Public interest groups urged the U.S. Department of Justice (DOJ) to block the mega-merger of chemical corporations Dow and DuPont, which the organizations argue is part of a larger effort to put a "corporate cabal" in charge of the nation's food system.

If the merger is allowed, "[Dow and Monsanto] would control 76% of the market for corn and 66% of the market for soybeans, giving them the power to charge farmers higher prices and effectively decide which seeds farmers could plant."

--FWW, NFU, AAIDow and DuPont announced in December plans "to merge into a $130 billion giant, thereby establishing the world's biggest seed and pesticide conglomerate," as Common Dreams reported.

Food & Water Watch (FWW), National Farmers Union (NFU), and the American Antitrust Institute (AAI) authored the letter (pdf) to the DOJ sent Tuesday.

"The Department of Justice must block this biotechnology mega-merger that would raise farmers' prices and severely limit the choices for farmers, consumers and rural communities," said Food & Water Watch executive director Wenonah Hauter in a statement. "Today's wave of agribusiness and food company mega-mergers is surrendering our food system to a corporate cabal that thwarts our efforts to build an fair and healthy food system."

Tuesday's letter argued that the mega-merger "would further consolidate an already highly concentrated biotechnology industry and would likely curtail innovation, raise prices, and reduce cultivation choices for farmers, consumers and the food system."

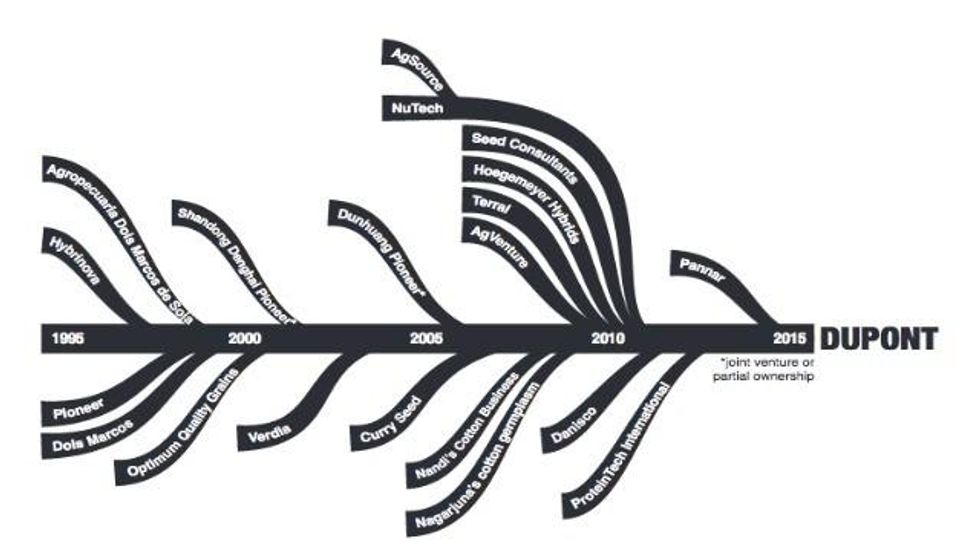

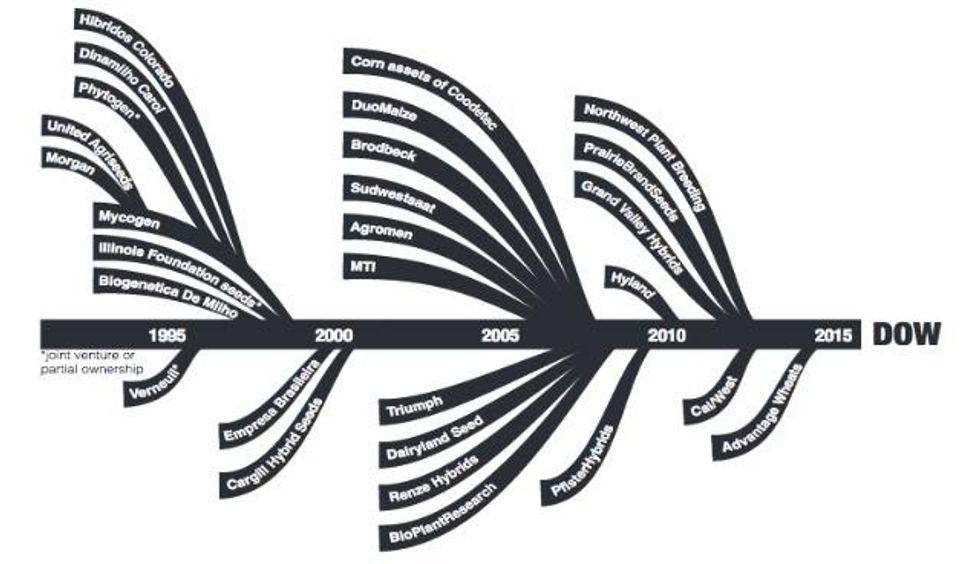

The watchdog groups also noted that the "current rumored or announced deals--including Dow-DuPont, ChemChina-Syngenta, and Bayer-Monsanto--would be a third wave of consolidation. Two previous merger waves eliminated the majority of small to medium-sized biotechnology R&D firms to create the Big Six--Monsanto, Syngenta, Bayer, DuPont, Dow and BASF."

The letter illustrated the successive waves of consolidation that have transformed DuPont and Dow into the biotech behemoths they are today:

"The proposed merger would create a powerful duopoly between Dow-DuPont and Monsanto," the organizations added. "Together, the two companies would control 76% of the market for corn and 66% of the market for soybeans, giving them the power to charge farmers higher prices and effectively decide which seeds farmers could plant."

Two farmers quoted in the letter to the DOJ argued, "We need more competition to keep prices down," and "We don't like to see more consolidation; it means higher [costs] for farmers."

"Seed costs are the highest input expense for farmers," explained NFU president Roger Johnson. "We have seen time and again that consolidation and market restructuring has increased the cost of crop inputs. In a lagging farm economy with multi-year trends of low commodity prices, additional cost increases for crop inputs could cripple a lot of family farms in this country."

Executives at both corporations seem highly optimistic that the DOJ would approve the mega-merger deal, as last week they announced the chief executives who would helm the newly created company. According to the Wall Street Journal, the deal is expected to close in the second half of 2016.