SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

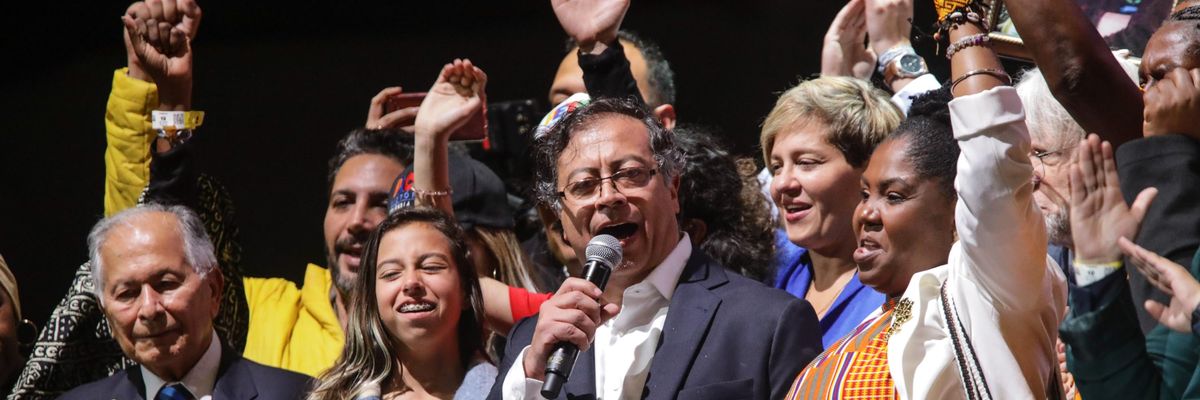

Gustavo Petro, the leftist former mayor of Bogota, celebrates in Bogota after winning Colombia's presidential election on June 19, 2022. (Photo: Juancho Torres/Anadolu Agency via Getty Images)

The same day as his historic inauguration on August 7, the newly-elected President of Colombia Gustavo Petro introduced his ambitious tax reform bill to Congress. The proposed legislation would collect $50 trillion Colombian pesos annually--approximately $12.5 billion USD--through a new, progressive tax system.

It is an unprecedented sum of money for the Colombian state, but the coalition that makes up the Pacto Historico considers it a necessary measure to address both the fiscal deficit that ballooned under former President Ivan Duque and to finance the proposed social programs designed to alleviate poverty and reduce economic inequality.

While the bill is yet to be finalized, a progressive wealth tax on the nation's millionaires and billionaires will be a core feature.

During the presidential campaign, Petro declared he would focus on the fortunes of 4,000 of the most affluent families in the country. But since his historic victory in June, his economic advisors have sent mixed messages on who exactly will be subjected to the reform. According to Colombian economist Ricardo Bonilla, the wealth threshold will be lowered to $1 billion pesos, or $250,000 USD.

The Colombian right reacted strongly, arguing that such a threshold will increase the tax burden on the middle class. But given the unequal distribution of wealth in the country, this is unlikely. A Credit Suisse report released last year found that the median wealth per adult in Colombia is just $4,854 USD, and only 2.6 percent of adults have a net worth of more than $100,000 USD.

Media reports suggest Petro plans to levy a 0.25 percent tax on wealth over $250,000 USD; 0.5 percent on wealth over $500,000 USD; 0.75 percent on wealth over $750,000 USD; and one percent on wealth over a million US dollars.

The Institute for Policy Studies consulted the Wealth-X database to estimate how much revenue Petro's wealth tax would raise if implemented on the wealthiest in Colombia. We identified 4,740 individuals who, at the end of 2021, had at least $5 million USD in wealth. Their combined net worth totals $104.3 billion USD. This list of wealthy elites also includes 250 individuals who have $50 million USD or more and a combined net worth of $52.81 billion USD.

These 4,700+ individuals represent only 0.009 percent of the population, yet hold approximately 17.3 percent of the country's total wealth.

According to IPS analysis, a straightforward progressive wealth tax, at the rates listed above and levied on the wealthiest 4,700+ individuals, would raise more than $4 trillion pesos or $1 billion USD. This accounts for roughly 8 percent of the revenue that President Petro wants to raise.

But if we include a more progressive wealth tax that adds a two percent tax on wealth over $5 million USD and a three percent tax on wealth over $50 million USD, the revenue raised more than doubles to $8.8 trillion pesos or $2.2 billion USD.

To give a concrete example of how a wealth tax would work in practice, we can take a look at the richest man in Colombia, Luis Carlos Sarmiento Angulo, and how much revenue he would contribute under this tax structure.

Sarmiento's net worth was listed at $8 billion USD by Forbes when the markets closed on August 1. Under Petro's plan, he would pay:

His total tax obligation would be $79.9 million USD. Under our recommended tax rates, however, he would pay more than $239 million USD and still have a net worth of over $7.7 billion USD, about 1.6 million times more than the median Colombian. Meanwhile, adults with the mean or median wealth pay nothing.

Petro will have to exert a lot of political capital in order to get his tax reform bill passed. But considering the extreme inequality that currently exists in Colombia, it is evident that the status quo will not change absent a redistribution of wealth.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

The same day as his historic inauguration on August 7, the newly-elected President of Colombia Gustavo Petro introduced his ambitious tax reform bill to Congress. The proposed legislation would collect $50 trillion Colombian pesos annually--approximately $12.5 billion USD--through a new, progressive tax system.

It is an unprecedented sum of money for the Colombian state, but the coalition that makes up the Pacto Historico considers it a necessary measure to address both the fiscal deficit that ballooned under former President Ivan Duque and to finance the proposed social programs designed to alleviate poverty and reduce economic inequality.

While the bill is yet to be finalized, a progressive wealth tax on the nation's millionaires and billionaires will be a core feature.

During the presidential campaign, Petro declared he would focus on the fortunes of 4,000 of the most affluent families in the country. But since his historic victory in June, his economic advisors have sent mixed messages on who exactly will be subjected to the reform. According to Colombian economist Ricardo Bonilla, the wealth threshold will be lowered to $1 billion pesos, or $250,000 USD.

The Colombian right reacted strongly, arguing that such a threshold will increase the tax burden on the middle class. But given the unequal distribution of wealth in the country, this is unlikely. A Credit Suisse report released last year found that the median wealth per adult in Colombia is just $4,854 USD, and only 2.6 percent of adults have a net worth of more than $100,000 USD.

Media reports suggest Petro plans to levy a 0.25 percent tax on wealth over $250,000 USD; 0.5 percent on wealth over $500,000 USD; 0.75 percent on wealth over $750,000 USD; and one percent on wealth over a million US dollars.

The Institute for Policy Studies consulted the Wealth-X database to estimate how much revenue Petro's wealth tax would raise if implemented on the wealthiest in Colombia. We identified 4,740 individuals who, at the end of 2021, had at least $5 million USD in wealth. Their combined net worth totals $104.3 billion USD. This list of wealthy elites also includes 250 individuals who have $50 million USD or more and a combined net worth of $52.81 billion USD.

These 4,700+ individuals represent only 0.009 percent of the population, yet hold approximately 17.3 percent of the country's total wealth.

According to IPS analysis, a straightforward progressive wealth tax, at the rates listed above and levied on the wealthiest 4,700+ individuals, would raise more than $4 trillion pesos or $1 billion USD. This accounts for roughly 8 percent of the revenue that President Petro wants to raise.

But if we include a more progressive wealth tax that adds a two percent tax on wealth over $5 million USD and a three percent tax on wealth over $50 million USD, the revenue raised more than doubles to $8.8 trillion pesos or $2.2 billion USD.

To give a concrete example of how a wealth tax would work in practice, we can take a look at the richest man in Colombia, Luis Carlos Sarmiento Angulo, and how much revenue he would contribute under this tax structure.

Sarmiento's net worth was listed at $8 billion USD by Forbes when the markets closed on August 1. Under Petro's plan, he would pay:

His total tax obligation would be $79.9 million USD. Under our recommended tax rates, however, he would pay more than $239 million USD and still have a net worth of over $7.7 billion USD, about 1.6 million times more than the median Colombian. Meanwhile, adults with the mean or median wealth pay nothing.

Petro will have to exert a lot of political capital in order to get his tax reform bill passed. But considering the extreme inequality that currently exists in Colombia, it is evident that the status quo will not change absent a redistribution of wealth.

The same day as his historic inauguration on August 7, the newly-elected President of Colombia Gustavo Petro introduced his ambitious tax reform bill to Congress. The proposed legislation would collect $50 trillion Colombian pesos annually--approximately $12.5 billion USD--through a new, progressive tax system.

It is an unprecedented sum of money for the Colombian state, but the coalition that makes up the Pacto Historico considers it a necessary measure to address both the fiscal deficit that ballooned under former President Ivan Duque and to finance the proposed social programs designed to alleviate poverty and reduce economic inequality.

While the bill is yet to be finalized, a progressive wealth tax on the nation's millionaires and billionaires will be a core feature.

During the presidential campaign, Petro declared he would focus on the fortunes of 4,000 of the most affluent families in the country. But since his historic victory in June, his economic advisors have sent mixed messages on who exactly will be subjected to the reform. According to Colombian economist Ricardo Bonilla, the wealth threshold will be lowered to $1 billion pesos, or $250,000 USD.

The Colombian right reacted strongly, arguing that such a threshold will increase the tax burden on the middle class. But given the unequal distribution of wealth in the country, this is unlikely. A Credit Suisse report released last year found that the median wealth per adult in Colombia is just $4,854 USD, and only 2.6 percent of adults have a net worth of more than $100,000 USD.

Media reports suggest Petro plans to levy a 0.25 percent tax on wealth over $250,000 USD; 0.5 percent on wealth over $500,000 USD; 0.75 percent on wealth over $750,000 USD; and one percent on wealth over a million US dollars.

The Institute for Policy Studies consulted the Wealth-X database to estimate how much revenue Petro's wealth tax would raise if implemented on the wealthiest in Colombia. We identified 4,740 individuals who, at the end of 2021, had at least $5 million USD in wealth. Their combined net worth totals $104.3 billion USD. This list of wealthy elites also includes 250 individuals who have $50 million USD or more and a combined net worth of $52.81 billion USD.

These 4,700+ individuals represent only 0.009 percent of the population, yet hold approximately 17.3 percent of the country's total wealth.

According to IPS analysis, a straightforward progressive wealth tax, at the rates listed above and levied on the wealthiest 4,700+ individuals, would raise more than $4 trillion pesos or $1 billion USD. This accounts for roughly 8 percent of the revenue that President Petro wants to raise.

But if we include a more progressive wealth tax that adds a two percent tax on wealth over $5 million USD and a three percent tax on wealth over $50 million USD, the revenue raised more than doubles to $8.8 trillion pesos or $2.2 billion USD.

To give a concrete example of how a wealth tax would work in practice, we can take a look at the richest man in Colombia, Luis Carlos Sarmiento Angulo, and how much revenue he would contribute under this tax structure.

Sarmiento's net worth was listed at $8 billion USD by Forbes when the markets closed on August 1. Under Petro's plan, he would pay:

His total tax obligation would be $79.9 million USD. Under our recommended tax rates, however, he would pay more than $239 million USD and still have a net worth of over $7.7 billion USD, about 1.6 million times more than the median Colombian. Meanwhile, adults with the mean or median wealth pay nothing.

Petro will have to exert a lot of political capital in order to get his tax reform bill passed. But considering the extreme inequality that currently exists in Colombia, it is evident that the status quo will not change absent a redistribution of wealth.