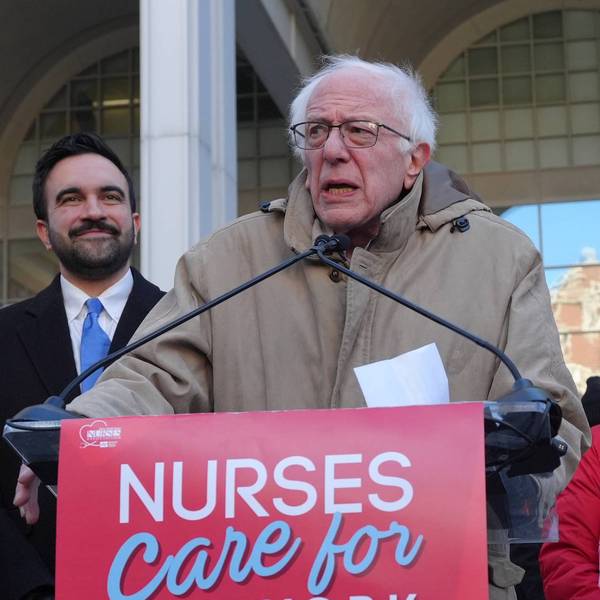

In a bid to prevent what has been called the biggest tax evasion scheme of its kind--and others like it--Sen. Bernie Sanders of Vermont has urged U.S. Treasury Secretary Jack Lew to use his agency's authority to block the planned merger of two pharmaceutical giants.

Viagra-maker Pfizer's proposal to acquire Allergan, which manufactures Botox, is "nothing less than a tax scam," Sanders wrote in a letter (pdf) sent to Lew on Friday.

The so-called "corporate inversion," which would allow Pfizer to profit from a lower corporate tax rate in Allergan's home country of Ireland, could starve the U.S. government of up to $35 billion in tax revenue, Sanders said, citing a recent report from consumer group Americans for Tax Fairness.

"Enough is enough," Sanders said in a statement on Friday. "Pfizer and other pharmaceutical companies cannot be allowed evade taxes and rip off American patients who already pay the highest prices in the world for prescription drugs."

"The stakes are high," wrote the Democratic presidential candidate. "I find it ironic that some of my Republican colleagues, in their internal budget negotiations, claim that $30 billion in deficit-reduction is required for the coming fiscal year. Preventing the inversion planned by just one company, Pfizer, could produce more deficit-reduction than the cuts they are demanding."

In the absence of Congressional action to limit inversions, Sanders called on the Treasury Department to block tax-dodging techniques like "hopscotch" loans and "earnings stripping"--for Pfizer and other potential corporate tax dodgers, too.

As explained by The Hill:

Hopscotch loans occur when an inverted company moves untaxed overseas profits to U.S. shareholders through transactions that appear to be loans to the foreign parent. Treasury has already blocked hopscotch loans for inverted companies in which at least 60 percent of the merged company is owned by shareholders of the American company, but Pfizer shareholders would only own 56 percent of the combined company after its merger, according to the letter.

Earnings stripping is when U.S. subsidiaries deduct interest payments made to their foreign parents.

The report released last month by Americans for Tax Fairness found that if Pfizer's inversion goes through, the company could avoid paying as much as $35 billion in taxes through such tactics, even while it continues to aggressively raise drug prices.

"By dodging taxes while boosting prescription drug prices, Pfizer squeezes American families and communities from two sides at once," said Americans for Tax Fairness executive director Frank Clemente at the time. "In the company's biggest insult to America yet, Pfizer's merger would allow it to go on enjoying all the benefits of being based here--everything from a publicly-educated workforce, to an excellent communications infrastructure, to a reliable patent system--without adequately paying to support them."

On Thursday, Americans for Tax Fairness delivered more than 270,000 petition signatures to Senate Majority Leader Mitch McConnell, as well as Sens. Richard Durbin (D-Ill.), Jack Reed (D-R.I.), and Elizabeth Warren (D-Mass), calling on Congress to support the Stop Corporate Inversions Act (S. 198).

Sanders' Corporate Tax Dodging Prevention Act (S. 922), introduced last year, also seeks to prevent offshore corporate tax avoidance schemes, including inversions.