Others slammed the reported conduct by Shogan, an appointee of Democratic U.S. President Joe Biden, and her advisers as "disgraceful" and "totally unacceptable."

Shogan had her initial Senate confirmation hearing in September 2022, around six weeks after the Federal Bureau of Investigation first raided Mar-a-Lago, the Florida residence of former President Donald Trump, the Republican nominee now facing Vice President Kamala Harris in the November 5 election. That federal case against Trump—which is still playing out in court—began with the National Archives discovering he had taken boxes of materials.

The Biden appointee is now responsible for a $40 million overhaul of the National Archives Museum—home to the Bill of Rights, Constitution, and Declaration of Independence—and the adjacent Discovery Center. Current and former employees expressed concerns about various changes to both spaces in interviews with the

Journal, which also reviewed internal documents and notes.

"Visitors shouldn't feel confronted, a senior official told employees, they should feel welcomed," according to the newspaper. "Shogan and her senior advisers also have raised concerns that planned exhibits and educational displays expected to open next year might anger Republican lawmakers—who share control of the agency's budget—or a potential Trump administration."

Responding on social media Thursday, Mary Todd said that "as a historian, I am gobsmacked by this. History should make you uncomfortable."

As the

Journal reported:

Shogan's senior aides ordered that a proposed image of Civil Rights leader Martin Luther King Jr. be cut from a planned "Step Into History" photo booth in the Discovery Center. The booth will give visitors a chance to take photos of themselves superimposed alongside historic figures. The aides also ordered the removal of labor union pioneer Dolores Huerta and Minnie Spotted-Wolf, the first Native American woman to join the Marine Corps, from the photo booth, according to current and former employees and agency documents.

The aides proposed using instead images of former President Richard Nixon greeting Elvis Presley and former President Ronald Reagan with baseball player Cal Ripken Jr.

After reviewing plans for an exhibit about the nation's Westward expansion, Shogan asked one staffer, Why is it so much about Indians? according to current and former employees. Among the records Shogan ordered cut from the exhibit were several treaties signed by Native American tribes ceding their lands to the U.S. government, according to the employees and documents.

"Shogan and her top advisers told employees to remove Dorothea Lange's photos of Japanese-American incarceration camps from a planned exhibit because the images were too negative and controversial," the Journal detailed. Additionally, in an exhibit about patents, the example of the contraceptive pill was swapped for television, though a Shogan aide had proposed the bump stock, a gun accessory.

Employees further criticized Shogan for giving an internship to the niece of Republican Texas Congressman Pete Sessions and inviting former First Lady Melania Trump to speak at a naturalization ceremony. The National Archives declined to make the appointee available for an interview and said in a statement that "leading a nonpartisan agency during an era of political polarization is not for the faint of heart."

Current Affairs' Nathan J. Robinson wrote Thursday that "essentially, the National Archives Museum is becoming a tribute to (supposed) American greatness, rather than an honest account of all aspects of our history. It might be surprising that this is occurring under a Biden appointee, but it's clear that Shogan is intensely worried about being accused of partisanship."

"Of course, trying to appease the right is a fool's errand, because the right is never going to say, 'Oh, actually, the Biden-appointed archivist is quite good at her job and very fair-minded,'" Robinson argued. "They consider anything that doesn't fully support their agenda to be pernicious leftism, so Trump will likely still want to replace Shogan with a full-blown MAGA Archivist who puts up exhibits honoring the great contributions of real estate developers to American history, and builds a shrine to the

memory of Ronald Reagan."

"The correct stance for an archivist is to be committed to telling a truthful story that reflects what actually happened, even if this makes some people uncomfortable because there are truths they would rather block out of their understanding of the country's past," he added. "Librarians, archivists, curators, and historians all have essential work to do in guarding the truth, and making sure it is not replaced with mythology. The National Archives story shows how little we can count on liberals to maintain their commitment to this mission in the face of right-wing pressure."

Some people in those fields were among those forcefully speaking out against Shogan this week and even calling for her to

resign or be fired. David Neiwert, author of The Age of Insurrection: The Radical Right's Assault on American Democracy, declared: "This person needs to be shitcanned and these advisers entirely replaced ASAP. She's making a travesty of American history."

Harvey G. Cohen

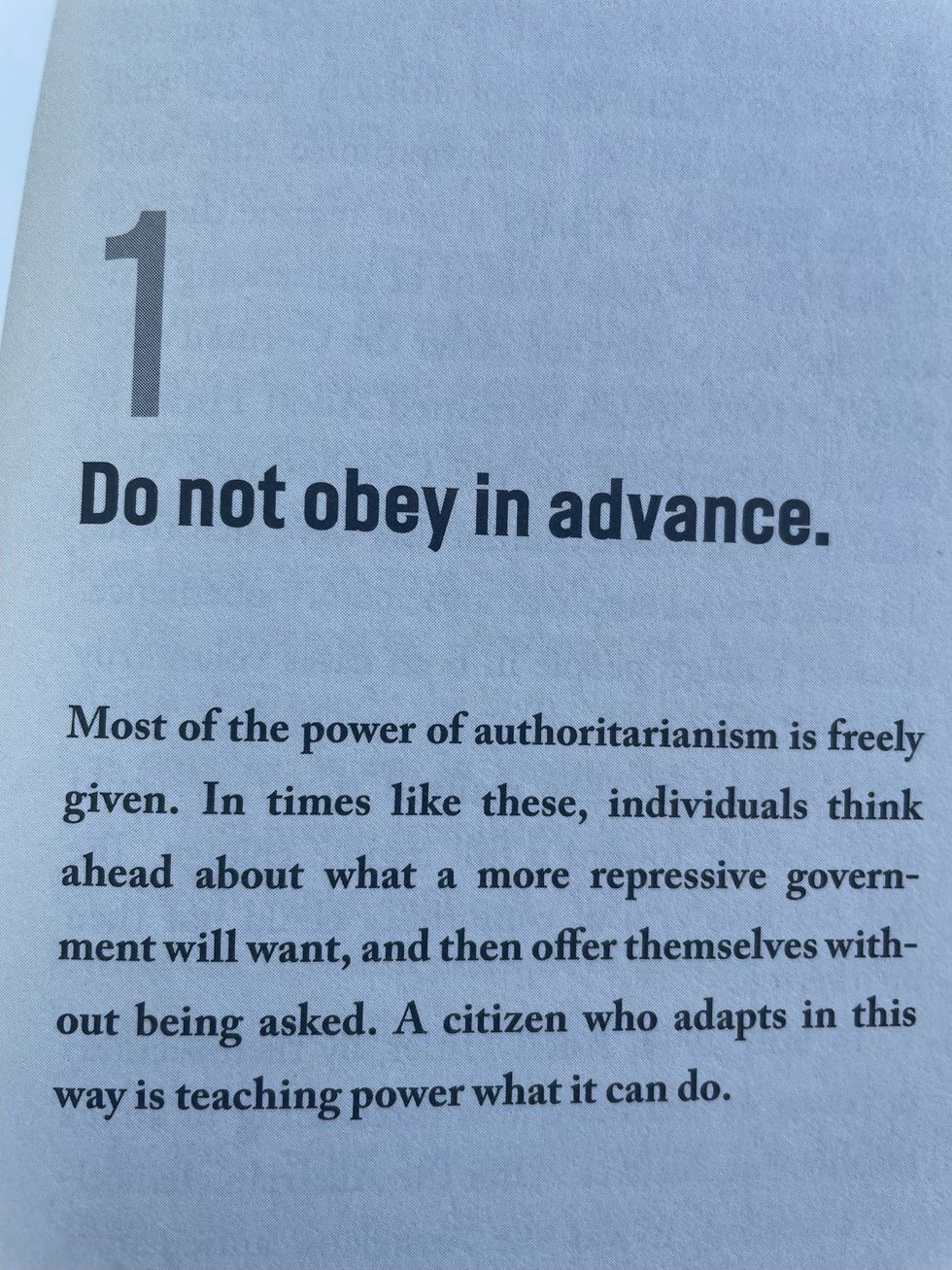

said that "as a historian who has spent months in the National Archives, I say (not lightly) this U.S. archivist should [be] fired. The National Archives should [be] concerned [with] preserving and presenting the truth—nothing else. This is what historian Timothy D. Snyder calls 'anticipatory obedience.'"

Others also cited Snyder. Abdelilah Skhir of the ACLU of Florida

posted on social media a screenshot from his book On Tyranny: Twenty Lessons from the Twentieth Century:

Former Obama administration official Brandon Friedman

described the reported conduct at the agency as "a textbook example of obeying in advance," and Philadelphia Inquirer columnist Will Bunch similarly called it "another shocking example of obeying fascism in advance."

Some readers of the newspaper used the reporting to sound the alarm about Trump and his influence over the Republican Party ahead of next week's elections, during which U.S. voters will pick the next president and which party controls each chamber of Congress.

"The Trump/GOP obsession with whitewashing U.S. history has extended to intimidating public agencies like the National Archives," said Charles Idelson of National Nurses United. "That's another characteristic of authoritarian/fascist rule."

Journalist Mehdi Hasan called the reporting "insanity," adding: "This is what cancel culture and this is what snowflakes actually look like. It’s all *Republican*."

Jacobin's Branko Marceticsaid that "at first glance laughable, this is a very ominous preview of what will be far vaster self-censorship and reality distortion that fearful [government] agencies, companies, other private entities will engage in if Trump wins."

"If this is what just one careerist civil servant does out of cowardice at merely the *potential* of a Trump presidency," Marcetic warned, "you can imagine what might happen if and when he actually does."