'Break Em Up!': Sanders Speech Takes Aim at Big Bank Greed

Speaking in downtown Manhattan, presidential hopeful calls to break up 'too big to fail' banks and reinstate Glass-Steagall

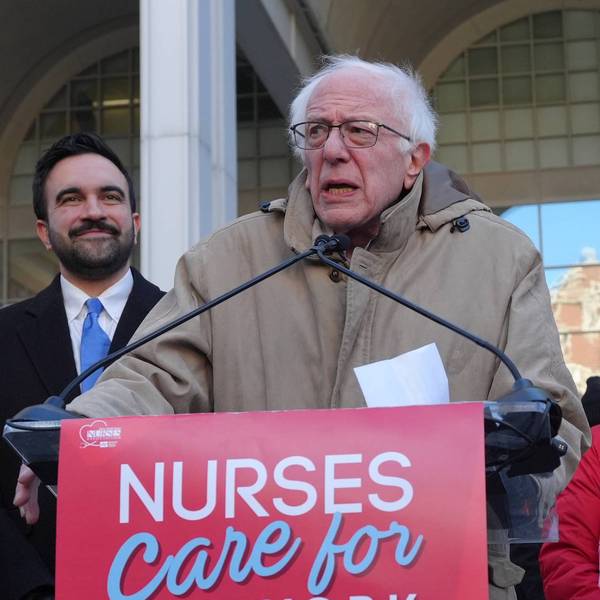

Speaking just blocks away from the belly of the beast, presidential hopeful Bernie Sanders on Tuesday gave a major policy speech during which he laid out his plan to take on Wall Street and end the era of "too big to fail" banking.

"To those on Wall Street who may be listening today, let me be very clear," Sanders said. "Greed is not good. Wall Street and corporate greed is destroying the fabric of our nation. And, here is a New Year's Resolution that we will keep: If you do not end your greed we will end it for you."

If elected president, Sanders will ask his Treasury secretary to create a "'too big to fail' list of commercial banks, shadow banks and insurance companies whose failure would pose a catastrophic risk to the United States economy without a taxpayer bailout"--and within a year, he vows, he will break up those entities.

"A handful of huge financial institutions simply have too much economic and political power over this country," Sanders said during the address, which was held at a venue in downtown Manhattan. "If a bank is too big to fail, it is too big to exist...When it comes to Wall Street reform, that must be our bottom line."

Among other proposals, the Vermont senator threw his support behind a measure introduced by Sen. Elizabeth Warren (D-Mass.) to reinstate the Glass-Steagall Act, which separated commercial and investment banking.

"Let's be clear: this legislation, introduced by my colleague Senator Elizabeth Warren aims at the heart of the shadow banking system," he stated.

Sanders' chief rival, Hillary Clinton, opposes that measure. On Monday, Clinton's campaign attempted to preempt Sanders' Wall Street speech by calling on the progressive senator to endorse her proposal for banking reform.

In response, Sanders' communications director, Michael Briggs, took aim at Gary Gensler, Clinton's chief financial adviser. "Senator Sanders won't be taking advice on how to regulate Wall Street from a former Goldman Sachs partner and a former Treasury Department official who helped Wall Street rig the system," Briggs said.

The former Secretary of State has repeatedly faced criticism for her longstanding ties to Wall Street.

Watch the speech below:

Updates on the speech will be shared on Twitter under the hashtag #BreakEmUp.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Speaking just blocks away from the belly of the beast, presidential hopeful Bernie Sanders on Tuesday gave a major policy speech during which he laid out his plan to take on Wall Street and end the era of "too big to fail" banking.

"To those on Wall Street who may be listening today, let me be very clear," Sanders said. "Greed is not good. Wall Street and corporate greed is destroying the fabric of our nation. And, here is a New Year's Resolution that we will keep: If you do not end your greed we will end it for you."

If elected president, Sanders will ask his Treasury secretary to create a "'too big to fail' list of commercial banks, shadow banks and insurance companies whose failure would pose a catastrophic risk to the United States economy without a taxpayer bailout"--and within a year, he vows, he will break up those entities.

"A handful of huge financial institutions simply have too much economic and political power over this country," Sanders said during the address, which was held at a venue in downtown Manhattan. "If a bank is too big to fail, it is too big to exist...When it comes to Wall Street reform, that must be our bottom line."

Among other proposals, the Vermont senator threw his support behind a measure introduced by Sen. Elizabeth Warren (D-Mass.) to reinstate the Glass-Steagall Act, which separated commercial and investment banking.

"Let's be clear: this legislation, introduced by my colleague Senator Elizabeth Warren aims at the heart of the shadow banking system," he stated.

Sanders' chief rival, Hillary Clinton, opposes that measure. On Monday, Clinton's campaign attempted to preempt Sanders' Wall Street speech by calling on the progressive senator to endorse her proposal for banking reform.

In response, Sanders' communications director, Michael Briggs, took aim at Gary Gensler, Clinton's chief financial adviser. "Senator Sanders won't be taking advice on how to regulate Wall Street from a former Goldman Sachs partner and a former Treasury Department official who helped Wall Street rig the system," Briggs said.

The former Secretary of State has repeatedly faced criticism for her longstanding ties to Wall Street.

Watch the speech below:

Updates on the speech will be shared on Twitter under the hashtag #BreakEmUp.

Speaking just blocks away from the belly of the beast, presidential hopeful Bernie Sanders on Tuesday gave a major policy speech during which he laid out his plan to take on Wall Street and end the era of "too big to fail" banking.

"To those on Wall Street who may be listening today, let me be very clear," Sanders said. "Greed is not good. Wall Street and corporate greed is destroying the fabric of our nation. And, here is a New Year's Resolution that we will keep: If you do not end your greed we will end it for you."

If elected president, Sanders will ask his Treasury secretary to create a "'too big to fail' list of commercial banks, shadow banks and insurance companies whose failure would pose a catastrophic risk to the United States economy without a taxpayer bailout"--and within a year, he vows, he will break up those entities.

"A handful of huge financial institutions simply have too much economic and political power over this country," Sanders said during the address, which was held at a venue in downtown Manhattan. "If a bank is too big to fail, it is too big to exist...When it comes to Wall Street reform, that must be our bottom line."

Among other proposals, the Vermont senator threw his support behind a measure introduced by Sen. Elizabeth Warren (D-Mass.) to reinstate the Glass-Steagall Act, which separated commercial and investment banking.

"Let's be clear: this legislation, introduced by my colleague Senator Elizabeth Warren aims at the heart of the shadow banking system," he stated.

Sanders' chief rival, Hillary Clinton, opposes that measure. On Monday, Clinton's campaign attempted to preempt Sanders' Wall Street speech by calling on the progressive senator to endorse her proposal for banking reform.

In response, Sanders' communications director, Michael Briggs, took aim at Gary Gensler, Clinton's chief financial adviser. "Senator Sanders won't be taking advice on how to regulate Wall Street from a former Goldman Sachs partner and a former Treasury Department official who helped Wall Street rig the system," Briggs said.

The former Secretary of State has repeatedly faced criticism for her longstanding ties to Wall Street.

Watch the speech below:

Updates on the speech will be shared on Twitter under the hashtag #BreakEmUp.