SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

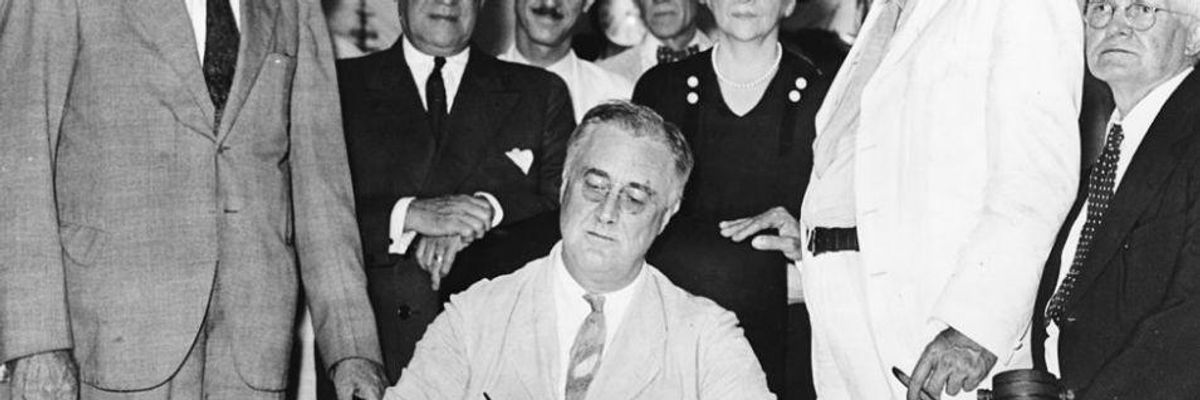

President Roosevelt signs the Social Security Act on 14 August 1935.

An overwhelming majority of Americans supports Social Security's contribution to the common good, a new AARP survey has found.

The findings (pdf), released on the eve of program's 80th anniversary, show how vital the program continues to be.

"As we celebrate Social Security on its 80th anniversary, our survey found that it remains as important as ever to American families," said AARP CEO Jo Ann Jenkins.

The organization's national survey of public opinions found that 80 percent of all age groups are currently depending on or plan to depend on Social Security for their retirement income.

Sixty-six percent said that it's "one of the very most important government programs"--and that's a perception that's remained consistent over the past twenty years, the organization found.

Though Democrats were more likely (74 percent) to say that it's one of the very most important programs, a majority of Republicans--56 percent--agreed.

In addition, 82 percent of respondents said they "think it's important to continue to contribute to Social Security for the common good."

Fifty-five percent of those aged 18-29 said they thought the program wouldn't be there when they hit retirement, but shortfalls in Social Security could be avoided, according to economist Dean Baker, a co-director of the Center for Economic and Policy Research, with broadly based wage growth. Two reasons account for that, he stated:

The first is that the upward redistribution of wage income over the last three decades has played a large role in the projected shortfall. As income has been transferred from ordinary workers to those at the top of the wage distribution, a larger share of wage income has escaped taxation. When the Greenspan Commission set the cap for taxable wages in 1983, it covered 90 percent of wage income. Currently the cap only covers around 82 percent of wage income. If the cap had continued to cover 90 percent of wage income, the projected shortfall would be roughly 40 percent less than it is now.

The other reason why broadly based wage growth is key to the program's continuing solvency is that the burden of possible future tax increases would be much less consequential if most workers will share in the gains of economic growth. The Social Security trustees project that real wages will rise by more than 34 percent over the next two decades. (They are projected to rise by another 30 percent over the following two decades.) Even if the payroll tax is increased by three percentage points, it would take back less than one-tenth of the projected rise in before-tax wages if wage growth is evenly shared. On the other hand, if most of the gains from growth continue to go to those at the top end of the distribution, any tax increase will be a major burden.

Among the reasons to celebrate Social Security's anniversary, writes Jasmine Tucker, research analyst with the National Priorities Project, is that Social Security is an excellent anti-poverty program:

Without Social Security, 42.6 percent of people over 65 would have been poor in 2013. Social Security benefits brought that percentage down to 9.5 percent. And benefits also lifted more than 6.2 million non-elderly adults and nearly 1.2 million kids out of poverty in 2013, making it one of the most effective anti-poverty programs we have.

Most people also want to expand the program, Tucker continues:

Recent polling shows that when faced with hard choices about Social Security's future, Americans would increase the Social Security payroll tax on all workers and those with higher earnings in order to preserve benefits for current beneficiaries. What's more: nearly 3 in 4 people think we should consider increasing benefits.

That's a cause shared by a group of 70 Democratic lawmakers led by Sen. Bernie Sanders (I-Vt.) and Rep. John Conyers (D-Mich.), who wrote in a letter to the White House last month that "[a]s Social Security is affordable, universal, efficient, secure, portable, distributionally fair, and popular, expanding its modest benefits should be the number one retirement security recommendation of the White House Conference on Aging."

Echoing their message, Nancy Altman, president of Social Security Works and chair of the Strengthen Social Security Coalition, said last month that the best way to mark the milestone 80th anniversary--and help address inequality--is by expanding the program's benefits.

"Social Security is a solution to our looming retirement income crisis, the increasing economic squeeze on middle class families, and the perilous and growing income and wealth inequality," Altman stated. "In light of these challenges and Social Security's important role in addressing them, the right question is not how can we afford to expand Social Security, but, rather, how can we afford not to expand it."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

An overwhelming majority of Americans supports Social Security's contribution to the common good, a new AARP survey has found.

The findings (pdf), released on the eve of program's 80th anniversary, show how vital the program continues to be.

"As we celebrate Social Security on its 80th anniversary, our survey found that it remains as important as ever to American families," said AARP CEO Jo Ann Jenkins.

The organization's national survey of public opinions found that 80 percent of all age groups are currently depending on or plan to depend on Social Security for their retirement income.

Sixty-six percent said that it's "one of the very most important government programs"--and that's a perception that's remained consistent over the past twenty years, the organization found.

Though Democrats were more likely (74 percent) to say that it's one of the very most important programs, a majority of Republicans--56 percent--agreed.

In addition, 82 percent of respondents said they "think it's important to continue to contribute to Social Security for the common good."

Fifty-five percent of those aged 18-29 said they thought the program wouldn't be there when they hit retirement, but shortfalls in Social Security could be avoided, according to economist Dean Baker, a co-director of the Center for Economic and Policy Research, with broadly based wage growth. Two reasons account for that, he stated:

The first is that the upward redistribution of wage income over the last three decades has played a large role in the projected shortfall. As income has been transferred from ordinary workers to those at the top of the wage distribution, a larger share of wage income has escaped taxation. When the Greenspan Commission set the cap for taxable wages in 1983, it covered 90 percent of wage income. Currently the cap only covers around 82 percent of wage income. If the cap had continued to cover 90 percent of wage income, the projected shortfall would be roughly 40 percent less than it is now.

The other reason why broadly based wage growth is key to the program's continuing solvency is that the burden of possible future tax increases would be much less consequential if most workers will share in the gains of economic growth. The Social Security trustees project that real wages will rise by more than 34 percent over the next two decades. (They are projected to rise by another 30 percent over the following two decades.) Even if the payroll tax is increased by three percentage points, it would take back less than one-tenth of the projected rise in before-tax wages if wage growth is evenly shared. On the other hand, if most of the gains from growth continue to go to those at the top end of the distribution, any tax increase will be a major burden.

Among the reasons to celebrate Social Security's anniversary, writes Jasmine Tucker, research analyst with the National Priorities Project, is that Social Security is an excellent anti-poverty program:

Without Social Security, 42.6 percent of people over 65 would have been poor in 2013. Social Security benefits brought that percentage down to 9.5 percent. And benefits also lifted more than 6.2 million non-elderly adults and nearly 1.2 million kids out of poverty in 2013, making it one of the most effective anti-poverty programs we have.

Most people also want to expand the program, Tucker continues:

Recent polling shows that when faced with hard choices about Social Security's future, Americans would increase the Social Security payroll tax on all workers and those with higher earnings in order to preserve benefits for current beneficiaries. What's more: nearly 3 in 4 people think we should consider increasing benefits.

That's a cause shared by a group of 70 Democratic lawmakers led by Sen. Bernie Sanders (I-Vt.) and Rep. John Conyers (D-Mich.), who wrote in a letter to the White House last month that "[a]s Social Security is affordable, universal, efficient, secure, portable, distributionally fair, and popular, expanding its modest benefits should be the number one retirement security recommendation of the White House Conference on Aging."

Echoing their message, Nancy Altman, president of Social Security Works and chair of the Strengthen Social Security Coalition, said last month that the best way to mark the milestone 80th anniversary--and help address inequality--is by expanding the program's benefits.

"Social Security is a solution to our looming retirement income crisis, the increasing economic squeeze on middle class families, and the perilous and growing income and wealth inequality," Altman stated. "In light of these challenges and Social Security's important role in addressing them, the right question is not how can we afford to expand Social Security, but, rather, how can we afford not to expand it."

An overwhelming majority of Americans supports Social Security's contribution to the common good, a new AARP survey has found.

The findings (pdf), released on the eve of program's 80th anniversary, show how vital the program continues to be.

"As we celebrate Social Security on its 80th anniversary, our survey found that it remains as important as ever to American families," said AARP CEO Jo Ann Jenkins.

The organization's national survey of public opinions found that 80 percent of all age groups are currently depending on or plan to depend on Social Security for their retirement income.

Sixty-six percent said that it's "one of the very most important government programs"--and that's a perception that's remained consistent over the past twenty years, the organization found.

Though Democrats were more likely (74 percent) to say that it's one of the very most important programs, a majority of Republicans--56 percent--agreed.

In addition, 82 percent of respondents said they "think it's important to continue to contribute to Social Security for the common good."

Fifty-five percent of those aged 18-29 said they thought the program wouldn't be there when they hit retirement, but shortfalls in Social Security could be avoided, according to economist Dean Baker, a co-director of the Center for Economic and Policy Research, with broadly based wage growth. Two reasons account for that, he stated:

The first is that the upward redistribution of wage income over the last three decades has played a large role in the projected shortfall. As income has been transferred from ordinary workers to those at the top of the wage distribution, a larger share of wage income has escaped taxation. When the Greenspan Commission set the cap for taxable wages in 1983, it covered 90 percent of wage income. Currently the cap only covers around 82 percent of wage income. If the cap had continued to cover 90 percent of wage income, the projected shortfall would be roughly 40 percent less than it is now.

The other reason why broadly based wage growth is key to the program's continuing solvency is that the burden of possible future tax increases would be much less consequential if most workers will share in the gains of economic growth. The Social Security trustees project that real wages will rise by more than 34 percent over the next two decades. (They are projected to rise by another 30 percent over the following two decades.) Even if the payroll tax is increased by three percentage points, it would take back less than one-tenth of the projected rise in before-tax wages if wage growth is evenly shared. On the other hand, if most of the gains from growth continue to go to those at the top end of the distribution, any tax increase will be a major burden.

Among the reasons to celebrate Social Security's anniversary, writes Jasmine Tucker, research analyst with the National Priorities Project, is that Social Security is an excellent anti-poverty program:

Without Social Security, 42.6 percent of people over 65 would have been poor in 2013. Social Security benefits brought that percentage down to 9.5 percent. And benefits also lifted more than 6.2 million non-elderly adults and nearly 1.2 million kids out of poverty in 2013, making it one of the most effective anti-poverty programs we have.

Most people also want to expand the program, Tucker continues:

Recent polling shows that when faced with hard choices about Social Security's future, Americans would increase the Social Security payroll tax on all workers and those with higher earnings in order to preserve benefits for current beneficiaries. What's more: nearly 3 in 4 people think we should consider increasing benefits.

That's a cause shared by a group of 70 Democratic lawmakers led by Sen. Bernie Sanders (I-Vt.) and Rep. John Conyers (D-Mich.), who wrote in a letter to the White House last month that "[a]s Social Security is affordable, universal, efficient, secure, portable, distributionally fair, and popular, expanding its modest benefits should be the number one retirement security recommendation of the White House Conference on Aging."

Echoing their message, Nancy Altman, president of Social Security Works and chair of the Strengthen Social Security Coalition, said last month that the best way to mark the milestone 80th anniversary--and help address inequality--is by expanding the program's benefits.

"Social Security is a solution to our looming retirement income crisis, the increasing economic squeeze on middle class families, and the perilous and growing income and wealth inequality," Altman stated. "In light of these challenges and Social Security's important role in addressing them, the right question is not how can we afford to expand Social Security, but, rather, how can we afford not to expand it."