In a new report (pdf) focused on Scotland but with global implications, a coalition of social justice groups in the U.K. outlines the risks inherent to an economic system built to serve mega banks, and advocates for the radical reform of replacing these multinational conglomerates with small, local, and not-for-profit "people's banks" that would serve citizens instead of shareholders.

Progressives have long argued that corporate banking is an enormous threat to the global economy, as the 2008 economic crisis clearly demonstrated. What's more, the situation has only grown worse as multinational mega banks continue to merge and consolidate--a trend that shows no signs of stopping.

"We need to move away from highly concentrated, profit-driven banking to an ecosystem of institutions which are structurally designed to work for the common good."--Robin McAlpine, Common Weal

This latest call for local, publicly-owned "people's banks" joins a growing movement that has argued for such democratic reforms to banks in the U.S., Europe and around the world.

The report, called "Banking for the Common Good: Laying the foundations of safe, sustainable, stakeholder banking in Scotland," was the result of a collaboration between the social and economic justice groups New Economics Foundation, Friends of the Earth Scotland, Move Your Money and Common Weal.

"Scotland's banking system is unstable and unfit for purpose," the report begins. It goes on to paint a woeful picture of the effects of corporate banking on Scottish society:

Our banks are not providing sufficient funds for much-needed infrastructure. Our banking system is structurally unable to fund "patient capital", i.e. low-return but potentially risky investments, like those which are needed to stimulate the transition to a low-carbon, sustainable economy. Instead, billions are channelled into property, inflating asset prices, as well as unsustainable industries such as coal mining, the manufacture of nuclear weapons, and speculation on food prices, a practice which is fuelling global malnutrition.

Friends of the Earth Scotland argues, "We need to move away from highly concentrated, profit-driven banking to an ecosystem of institutions which are structurally designed to work for the common good."

"Alternative institutions exist but are small and struggling to compete in a system set up to privilege the big banks," the report goes on.

The report makes an argument for democratic banking reforms on the local, regional, and national level, calling for three key reforms that could be applied to other countries as well:

- Not-for-profit "People's Banks" in each of Scotland's regions to offer banking services to local people and business.

- Local banks would be part of a "People's Banking Network" to share risk and cooperate on training, marketing and the operation of key services such as payments systems.

- A "Scottish National Investment Bank" would help establish these institutions by offering seed funding and structural support. The bank would be institutionally independent from Government but publicly owned, and mandated to promote through its lending sustainable development and employment.

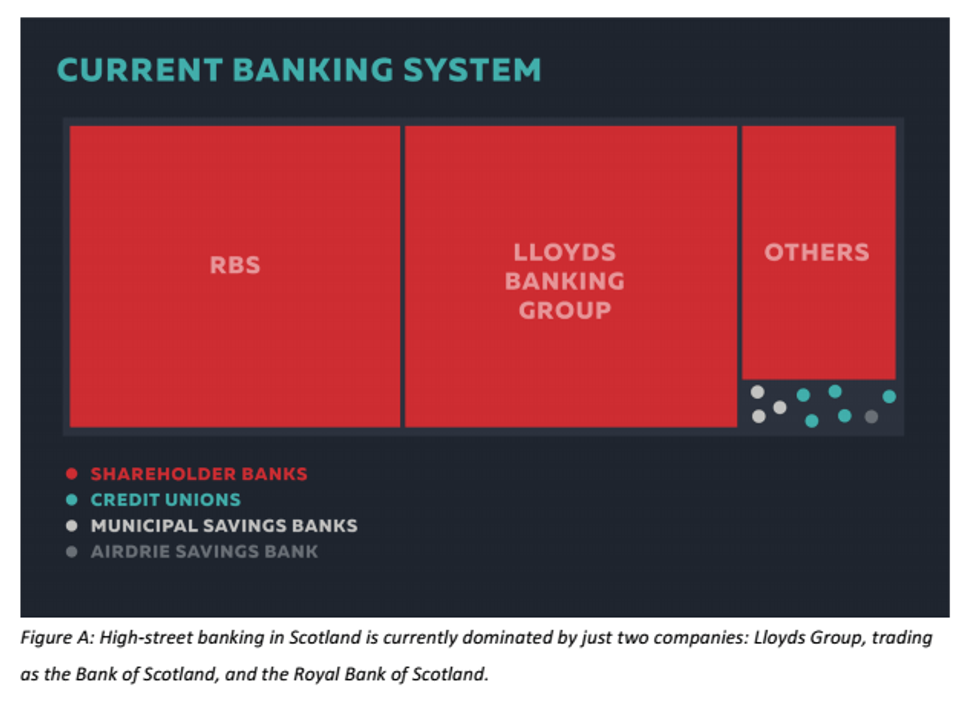

The report notes that in most other developed countries, people keep their money in small, local banks (or credit unions) in higher numbers than in the U.K. But Scotland's particularly severe over-reliance on multinational conglomerates, on the other hand, results in a system "locked into a cycle of fines, bailouts and crisis," the report argues.

"We really want to get across the message that Scotland could create a really powerful, people-centred banking system within the powers it already has and that this could be a really big, really transformative project for a Scottish Government," Robin McAlpine, director of Common Weal, said of the report. "It is the kind of project future generations would thank us for."