SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

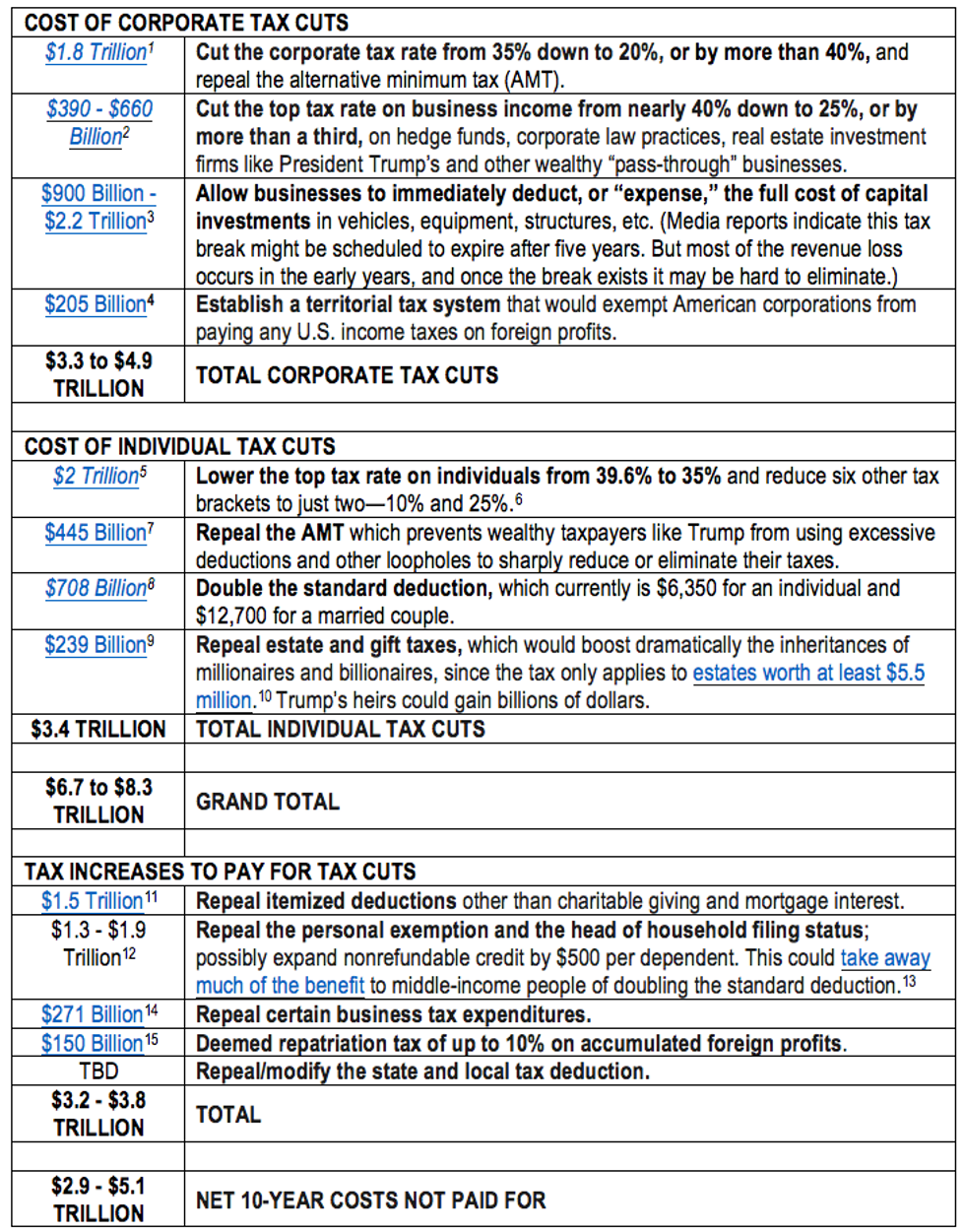

As President Trump and Republican leaders in Congress prepare to unveil their tax plan on Wednesday, Sept. 27, Americans for Tax Fairness has prepared an analysis that shows Trump's tax cuts could total $6.7 to $8.3 trillion, $3 to $5 trillion of which may not be paid for by closing other tax loopholes and/or by limiting tax deductions. The resulting jump in the deficit threatens funding of Social Security, Medicare, Medicaid, public education and other vital services. This analysis is based on recent media reports identifying possible tax cuts under consideration by the "Big Six" of Trump Administration and Congressional negotiators, and on the tax-cutting priorities President Trump and House Republican leaders have emphasized in tax plans unveiled over the past year.

The table below summarizes many of the tax cuts that are likely to be in the Trump-Republican leaders' tax plan, along with estimates of their considerable costs. Assuming the tax plan reflects recent media reports and high-priority tax cuts included in their earlier tax plans, with some modifications, the new tax plan is likely to:

"The idea that this plan would help average Americans instead of the wealthy and big corporations has been a hoax all along," said Frank Clemente, executive director, Americans for Tax Fairness. "This isn't 'tax reform,' it's just a big giveaway to millionaires and corporations, and it won't 'trickle down' to the rest of us. It won't help small businesses, but it will help Wall Street hedge fund managers and real estate moguls like Donald Trump. This plan will not lead to robust job creation or economic growth, but its eye-popping cost will lead to deep cuts in Social Security, Medicaid, Medicare, and public education that will leave working families in the cold."

ESTIMATES OF COSTS OF THE TRUMP & CONGRESSIONAL LEADERS' TAX PLAN

Note about cost estimates, which are mostly from the non-partisan Tax Policy Center: Tax cuts are ten-year estimates except where noted. Italicized cost estimates are tax cuts that have been mentioned in recent news reports.

Clickable version of chart and footnotes can be found here:

https://americansfortaxfairness.org/new-analysis-trumps-unpaid-tax-cuts-may-total-5-trillion-new-tax-plan/

Americans for Tax Fairness (ATF) is a diverse campaign of more than 420 national, state and local endorsing organizations united in support of a fair tax system that works for all Americans. It has come together based on the belief that the country needs comprehensive, progressive tax reform that results in greater revenue to meet our growing needs. This requires big corporations and the wealthy to pay their fair share in taxes, not to live by their own set of rules.

(202) 506-3264"Burgum is an oligarch completely out of touch with the overwhelming majority of Americans who cherish our natural heritage," said the executive director of the Center for Biological Diversity.

President-elect Donald Trump announced Thursday that he has chosen billionaire North Dakota Gov. Doug Burgum, a close ally of the fossil fuel industry and vocal proponent of oil drilling, to serve as head of the Interior Department in the incoming administration, a critical post tasked with overseeing hundreds of millions of acres of federal land and water.

Burgum, a friend of oil billionaire Harold Hamm, served as a kind of middleman between Trump's presidential campaign and the fossil fuel industry during the 2024 race. The Washington Postreported that Burgum's selection as interior secretary will "give Hamm expansive influence over policy related to drilling on public lands, at a time his company stands to benefit from the rule changes Trump envisions."

Burgum and Hamm have already worked to shape Trump's energy policy during the presidential transition, with Reutersreporting Thursday that the pair is leading the push for a repeal of electric vehicle tax credits—a key component of the Biden administration's signature climate law, the Inflation Reduction Act.

During a fundraiser over the summer, Burgum said Trump could "on day one" move to unleash "liquid fuels," accusing the Biden administration of waging war on "American energy."

"Whether it's baseload electricity, whether it's oil, whether it's gas, whether it's ethanol, there is an attack on liquid fuels," Burgum declared.

"We're ready to fight Burgum and Trump's extreme agenda every step of the way."

Trump campaigned on a pledge to "drill, baby, drill" in the face of a fossil fuel-driven climate emergency that is wreaking deadly havoc in the United States and around the world. While the Biden administration has presided over record oil and gas production and approved many new drilling permits to the dismay of climate advocates, Trump has made clear that he intends to take a sledgehammer to any guardrails constraining the fossil fuel industry.

In Burgum, Trump will have an enthusiastic champion of oil and gas drilling in a Cabinet that is shaping up to be a boon for the fossil fuel industry. Burgum helped organize the dinner at which Trump urged the oil and gas industry to raise $1 billion for his campaign in exchange for tax breaks and large-scale deregulation.

"We're going do things with energy and with land—Interior—that is going to be incredible," Trump said late Thursday.

Kierán Suckling, executive director of the Center for Biological Diversity, said in a statement that "Burgum is an oligarch completely out of touch with the overwhelming majority of Americans who cherish our natural heritage and don't want our parks, wildlife refuges, and other special places carved up and destroyed."

"We're ready to fight Burgum and Trump's extreme agenda every step of the way," Suckling added.

In his current capacity as North Dakota governor, Burgum is pushing a 2,000-mile carbon pipeline project set to be built by Summit Carbon Solutions with the stated goal of capturing planet-warming CO2 and storing it underground. Climate advocates have long derided carbon capture and storage—a method boosted by the fossil fuel industry—as a dangerous scam that can actually result in more emissions.

The Associated Pressreported earlier this year that "the blowback in North Dakota to the Summit project has been intense with Burgum caught in the crossfire."

"There are fears a pipeline rupture would unleash a lethal cloud of CO2," the outlet noted. "Landowners worry their property values will plummet if the pipeline passes under their land."

The North Dakota Public Service Commission is planning to meet Friday to vote on the project.

"It's important that we'll have a government ethics chief in place who serves the American people, not Trump's wallet," said Sen. Elizabeth Warren.

As the clock winds down on Democratic control of the U.S. Senate, upper chamber lawmakers on Thursday confirmed President Joe Biden's nomination of David Huitema, head of the State Department's ethics program, to lead the Office of Government Ethics for a five-year term.

Senators voted 50-46 in favor of Huitema's confirmation to head the OGE through the duration of Republican President-elect Donald Trump's tenure, averting at least temporarily a scenario in which the winner of the 2024 election—who has refused to sign required transition-related ethics agreements and whose first term saw thousands of conflicts of interest—would be empowered to fill or stonewall the post.

The OGE has been without a director for more than a year, ever since the term of Trump appointee Emory Rounds expired. In September, Sen. Mike Lee (R-Utah) blocked Senate Democrats' attempt to confirm Huitema via unanimous consent until after the presidential election, alleging "political weaponization of the U.S. government against Donald Trump by the Biden-Harris administration."

As the consumer advocacy group Public Citizen said ahead of Huitema's confirmation:

One of the most important roles of the Office of Government Ethics is to oversee and advise the presidential transition process. The selection and nomination of most new administration officials takes place during the transition, in which OGE's vetting of pending nominees for conflicts of interest is most critical. The office needs to be fully staffed and operational during the course of the transition period.

However, Walter Shaub, who led the OGE during the Obama administration and resigned in 2017 after months of conflict with the Trump White House, warned in a Thursday interview with Government Executive that "it might be a hollow victory for government ethics if Trump fires Huitema after the inauguration."

"Even if Trump doesn't fire Huitema, OGE won't be able to prevent Trump's top appointees from retaining conflicting financial interests if the Senate grants Trump's request that lawmakers conspire in skirting or short-shrifting the constitutional confirmation process," Shaub added.

Still, ethics advocates cheered Huitema's confirmation, with the watchdog group Citizens for Responsibility and Ethics in Washington hailing what it called the "good news" and "an important step to safeguard ethics compliance ahead of a second Trump administration that threatens to be even more corrupt than the first."

As one Democratic strategist said on social media following his confirmation, "Buckle up, David Huitema."

"Confirming this lunatic would amount to killing people," one journalist warned amid fears Trump will avoid Senate votes for controversial picks.

U.S. lawmakers, government watchdogs, and other critics responded with alarm to President-elect Donald Trump's long-anticipated announcement on Thursday that he wants Robert F. Kennedy Jr. to lead the Department of Health and Human Services.

"Robert F. Kennedy Jr. is a clear and present danger to the nation's health," declared Public Citizen co-president Robert Weissman. "He shouldn't be allowed in the building at the Department of Health and Human Services (HHS), let alone be placed in charge of the nation's public health agency."

"Donald Trump's bungling of public health policy during the Covid pandemic cost hundreds of thousands of lives," Weissman highlighted. "By appointing Kennedy as his secretary of HHS, Trump is courting another policy-driven public health catastrophe."

The RFK Jr. decision continued a trend of Trump choosing Cabinet secretaries who have demonstrated loyalty to him, even if their qualifications are questionable. After running for president as a Democrat and then an Independent—without support from many members of his political family—Kennedy suspended his campaign and endorsed the Republican in August.

"RFK Jr. poses a danger to public health, scientific research, medicine, and healthcare coverage for millions."

Leading up to the election last week, Trump acknowledged plans to let Kennedy "go wild on health," sparking speculation that he would let the lawyer and conspiracy theorist lead HHS, the Centers for Disease Control and Prevention, Department of Agriculture, Food and Drug Administration, or National Institutes of Health.

Once lauded for his environmental activism, Kennedy has recently faced criticism for spreading anti-vaccine misinformation, downplaying the climate emergency, and opposing a cease-fire in the Gaza Strip. There have also been revelations about a brain worm, a dead baby bear, a whale head, a reported affair with a journalist, and an alleged sexual assault of a babysitter.

Trump—who is known for his love of McDonald's—said in his statement about RFK Jr. that "for too long, Americans have been crushed by the industrial food complex and drug companies who have engaged in deception, misinformation, and disinformation when it comes to Public Health."

"The Safety and Health of all Americans is the most important role of any Administration, and HHS will play a big role in helping ensure that everybody will be protected from harmful chemicals, pollutants, pesticides, pharmaceutical products, and food additives that have contributed to the overwhelming Health Crisis in this Country," Trump continued. "Mr. Kennedy will restore these Agencies to the traditions of Gold Standard Scientific Research, and beacons of Transparency, to end the Chronic Disease epidemic, and to Make America Great and Healthy Again!"

Accountable.US executive director Tony Carrk cast doubt on the suggestion that Kennedy's appointment would benefit the public.

"Robert F. Kennedy Jr. has spent years recklessly promoting unfounded, anti-scientific conspiracies about everything from vaccines to antidepressants," Carrk said in a statement. "Not only does he lack any serious credentials, but his troubling grasp of facts poses a serious threat to the health of millions of Americans."

Journalist Mehdi Hasan compared Kennedy to the far-right founder of the fake news website InfoWars: "It is difficult to overstate just how extreme, conspiratorial, and insane RFK's views are, on vaccines, microchips, and beyond. He's Alex Jones in a suit."

Noting Kennedy's previous pledge to halt research on drug development and infectious diseases, Slate's Mark Joseph Stern called his selection "just a massive 'fuck you' to the millions of families relying on advancements in treatment for loved ones with ALS, Parkinson's, Alzheimer's, cancer, and so much more," adding that "confirming this lunatic would amount to killing people."

Some senators are already speaking out. Sen. Ed Markey (D-Mass.) said Thursday: "Dangerous. Unqualified. Unserious."

Senate Finance Committee Chair Ron Wyden (D-Ore.) said in a statement that "Trump's health agenda isn't a secret: worse healthcare at a higher cost for American families."

"Trump and Republicans in Congress have a proven track record of empowering insurance companies and Big Pharma while leaving everyday Americans to foot the bill. That means higher premiums, weakened protections for pre-existing conditions, criminalizing reproductive healthcare, and attacks on essential health coverage like Medicaid," he noted.

"Mr. Kennedy's outlandish views on basic scientific facts are disturbing and should worry all parents who expect schools and other public spaces to be safe for their children," Wyden added. "When Mr. Kennedy comes before the Finance Committee, it's going to be very clear what Americans stand to lose under Trump and Republicans in Congress."

Sen. Elizabeth Warren (D-Mass.) wrote on social media that "RFK Jr. poses a danger to public health, scientific research, medicine, and healthcare coverage for millions. He wants to stop parents from protecting their babies from measles and his ideas would welcome the return of polio. I have a lot of questions for his Senate hearing."

While Republicans are set to control Congress next year, Trump's controversial Cabinet picks have stoked fears that he will try to force through his allies with recess appointments, which don't require Senate confirmation.

If RFK Jr. makes it to HHS one way or another, critics are already preparing to challenge him. Center for Biological Diversity environmental health director Lori Ann Burd vowed that "we'll be joining with other organizations concerned with public health and the environment to ensure that Kennedy's dangerous anti-science agenda fails."