SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

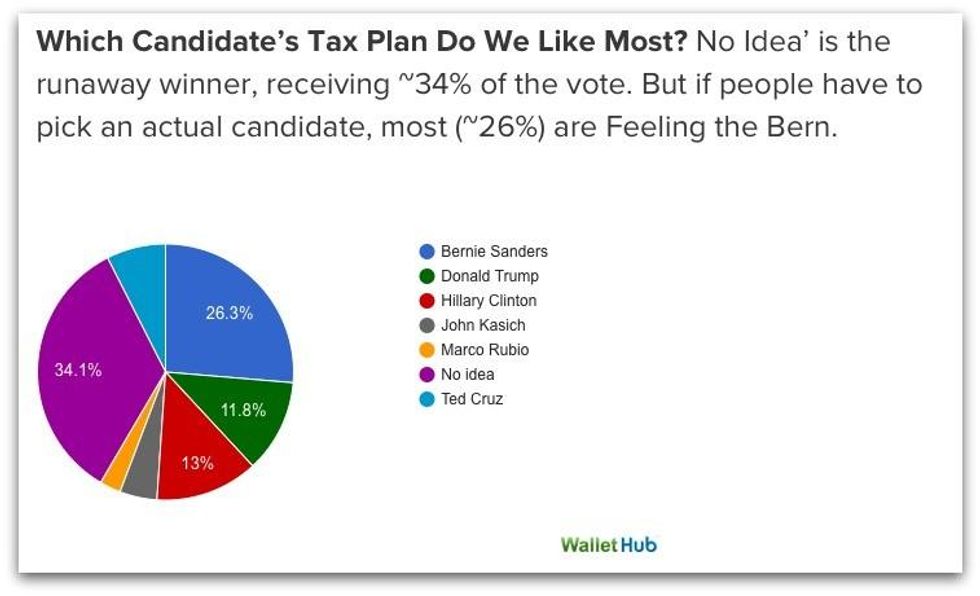

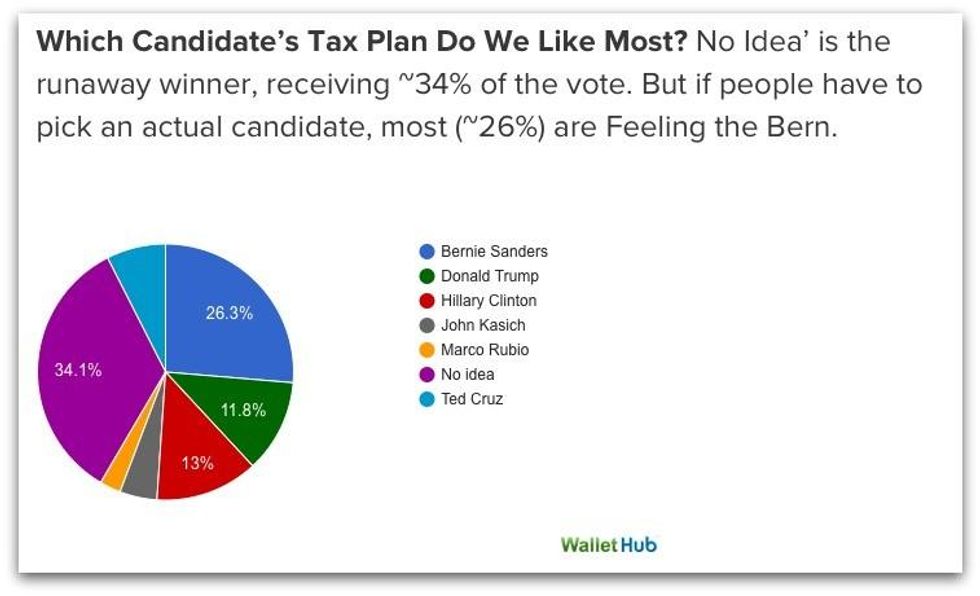

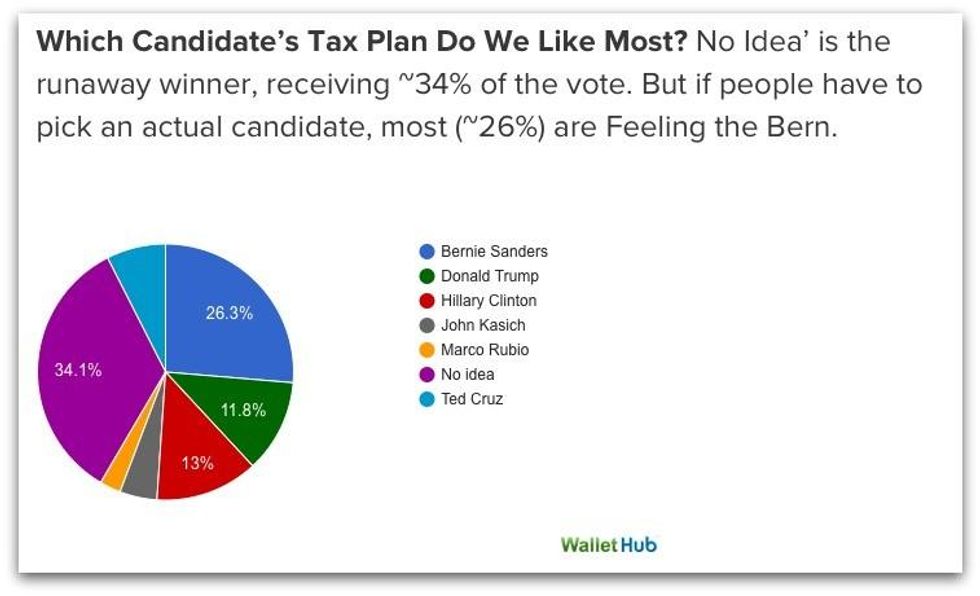

Undermining the flawed trope that "everyone hates the tax man," for those who have opinions on the competing tax plans put forth by this year's presidential candidates, Bernie Sanders' proposal is the hands-down favorite.

Beating out all other contenders from both major parties by double-digit margins, according to a new survey WalletHub/Survey Monkey published Monday, Sanders' plan was supported by 23 percent of respondents. In comparison, only 13 percent liked the plan of Hillary Clinton best, giving her a slight edge over the 12 percent who chose Donald Trump's plan. Taking the fourth and fifth spots respectively, Sen. Ted Cruz nabbed 8 percent support while Gov. John Kasich (R-Ohio) got 5 percent.

According to recent analysis (pdf) by the Tax Policy Center, a joint project of the Urban Institute and the Brookings Institution, an implemented Sanders' tax plan would generate more than $15 trillion in revenue over its first ten years.

Len Burman, director of the Tax Policy Center, told Bloomberg News that not only is the Sanders plan the most ambitious among the 2016 candidates, it is also the most detailed. Compared to Clinton's more "incremental" approach to taxation and social change, said Burman, "Bernie Sanders clearly wants to change things radically. There's a very, very clear choice."

And, at least according to Monday's poll, it's a choice many are willing to make.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Undermining the flawed trope that "everyone hates the tax man," for those who have opinions on the competing tax plans put forth by this year's presidential candidates, Bernie Sanders' proposal is the hands-down favorite.

Beating out all other contenders from both major parties by double-digit margins, according to a new survey WalletHub/Survey Monkey published Monday, Sanders' plan was supported by 23 percent of respondents. In comparison, only 13 percent liked the plan of Hillary Clinton best, giving her a slight edge over the 12 percent who chose Donald Trump's plan. Taking the fourth and fifth spots respectively, Sen. Ted Cruz nabbed 8 percent support while Gov. John Kasich (R-Ohio) got 5 percent.

According to recent analysis (pdf) by the Tax Policy Center, a joint project of the Urban Institute and the Brookings Institution, an implemented Sanders' tax plan would generate more than $15 trillion in revenue over its first ten years.

Len Burman, director of the Tax Policy Center, told Bloomberg News that not only is the Sanders plan the most ambitious among the 2016 candidates, it is also the most detailed. Compared to Clinton's more "incremental" approach to taxation and social change, said Burman, "Bernie Sanders clearly wants to change things radically. There's a very, very clear choice."

And, at least according to Monday's poll, it's a choice many are willing to make.

Undermining the flawed trope that "everyone hates the tax man," for those who have opinions on the competing tax plans put forth by this year's presidential candidates, Bernie Sanders' proposal is the hands-down favorite.

Beating out all other contenders from both major parties by double-digit margins, according to a new survey WalletHub/Survey Monkey published Monday, Sanders' plan was supported by 23 percent of respondents. In comparison, only 13 percent liked the plan of Hillary Clinton best, giving her a slight edge over the 12 percent who chose Donald Trump's plan. Taking the fourth and fifth spots respectively, Sen. Ted Cruz nabbed 8 percent support while Gov. John Kasich (R-Ohio) got 5 percent.

According to recent analysis (pdf) by the Tax Policy Center, a joint project of the Urban Institute and the Brookings Institution, an implemented Sanders' tax plan would generate more than $15 trillion in revenue over its first ten years.

Len Burman, director of the Tax Policy Center, told Bloomberg News that not only is the Sanders plan the most ambitious among the 2016 candidates, it is also the most detailed. Compared to Clinton's more "incremental" approach to taxation and social change, said Burman, "Bernie Sanders clearly wants to change things radically. There's a very, very clear choice."

And, at least according to Monday's poll, it's a choice many are willing to make.