The Rich Are Destroying the Economy

Ever since the Great Recession shook the foundations of the U.S. economy, President Obama has been promising recovery. Evidence of this recovery, we were told, was manifested in the massive post-bailout profits corporations made. Soon enough, the President assured us, these corporations would tire of hoarding mountains of cash and start a hiring bonanza, followed by raising wages and benefits. It was either wishful thinking or conscious deception. The recent stock market meltdown has squashed any hope of a corporate-led recovery.

The Democrats fought the recession by the same methods the Republicans used to create it: allowing the super rich to recklessly dominate the economy while giving them massive handouts. This strategy, commonly referred to as Reaganomics or Trickle Down Economics, is now religion to both Democrats and Republicans; never mind the staged in-fighting for the gullible or complicit media.

When it becomes obvious to even the President that the economic recovery never existed beyond the bank accounts of the rich, questions will have to be answered. Why, for example, did nobody in either political party foresee the disastrous consequences of the bailouts? Not only did the U.S. deficit drastically increase but the same U.S. corporations that caused the recession were given reinforcement for their destructive actions, ensuring that it would continue unabated.

In his book, Crisis Economics, Nouriel Roubini outlines the insane response to the recession by Republicans and Democrats. Because both parties simply threw money at the banks and hedge funds instead of punishing them, a condition of "moral hazard" was created, meaning, that banks would assume another bailout would come their way if they destroyed the economy again -- too big too fail, remember? Roubini explains how the Democrats allowed the "too big" banks to get even bigger; how Wall Street salaries based on short-term profits went unregulated; how the regulations that were put into place were inadequate and filled with loopholes; how nothing of any significance changed.

Roubini has also written extensively about how the post-bailout Federal Reserve policies were fueling a commodity bubble that may be in the midst of bursting, possibly triggering a double dip recession. Essentially the big banks and rich investors were borrowing cheap dollars from the Fed and investing abroad in commodities with the hopes of higher returns. Roubini states:

"The risk is that we are planting the seeds of the next financial crisis...this asset bubble is totally inconsistent with a weaker recovery of economic and financial fundamentals." (October 27, 2009).

This investor-created commodity bubble pushed up prices in oil, food, and other basic products, causing further pain for working families and the economy as a whole. This speculative bubble was easily predictable but ignored by both political parties, since they claimed the bubble was a sign of recovery.

Another mainstream economist, Paul Krugman, also admits that the rich's death-grip on the U.S. political and economic system is causing pain for everybody else:

"Far from being ready to spend more on job creation, both parties agree that it's time to slash spending - destroying jobs in the process - with the only difference being one of degree...policy makers are catering almost exclusively to the interests of rentiers [rich investors] - those who derive lots of income from assets, who lent large sums of money in the past, often unwisely, but are now being protected from loss at everyone else's expense." (June 10, 2011)

Krugman explains that this process continues because the rich dominate the political system through campaign contributions, "access to policy makers," promises of high paying corporate jobs after their congressional term is over, and good o'l fashion corruption. Because he's a true blue Democrat at heart, Krugman nevertheless focuses most of his rage on Republicans.

Krugman's repeated calls to Democrats and Republicans to create jobs have fallen on deaf ears. Both parties agree that the "private sector" [corporations] should create jobs; until they decide to hire, nothing will happen. This is not merely "bad policy," as liberals like Krugman like to fret about, but the conscious agenda of the rich. Corporations and rich investors love high unemployment. The Kansas City Star explains why:

"Last year [2010], for the second year in a row, U.S. companies got more work out of their employees while spending less on overall labor costs." (February 3, 2011)

It really is that simple. High unemployment creates a downward pressure on wages, allowing employers to work the remaining employees harder and thus to increase profits. This dynamic, combined with the above commodity speculation, has been the entire basis for the corporate recovery, while working people have literally seen nothing beneficial.

This process is an extension of the bailouts, in the sense that more wealth is being transferred from working people to the corporations. Since consumer spending accounts for 70 percent of the U.S. economy, policies like these ensure that another crisis is inevitable.

Further complicating matters is the ending of the Federal Reserve's Quantitative Easing program (printing money), which amounted to the Fed buying $600 billion in U.S. Treasury bonds since last fall, essentially funding the U.S. debt and driving down interest rates.

Since the Fed was buying 60 percent of the bonds, a new creditor will need to be found; and this lender will likely require higher interest rates before loaning to the U.S. government, to make sure the loan is profitable. And although different nations buy U.S. debt for different reasons, much of this debt is bought by rich U.S. citizens, who will put the squeeze on the rest of us that have to pay back this debt. The Washington Times explains:

"...Bill Gross, the head of America's own Pimco bond fund, the largest buyer of bonds worldwide, recently reduced Pimco's holdings of Treasuries to zero out of concern that they weren't yielding enough given the risks of inflation and deficit spending." (June 7, 2011)

When the Federal Reserve raises interest rates to satisfy these rich investors, the economy will likely take a further nosedive. It appears, then, that the rich have a win-win situation: they got free bailout money, which increased the deficit; and because the deficit is too high, the rich want higher interest rates for investing in U.S. Treasury Bonds. In both instances working people pay the bills.

This insanity cannot be stopped by conventional measures, since politicians are tone deaf to anything that doesn't ring of corporate cash. The jobs crisis continues as a result of the policy agreed to by both Democrats and Republicans. The labor movement has a special role to play in reversing the above policies.

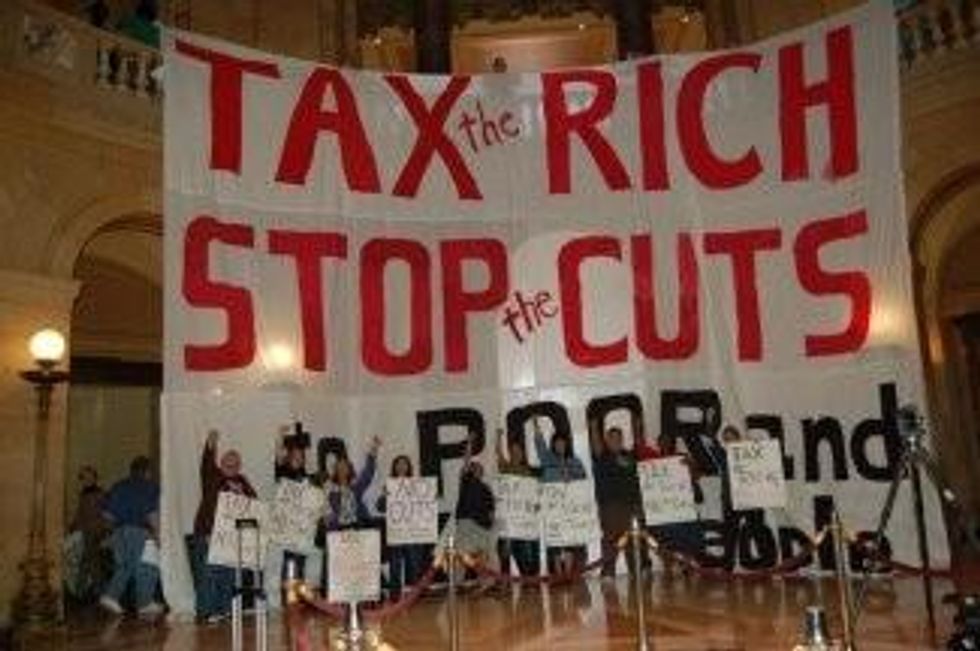

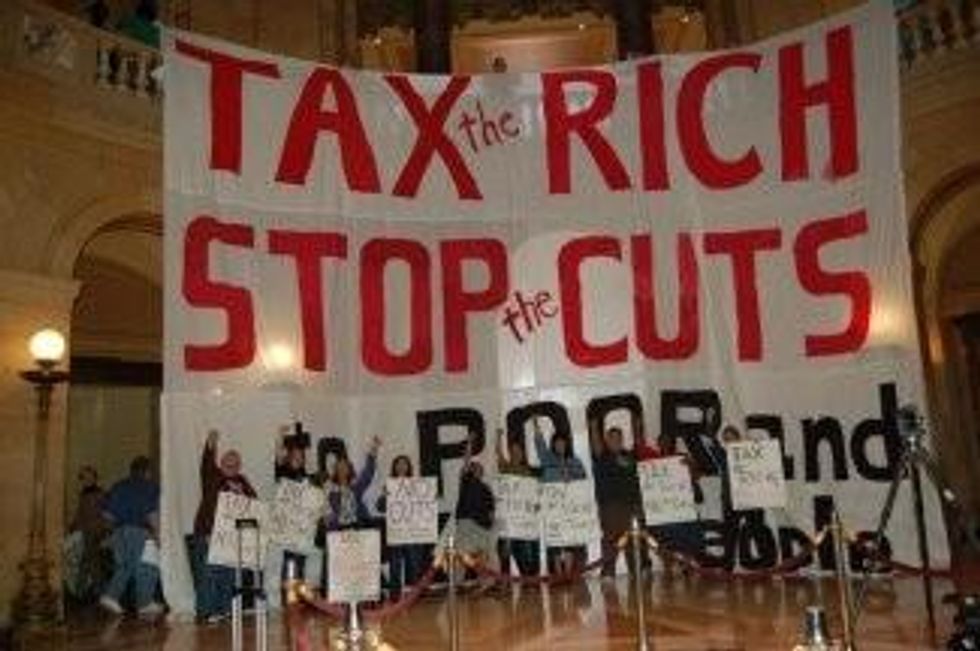

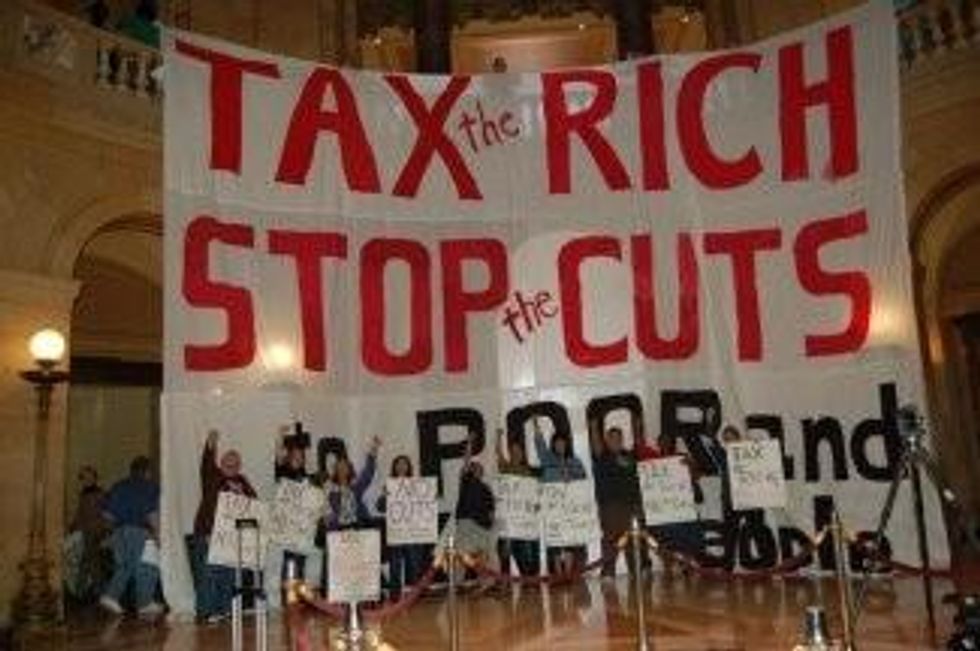

The corporate-led discussion around cutting social programs to fix the deficits -- on a state and national level -- can be challenged by a nationally coordinated campaign of unions and community allies demanding: Tax the Rich! This demand is significant because it can address both the deficits and the jobs crisis: a massive public works program can be funded by taxing the corporations and the wealthy to pre-Reagan levels. And it makes complete sense because the growing inequalities in wealth over the past three decades has meant a spectacular concentration of wealth at the top. The rich have plenty of money to spare.

Organized labor needs to bring masses of people in the street all over the country in order to get attention and pressure the government to respond to these demands. And it can succeed, especially if it organizes a serious, protracted campaign and especially if this campaign does not get funneled into supporting Democratic candidates, the surest way to kill campaign momentum.

AFL-CIO President Richard Trumka recently spoke in favor of a strong, independent labor movement. This is the direction it must take, rather than relying on the Democrats. The labor movement must get its act together, unite to put up a fight and demand specific policies that can concretely address the crisis faced by millions of working people.

No one is coming to save us. Join with us.

| The world is a pretty dark place right now. Economic inequality off the charts. The climate emergency. Supreme Court corruption in the U.S. and corporate capture worldwide. Democracy in many nations coming apart at the seams. Fascism threatens. It’s enough to make you wish for some powerful being to come along and save us. But the truth is this: no heroes are coming to save us. The only path to real and progressive change is when well-informed, well-intentioned people—fed up with being kicked around by the rich, the powerful, and the wicked—get organized and fight for the better world we all deserve. That’s why we created Common Dreams. We cover the issues that corporate media never will and lift up voices others would rather keep silent. But this people-powered media model can only survive with the support of readers like you. Can you join with us and donate right now to Common Dreams’ Mid-Year Campaign? |

Ever since the Great Recession shook the foundations of the U.S. economy, President Obama has been promising recovery. Evidence of this recovery, we were told, was manifested in the massive post-bailout profits corporations made. Soon enough, the President assured us, these corporations would tire of hoarding mountains of cash and start a hiring bonanza, followed by raising wages and benefits. It was either wishful thinking or conscious deception. The recent stock market meltdown has squashed any hope of a corporate-led recovery.

The Democrats fought the recession by the same methods the Republicans used to create it: allowing the super rich to recklessly dominate the economy while giving them massive handouts. This strategy, commonly referred to as Reaganomics or Trickle Down Economics, is now religion to both Democrats and Republicans; never mind the staged in-fighting for the gullible or complicit media.

When it becomes obvious to even the President that the economic recovery never existed beyond the bank accounts of the rich, questions will have to be answered. Why, for example, did nobody in either political party foresee the disastrous consequences of the bailouts? Not only did the U.S. deficit drastically increase but the same U.S. corporations that caused the recession were given reinforcement for their destructive actions, ensuring that it would continue unabated.

In his book, Crisis Economics, Nouriel Roubini outlines the insane response to the recession by Republicans and Democrats. Because both parties simply threw money at the banks and hedge funds instead of punishing them, a condition of "moral hazard" was created, meaning, that banks would assume another bailout would come their way if they destroyed the economy again -- too big too fail, remember? Roubini explains how the Democrats allowed the "too big" banks to get even bigger; how Wall Street salaries based on short-term profits went unregulated; how the regulations that were put into place were inadequate and filled with loopholes; how nothing of any significance changed.

Roubini has also written extensively about how the post-bailout Federal Reserve policies were fueling a commodity bubble that may be in the midst of bursting, possibly triggering a double dip recession. Essentially the big banks and rich investors were borrowing cheap dollars from the Fed and investing abroad in commodities with the hopes of higher returns. Roubini states:

"The risk is that we are planting the seeds of the next financial crisis...this asset bubble is totally inconsistent with a weaker recovery of economic and financial fundamentals." (October 27, 2009).

This investor-created commodity bubble pushed up prices in oil, food, and other basic products, causing further pain for working families and the economy as a whole. This speculative bubble was easily predictable but ignored by both political parties, since they claimed the bubble was a sign of recovery.

Another mainstream economist, Paul Krugman, also admits that the rich's death-grip on the U.S. political and economic system is causing pain for everybody else:

"Far from being ready to spend more on job creation, both parties agree that it's time to slash spending - destroying jobs in the process - with the only difference being one of degree...policy makers are catering almost exclusively to the interests of rentiers [rich investors] - those who derive lots of income from assets, who lent large sums of money in the past, often unwisely, but are now being protected from loss at everyone else's expense." (June 10, 2011)

Krugman explains that this process continues because the rich dominate the political system through campaign contributions, "access to policy makers," promises of high paying corporate jobs after their congressional term is over, and good o'l fashion corruption. Because he's a true blue Democrat at heart, Krugman nevertheless focuses most of his rage on Republicans.

Krugman's repeated calls to Democrats and Republicans to create jobs have fallen on deaf ears. Both parties agree that the "private sector" [corporations] should create jobs; until they decide to hire, nothing will happen. This is not merely "bad policy," as liberals like Krugman like to fret about, but the conscious agenda of the rich. Corporations and rich investors love high unemployment. The Kansas City Star explains why:

"Last year [2010], for the second year in a row, U.S. companies got more work out of their employees while spending less on overall labor costs." (February 3, 2011)

It really is that simple. High unemployment creates a downward pressure on wages, allowing employers to work the remaining employees harder and thus to increase profits. This dynamic, combined with the above commodity speculation, has been the entire basis for the corporate recovery, while working people have literally seen nothing beneficial.

This process is an extension of the bailouts, in the sense that more wealth is being transferred from working people to the corporations. Since consumer spending accounts for 70 percent of the U.S. economy, policies like these ensure that another crisis is inevitable.

Further complicating matters is the ending of the Federal Reserve's Quantitative Easing program (printing money), which amounted to the Fed buying $600 billion in U.S. Treasury bonds since last fall, essentially funding the U.S. debt and driving down interest rates.

Since the Fed was buying 60 percent of the bonds, a new creditor will need to be found; and this lender will likely require higher interest rates before loaning to the U.S. government, to make sure the loan is profitable. And although different nations buy U.S. debt for different reasons, much of this debt is bought by rich U.S. citizens, who will put the squeeze on the rest of us that have to pay back this debt. The Washington Times explains:

"...Bill Gross, the head of America's own Pimco bond fund, the largest buyer of bonds worldwide, recently reduced Pimco's holdings of Treasuries to zero out of concern that they weren't yielding enough given the risks of inflation and deficit spending." (June 7, 2011)

When the Federal Reserve raises interest rates to satisfy these rich investors, the economy will likely take a further nosedive. It appears, then, that the rich have a win-win situation: they got free bailout money, which increased the deficit; and because the deficit is too high, the rich want higher interest rates for investing in U.S. Treasury Bonds. In both instances working people pay the bills.

This insanity cannot be stopped by conventional measures, since politicians are tone deaf to anything that doesn't ring of corporate cash. The jobs crisis continues as a result of the policy agreed to by both Democrats and Republicans. The labor movement has a special role to play in reversing the above policies.

The corporate-led discussion around cutting social programs to fix the deficits -- on a state and national level -- can be challenged by a nationally coordinated campaign of unions and community allies demanding: Tax the Rich! This demand is significant because it can address both the deficits and the jobs crisis: a massive public works program can be funded by taxing the corporations and the wealthy to pre-Reagan levels. And it makes complete sense because the growing inequalities in wealth over the past three decades has meant a spectacular concentration of wealth at the top. The rich have plenty of money to spare.

Organized labor needs to bring masses of people in the street all over the country in order to get attention and pressure the government to respond to these demands. And it can succeed, especially if it organizes a serious, protracted campaign and especially if this campaign does not get funneled into supporting Democratic candidates, the surest way to kill campaign momentum.

AFL-CIO President Richard Trumka recently spoke in favor of a strong, independent labor movement. This is the direction it must take, rather than relying on the Democrats. The labor movement must get its act together, unite to put up a fight and demand specific policies that can concretely address the crisis faced by millions of working people.

Ever since the Great Recession shook the foundations of the U.S. economy, President Obama has been promising recovery. Evidence of this recovery, we were told, was manifested in the massive post-bailout profits corporations made. Soon enough, the President assured us, these corporations would tire of hoarding mountains of cash and start a hiring bonanza, followed by raising wages and benefits. It was either wishful thinking or conscious deception. The recent stock market meltdown has squashed any hope of a corporate-led recovery.

The Democrats fought the recession by the same methods the Republicans used to create it: allowing the super rich to recklessly dominate the economy while giving them massive handouts. This strategy, commonly referred to as Reaganomics or Trickle Down Economics, is now religion to both Democrats and Republicans; never mind the staged in-fighting for the gullible or complicit media.

When it becomes obvious to even the President that the economic recovery never existed beyond the bank accounts of the rich, questions will have to be answered. Why, for example, did nobody in either political party foresee the disastrous consequences of the bailouts? Not only did the U.S. deficit drastically increase but the same U.S. corporations that caused the recession were given reinforcement for their destructive actions, ensuring that it would continue unabated.

In his book, Crisis Economics, Nouriel Roubini outlines the insane response to the recession by Republicans and Democrats. Because both parties simply threw money at the banks and hedge funds instead of punishing them, a condition of "moral hazard" was created, meaning, that banks would assume another bailout would come their way if they destroyed the economy again -- too big too fail, remember? Roubini explains how the Democrats allowed the "too big" banks to get even bigger; how Wall Street salaries based on short-term profits went unregulated; how the regulations that were put into place were inadequate and filled with loopholes; how nothing of any significance changed.

Roubini has also written extensively about how the post-bailout Federal Reserve policies were fueling a commodity bubble that may be in the midst of bursting, possibly triggering a double dip recession. Essentially the big banks and rich investors were borrowing cheap dollars from the Fed and investing abroad in commodities with the hopes of higher returns. Roubini states:

"The risk is that we are planting the seeds of the next financial crisis...this asset bubble is totally inconsistent with a weaker recovery of economic and financial fundamentals." (October 27, 2009).

This investor-created commodity bubble pushed up prices in oil, food, and other basic products, causing further pain for working families and the economy as a whole. This speculative bubble was easily predictable but ignored by both political parties, since they claimed the bubble was a sign of recovery.

Another mainstream economist, Paul Krugman, also admits that the rich's death-grip on the U.S. political and economic system is causing pain for everybody else:

"Far from being ready to spend more on job creation, both parties agree that it's time to slash spending - destroying jobs in the process - with the only difference being one of degree...policy makers are catering almost exclusively to the interests of rentiers [rich investors] - those who derive lots of income from assets, who lent large sums of money in the past, often unwisely, but are now being protected from loss at everyone else's expense." (June 10, 2011)

Krugman explains that this process continues because the rich dominate the political system through campaign contributions, "access to policy makers," promises of high paying corporate jobs after their congressional term is over, and good o'l fashion corruption. Because he's a true blue Democrat at heart, Krugman nevertheless focuses most of his rage on Republicans.

Krugman's repeated calls to Democrats and Republicans to create jobs have fallen on deaf ears. Both parties agree that the "private sector" [corporations] should create jobs; until they decide to hire, nothing will happen. This is not merely "bad policy," as liberals like Krugman like to fret about, but the conscious agenda of the rich. Corporations and rich investors love high unemployment. The Kansas City Star explains why:

"Last year [2010], for the second year in a row, U.S. companies got more work out of their employees while spending less on overall labor costs." (February 3, 2011)

It really is that simple. High unemployment creates a downward pressure on wages, allowing employers to work the remaining employees harder and thus to increase profits. This dynamic, combined with the above commodity speculation, has been the entire basis for the corporate recovery, while working people have literally seen nothing beneficial.

This process is an extension of the bailouts, in the sense that more wealth is being transferred from working people to the corporations. Since consumer spending accounts for 70 percent of the U.S. economy, policies like these ensure that another crisis is inevitable.

Further complicating matters is the ending of the Federal Reserve's Quantitative Easing program (printing money), which amounted to the Fed buying $600 billion in U.S. Treasury bonds since last fall, essentially funding the U.S. debt and driving down interest rates.

Since the Fed was buying 60 percent of the bonds, a new creditor will need to be found; and this lender will likely require higher interest rates before loaning to the U.S. government, to make sure the loan is profitable. And although different nations buy U.S. debt for different reasons, much of this debt is bought by rich U.S. citizens, who will put the squeeze on the rest of us that have to pay back this debt. The Washington Times explains:

"...Bill Gross, the head of America's own Pimco bond fund, the largest buyer of bonds worldwide, recently reduced Pimco's holdings of Treasuries to zero out of concern that they weren't yielding enough given the risks of inflation and deficit spending." (June 7, 2011)

When the Federal Reserve raises interest rates to satisfy these rich investors, the economy will likely take a further nosedive. It appears, then, that the rich have a win-win situation: they got free bailout money, which increased the deficit; and because the deficit is too high, the rich want higher interest rates for investing in U.S. Treasury Bonds. In both instances working people pay the bills.

This insanity cannot be stopped by conventional measures, since politicians are tone deaf to anything that doesn't ring of corporate cash. The jobs crisis continues as a result of the policy agreed to by both Democrats and Republicans. The labor movement has a special role to play in reversing the above policies.

The corporate-led discussion around cutting social programs to fix the deficits -- on a state and national level -- can be challenged by a nationally coordinated campaign of unions and community allies demanding: Tax the Rich! This demand is significant because it can address both the deficits and the jobs crisis: a massive public works program can be funded by taxing the corporations and the wealthy to pre-Reagan levels. And it makes complete sense because the growing inequalities in wealth over the past three decades has meant a spectacular concentration of wealth at the top. The rich have plenty of money to spare.

Organized labor needs to bring masses of people in the street all over the country in order to get attention and pressure the government to respond to these demands. And it can succeed, especially if it organizes a serious, protracted campaign and especially if this campaign does not get funneled into supporting Democratic candidates, the surest way to kill campaign momentum.

AFL-CIO President Richard Trumka recently spoke in favor of a strong, independent labor movement. This is the direction it must take, rather than relying on the Democrats. The labor movement must get its act together, unite to put up a fight and demand specific policies that can concretely address the crisis faced by millions of working people.