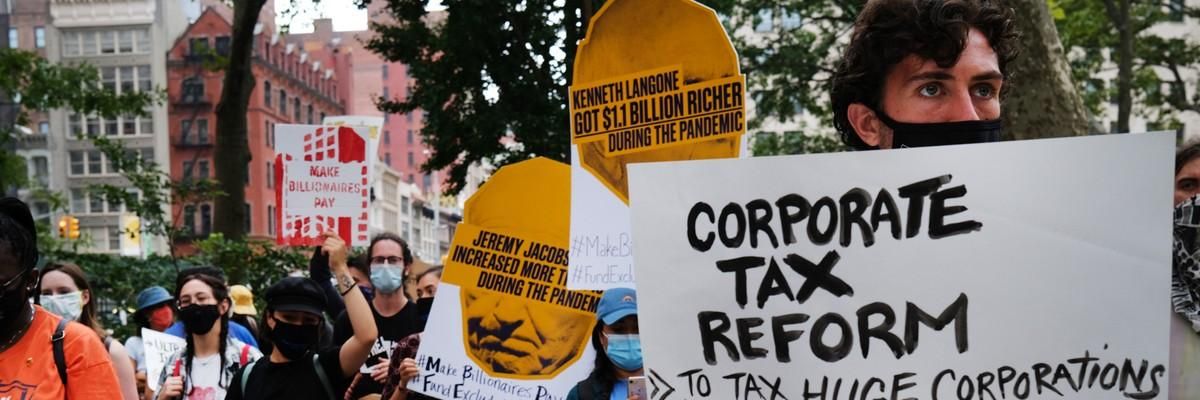

This amounts to a direct upward transfer of wealth from average working people's wallets into CEOs' and shareholders' pockets. Just look: billionaires have become at least $1.7 trillion richer during the pandemic, while CEO pay (based largely on stock values) is now at a record 350 times the typical worker's pay.

The Federal Reserve wants to curb inflation by continuing to raise interest rates. That would be a grave mistake, because it doesn't address corporate concentration and it will slow job and wage growth. The labor market isn't "unhealthily tight," as Fed Chair Jerome Powell claims. Corporations are unhealthily fat.

So what's the real solution?

First, tougher antitrust enforcement to address the growing concentration of the economy into the hands of a few giant corporations. Since the 1980s, over two-thirds of American industries have become more concentrated, enabling corporations to coordinate price increases.

Next, a temporary windfall profits tax that takes corporation's record profits and redistributes them as direct payments to everyday Americans struggling to cover soaring prices.

Third, a ban on corporate stock buybacks. Buybacks were illegal before Ronald Reagan's SEC legalized them in 1982--and they should be made illegal again.

Fourth, higher taxes on the wealthy and on corporations. Corporate tax rates are at near-record lows, even as corporate profits are at a near-record highs. And much of billionaires' pandemic gains have escaped taxes altogether.

Lastly, stronger unions. As corporate power has grown, union membership has declined

, and economic inequality has risen--the reason most workers haven't seen a real raise in 40 years. All workers deserve the right to collectively bargain for higher wages and better benefits.

In short, the real problem is not inflation.

The real problem is the increase in corporate power and the decline in worker power over the past 40 years. Unless we address this growing imbalance, corporations will continue siphoning off the economy's gains into their CEOs' and shareholders' pockets--while everyday Americans get shafted.

Watch: