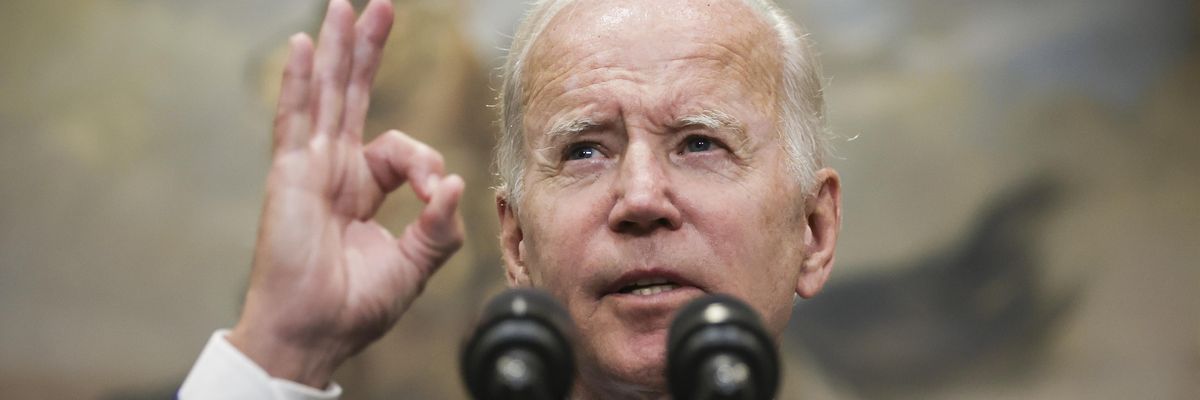

Is the Biden administration doing an about-face on its student debt cancellation program? Some sensationalist headlines might lead you to believe that it is, but we believe that characterization is unfair.

Here's what's really happening.

The administration's very popular cancellation program will dispel $10,000 in federally held student debt for single borrowers who made less than $125,000 or married borrowers making less than $250,000. And it doubles that relief for low-income borrowers who received Pell Grants, wiping up to $20,000 off their balance sheets.

Borrowers can start applying for this relief now.

The proposal also seeks to reform the payment process to prevent ballooning balances for borrowers who make repayments based on their income. By limiting how much current and future borrowers have to pay and how long they have to pay it, the order will significantly reduce debt for the next generation of students as well.

Some 43 million Americans currently hold student debt. Of these, all but about 800,000--less than 2 percent of the total--have loans that are held by the U.S. Department of Education. The administration is trying to find a way to help these private borrowers too, but their efforts are being complicated by GOP lawsuits that are attempting to kill the entire forgiveness program.

If this progress can be defended, it opens the door to bigger steps still to come.

Since the cancellation program was announced in August, there's been a question as to whether Biden could cancel the student debt held by commercial lenders. With right-wing legal attacks putting forgiveness for tens of millions of borrowers at risk, the administration decided to leave those less than 800,000 commercial borrowers out--for now--to keep the rest of the cancellation on solid legal ground.

Although these 800,000 FFEL borrowers are a relatively small group, they are a vulnerable group and this exclusion hits hard. Biden has vowed to keep working for a way to extend debt cancellation to these borrowers as well.

On October 21, the Republican-dominated 8th Circuit Court made clear that the GOP legal threat is a real one. The court issued an "administrative stay" on loan relief while the case is litigated, basically an injunction to steal student loan relief from borrowers. However, the Biden administration is moving full steam ahead preparing for cancellation. Borrowers should continue to sign up and spread the word.

Headlines characterized Biden's defensive maneuver as "scaling back" the program or even as a "reversal." It's admittedly a painful tradeoff, and justifyingly concerning for holders of commercial debt who also deserve relief. But it's not the administration that's attacking debt relief--it's right-wing office holders and their billionaire backers.

But that's not to say debt relief advocates shouldn't keep pushing for more. They should.

The "debt for diploma" scheme in the U.S. has millions of people just trying to get an education and make a good living on the financial rails. With debt and tuition costs skyrocketing, demands to cancel debt entirely have made tremendous strides.

These efforts accelerated in 2011 when Occupy Wall Street made student debt cancellation one of its central demands. That same year, the federal Consumer Financial Protection Bureau opened and created a student loan division. Continued popular pressure led to a real breakthrough in the 2020 presidential primary, with Senators and Democratic candidates Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) campaigning on canceling all student debt.

The popularity of their positions led then-candidate Joe Biden to say he would cancel $10,000 in student debt if he were elected. And as activists kept the pressure on, he eventually did. He's also taken steps toward cracking down on predatory lending for higher education, for example by erasing student debt from fraudulent institutions like the ITT Technical Institute.

These are more modest steps than advocates were hoping for. But if this progress can be defended, it opens the door to bigger steps still to come.

Eventually, all existing student debt should be canceled. The system that created these debts is predatory and profits off young people simply trying to get ahead, with especially harmful impacts on low-income students and particularly students of color.

In fact, debt should become unnecessary altogether: Public college and trade school tuition should be free.

Senator Sanders and Rep. Pramila Jayapal (D-Wash.) have introduced a bill that would do just that. It would make two-year college free for all and public four-year college free for students with household incomes up to $125,000. And it would reduce interest rates on all new loans. These are worthwhile steps, although they should be done without means-testing.

Down the road, private institutions that accept federal subsidies like Pell Grants could also be forced to offer affordable tuition rates and encouraged to offer a debt-free education altogether. A good track record of graduates securing good jobs upon completing their programs--whether in college, trade school, apprenticeships, or certificate programs--should also be a requirement.

These are just a few ideas. Advocates should keep the pressure on lawmakers to make sure today's fix is just the first of our victories.

Update: This piece was updated to reflect the Court's temporary stay on the debt forgiveness policy.