SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

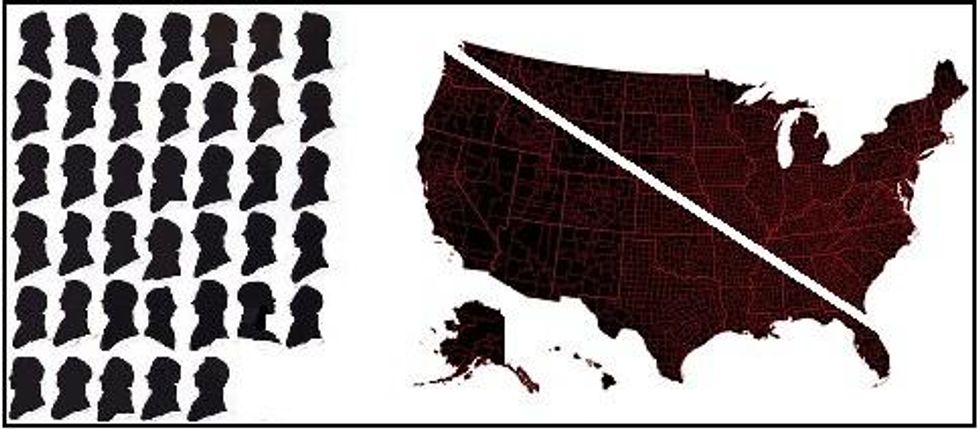

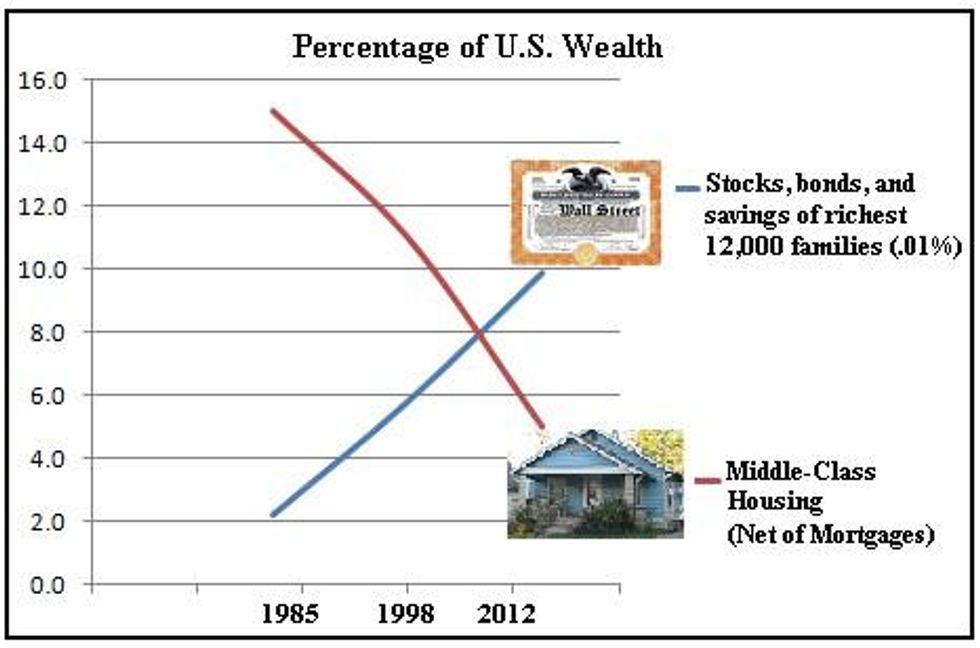

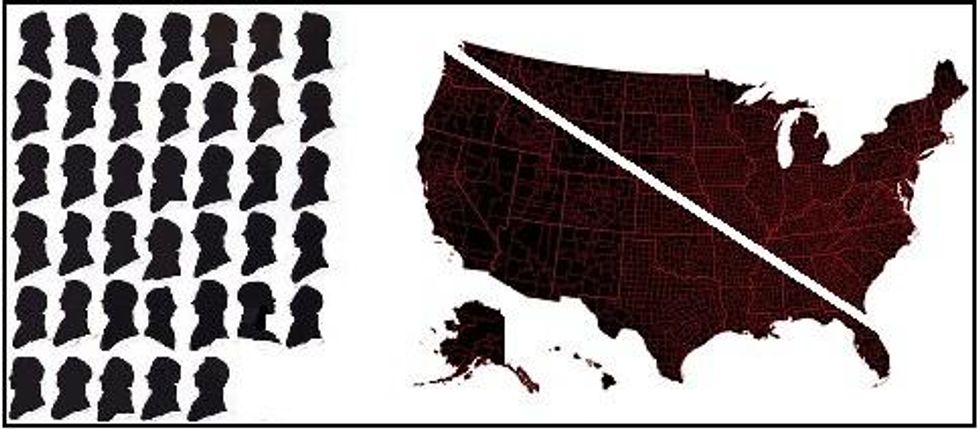

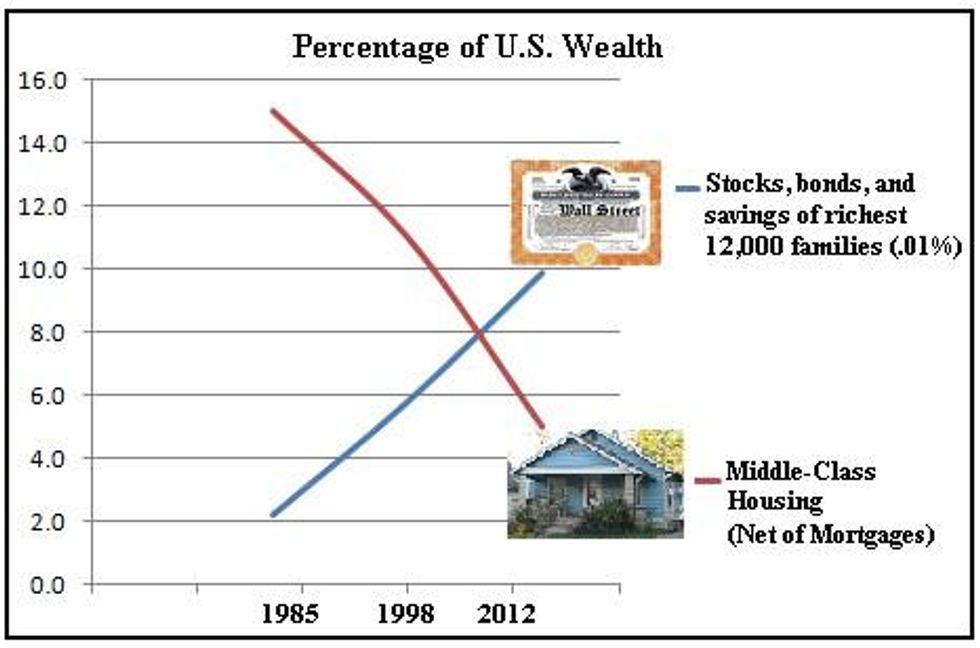

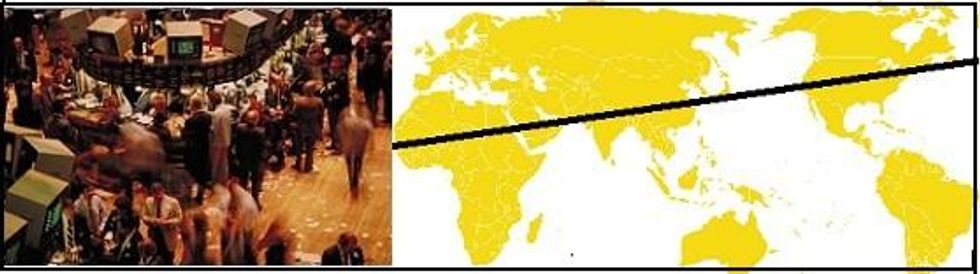

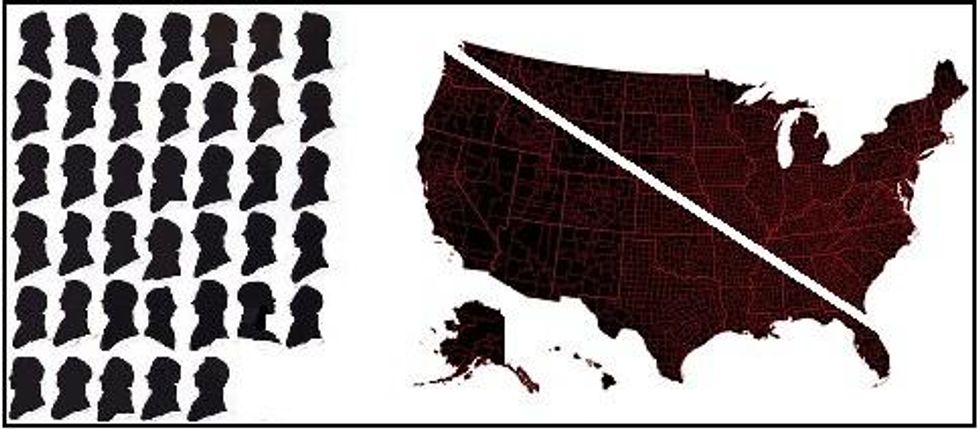

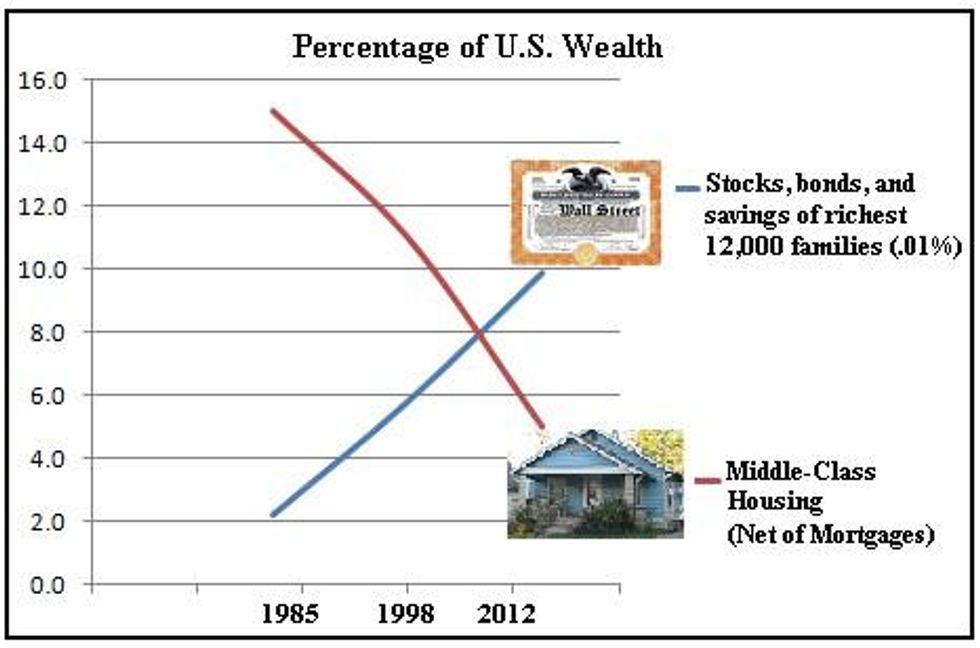

Just 70 individuals now own as much wealth as half the world. In the U.S., the richest 40 individuals own as much as half the country, and the 16,000 American households in the top .01% have accumulated an average net worth of over a third of a billion dollars. As extreme wealth continues to grow out of control, inequality worsens for the rest of us, plaguing our country and our world, spreading like a terminal form of cancer. It should be a major news item in the mainstream media. But the well-positioned few are either oblivious to or uncaring about its effect on less fortunate people.

The data and charts (citations here) come from Forbes, Credit Suisse, and a recent study by Emmanuel Saez and Gabriel Zucman.

1. Just 70 Individuals Own As Much Wealth As Half the World

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Just 70 individuals now own as much wealth as half the world. In the U.S., the richest 40 individuals own as much as half the country, and the 16,000 American households in the top .01% have accumulated an average net worth of over a third of a billion dollars. As extreme wealth continues to grow out of control, inequality worsens for the rest of us, plaguing our country and our world, spreading like a terminal form of cancer. It should be a major news item in the mainstream media. But the well-positioned few are either oblivious to or uncaring about its effect on less fortunate people.

The data and charts (citations here) come from Forbes, Credit Suisse, and a recent study by Emmanuel Saez and Gabriel Zucman.

1. Just 70 Individuals Own As Much Wealth As Half the World

Just 70 individuals now own as much wealth as half the world. In the U.S., the richest 40 individuals own as much as half the country, and the 16,000 American households in the top .01% have accumulated an average net worth of over a third of a billion dollars. As extreme wealth continues to grow out of control, inequality worsens for the rest of us, plaguing our country and our world, spreading like a terminal form of cancer. It should be a major news item in the mainstream media. But the well-positioned few are either oblivious to or uncaring about its effect on less fortunate people.

The data and charts (citations here) come from Forbes, Credit Suisse, and a recent study by Emmanuel Saez and Gabriel Zucman.

1. Just 70 Individuals Own As Much Wealth As Half the World