SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Sen. Bob Corker (R-Tenn.) talks to reporters as he heads to a vote on amendments to the fiscal year 2018 budget resolution, on Capitol Hill, October 19, 2017 in Washington, D.C. (Photo by Drew Angerer/Getty Images)

This post has been updated with Sen. Orrin Hatch's response to Corker's request for information on the provision.

The firestorm of outrage sparked by a provision in the GOP tax bill that would personally enrich Sen. Bob Corker (R-Tenn.) and President Donald Trump continued to grow on Monday as a leading economist estimated that, if passed, the measure could shave over $1.1 million from Corker's taxes each year.

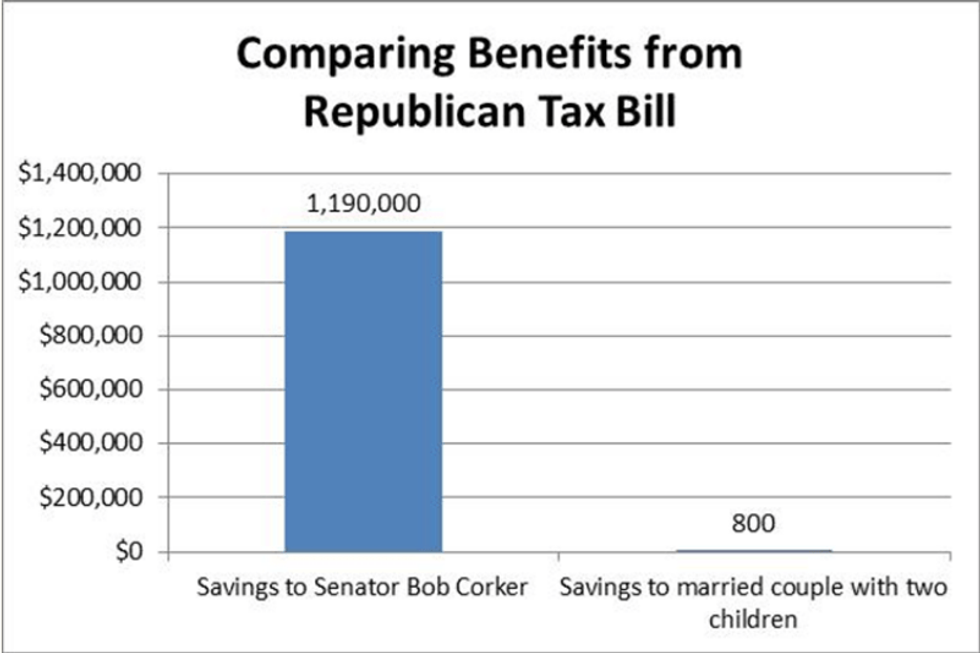

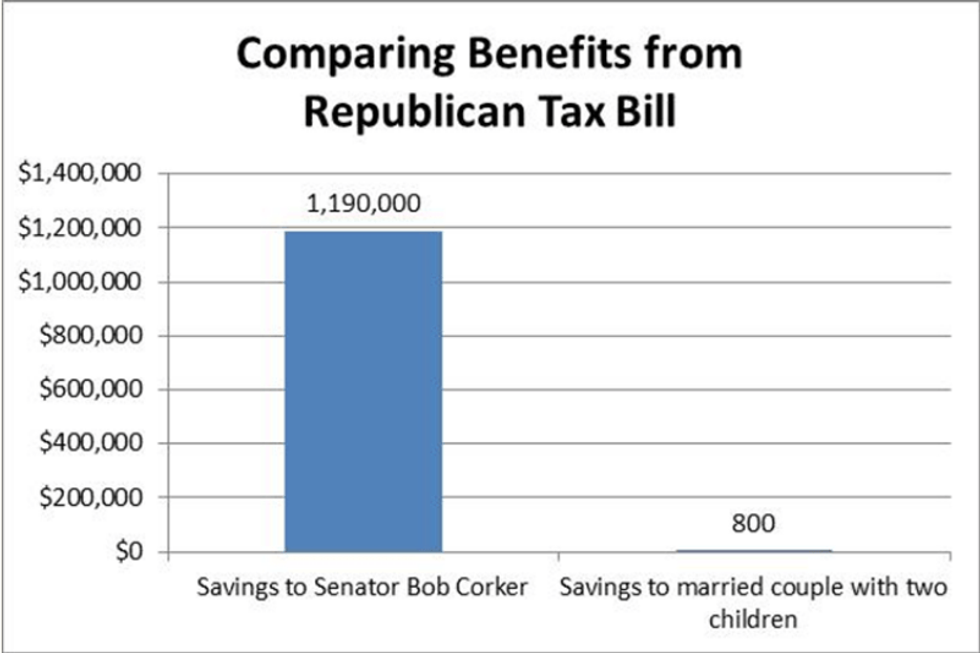

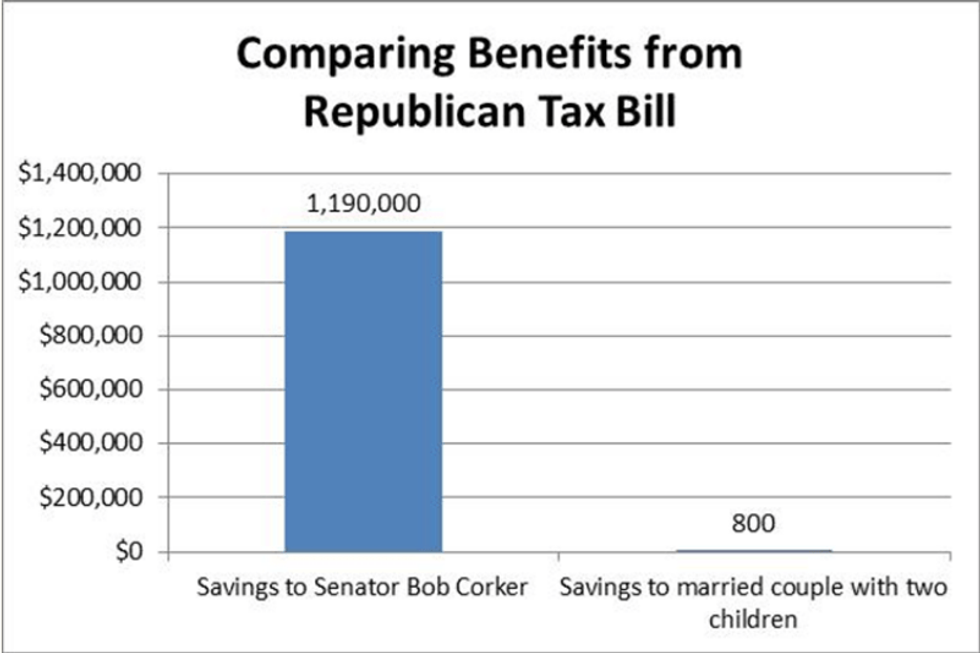

First unveiled by the International Business Times on Saturday, the provision--buried in the 500-page Republican tax plan--"would allow income from real estate investment trusts to be taxed at a 20 percent rate, as opposed to the 37 percent tax rate paid by high income individuals," notes Dean Baker, co-director of the Center for Economic and Policy Research. "According to Corker's disclosure forms, he makes between $1.2 million and $7.0 million annually in this sort of income....If we plug in the top end $7 million figure, Corker could be saving as much as $1,190,000 from this late addition to the tax bill."

These savings serve as a marked contrast to the benefits that would be seen by low-income families as a result of the highly-touted child tax credit changes demanded by Sen. Marco Rubio (R-Fla.) in exchange for his vote, Baker goes on to observe. While Corker, one of the wealthiest members of Congress, could potentially see a million-dollar annual benefit from the GOP tax plan, a married couple with two children earning $30,000 a year would only get an extra $800 from Rubio's tax credit efforts.

Baker used a simple chart to spotlight the vast disparity:

Following reports that Sen. John McCain (R-Ariz.) is expected to miss the Senate's vote on the final version of the GOP tax plan, which could come as early as Tuesday, the widespread fury prompted by what has been termed the "Corker Kickback" gained even more significance. With McCain likely out of the mix, the Senate can only afford to lose one vote if the $1.5 trillion tax bill is to reach Trump's desk.

"The senator at the center of the #CorkerKickback scandal is facing a national firestorm and is now publicly demanding answers from his own party--and he's doing it hours before he could sink the entire tax bill."

--David Sirota, International Business Times

The outrage prompted by the real estate provision, which was not in previous versions of the tax bill, has not gone unnoticed by Corker. In response to the International Business Times' reporting on Saturday, Corker conceded that he has not read the tax bill in full--just a "a two-page summary"--and claimed that he was unaware of the addition that has drawn so much condemnation.

Late Sunday, Corker--the lone Republican to vote against the Senate version of the tax bill--sent a letter to Sen. Orrin Hatch (R-Utah), chairman of the Senate Finance Committee, highlighting "concerns" that the provision has raised and requesting "an explanation of the evolution of this provision and how it made it into the final conference report."

David Sirota--who, along with his colleague Josh Keefe, broke the initial stories on the provision, which critics have said "reeks of bribery"--called Corker's demand "big news" and "a truly rare moment in American politics."

"The senator at the center of the #CorkerKickback scandal is facing a national firestorm and is now publicly demanding answers from his own party--and he's doing it hours before he could sink the entire tax bill," Sirota noted on Twitter.

In a letter responding to Corker's request for information on Monday, Hatch said he is "disgusted" by the press's coverage of the provision, which he says he authored. Hatch went on to claim that the provision is not new--a characterization that was disputed by tax experts and analysts--and deny any suggestion that Corker advocated the inclusion of the provision.

As the International Business Timesnoted on Monday, Hatch's letter "did not dispute that Corker and other Republicans who have large ownership stakes in real-estate-related LLCs stand to reap a personal windfall from the legislative language he added to the final bill." In addition, "Hatch did not dispute that Corker voted against the Senate bill when it restricted him from getting a personal benefit, and then switched his position and announced his support for the final bill after it included Hatch's language."

With nationwide protests against the GOP tax plan already expected on Monday, reporting on the "Corker Kickback" appeared to further intensify opposition to the already deeply unpopular legislation.

Chad Bolt, senior policy manager at Indivisible, urged Americans to keep the heat on Corker as well as Sens. Susan Collins (R-Maine) and Jeff Flake (R-Ariz.).

\u201cWith McCain out, the best Rs can do is 51-48. If Corker does the right thing to reject the #CorkerKickback, that puts them at 50-49. That means Corker, @SenatorCollins, and @JeffFlake continue to be key targets. 10/\u201d— Chad Bolt (@Chad Bolt) 1513599724

\u201cIndivisibles in Maine and Arizona have been crushing it the last few weeks to keep the heat at 500\u00b0 on both of these Senators. And we\u2019re not slowing down. @Indivisible_MDI has an event in Bangor at 3:30p today: 11/ https://t.co/NCKlx3YlUb\u201d— Chad Bolt (@Chad Bolt) 1513599724

\u201cIf these Senators are yours, then call them NOW and say VOTE NO on the tax bill. \n\nCorker: 202-224-3344\nCollins: 202-224-2523\nFlake: 202-224-4521\n\n13/\u201d— Chad Bolt (@Chad Bolt) 1513600257

Common Dreams is powered by optimists who believe in the power of informed and engaged citizens to ignite and enact change to make the world a better place. We're hundreds of thousands strong, but every single supporter makes the difference. Your contribution supports this bold media model—free, independent, and dedicated to reporting the facts every day. Stand with us in the fight for economic equality, social justice, human rights, and a more sustainable future. As a people-powered nonprofit news outlet, we cover the issues the corporate media never will. |

This post has been updated with Sen. Orrin Hatch's response to Corker's request for information on the provision.

The firestorm of outrage sparked by a provision in the GOP tax bill that would personally enrich Sen. Bob Corker (R-Tenn.) and President Donald Trump continued to grow on Monday as a leading economist estimated that, if passed, the measure could shave over $1.1 million from Corker's taxes each year.

First unveiled by the International Business Times on Saturday, the provision--buried in the 500-page Republican tax plan--"would allow income from real estate investment trusts to be taxed at a 20 percent rate, as opposed to the 37 percent tax rate paid by high income individuals," notes Dean Baker, co-director of the Center for Economic and Policy Research. "According to Corker's disclosure forms, he makes between $1.2 million and $7.0 million annually in this sort of income....If we plug in the top end $7 million figure, Corker could be saving as much as $1,190,000 from this late addition to the tax bill."

These savings serve as a marked contrast to the benefits that would be seen by low-income families as a result of the highly-touted child tax credit changes demanded by Sen. Marco Rubio (R-Fla.) in exchange for his vote, Baker goes on to observe. While Corker, one of the wealthiest members of Congress, could potentially see a million-dollar annual benefit from the GOP tax plan, a married couple with two children earning $30,000 a year would only get an extra $800 from Rubio's tax credit efforts.

Baker used a simple chart to spotlight the vast disparity:

Following reports that Sen. John McCain (R-Ariz.) is expected to miss the Senate's vote on the final version of the GOP tax plan, which could come as early as Tuesday, the widespread fury prompted by what has been termed the "Corker Kickback" gained even more significance. With McCain likely out of the mix, the Senate can only afford to lose one vote if the $1.5 trillion tax bill is to reach Trump's desk.

"The senator at the center of the #CorkerKickback scandal is facing a national firestorm and is now publicly demanding answers from his own party--and he's doing it hours before he could sink the entire tax bill."

--David Sirota, International Business Times

The outrage prompted by the real estate provision, which was not in previous versions of the tax bill, has not gone unnoticed by Corker. In response to the International Business Times' reporting on Saturday, Corker conceded that he has not read the tax bill in full--just a "a two-page summary"--and claimed that he was unaware of the addition that has drawn so much condemnation.

Late Sunday, Corker--the lone Republican to vote against the Senate version of the tax bill--sent a letter to Sen. Orrin Hatch (R-Utah), chairman of the Senate Finance Committee, highlighting "concerns" that the provision has raised and requesting "an explanation of the evolution of this provision and how it made it into the final conference report."

David Sirota--who, along with his colleague Josh Keefe, broke the initial stories on the provision, which critics have said "reeks of bribery"--called Corker's demand "big news" and "a truly rare moment in American politics."

"The senator at the center of the #CorkerKickback scandal is facing a national firestorm and is now publicly demanding answers from his own party--and he's doing it hours before he could sink the entire tax bill," Sirota noted on Twitter.

In a letter responding to Corker's request for information on Monday, Hatch said he is "disgusted" by the press's coverage of the provision, which he says he authored. Hatch went on to claim that the provision is not new--a characterization that was disputed by tax experts and analysts--and deny any suggestion that Corker advocated the inclusion of the provision.

As the International Business Timesnoted on Monday, Hatch's letter "did not dispute that Corker and other Republicans who have large ownership stakes in real-estate-related LLCs stand to reap a personal windfall from the legislative language he added to the final bill." In addition, "Hatch did not dispute that Corker voted against the Senate bill when it restricted him from getting a personal benefit, and then switched his position and announced his support for the final bill after it included Hatch's language."

With nationwide protests against the GOP tax plan already expected on Monday, reporting on the "Corker Kickback" appeared to further intensify opposition to the already deeply unpopular legislation.

Chad Bolt, senior policy manager at Indivisible, urged Americans to keep the heat on Corker as well as Sens. Susan Collins (R-Maine) and Jeff Flake (R-Ariz.).

\u201cWith McCain out, the best Rs can do is 51-48. If Corker does the right thing to reject the #CorkerKickback, that puts them at 50-49. That means Corker, @SenatorCollins, and @JeffFlake continue to be key targets. 10/\u201d— Chad Bolt (@Chad Bolt) 1513599724

\u201cIndivisibles in Maine and Arizona have been crushing it the last few weeks to keep the heat at 500\u00b0 on both of these Senators. And we\u2019re not slowing down. @Indivisible_MDI has an event in Bangor at 3:30p today: 11/ https://t.co/NCKlx3YlUb\u201d— Chad Bolt (@Chad Bolt) 1513599724

\u201cIf these Senators are yours, then call them NOW and say VOTE NO on the tax bill. \n\nCorker: 202-224-3344\nCollins: 202-224-2523\nFlake: 202-224-4521\n\n13/\u201d— Chad Bolt (@Chad Bolt) 1513600257

This post has been updated with Sen. Orrin Hatch's response to Corker's request for information on the provision.

The firestorm of outrage sparked by a provision in the GOP tax bill that would personally enrich Sen. Bob Corker (R-Tenn.) and President Donald Trump continued to grow on Monday as a leading economist estimated that, if passed, the measure could shave over $1.1 million from Corker's taxes each year.

First unveiled by the International Business Times on Saturday, the provision--buried in the 500-page Republican tax plan--"would allow income from real estate investment trusts to be taxed at a 20 percent rate, as opposed to the 37 percent tax rate paid by high income individuals," notes Dean Baker, co-director of the Center for Economic and Policy Research. "According to Corker's disclosure forms, he makes between $1.2 million and $7.0 million annually in this sort of income....If we plug in the top end $7 million figure, Corker could be saving as much as $1,190,000 from this late addition to the tax bill."

These savings serve as a marked contrast to the benefits that would be seen by low-income families as a result of the highly-touted child tax credit changes demanded by Sen. Marco Rubio (R-Fla.) in exchange for his vote, Baker goes on to observe. While Corker, one of the wealthiest members of Congress, could potentially see a million-dollar annual benefit from the GOP tax plan, a married couple with two children earning $30,000 a year would only get an extra $800 from Rubio's tax credit efforts.

Baker used a simple chart to spotlight the vast disparity:

Following reports that Sen. John McCain (R-Ariz.) is expected to miss the Senate's vote on the final version of the GOP tax plan, which could come as early as Tuesday, the widespread fury prompted by what has been termed the "Corker Kickback" gained even more significance. With McCain likely out of the mix, the Senate can only afford to lose one vote if the $1.5 trillion tax bill is to reach Trump's desk.

"The senator at the center of the #CorkerKickback scandal is facing a national firestorm and is now publicly demanding answers from his own party--and he's doing it hours before he could sink the entire tax bill."

--David Sirota, International Business Times

The outrage prompted by the real estate provision, which was not in previous versions of the tax bill, has not gone unnoticed by Corker. In response to the International Business Times' reporting on Saturday, Corker conceded that he has not read the tax bill in full--just a "a two-page summary"--and claimed that he was unaware of the addition that has drawn so much condemnation.

Late Sunday, Corker--the lone Republican to vote against the Senate version of the tax bill--sent a letter to Sen. Orrin Hatch (R-Utah), chairman of the Senate Finance Committee, highlighting "concerns" that the provision has raised and requesting "an explanation of the evolution of this provision and how it made it into the final conference report."

David Sirota--who, along with his colleague Josh Keefe, broke the initial stories on the provision, which critics have said "reeks of bribery"--called Corker's demand "big news" and "a truly rare moment in American politics."

"The senator at the center of the #CorkerKickback scandal is facing a national firestorm and is now publicly demanding answers from his own party--and he's doing it hours before he could sink the entire tax bill," Sirota noted on Twitter.

In a letter responding to Corker's request for information on Monday, Hatch said he is "disgusted" by the press's coverage of the provision, which he says he authored. Hatch went on to claim that the provision is not new--a characterization that was disputed by tax experts and analysts--and deny any suggestion that Corker advocated the inclusion of the provision.

As the International Business Timesnoted on Monday, Hatch's letter "did not dispute that Corker and other Republicans who have large ownership stakes in real-estate-related LLCs stand to reap a personal windfall from the legislative language he added to the final bill." In addition, "Hatch did not dispute that Corker voted against the Senate bill when it restricted him from getting a personal benefit, and then switched his position and announced his support for the final bill after it included Hatch's language."

With nationwide protests against the GOP tax plan already expected on Monday, reporting on the "Corker Kickback" appeared to further intensify opposition to the already deeply unpopular legislation.

Chad Bolt, senior policy manager at Indivisible, urged Americans to keep the heat on Corker as well as Sens. Susan Collins (R-Maine) and Jeff Flake (R-Ariz.).

\u201cWith McCain out, the best Rs can do is 51-48. If Corker does the right thing to reject the #CorkerKickback, that puts them at 50-49. That means Corker, @SenatorCollins, and @JeffFlake continue to be key targets. 10/\u201d— Chad Bolt (@Chad Bolt) 1513599724

\u201cIndivisibles in Maine and Arizona have been crushing it the last few weeks to keep the heat at 500\u00b0 on both of these Senators. And we\u2019re not slowing down. @Indivisible_MDI has an event in Bangor at 3:30p today: 11/ https://t.co/NCKlx3YlUb\u201d— Chad Bolt (@Chad Bolt) 1513599724

\u201cIf these Senators are yours, then call them NOW and say VOTE NO on the tax bill. \n\nCorker: 202-224-3344\nCollins: 202-224-2523\nFlake: 202-224-4521\n\n13/\u201d— Chad Bolt (@Chad Bolt) 1513600257