In another boon for U.S. billionaires, Congressional Republicans are planning to ring in this year's Tax Day with a vote to repeal the federal estate tax.

Under the bill (H.R. 1105) offered by Rep. Kevin Brady (R-Texas), estates--no matter how large--would not be taxed, whereas under current law, a deceased person's assets must be worth more than $5.43 million before they are subject to the tax.

Further, the legislation would also repeal a generation-skipping transfer tax and lower the top marginal gift tax rate. In an email to Common Dreams, Scott Klinger, director of Revenue and Spending Policies at the Center for Effective Government, said the bill is really "repeal on steroids--it would allow vast amounts of wealth to pass from one generation to the next."

The Congressional Budget Office estimates that the repeal would add nearly $270 billion to the deficit over the next ten years.

And according to critics of the legislation, the repeal would amount to a roughly $3 million tax cut for the wealthiest 0.2 percent of households.

"The estate tax is an essential tool for leveling the playing field and preventing the rise of wealth dynasties," Josh Hoxie and Chuck Collins, both with the Institute for Policy Studies (IPS), wrote in a joint letter sent Monday. "In our tax code since 1916, the federal estate tax was designed to stem the rise of concentrated wealth and the economic as well as political power that comes with it."

As Klinger further explains:

Imagine Mark Zuckerberg, founder of Facebook, whose company stock is valued for tax purposes at pennies a share. None of Zuckerberg's fabulous stock gains have yet been taxed. [...]

If the estate tax were eliminated and all accrued but unpaid capital gains taxes were forgiven, $40 billion of untaxed stock-based wealth would be passed to heirs tax-free. And if those heirs took their huge inheritances and invested them in portfolios that they didn't touch during their lives, all of their capital gains taxes would be forgiven when they died, and their heirs would inherit still larger fortunes.

Congress is on the path to creating a permanent class of Americans who never have to work or pay taxes.

The House of Representatives is expected to vote Wednesday on the legislation while a Senate bill introduced by Sen. John Thune (R-S.D.) received backing from 27 Senate Republicans during a test vote in late March.

During a recent event in Louisville, Kentucky, President Barack Obama expressed his own distaste for the legislation, calling it a "deficit-busting tax cut for a fraction of the top one-tenth of 1 percent."

Progressive groups including IPS, along with National People's Action, RootsAction, as well as Michigan Rep. Keith Ellison (D) are circulating a petition calling on House Speaker John Boehner to block the repeal.

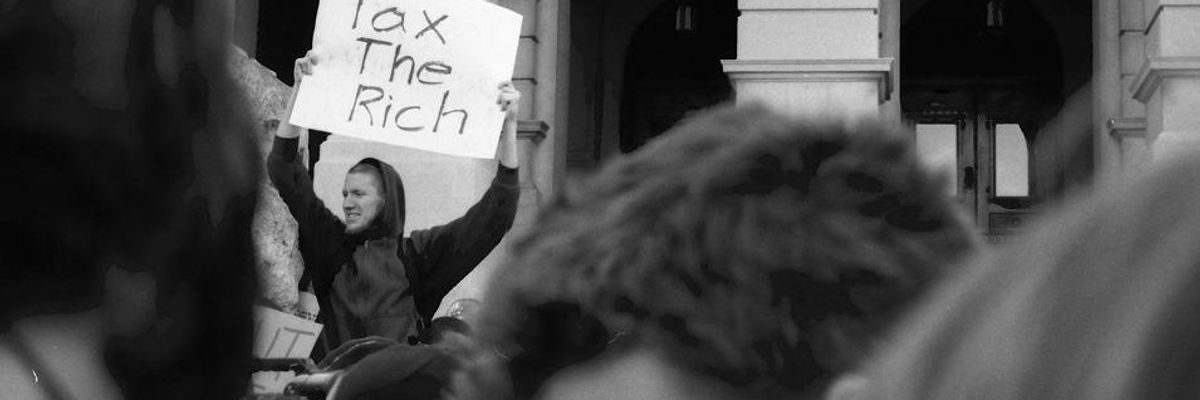

"We can't let this happen," the petition reads. "The wealth of the rich has skyrocketed in recent years. The rest of us are barely getting by. Nothing illustrates more how much the political system is rigged in favor of the wealthy and corporations than this effort to repeal the estate tax."