SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

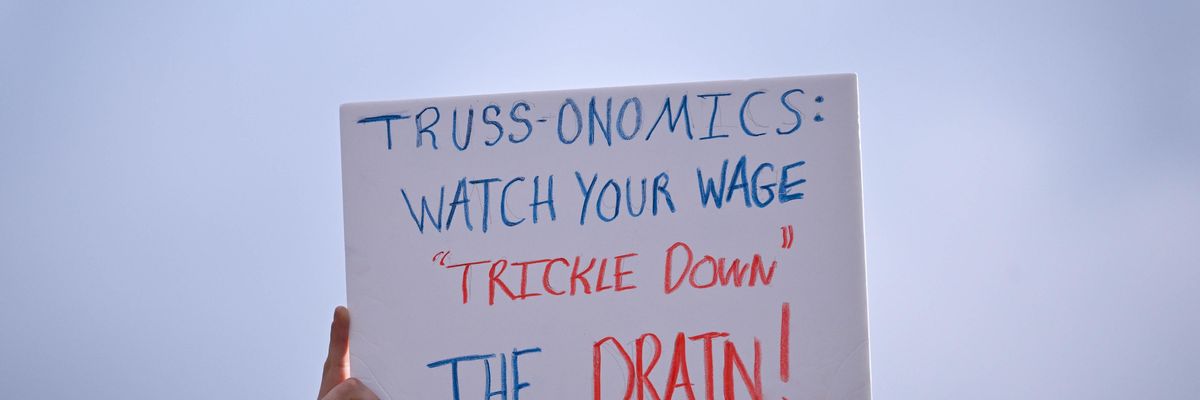

Protester holds up a placard against trickle down economics as they march through the streets during the 'Enough is Enough' Rally Against Energy Bills, on October 01, 2022 in Bristol, England. (Photo: Finnbarr Webster/Getty Images)

Within weeks of taking office, Britain's new Prime Minister, Liz Truss, and her chancellor of the Exchequer, Kwasi Kwarteng, proposed a radical new set of economic measures that echoed the trickle-down policies of Margaret Thatcher and Ronald Reagan -- heavy on tax cuts for the rich and deregulation.

Last Monday, after a backlash from investors, economists and members of his own party, Mr. Kwarteng reversed one of the proposals, deciding against abolishing the tax rate of 45 percent on the highest earners. But proposals for other tax cuts worth tens of billions of pounds remain intact, as the government insists it is on the right path.

What's bizarre about this latest episode of trickle-down economics -- the abiding faith on the political right that tax cuts and deregulation are good for an economy -- is that this gonzo economic theory continues to live on, notwithstanding its repeated failures.

Why has the public been repeatedly willing to go along with trickle-down economics when nothing ever trickles down?

Ever since Reagan and Thatcher first tried them, trickle-down policies have exploded budget deficits and widened inequality. At best, they've temporarily increased consumer demand (the opposite of what's needed during the high inflation that Britain, the US, and much of the world are experiencing).

Reagan's tax cuts and deregulation at the start of the 1980s were not responsible for America's rapid growth through the late 1980s. His exorbitant spending (mostly on national defense) fueled a temporary boom that ended in a fierce recession.

Trump's 2018 tax cut never trickled down.

Yet the US never restored the highest marginal tax rates before Reagan. And deregulation -- especially of financial markets -- continues to endanger the stability of the economy and expose workers, consumers, and the environment to unnecessary risk.

The result? From 1989 to 2019, typical working families in the United States saw negligible increases in their real (inflation-adjusted) incomes and wealth.

Over the same period, the wealthiest 1 percent of Americans became $29 trillion richer. The national debt exploded. And Wall Street's takeover of the economy continued.

Meanwhile, and largely as a result, America has become more bitterly divided along the fissures of class and education. Donald Trump didn't cause this. He exploited it.

The situation in the UK after Thatcher has not been dramatically different.

So why is trickle-down economics still with us? What explains the fatal attraction of this repeatedly failed economic theory?

The easiest answer is that it satisfies politically powerful moneyed interests who want to rake in even more. Armies of lobbyists in Washington, London, and Brussels continuously demand tax cuts and "regulatory relief" for their wealthy patrons.

But why has the public been repeatedly willing to go along with trickle-down economics when nothing ever trickles down? What accounts for the collective amnesia?

Part of the answer is that the moneyed interests have also invested a portion of their gains in an intellectual infrastructure of economists and pundits who continue to promote this failed doctrine -- along with institutions that house them, such as, in the US, the Heritage Foundation, Cato Institute, and Club for Growth.

Consider Stephen Moore, the founder and past president of the Club for Growth and a leading economist at the Heritage Foundation, whose columns appear regularly in the Wall Street Journal and is a frequent guest on Fox News.

Moore helped draft and promote Trump's trickle-down tax. In recent weeks he praised Ms. Truss for her willingness "to challenge the reigning orthodoxy by sharply cutting taxes to boost growth," calling her package "a gutsy and sound policy decision," that "will bring jobs, capital and businesses back to the U.K."

Moore and others like him are happy to disregard the history of trickle-down's abject failures. They simply repeat the same set of promises made decades ago when Reagan and Thatcher set out to convince the public that trickle-down would work splendidly.

The public has so much else on its mind, and is so confused by the cacophony, that it doesn't remember -- until immediately after the next trickle-down failure.

But perhaps the main reason for the public's amnesia is that Democrats in the US and Labor in the UK have failed to offer what should be the obvious alternative: A bottom-up economics that invests in the education and health of the public, and the infrastructure connecting them.

This is the only true path to higher productivity and widely-shared prosperity.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Within weeks of taking office, Britain's new Prime Minister, Liz Truss, and her chancellor of the Exchequer, Kwasi Kwarteng, proposed a radical new set of economic measures that echoed the trickle-down policies of Margaret Thatcher and Ronald Reagan -- heavy on tax cuts for the rich and deregulation.

Last Monday, after a backlash from investors, economists and members of his own party, Mr. Kwarteng reversed one of the proposals, deciding against abolishing the tax rate of 45 percent on the highest earners. But proposals for other tax cuts worth tens of billions of pounds remain intact, as the government insists it is on the right path.

What's bizarre about this latest episode of trickle-down economics -- the abiding faith on the political right that tax cuts and deregulation are good for an economy -- is that this gonzo economic theory continues to live on, notwithstanding its repeated failures.

Why has the public been repeatedly willing to go along with trickle-down economics when nothing ever trickles down?

Ever since Reagan and Thatcher first tried them, trickle-down policies have exploded budget deficits and widened inequality. At best, they've temporarily increased consumer demand (the opposite of what's needed during the high inflation that Britain, the US, and much of the world are experiencing).

Reagan's tax cuts and deregulation at the start of the 1980s were not responsible for America's rapid growth through the late 1980s. His exorbitant spending (mostly on national defense) fueled a temporary boom that ended in a fierce recession.

Trump's 2018 tax cut never trickled down.

Yet the US never restored the highest marginal tax rates before Reagan. And deregulation -- especially of financial markets -- continues to endanger the stability of the economy and expose workers, consumers, and the environment to unnecessary risk.

The result? From 1989 to 2019, typical working families in the United States saw negligible increases in their real (inflation-adjusted) incomes and wealth.

Over the same period, the wealthiest 1 percent of Americans became $29 trillion richer. The national debt exploded. And Wall Street's takeover of the economy continued.

Meanwhile, and largely as a result, America has become more bitterly divided along the fissures of class and education. Donald Trump didn't cause this. He exploited it.

The situation in the UK after Thatcher has not been dramatically different.

So why is trickle-down economics still with us? What explains the fatal attraction of this repeatedly failed economic theory?

The easiest answer is that it satisfies politically powerful moneyed interests who want to rake in even more. Armies of lobbyists in Washington, London, and Brussels continuously demand tax cuts and "regulatory relief" for their wealthy patrons.

But why has the public been repeatedly willing to go along with trickle-down economics when nothing ever trickles down? What accounts for the collective amnesia?

Part of the answer is that the moneyed interests have also invested a portion of their gains in an intellectual infrastructure of economists and pundits who continue to promote this failed doctrine -- along with institutions that house them, such as, in the US, the Heritage Foundation, Cato Institute, and Club for Growth.

Consider Stephen Moore, the founder and past president of the Club for Growth and a leading economist at the Heritage Foundation, whose columns appear regularly in the Wall Street Journal and is a frequent guest on Fox News.

Moore helped draft and promote Trump's trickle-down tax. In recent weeks he praised Ms. Truss for her willingness "to challenge the reigning orthodoxy by sharply cutting taxes to boost growth," calling her package "a gutsy and sound policy decision," that "will bring jobs, capital and businesses back to the U.K."

Moore and others like him are happy to disregard the history of trickle-down's abject failures. They simply repeat the same set of promises made decades ago when Reagan and Thatcher set out to convince the public that trickle-down would work splendidly.

The public has so much else on its mind, and is so confused by the cacophony, that it doesn't remember -- until immediately after the next trickle-down failure.

But perhaps the main reason for the public's amnesia is that Democrats in the US and Labor in the UK have failed to offer what should be the obvious alternative: A bottom-up economics that invests in the education and health of the public, and the infrastructure connecting them.

This is the only true path to higher productivity and widely-shared prosperity.

Within weeks of taking office, Britain's new Prime Minister, Liz Truss, and her chancellor of the Exchequer, Kwasi Kwarteng, proposed a radical new set of economic measures that echoed the trickle-down policies of Margaret Thatcher and Ronald Reagan -- heavy on tax cuts for the rich and deregulation.

Last Monday, after a backlash from investors, economists and members of his own party, Mr. Kwarteng reversed one of the proposals, deciding against abolishing the tax rate of 45 percent on the highest earners. But proposals for other tax cuts worth tens of billions of pounds remain intact, as the government insists it is on the right path.

What's bizarre about this latest episode of trickle-down economics -- the abiding faith on the political right that tax cuts and deregulation are good for an economy -- is that this gonzo economic theory continues to live on, notwithstanding its repeated failures.

Why has the public been repeatedly willing to go along with trickle-down economics when nothing ever trickles down?

Ever since Reagan and Thatcher first tried them, trickle-down policies have exploded budget deficits and widened inequality. At best, they've temporarily increased consumer demand (the opposite of what's needed during the high inflation that Britain, the US, and much of the world are experiencing).

Reagan's tax cuts and deregulation at the start of the 1980s were not responsible for America's rapid growth through the late 1980s. His exorbitant spending (mostly on national defense) fueled a temporary boom that ended in a fierce recession.

Trump's 2018 tax cut never trickled down.

Yet the US never restored the highest marginal tax rates before Reagan. And deregulation -- especially of financial markets -- continues to endanger the stability of the economy and expose workers, consumers, and the environment to unnecessary risk.

The result? From 1989 to 2019, typical working families in the United States saw negligible increases in their real (inflation-adjusted) incomes and wealth.

Over the same period, the wealthiest 1 percent of Americans became $29 trillion richer. The national debt exploded. And Wall Street's takeover of the economy continued.

Meanwhile, and largely as a result, America has become more bitterly divided along the fissures of class and education. Donald Trump didn't cause this. He exploited it.

The situation in the UK after Thatcher has not been dramatically different.

So why is trickle-down economics still with us? What explains the fatal attraction of this repeatedly failed economic theory?

The easiest answer is that it satisfies politically powerful moneyed interests who want to rake in even more. Armies of lobbyists in Washington, London, and Brussels continuously demand tax cuts and "regulatory relief" for their wealthy patrons.

But why has the public been repeatedly willing to go along with trickle-down economics when nothing ever trickles down? What accounts for the collective amnesia?

Part of the answer is that the moneyed interests have also invested a portion of their gains in an intellectual infrastructure of economists and pundits who continue to promote this failed doctrine -- along with institutions that house them, such as, in the US, the Heritage Foundation, Cato Institute, and Club for Growth.

Consider Stephen Moore, the founder and past president of the Club for Growth and a leading economist at the Heritage Foundation, whose columns appear regularly in the Wall Street Journal and is a frequent guest on Fox News.

Moore helped draft and promote Trump's trickle-down tax. In recent weeks he praised Ms. Truss for her willingness "to challenge the reigning orthodoxy by sharply cutting taxes to boost growth," calling her package "a gutsy and sound policy decision," that "will bring jobs, capital and businesses back to the U.K."

Moore and others like him are happy to disregard the history of trickle-down's abject failures. They simply repeat the same set of promises made decades ago when Reagan and Thatcher set out to convince the public that trickle-down would work splendidly.

The public has so much else on its mind, and is so confused by the cacophony, that it doesn't remember -- until immediately after the next trickle-down failure.

But perhaps the main reason for the public's amnesia is that Democrats in the US and Labor in the UK have failed to offer what should be the obvious alternative: A bottom-up economics that invests in the education and health of the public, and the infrastructure connecting them.

This is the only true path to higher productivity and widely-shared prosperity.