SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

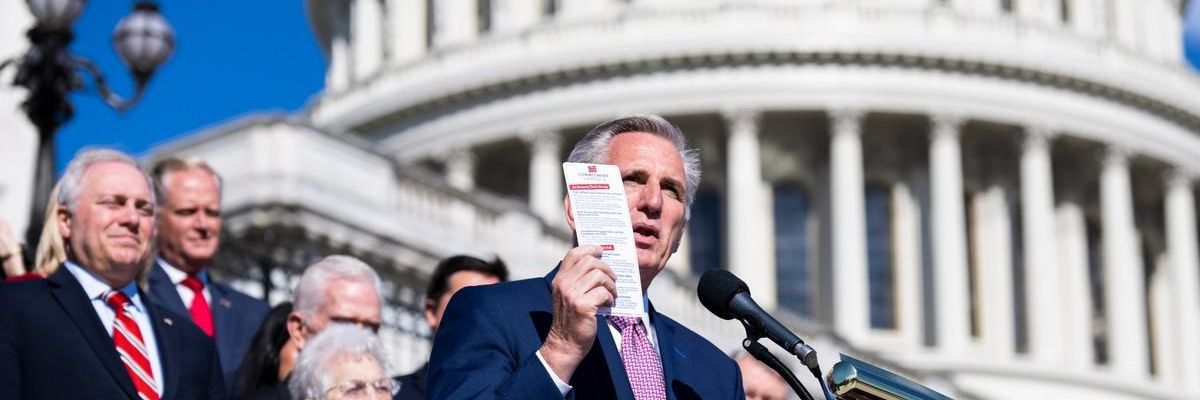

House Minority Leader Kevin McCarthy (R-Calif.) speaks during a news conference on September 29, 2022. (Photo: Tom Williams/CQ-Roll Call, Inc. via Getty Images)

Minority Leader Kevin McCarthy and other senior House Republicans are saying that, if their party takes control of the House, they will seek to use debt ceiling legislation as a vehicle to force spending cuts and other policy changes--possibly including cuts in Social Security and Medicare. Using the debt ceiling as a bargaining chip is always irresponsible, but it's especially dangerous at this moment, when monetary policy is tightening and the economic recovery is fragile.

The debt limit isn't an effective tool for limiting the amount of federal debt.

The debt limit isn't an effective tool for limiting the amount of federal debt. Raising the debt limit doesn't authorize new spending or tax cuts; it merely acknowledges the results of past budgetary decisions. As the Government Accountability Office (GAO) has written, "The debt ceiling does not control the amount of debt. Instead, it is an after-the-fact measure that restricts the Treasury's ability to borrow to finance the decisions already enacted by Congress and the President."

Unless Congress increases or suspends the debt limit, the Treasury will run out of borrowing room sometime in the second half of next year. At that point, the Treasury would be unable to meet ongoing government operations required by law and would default on its legal obligations.

If the government couldn't borrow, it would need to impose sharp, massive reductions in spending, which would have devastating economy-wide consequences. Some households, businesses, and nonprofits would be unable to pay their bills while they waited for payments the government legally owed them. Cuts in grants-in-aid would strain the budgets of state and local governments. Such a large drop in spending would plunge the nation into recession and drive up unemployment. The Treasury's inability to borrow would make it impossible for the federal government to use countercyclical fiscal policy to stimulate the economy or mitigate the hardship faced by those losing their jobs or benefits because of the sharp curtailing of government spending.

Moreover, the government's inability to pay all its bills would shake financial markets around the world. It would raise serious doubts about the nation's creditworthiness, sap the confidence of lenders, call into question the dollar's place as a reserve currency, and increase federal borrowing costs. Even going to the brink of default would seriously harm the economy. GAO has found that previous debt limit impasses have disrupted the Treasury debt market, caused a decline in liquidity for certain securities, and added to federal borrowing costs, even though none of these episodes ultimately triggered a default.

An actual default would be far worse. It would send Treasury rates up sharply as lenders demanded a greater rate of return to compensate for increased risk. Other interest rates--both domestic and foreign--would follow Treasury rates higher. Households already struggling with higher prices and interest rates would face the dual threat of far higher borrowing costs and job losses.

Protecting the full faith and credit of the U.S. government by suspending or raising the debt limit need not be a partisan issue. In recent decades, the President and Congress have come together many times to raise or suspend the debt limit and avoid default. During the Trump Administration, for example, Congress suspended the debt limit three times on a bipartisan basis without much fanfare or threats of default, despite deep differences over tax and budget policies.

The U.S. is the only major country that places a binding legal limit on the amount of debt that the Treasury can issue. Denmark has a debt limit, but it's deliberately set at such a high level that it's not a constraint. We and other budget analysts have long argued that the U.S. should follow international practice and abolish the debt limit.

As the recent turmoil in the United Kingdom illustrates, financial markets can be extremely sensitive to fiscal policy missteps and political uncertainty, particularly when the economy is already fragile. Under the present circumstances, even the serious threat of a U.S. default could be enough to roil markets and further damage the global economy. Congress should therefore raise, suspend, or abolish the debt ceiling in a timely way and should not engage in reckless brinksmanship by insisting on attaching other controversial measures.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Minority Leader Kevin McCarthy and other senior House Republicans are saying that, if their party takes control of the House, they will seek to use debt ceiling legislation as a vehicle to force spending cuts and other policy changes--possibly including cuts in Social Security and Medicare. Using the debt ceiling as a bargaining chip is always irresponsible, but it's especially dangerous at this moment, when monetary policy is tightening and the economic recovery is fragile.

The debt limit isn't an effective tool for limiting the amount of federal debt.

The debt limit isn't an effective tool for limiting the amount of federal debt. Raising the debt limit doesn't authorize new spending or tax cuts; it merely acknowledges the results of past budgetary decisions. As the Government Accountability Office (GAO) has written, "The debt ceiling does not control the amount of debt. Instead, it is an after-the-fact measure that restricts the Treasury's ability to borrow to finance the decisions already enacted by Congress and the President."

Unless Congress increases or suspends the debt limit, the Treasury will run out of borrowing room sometime in the second half of next year. At that point, the Treasury would be unable to meet ongoing government operations required by law and would default on its legal obligations.

If the government couldn't borrow, it would need to impose sharp, massive reductions in spending, which would have devastating economy-wide consequences. Some households, businesses, and nonprofits would be unable to pay their bills while they waited for payments the government legally owed them. Cuts in grants-in-aid would strain the budgets of state and local governments. Such a large drop in spending would plunge the nation into recession and drive up unemployment. The Treasury's inability to borrow would make it impossible for the federal government to use countercyclical fiscal policy to stimulate the economy or mitigate the hardship faced by those losing their jobs or benefits because of the sharp curtailing of government spending.

Moreover, the government's inability to pay all its bills would shake financial markets around the world. It would raise serious doubts about the nation's creditworthiness, sap the confidence of lenders, call into question the dollar's place as a reserve currency, and increase federal borrowing costs. Even going to the brink of default would seriously harm the economy. GAO has found that previous debt limit impasses have disrupted the Treasury debt market, caused a decline in liquidity for certain securities, and added to federal borrowing costs, even though none of these episodes ultimately triggered a default.

An actual default would be far worse. It would send Treasury rates up sharply as lenders demanded a greater rate of return to compensate for increased risk. Other interest rates--both domestic and foreign--would follow Treasury rates higher. Households already struggling with higher prices and interest rates would face the dual threat of far higher borrowing costs and job losses.

Protecting the full faith and credit of the U.S. government by suspending or raising the debt limit need not be a partisan issue. In recent decades, the President and Congress have come together many times to raise or suspend the debt limit and avoid default. During the Trump Administration, for example, Congress suspended the debt limit three times on a bipartisan basis without much fanfare or threats of default, despite deep differences over tax and budget policies.

The U.S. is the only major country that places a binding legal limit on the amount of debt that the Treasury can issue. Denmark has a debt limit, but it's deliberately set at such a high level that it's not a constraint. We and other budget analysts have long argued that the U.S. should follow international practice and abolish the debt limit.

As the recent turmoil in the United Kingdom illustrates, financial markets can be extremely sensitive to fiscal policy missteps and political uncertainty, particularly when the economy is already fragile. Under the present circumstances, even the serious threat of a U.S. default could be enough to roil markets and further damage the global economy. Congress should therefore raise, suspend, or abolish the debt ceiling in a timely way and should not engage in reckless brinksmanship by insisting on attaching other controversial measures.

Minority Leader Kevin McCarthy and other senior House Republicans are saying that, if their party takes control of the House, they will seek to use debt ceiling legislation as a vehicle to force spending cuts and other policy changes--possibly including cuts in Social Security and Medicare. Using the debt ceiling as a bargaining chip is always irresponsible, but it's especially dangerous at this moment, when monetary policy is tightening and the economic recovery is fragile.

The debt limit isn't an effective tool for limiting the amount of federal debt.

The debt limit isn't an effective tool for limiting the amount of federal debt. Raising the debt limit doesn't authorize new spending or tax cuts; it merely acknowledges the results of past budgetary decisions. As the Government Accountability Office (GAO) has written, "The debt ceiling does not control the amount of debt. Instead, it is an after-the-fact measure that restricts the Treasury's ability to borrow to finance the decisions already enacted by Congress and the President."

Unless Congress increases or suspends the debt limit, the Treasury will run out of borrowing room sometime in the second half of next year. At that point, the Treasury would be unable to meet ongoing government operations required by law and would default on its legal obligations.

If the government couldn't borrow, it would need to impose sharp, massive reductions in spending, which would have devastating economy-wide consequences. Some households, businesses, and nonprofits would be unable to pay their bills while they waited for payments the government legally owed them. Cuts in grants-in-aid would strain the budgets of state and local governments. Such a large drop in spending would plunge the nation into recession and drive up unemployment. The Treasury's inability to borrow would make it impossible for the federal government to use countercyclical fiscal policy to stimulate the economy or mitigate the hardship faced by those losing their jobs or benefits because of the sharp curtailing of government spending.

Moreover, the government's inability to pay all its bills would shake financial markets around the world. It would raise serious doubts about the nation's creditworthiness, sap the confidence of lenders, call into question the dollar's place as a reserve currency, and increase federal borrowing costs. Even going to the brink of default would seriously harm the economy. GAO has found that previous debt limit impasses have disrupted the Treasury debt market, caused a decline in liquidity for certain securities, and added to federal borrowing costs, even though none of these episodes ultimately triggered a default.

An actual default would be far worse. It would send Treasury rates up sharply as lenders demanded a greater rate of return to compensate for increased risk. Other interest rates--both domestic and foreign--would follow Treasury rates higher. Households already struggling with higher prices and interest rates would face the dual threat of far higher borrowing costs and job losses.

Protecting the full faith and credit of the U.S. government by suspending or raising the debt limit need not be a partisan issue. In recent decades, the President and Congress have come together many times to raise or suspend the debt limit and avoid default. During the Trump Administration, for example, Congress suspended the debt limit three times on a bipartisan basis without much fanfare or threats of default, despite deep differences over tax and budget policies.

The U.S. is the only major country that places a binding legal limit on the amount of debt that the Treasury can issue. Denmark has a debt limit, but it's deliberately set at such a high level that it's not a constraint. We and other budget analysts have long argued that the U.S. should follow international practice and abolish the debt limit.

As the recent turmoil in the United Kingdom illustrates, financial markets can be extremely sensitive to fiscal policy missteps and political uncertainty, particularly when the economy is already fragile. Under the present circumstances, even the serious threat of a U.S. default could be enough to roil markets and further damage the global economy. Congress should therefore raise, suspend, or abolish the debt ceiling in a timely way and should not engage in reckless brinksmanship by insisting on attaching other controversial measures.