In a case illustrating the dangers of corporate-friendly provisions buried in trade deals like the Trans-Pacific Partnership, a secret tribunal is on the brink of issuing a ruling any day that that could force the Central American country of El Salvador to pay $301 million to a Canadian-Australian gold-mining firm.

OceanaGold, which purchased the Vancouver-based Pacific Rim Mining in 2013, is suing El Salvador--the most water-stressed country in the region--for an amount equivalent to 5 percent of its gross domestic product for refusing to grant it a permit to put a gold mine into operation.

"As the TTIP and TPP negotiations continue, Pacific Rim vs. El Salvador should remind us not to privilege foreign investors to the detriment of the national--or global--good."

--Manuel Perez-Rocha, Institute for Policy Studies

El Salvador's government says the mining company never complied with the minimum legal requirements for obtaining a permit. In addition, there are serious concerns about the social and environmental impacts of mining in a nation where more than 90 percent of the surface water supply is already contaminated, and more than 50 percent of the 6.3 million people depend on one fragile watershed for drinking water.

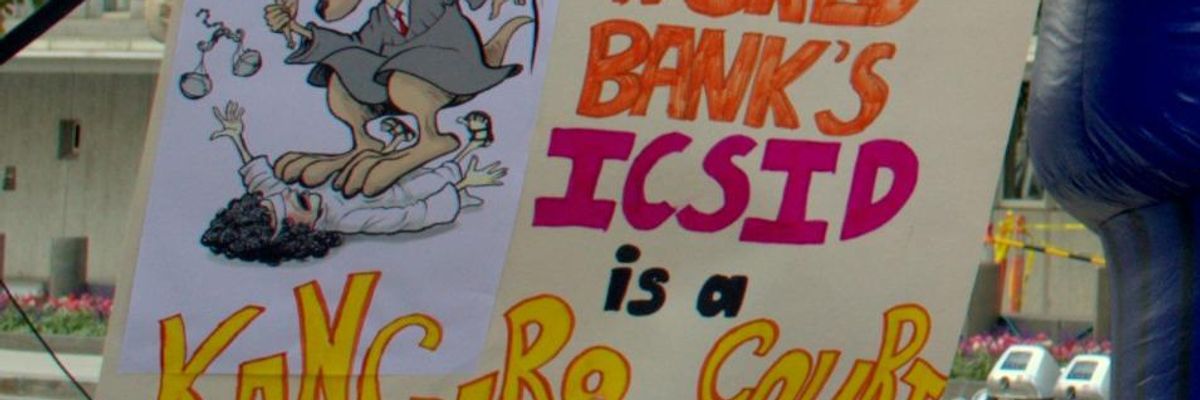

But in the wake of the permit rejection--and after the first of three successive Salvadoran Presidents committed to an effective moratorium on new mining projects--Pacific Rim filed a lawsuit in 2009 before the International Center for Settlement of Investment Disputes (ICSID), a little-known World Bank-based tribunal.

Since purchasing Pacific Rim in 2013, Australia's OceanaGold has "stubbornly continued with the case," according to a press release from MiningWatch Canada. The company claims that under the Central American Free Trade Agreement, it has the right to sue the Salvadoran government for passing a law that threatens its bottom line.

The ICSID is poised to issue its ruling sometime in 2015.

According to activists, the case shows how corporate-rights provisions in so-called "free trade" agreements--such as the existing North American Free Trade Agreement (NAFTA), and proposed Transatlantic Trade and Investment Partnership (TTIP) and Trans-Pacific Partnership (TPP)--threaten democracy, public health, and the environment.

"The ICSID suit, taking place far beyond any democratic process or court system, aims to put a chill on important project and policy making decisions related to large-scale mining in El Salvador," according to the MiningWatch statement. "In particular, a proposed legislated ban on mining has been stalled in the Salvadoran legislature for years. Meanwhile, mining-affected communities lack access to justice for the harms that they have faced. Neither are their appeals on human rights and environmental grounds considered relevant in the strictly commercial ICSID tribunal system."

A Salvadoran delegation is in Canada this week not only to request support for the Salvadoran people's struggle, but also to warn of dangers that Canadians face through such investor provisions. In addition to panel discussions and workshops, the 'Stop the Suits' week includes a public theater action with the Mining Injustice Solidarity Network entitled, "Stop the Suits, Close the (Kangaroo) Court!"

As Stop the Suits organizers point out, "the number of investor-state suits has ballooned in recent years." As of 2013, there were 169 investor-state suits being heard at the ICSID, up from only 3 in 2000. About 35 percent were brought by oil, gas, and mining firms and nearly 50 percent of all 169 suits were against Latin American governments. The trend with NAFTA suits is similar--over the last decade, the number of suits has doubled, with Canada the target in roughly 70 percent of cases.

Should the controversial TPP go into effect, U.S. ISDS liability would increase "to an unprecedented degree," the watchdog group Public Citizen warned after the most recent WikiLeaks revelation.

But in El Salvador, the impact of a pro-corporate ruling would be both immediate and harsh.

"For El Salvador, a $301 million loss...would significantly reduce funds available for health care and education," wrote Manuel Perez-Rocha, an associate fellow at the Institute for Policy Studies, in a New York Times op-ed published in December.

"And even if Pacific Rim's claim fails, as many expect, the suit has cost El Salvador almost $13 million to date--which amounts to nearly its entire environment and natural resources spending in 2013," he added, calling on El Salvador to follow in the footsteps of Venezuela, Ecuador, and Bolivia in officially denouncing the ICSID convention.

"The investor-state dispute settlement mechanism is like playing soccer on half the field," Perez-Rocha argued. "Corporations are free to sue, and nations must defend themselves at enormous cost--and the best a government can hope for is a scoreless game. As the TTIP and TPP negotiations continue, Pacific Rim vs. El Salvador should remind us not to privilege foreign investors to the detriment of the national--or global--good."

In the meantime, Salvadoran communities are beginning to reclaim their sovereignty from the grassroots up.

In a piece that appeared Monday at Common Dreams, Salvadoran-Canadian activist Juan Carlos Jimenez pointed out that the agricultural town of Nueva Trinidad recently became the third municipality in El Salvador to officially declare itself a 'territory free of mining' through a historic popular community consultation.

"The new strategy is a way to bring the current mining conflict...away from judicial courts and back to the grassroots communities," Jimenez wrote.