'A Tale of Two Retirements': New Report Blasts Rigged Rules That Favor Corporate Execs

'Together, we can ... allow for all Americans to be able to retire with dignity.'

Imagine a retirement account worth over $49.3 million.

According to a report, A Tale of Two Retirements, released Wednesday by the Center for Effective Government and the Institute for Policy Studies (IPS), it's no dream for 100 Fortune 500 CEOs—it's their average retirement nest egg.

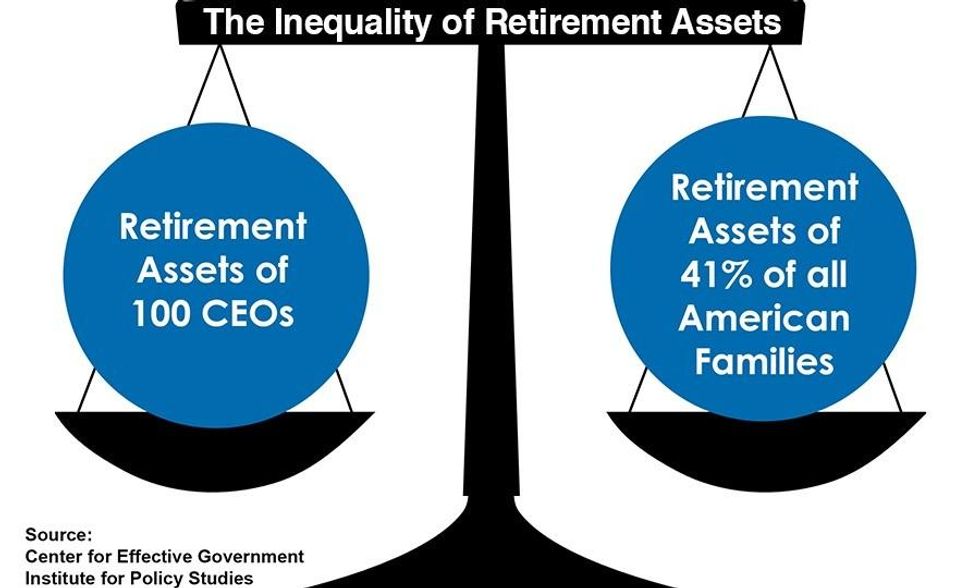

Underscoring the nation's inequality, the CEOs' retirement assets total $4.9 billion, the same amount held by 50 million families—41 percent of American families.

"The CEO-worker retirement divide has turned our country's already extreme income divide into an even wider economic chasm," said Sarah Anderson, IPS Global Economy Project director.

The report notes that Honeywell CEO David Cote has promoted cuts to Social Security and is a founding member of the pro-austerity group Fix the Debt. He receives a monthly retirement check of over $948,000, while General Electric CEO Jeffrey Immelt receives $463,000 monthly.

David Novak, who became CEO of YUM Brands in 2014 and is now its Executive Chairman, has the largest retirement assets, $234 million. This puts him on a path to receiving a monthly retirement check of $1.3 million.

Those amounts make President Obama's monthly retirement check of $16,975 seem like a mere pittance. More importantly, they highlight the economic chasm between CEOs and ordinary Americans. As a separate report released earlier this year showed, 55 percent (pdf) of those aged 50-64 will get about $1,200 a month, as they will have to rely nearly entirely on Social Security.

The report adds that nearly half of all working-age Americans have no access to any retirement plan at work, while even for those who do have a 401(k) plan--a plan "where workers, not employers, bear the investment risk"--at the end of 2013 the average total was $18,433, equaling a monthly retirement check of $104. The report adds:

Today's emphasis by CEOs on short-term corporate profits, together with government's failure to prevent employers from engaging in union busting (and sometimes even engaging in union-busting directly) help explain the decline in private sector employees receiving a pension at work from 43 percent in 1980 to just 13 percent in 2013.

But are these CEO retirement assets just compensation for exemplary work? Hardly, says Scott Klinger, director of Revenue and Spending Policies at the Center for Effective Government.

"The CEOs' extraordinary nest eggs are not the result of extraordinary performance," Klinger stated. "They are the result of rules intentionally tipped to reward those already on the ladder's highest rungs."

Here's part of how those rules are rigged to favor corporate executives, the report's introduction states. While those workers who are offered a 401(k) plan face limits ($18,000 for workers under 50) for how much they can set aside tax-free for retirement, such limits don't apply to CEOs. The report continues:

While slashing worker pensions, CEOs take advantage of special loopholes that allow them to invest unlimited amounts of compensation into tax-deferred accounts set up by their employers. Nearly three-fourths of Fortune 500 firms offer executive deferred compensation plans. As of the end of 2014, 341 Fortune 500 CEOs had accumulated $3.2 billion in these deferred compensation accounts--more than 53.8 percent of American families had in their deferred compensation accounts.

[...]

In 2014, 198 Fortune 500 CEOs invested a combined $197 million more of their pre-tax income in these plans than they would have been able to invest if they'd been subject to the maximum $24,000 cap that applies to ordinary workers. If they had been subject to this limit, they would've owed the U.S. Treasury $78 million more in income taxes last year.

The economic disparities also exist even among the "top rungs of the corporate ladder," the report notes, as "the rules of the executive retirement system have been rigged to privilege those who have traditionally led large U.S. corporations, white males. Even when women and people of color break into Fortune 500 corner offices, their retirement assets still don't measure up to those of their white male counterparts."

The report indicates these disparities "mirror the far more disturbing gaps among lower-income Americans."

The report offers a list of suggestions to change the rules that foster inequality in retirement, including eliminating tax breaks for companies that increase worker retirement insecurity, strengthening the ability of all workers to unionize, expanding Social Security, and requiring CEOs to pay their fair share.

"We can rewrite the rules that have been rigged against the middle class for the last 30 years," the Center for Effective Government and IPS state. "Together, we can change this and allow for all Americans to be able to retire with dignity."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Imagine a retirement account worth over $49.3 million.

According to a report, A Tale of Two Retirements, released Wednesday by the Center for Effective Government and the Institute for Policy Studies (IPS), it's no dream for 100 Fortune 500 CEOs—it's their average retirement nest egg.

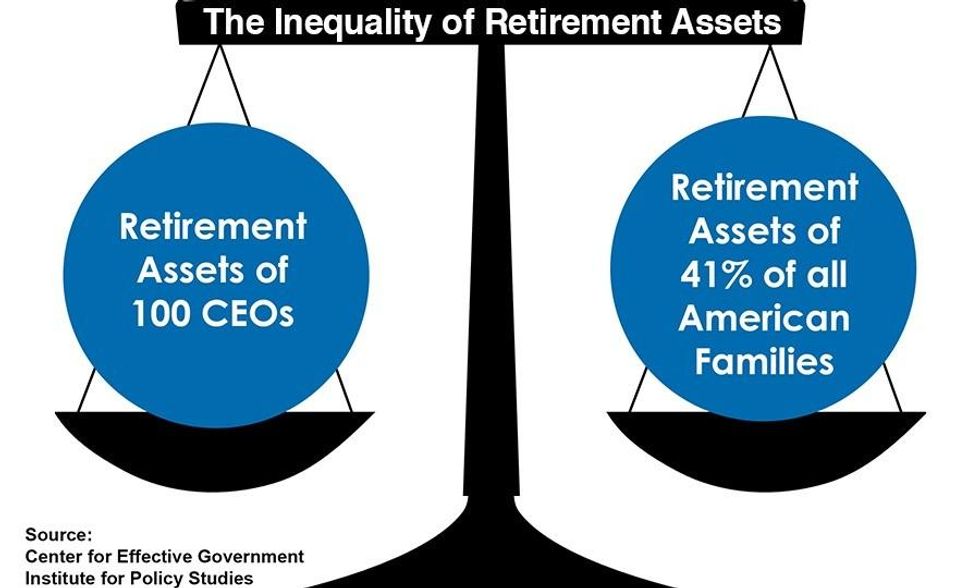

Underscoring the nation's inequality, the CEOs' retirement assets total $4.9 billion, the same amount held by 50 million families—41 percent of American families.

"The CEO-worker retirement divide has turned our country's already extreme income divide into an even wider economic chasm," said Sarah Anderson, IPS Global Economy Project director.

The report notes that Honeywell CEO David Cote has promoted cuts to Social Security and is a founding member of the pro-austerity group Fix the Debt. He receives a monthly retirement check of over $948,000, while General Electric CEO Jeffrey Immelt receives $463,000 monthly.

David Novak, who became CEO of YUM Brands in 2014 and is now its Executive Chairman, has the largest retirement assets, $234 million. This puts him on a path to receiving a monthly retirement check of $1.3 million.

Those amounts make President Obama's monthly retirement check of $16,975 seem like a mere pittance. More importantly, they highlight the economic chasm between CEOs and ordinary Americans. As a separate report released earlier this year showed, 55 percent (pdf) of those aged 50-64 will get about $1,200 a month, as they will have to rely nearly entirely on Social Security.

The report adds that nearly half of all working-age Americans have no access to any retirement plan at work, while even for those who do have a 401(k) plan--a plan "where workers, not employers, bear the investment risk"--at the end of 2013 the average total was $18,433, equaling a monthly retirement check of $104. The report adds:

Today's emphasis by CEOs on short-term corporate profits, together with government's failure to prevent employers from engaging in union busting (and sometimes even engaging in union-busting directly) help explain the decline in private sector employees receiving a pension at work from 43 percent in 1980 to just 13 percent in 2013.

But are these CEO retirement assets just compensation for exemplary work? Hardly, says Scott Klinger, director of Revenue and Spending Policies at the Center for Effective Government.

"The CEOs' extraordinary nest eggs are not the result of extraordinary performance," Klinger stated. "They are the result of rules intentionally tipped to reward those already on the ladder's highest rungs."

Here's part of how those rules are rigged to favor corporate executives, the report's introduction states. While those workers who are offered a 401(k) plan face limits ($18,000 for workers under 50) for how much they can set aside tax-free for retirement, such limits don't apply to CEOs. The report continues:

While slashing worker pensions, CEOs take advantage of special loopholes that allow them to invest unlimited amounts of compensation into tax-deferred accounts set up by their employers. Nearly three-fourths of Fortune 500 firms offer executive deferred compensation plans. As of the end of 2014, 341 Fortune 500 CEOs had accumulated $3.2 billion in these deferred compensation accounts--more than 53.8 percent of American families had in their deferred compensation accounts.

[...]

In 2014, 198 Fortune 500 CEOs invested a combined $197 million more of their pre-tax income in these plans than they would have been able to invest if they'd been subject to the maximum $24,000 cap that applies to ordinary workers. If they had been subject to this limit, they would've owed the U.S. Treasury $78 million more in income taxes last year.

The economic disparities also exist even among the "top rungs of the corporate ladder," the report notes, as "the rules of the executive retirement system have been rigged to privilege those who have traditionally led large U.S. corporations, white males. Even when women and people of color break into Fortune 500 corner offices, their retirement assets still don't measure up to those of their white male counterparts."

The report indicates these disparities "mirror the far more disturbing gaps among lower-income Americans."

The report offers a list of suggestions to change the rules that foster inequality in retirement, including eliminating tax breaks for companies that increase worker retirement insecurity, strengthening the ability of all workers to unionize, expanding Social Security, and requiring CEOs to pay their fair share.

"We can rewrite the rules that have been rigged against the middle class for the last 30 years," the Center for Effective Government and IPS state. "Together, we can change this and allow for all Americans to be able to retire with dignity."

Imagine a retirement account worth over $49.3 million.

According to a report, A Tale of Two Retirements, released Wednesday by the Center for Effective Government and the Institute for Policy Studies (IPS), it's no dream for 100 Fortune 500 CEOs—it's their average retirement nest egg.

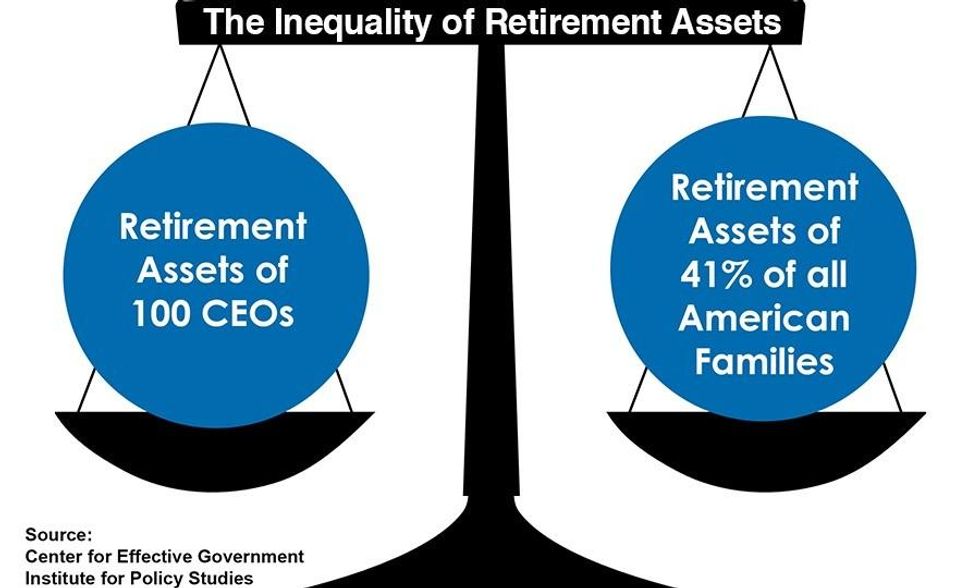

Underscoring the nation's inequality, the CEOs' retirement assets total $4.9 billion, the same amount held by 50 million families—41 percent of American families.

"The CEO-worker retirement divide has turned our country's already extreme income divide into an even wider economic chasm," said Sarah Anderson, IPS Global Economy Project director.

The report notes that Honeywell CEO David Cote has promoted cuts to Social Security and is a founding member of the pro-austerity group Fix the Debt. He receives a monthly retirement check of over $948,000, while General Electric CEO Jeffrey Immelt receives $463,000 monthly.

David Novak, who became CEO of YUM Brands in 2014 and is now its Executive Chairman, has the largest retirement assets, $234 million. This puts him on a path to receiving a monthly retirement check of $1.3 million.

Those amounts make President Obama's monthly retirement check of $16,975 seem like a mere pittance. More importantly, they highlight the economic chasm between CEOs and ordinary Americans. As a separate report released earlier this year showed, 55 percent (pdf) of those aged 50-64 will get about $1,200 a month, as they will have to rely nearly entirely on Social Security.

The report adds that nearly half of all working-age Americans have no access to any retirement plan at work, while even for those who do have a 401(k) plan--a plan "where workers, not employers, bear the investment risk"--at the end of 2013 the average total was $18,433, equaling a monthly retirement check of $104. The report adds:

Today's emphasis by CEOs on short-term corporate profits, together with government's failure to prevent employers from engaging in union busting (and sometimes even engaging in union-busting directly) help explain the decline in private sector employees receiving a pension at work from 43 percent in 1980 to just 13 percent in 2013.

But are these CEO retirement assets just compensation for exemplary work? Hardly, says Scott Klinger, director of Revenue and Spending Policies at the Center for Effective Government.

"The CEOs' extraordinary nest eggs are not the result of extraordinary performance," Klinger stated. "They are the result of rules intentionally tipped to reward those already on the ladder's highest rungs."

Here's part of how those rules are rigged to favor corporate executives, the report's introduction states. While those workers who are offered a 401(k) plan face limits ($18,000 for workers under 50) for how much they can set aside tax-free for retirement, such limits don't apply to CEOs. The report continues:

While slashing worker pensions, CEOs take advantage of special loopholes that allow them to invest unlimited amounts of compensation into tax-deferred accounts set up by their employers. Nearly three-fourths of Fortune 500 firms offer executive deferred compensation plans. As of the end of 2014, 341 Fortune 500 CEOs had accumulated $3.2 billion in these deferred compensation accounts--more than 53.8 percent of American families had in their deferred compensation accounts.

[...]

In 2014, 198 Fortune 500 CEOs invested a combined $197 million more of their pre-tax income in these plans than they would have been able to invest if they'd been subject to the maximum $24,000 cap that applies to ordinary workers. If they had been subject to this limit, they would've owed the U.S. Treasury $78 million more in income taxes last year.

The economic disparities also exist even among the "top rungs of the corporate ladder," the report notes, as "the rules of the executive retirement system have been rigged to privilege those who have traditionally led large U.S. corporations, white males. Even when women and people of color break into Fortune 500 corner offices, their retirement assets still don't measure up to those of their white male counterparts."

The report indicates these disparities "mirror the far more disturbing gaps among lower-income Americans."

The report offers a list of suggestions to change the rules that foster inequality in retirement, including eliminating tax breaks for companies that increase worker retirement insecurity, strengthening the ability of all workers to unionize, expanding Social Security, and requiring CEOs to pay their fair share.

"We can rewrite the rules that have been rigged against the middle class for the last 30 years," the Center for Effective Government and IPS state. "Together, we can change this and allow for all Americans to be able to retire with dignity."