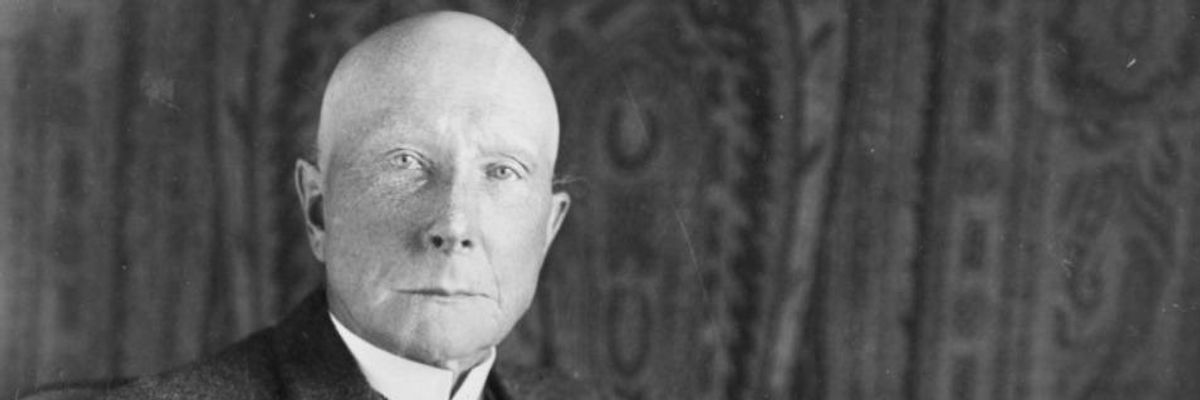

John D. Rockefeller built his fortune as the oil baron who built the Standard Oil empire. Now, some of the heirs to that substantial wealth are pledging to remove their holdings from fossil fuels and invest in a cleaner energy future. (Photo: Archive)

Major Foundations and Investors, Including Heirs to Oil Fortune, Pledge Fossil Fuel Divestment

$50 billion in assets will be removed from the fossil fuel sector and placed in clean energy investments

Prominent private philanthropies and charitable foundations, including one built from the oil fortune of John D. Rockefeller and Standard Oil, are announcing their intention to divest from fossil fuel holdings on Monday as they make clear statements that the threat of climate change and the irresponsible behavior of the oil, coal, and natural gas companies has fueled their decision.

The pledges from the group of endowments and individuals, which formed earlier this year as the Global Divest-Invest Coalition, will total $50 billion in assets that will be removed from the fossil fuel sector and placed in clean energy investments instead.

As the New York Times reports, "The family whose legendary wealth flowed from Standard Oil is planning to announce on Monday that its $860 million philanthropic organization, the Rockefeller Brothers Fund, is joining the divestment movement that began a couple years ago on college campuses."

The official announcement from the funds comes one day after an estimated 400,000 people marched through the streets of Manhattan demanding strong and immediate climate action and one day ahead of the UN Climate Summit, hosting world leaders from more than 125 nations, on Tuesday.

According to the Times:

The people who are selling shares of energy stocks are well aware that their actions are unlikely to have an immediate impact on the companies, given their enormous market capitalizations and cash flow.

Even so, some say they are taking action to align their assets with their environmental principles. Others want to shame companies that they believe are recklessly contributing to a warming planet. Still others say that the fight to limit climate change will lead to new regulations and disruptive new technologies that will make these companies an increasingly risky investment.

Ultimately, the activist investors say, their actions, like those of the anti-apartheid divestment fights of the 1980s, could help spur international debate, while the shift of investment funds to energy alternatives could lead to solutions to the carbon puzzle.

"This is a threshold moment," said Ellen Dorsey, executive director of the Wallace Global Fund, which has coordinated the effort to recruit foundations to the cause. "This movement has gone from a small activist band quickly into the mainstream."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. The final deadline for our crucial Summer Campaign fundraising drive is just days away, and we’re falling short of our must-hit goal. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Prominent private philanthropies and charitable foundations, including one built from the oil fortune of John D. Rockefeller and Standard Oil, are announcing their intention to divest from fossil fuel holdings on Monday as they make clear statements that the threat of climate change and the irresponsible behavior of the oil, coal, and natural gas companies has fueled their decision.

The pledges from the group of endowments and individuals, which formed earlier this year as the Global Divest-Invest Coalition, will total $50 billion in assets that will be removed from the fossil fuel sector and placed in clean energy investments instead.

As the New York Times reports, "The family whose legendary wealth flowed from Standard Oil is planning to announce on Monday that its $860 million philanthropic organization, the Rockefeller Brothers Fund, is joining the divestment movement that began a couple years ago on college campuses."

The official announcement from the funds comes one day after an estimated 400,000 people marched through the streets of Manhattan demanding strong and immediate climate action and one day ahead of the UN Climate Summit, hosting world leaders from more than 125 nations, on Tuesday.

According to the Times:

The people who are selling shares of energy stocks are well aware that their actions are unlikely to have an immediate impact on the companies, given their enormous market capitalizations and cash flow.

Even so, some say they are taking action to align their assets with their environmental principles. Others want to shame companies that they believe are recklessly contributing to a warming planet. Still others say that the fight to limit climate change will lead to new regulations and disruptive new technologies that will make these companies an increasingly risky investment.

Ultimately, the activist investors say, their actions, like those of the anti-apartheid divestment fights of the 1980s, could help spur international debate, while the shift of investment funds to energy alternatives could lead to solutions to the carbon puzzle.

"This is a threshold moment," said Ellen Dorsey, executive director of the Wallace Global Fund, which has coordinated the effort to recruit foundations to the cause. "This movement has gone from a small activist band quickly into the mainstream."

Prominent private philanthropies and charitable foundations, including one built from the oil fortune of John D. Rockefeller and Standard Oil, are announcing their intention to divest from fossil fuel holdings on Monday as they make clear statements that the threat of climate change and the irresponsible behavior of the oil, coal, and natural gas companies has fueled their decision.

The pledges from the group of endowments and individuals, which formed earlier this year as the Global Divest-Invest Coalition, will total $50 billion in assets that will be removed from the fossil fuel sector and placed in clean energy investments instead.

As the New York Times reports, "The family whose legendary wealth flowed from Standard Oil is planning to announce on Monday that its $860 million philanthropic organization, the Rockefeller Brothers Fund, is joining the divestment movement that began a couple years ago on college campuses."

The official announcement from the funds comes one day after an estimated 400,000 people marched through the streets of Manhattan demanding strong and immediate climate action and one day ahead of the UN Climate Summit, hosting world leaders from more than 125 nations, on Tuesday.

According to the Times:

The people who are selling shares of energy stocks are well aware that their actions are unlikely to have an immediate impact on the companies, given their enormous market capitalizations and cash flow.

Even so, some say they are taking action to align their assets with their environmental principles. Others want to shame companies that they believe are recklessly contributing to a warming planet. Still others say that the fight to limit climate change will lead to new regulations and disruptive new technologies that will make these companies an increasingly risky investment.

Ultimately, the activist investors say, their actions, like those of the anti-apartheid divestment fights of the 1980s, could help spur international debate, while the shift of investment funds to energy alternatives could lead to solutions to the carbon puzzle.

"This is a threshold moment," said Ellen Dorsey, executive director of the Wallace Global Fund, which has coordinated the effort to recruit foundations to the cause. "This movement has gone from a small activist band quickly into the mainstream."