SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

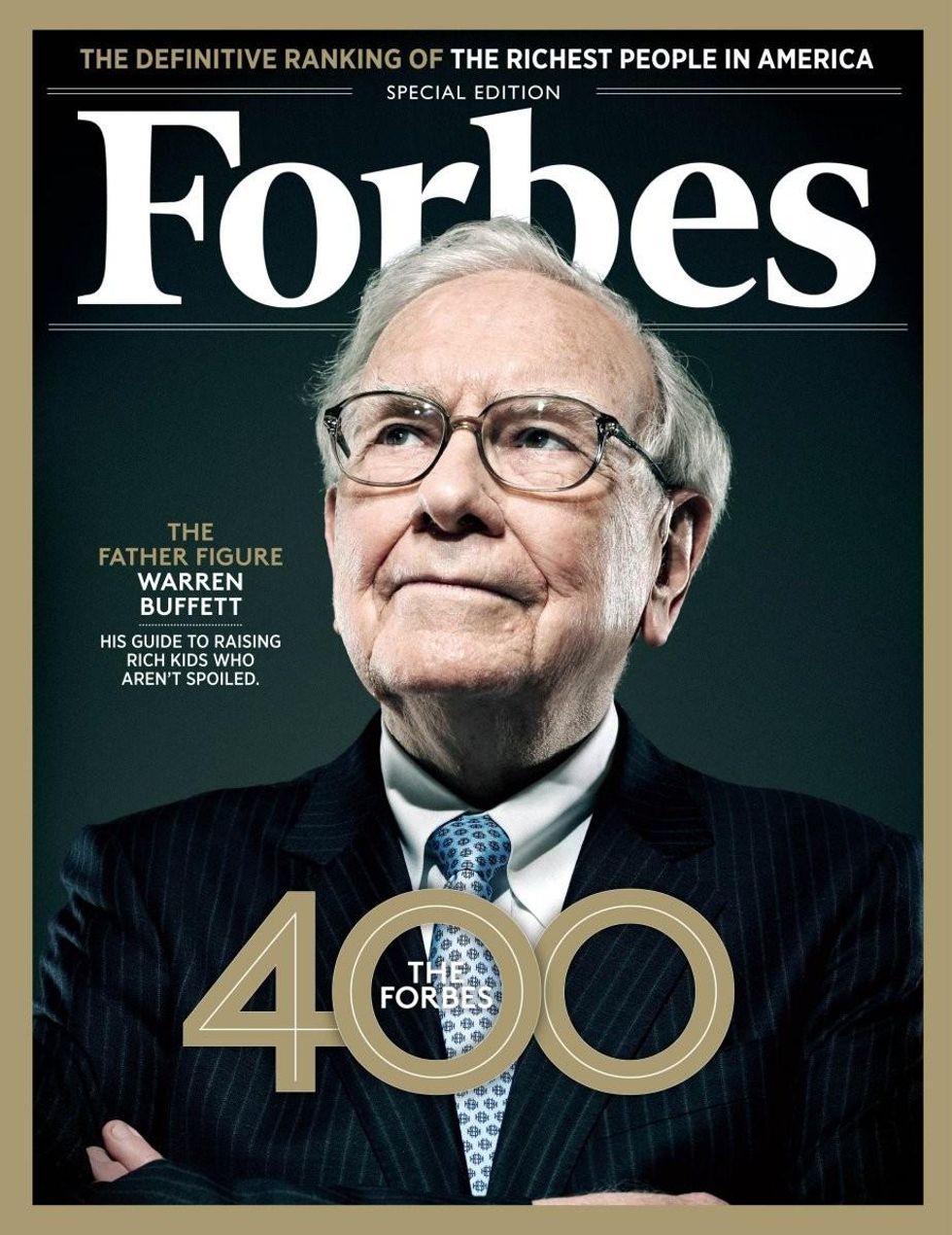

Two weeks ago, Forbes released its 2013 list of the richest 400 Americans. And the not-so-surprising news: The fortunes of those at the top continue to rise while Americans across the country continue to suffer. What is surprising though is that they have now regained "all" of the losses from the economic collapse.

"Five years after the financial crisis sent the fortunes of many in the U.S. and around the world tumbling, the wealthiest as a group have finally gained back all that they lost. The 400 wealthiest Americans are worth just over $2 trillion, roughly equivalent to the GDP of Russia. That is a gain of $300 billion from a year ago, and more than double a decade ago. The average net worth of list members is a staggering $5 billion, $800 million more than a year ago and also a record. The minimum net worth needed to make the 400 list was $1.3 billion. The last time it was that high was in 2007 and 2008, before property and stock market values began sliding. Because the bar is so high, 61 American billionaires didn't make the cut."

Half of those who dropped off the Forbes list didn't do so because their fortunes' declined. They "fell off the list" because others passed them up. As Forbes notes, "The rest simply couldn't keep up with the rising tide." It's an economic bonanza for the rich.

In glorifying and idolizing the superrich, what Forbes and much of our popular culture fails to acknowledge is the role that inherited wealth, race, gender, and public policy have played in shaping who is and who is not on the list. But last year, United for a Fair Economy (UFE) took a closer, more critical look at the list with the release of our "Born on Third Base" report, which analyzed the 2011 Forbes 400 list. Here's what we learned:

America's long history of race and gender bias also shape who is and is not on the list. Women and people of color make up only a tiny sliver of the overwhelmingly white, male Forbes 400. Even in 2013, the Forbes list includes only one African-America: Oprah Winfrey.

In UFE's 2006 book, The Color of Wealth, we examine the history of these disparities, including the way that women and people of color have been systematically excluded from the wealth-building public programs that helped create the white middle class. These wealth disparities have been passed on to each successive generation through the power of inheritance.

It's not just the birthright, there are public policies that give an unnecessary "leg up" to those at the top. One of the more egregious tax breaks we give to the wealthiest Americans is the reduced tax rate on investment income. We tax investment income from capital gains and appreciated stock at nearly half the top rate at which we tax income from wages earned through actual work.

Who does that special tax break benefit? No great mystery here. 60% of the income made by the Forbes 400 billionaires comes from capital gains, i.e. investment income. Together with the rest of their compatriots in the top 0.1%, they capture half of all capital gains income in the country. At the very least, we need to "tax wealth like work" and end this special tax break that disproportionately benefits those at the top.

By ignoring the role of inherited wealth, race, gender, and public policy advantages, Forbes describes many of the richest Americans as "self-made." This is an assertion that UFE challenged, both in our "Born on Third Base" report and in our 2012 book, The Self-Made Myth.

Attributing the success of those at the top entirely to their own efforts, by implication, also insinuates that those who are poor, are poor by their own efforts. Such an incomplete, black-and-white narrative distorts our views on the merits of a host of public policies--through this lens, progressive taxes become akin to "punishing success," and public policies aimed at correcting past injustices become "hand outs." The list goes on.

Instead of falling over ourselves in gleeful adulation of the superrich, let's honor the labors of all hard-working people across the country, and not overlook all the nuances. At the very least, it will be a more honest dialogue.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

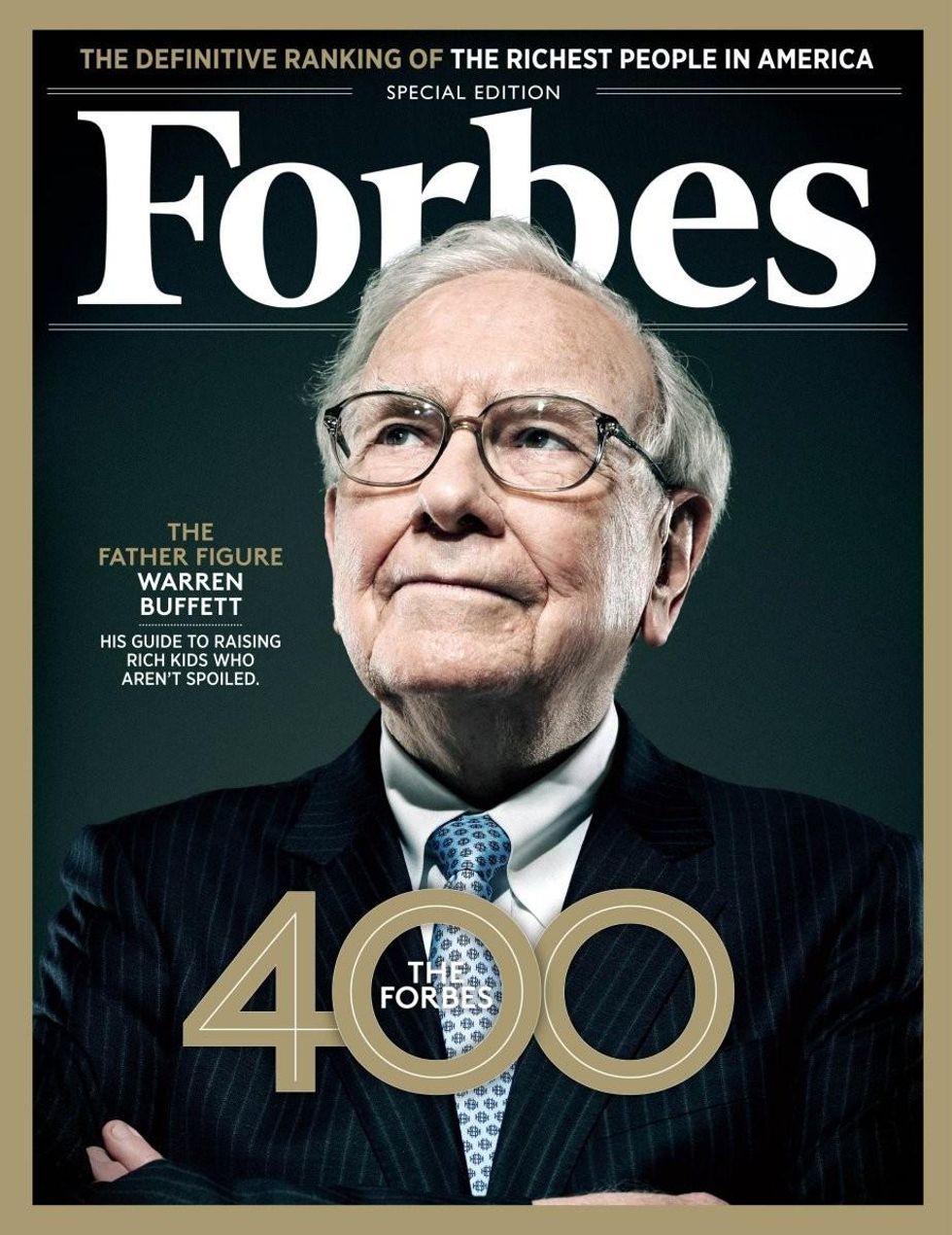

Two weeks ago, Forbes released its 2013 list of the richest 400 Americans. And the not-so-surprising news: The fortunes of those at the top continue to rise while Americans across the country continue to suffer. What is surprising though is that they have now regained "all" of the losses from the economic collapse.

"Five years after the financial crisis sent the fortunes of many in the U.S. and around the world tumbling, the wealthiest as a group have finally gained back all that they lost. The 400 wealthiest Americans are worth just over $2 trillion, roughly equivalent to the GDP of Russia. That is a gain of $300 billion from a year ago, and more than double a decade ago. The average net worth of list members is a staggering $5 billion, $800 million more than a year ago and also a record. The minimum net worth needed to make the 400 list was $1.3 billion. The last time it was that high was in 2007 and 2008, before property and stock market values began sliding. Because the bar is so high, 61 American billionaires didn't make the cut."

Half of those who dropped off the Forbes list didn't do so because their fortunes' declined. They "fell off the list" because others passed them up. As Forbes notes, "The rest simply couldn't keep up with the rising tide." It's an economic bonanza for the rich.

In glorifying and idolizing the superrich, what Forbes and much of our popular culture fails to acknowledge is the role that inherited wealth, race, gender, and public policy have played in shaping who is and who is not on the list. But last year, United for a Fair Economy (UFE) took a closer, more critical look at the list with the release of our "Born on Third Base" report, which analyzed the 2011 Forbes 400 list. Here's what we learned:

America's long history of race and gender bias also shape who is and is not on the list. Women and people of color make up only a tiny sliver of the overwhelmingly white, male Forbes 400. Even in 2013, the Forbes list includes only one African-America: Oprah Winfrey.

In UFE's 2006 book, The Color of Wealth, we examine the history of these disparities, including the way that women and people of color have been systematically excluded from the wealth-building public programs that helped create the white middle class. These wealth disparities have been passed on to each successive generation through the power of inheritance.

It's not just the birthright, there are public policies that give an unnecessary "leg up" to those at the top. One of the more egregious tax breaks we give to the wealthiest Americans is the reduced tax rate on investment income. We tax investment income from capital gains and appreciated stock at nearly half the top rate at which we tax income from wages earned through actual work.

Who does that special tax break benefit? No great mystery here. 60% of the income made by the Forbes 400 billionaires comes from capital gains, i.e. investment income. Together with the rest of their compatriots in the top 0.1%, they capture half of all capital gains income in the country. At the very least, we need to "tax wealth like work" and end this special tax break that disproportionately benefits those at the top.

By ignoring the role of inherited wealth, race, gender, and public policy advantages, Forbes describes many of the richest Americans as "self-made." This is an assertion that UFE challenged, both in our "Born on Third Base" report and in our 2012 book, The Self-Made Myth.

Attributing the success of those at the top entirely to their own efforts, by implication, also insinuates that those who are poor, are poor by their own efforts. Such an incomplete, black-and-white narrative distorts our views on the merits of a host of public policies--through this lens, progressive taxes become akin to "punishing success," and public policies aimed at correcting past injustices become "hand outs." The list goes on.

Instead of falling over ourselves in gleeful adulation of the superrich, let's honor the labors of all hard-working people across the country, and not overlook all the nuances. At the very least, it will be a more honest dialogue.

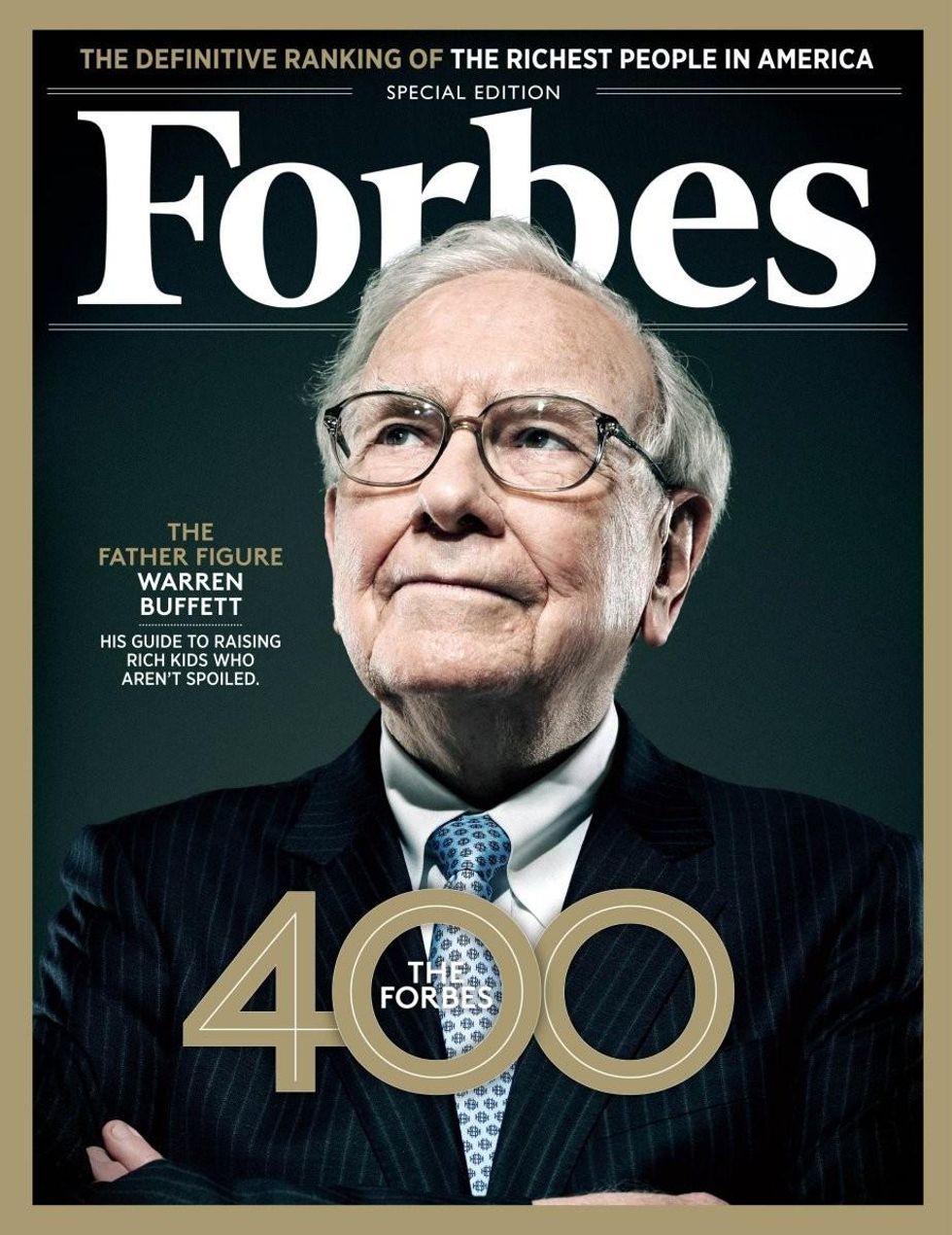

Two weeks ago, Forbes released its 2013 list of the richest 400 Americans. And the not-so-surprising news: The fortunes of those at the top continue to rise while Americans across the country continue to suffer. What is surprising though is that they have now regained "all" of the losses from the economic collapse.

"Five years after the financial crisis sent the fortunes of many in the U.S. and around the world tumbling, the wealthiest as a group have finally gained back all that they lost. The 400 wealthiest Americans are worth just over $2 trillion, roughly equivalent to the GDP of Russia. That is a gain of $300 billion from a year ago, and more than double a decade ago. The average net worth of list members is a staggering $5 billion, $800 million more than a year ago and also a record. The minimum net worth needed to make the 400 list was $1.3 billion. The last time it was that high was in 2007 and 2008, before property and stock market values began sliding. Because the bar is so high, 61 American billionaires didn't make the cut."

Half of those who dropped off the Forbes list didn't do so because their fortunes' declined. They "fell off the list" because others passed them up. As Forbes notes, "The rest simply couldn't keep up with the rising tide." It's an economic bonanza for the rich.

In glorifying and idolizing the superrich, what Forbes and much of our popular culture fails to acknowledge is the role that inherited wealth, race, gender, and public policy have played in shaping who is and who is not on the list. But last year, United for a Fair Economy (UFE) took a closer, more critical look at the list with the release of our "Born on Third Base" report, which analyzed the 2011 Forbes 400 list. Here's what we learned:

America's long history of race and gender bias also shape who is and is not on the list. Women and people of color make up only a tiny sliver of the overwhelmingly white, male Forbes 400. Even in 2013, the Forbes list includes only one African-America: Oprah Winfrey.

In UFE's 2006 book, The Color of Wealth, we examine the history of these disparities, including the way that women and people of color have been systematically excluded from the wealth-building public programs that helped create the white middle class. These wealth disparities have been passed on to each successive generation through the power of inheritance.

It's not just the birthright, there are public policies that give an unnecessary "leg up" to those at the top. One of the more egregious tax breaks we give to the wealthiest Americans is the reduced tax rate on investment income. We tax investment income from capital gains and appreciated stock at nearly half the top rate at which we tax income from wages earned through actual work.

Who does that special tax break benefit? No great mystery here. 60% of the income made by the Forbes 400 billionaires comes from capital gains, i.e. investment income. Together with the rest of their compatriots in the top 0.1%, they capture half of all capital gains income in the country. At the very least, we need to "tax wealth like work" and end this special tax break that disproportionately benefits those at the top.

By ignoring the role of inherited wealth, race, gender, and public policy advantages, Forbes describes many of the richest Americans as "self-made." This is an assertion that UFE challenged, both in our "Born on Third Base" report and in our 2012 book, The Self-Made Myth.

Attributing the success of those at the top entirely to their own efforts, by implication, also insinuates that those who are poor, are poor by their own efforts. Such an incomplete, black-and-white narrative distorts our views on the merits of a host of public policies--through this lens, progressive taxes become akin to "punishing success," and public policies aimed at correcting past injustices become "hand outs." The list goes on.

Instead of falling over ourselves in gleeful adulation of the superrich, let's honor the labors of all hard-working people across the country, and not overlook all the nuances. At the very least, it will be a more honest dialogue.