SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

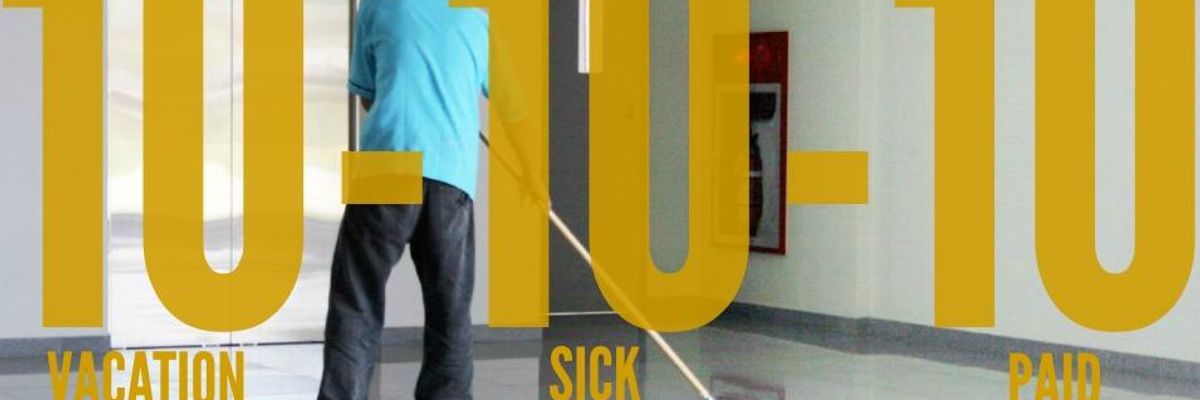

Whether working in air-conditioned offices or on sun-baked parking lots, all progressives can agree that 10-10-10 is a basic minimum standard that no one should have to go without. The demand for 10-10-10 should be the rallying cry that unites us all. (Photo: Stock/with overlay)

The following is an excerpt from the author's new book, Sixteen for '16: a Progressive Agenda for a Better America, and is re-printed with the kind permission of Policy Press publishers.

Far and away the most memorable slogan of the 2012 election campaign was the Republican candidate Herman Cain's "9-9-9" plan. It sure beats "Forward" (Barack Obama) and "Believe in America" (Mitt Romney) and is right up there with "Commerce, Education and the... uh, what's the third one there?" (Rick Perry). Herman Cain and his economic advisor, Cleveland accountant Rich Lowrie, called for a 9% value added tax, a 9% flat income tax, and 9% federal sales tax to replace all existing federal taxes. It has been suggested Cain's campaign copied the 9-9-9 plan from the default tax structure implemented in the computer game Sim City 3. Whether or not this is true, no one believes that 9-9-9 is a practical solution to the problems of contemporary society. No one, that is, outside the Herman Cain campaign team and presumably the still-operating 9-9-9 Fund political action committee.

After dropping out of the Republican nomination battle, Cain was invited to deliver the Tea Party State of the Union response in January 2012. Look for a return of the 9-9-9 plan in 2016, with or without Herman Cain. It might raise taxes on nearly all American households while still somehow managing to decimate overall federal government revenues, but there's no denying that it's a great slogan. Even if Cain doesn't run in 2016, expect someone else to pick it up.

Whether or not Cain makes a comeback in 2016, progressives would do well to up the ante one notch by introducing their own 10-10-10 plan. The 10-10-10 plan would require all employers to provide 10 paid sick days, 10 paid holidays, and 10 paid vacation days a year for all full-time workers, prorated for part-time workers as well. Those with well-paid professional jobs may not realize that other people don't already have 10-10-10, but they don't. Far from it. For many working Americans, 10-10-10 would be a dream come true.

Take sick days. Today just 65%--less than two-thirds--of all American workers have any opportunity to take paid sick days at all, according to official government statistics. This figure covers all workers, both full- and part-time. Hispanic Americans are particularly disadvantaged when it comes to sick leave. Many people expect paid sick days to be an ordinary benefit of a full-time job, but only 74% of full-time private sector workers receive any paid sick days at all. For part-time workers the figures are catastrophic: just 26 % of all workers and 24 % of private sector workers have the opportunity to take paid sick days. And part-time employment is the fastest-growing segment of the labor force.

The real situation for vulnerable parts of the workforce is even worse than these statistics indicate. Government statistics completely ignore the cash economy of illegal and semi-legal employment. Day laborers who wait before dawn in the parking lots of home improvement warehouses every morning looking for work do not get paid sick days--and they are not included in government employment benefits surveys. Accounting for those who fall between the cracks of government record-keeping and those who technically get paid sick days but are afraid to use them, it is likely that slightly less than half of all American workers can feel secure about calling in sick when they come down with the flu, without fear of losing pay--or even their jobs. Fewer still can afford to get seriously ill, be involved in a car crash, or need an operation.

You should at least be able to get sick on a holiday. The United States has 10 federal holidays: New Year's Day, Martin Luther King Day, Presidents' Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans' Day, Thanksgiving, and Christmas. Except of course that in the United States your employer doesn't have to give you a paid day off just because it's a public holiday. Only 76% of American workers get any paid holidays at all. Among part-timers that figure drops to 38%.

Similarly, paid vacation days are the preserve of well-paid full-time workers. Among all workers the proportion receiving paid vacation time is 74%. Among part-timers it is 34%. State and local governments are particularly stingy with paid vacation time. Only two thirds of full-time state and local government workers receive paid vacation days.

All of these figures get worse the farther you go down the pay scale, and all of them are worse for small employers. In the bottom quarter of the economy (those paid at or near minimum wage) only 30% of private sector workers get any paid sick days and slightly less than half get paid holidays and vacation days. And again, these figures apply only to the kinds of employers that get caught up in federal statistical surveys. Your local supermarket is in. Your local unregistered after-hours parking lot cleaning company is almost certainly out.

And that is part of the problem. Big companies now outsource many services that used to be performed by their own employees. The result is that a job with a barely regulated big business has been turned into a job with a completely unregulated small business. Among large private-sector employers of 500 or more workers, 81% offer their workers paid sick days. Among small employers of fewer than 100 employees, the figure is 51%. When jobs are outsourced from big companies to small contractors, benefits like sick pay tend to disappear. The lack of benefits and poor working conditions are the reasons why small private contractors can clean parking lots, mow lawns, and unload trucks more cheaply than big, super-efficient retailers can do these jobs for themselves.

For example, industry bulletin boards report that Walmart pays its contractors and through them its sub-contractors anywhere from $22 to $50 to clean an entire store parking lot in the middle of the night. These rates seem to be typical for other big-box retail stores as well. To put these rates into perspective, a big box retail store can have its parking lot cleaned overnight so that it is litter-free and ready to welcome your car in the morning for roughly the price of a nice shirt. Think how many shirts (toasters, drills) these stores sell in a day and it gives you some idea what a trivial expense cleaning is for a large store. Despite these already super-low rates, industry bulletin boards are full of online posts from contractors complaining about being screwed down from $35 to $30 to $25 a job. Big retailers are always looking for that extra $5. Mind you, that's not an extra $5 per customer or $5 per item sold. That's an extra $5 a day--or a store the size of a Walmart. No one ever got rich throwing away pennies.

In this business-outsourcing sector of the economy if you don't work, you don't get paid. It's as simple as that. And the big businesses that do the outsourcing typically shirk any responsibility for what happens to the outsourced workers, including injuries. Don't even ask about retirement. But then, what's wrong with paying people only for the hours they actually work? Many high-skill professionals work on this principle. Just ask any freelance writer, designer, or architect. Or any small business owner. Freelancers and small business owners have to set aside savings for rainy days all on their own. No one gives them paid sick days, holidays, or vacation days. They rely on their own discipline and planning to pay for time off.

"The 10-10-10 plan ensures that everyone gets the time off that everyone needs. It's the least we can do--and we should do it."

The difference between freelancers and hourly workers is that at the federal minimum wage of $7.25 an hour, or even at President Obama's preferred minimum wage of $10.10 an hour, it is nearly impossible to save for a rainy day. A bare minimum 10-10-10 benefits plan of 10 paid sick days, 10 paid holidays, and 10 paid vacation days a year amounts to 30 days off out of a typical 260-day work year. Roughly speaking, workers have to save 11.5% of their take-home pay every week to fund a 10-10-10 plan through personal discipline and planning alone. Personal discipline is quite a tall order when your total take-home pay is just $268 a week (minimum wage minus payroll taxes) or even $373 a week ($10.10 an hour minus payroll taxes). Planning can be even harder. People who have irregular, poorly paid jobs with no benefits tend to know many other people who have irregular, poorly paid jobs with no benefits. When people do somehow manage to save for a rainy day, more often than not they find themselves saving for someone else's rainy day. That is to say, if it comes to a choice between keeping your savings intact or paying your son's speeding ticket to keep him out of jail, it takes a hard heart to save your savings for your own rainy day.

Research on micro-savings plans confirms this. In 2011 and 2012, low- and middle-income Americans in four cities were recruited for a pilot study on the impact of incentives to save. Participants were offered a 50% bonus (up to $500) if they saved up to $1,000 of their tax refunds for at least one year. Depending on how the results are interpreted, between one quarter and one third of the study participants were unable to keep their pledged savings in the bank for a full year, despite the massive reward of a 50% bonus at the end of the study period. And this study represents a best case scenario: Research subjects got their money in a lump sum (through their tax refunds) instead of having to save money a few dollars a week out of their paychecks. In addition, many of the participants were nowhere near poor (enrollees had taxable incomes of up to $50,000). Even among those who saved for a full year and got their 50% bonuses, more than 60% cashed out and withdrew all their savings immediately after the end of the one-year lock-up period. If people find it difficult to save small sums under such favorable conditions, it is simply unrealistic to expect low-wage workers to save up for their own sick days, holidays, and vacation days.

The progressive solution to the rainy day problem is a federally mandated 10-10-10 plan for all American workers. Most Americans already have at least 10 sick days, 10 holidays, and 10 vacation days. Most Americans take basic benefits like this for granted and consider 10-10-10 (or better) a basic benefit that defines a "real" job. Well, sweeping parking lots, mowing lawns, and unloading trucks for minimum wage (or less) are real jobs too, and Americans who take on these tough tasks rarely get 10-10-10. They are lucky to get any days off at all. Whether working in air-conditioned offices or on sun-baked parking lots, all progressives can agree that 10-10-10 is a basic minimum standard that no one should have to go without. The demand for 10-10-10 should be the rallying cry that unites us all. Everyone needs 10-10-10.

Herman Cain etched 9-9-9 permanently into America's collective political memory. For a while it made him the Republican front-runner in the 2012 primary campaign. In 2016 progressives should do him one better. One, one, and one better. Every progressive Presidential candidate should embrace 10-10-10 from the very start of the 2016 primary season. It is hard to imagine a progressive argument against it. Who doesn't deserve 10-10-10? Everyone deserves a break now and then, and even people who don't deserve a break still need one. The 10-10-10 plan ensures that everyone gets the time off that everyone needs. It's the least we can do--and we should do it. Say it often and say it loud: 10-10-10 in 2016!

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

The following is an excerpt from the author's new book, Sixteen for '16: a Progressive Agenda for a Better America, and is re-printed with the kind permission of Policy Press publishers.

Far and away the most memorable slogan of the 2012 election campaign was the Republican candidate Herman Cain's "9-9-9" plan. It sure beats "Forward" (Barack Obama) and "Believe in America" (Mitt Romney) and is right up there with "Commerce, Education and the... uh, what's the third one there?" (Rick Perry). Herman Cain and his economic advisor, Cleveland accountant Rich Lowrie, called for a 9% value added tax, a 9% flat income tax, and 9% federal sales tax to replace all existing federal taxes. It has been suggested Cain's campaign copied the 9-9-9 plan from the default tax structure implemented in the computer game Sim City 3. Whether or not this is true, no one believes that 9-9-9 is a practical solution to the problems of contemporary society. No one, that is, outside the Herman Cain campaign team and presumably the still-operating 9-9-9 Fund political action committee.

After dropping out of the Republican nomination battle, Cain was invited to deliver the Tea Party State of the Union response in January 2012. Look for a return of the 9-9-9 plan in 2016, with or without Herman Cain. It might raise taxes on nearly all American households while still somehow managing to decimate overall federal government revenues, but there's no denying that it's a great slogan. Even if Cain doesn't run in 2016, expect someone else to pick it up.

Whether or not Cain makes a comeback in 2016, progressives would do well to up the ante one notch by introducing their own 10-10-10 plan. The 10-10-10 plan would require all employers to provide 10 paid sick days, 10 paid holidays, and 10 paid vacation days a year for all full-time workers, prorated for part-time workers as well. Those with well-paid professional jobs may not realize that other people don't already have 10-10-10, but they don't. Far from it. For many working Americans, 10-10-10 would be a dream come true.

Take sick days. Today just 65%--less than two-thirds--of all American workers have any opportunity to take paid sick days at all, according to official government statistics. This figure covers all workers, both full- and part-time. Hispanic Americans are particularly disadvantaged when it comes to sick leave. Many people expect paid sick days to be an ordinary benefit of a full-time job, but only 74% of full-time private sector workers receive any paid sick days at all. For part-time workers the figures are catastrophic: just 26 % of all workers and 24 % of private sector workers have the opportunity to take paid sick days. And part-time employment is the fastest-growing segment of the labor force.

The real situation for vulnerable parts of the workforce is even worse than these statistics indicate. Government statistics completely ignore the cash economy of illegal and semi-legal employment. Day laborers who wait before dawn in the parking lots of home improvement warehouses every morning looking for work do not get paid sick days--and they are not included in government employment benefits surveys. Accounting for those who fall between the cracks of government record-keeping and those who technically get paid sick days but are afraid to use them, it is likely that slightly less than half of all American workers can feel secure about calling in sick when they come down with the flu, without fear of losing pay--or even their jobs. Fewer still can afford to get seriously ill, be involved in a car crash, or need an operation.

You should at least be able to get sick on a holiday. The United States has 10 federal holidays: New Year's Day, Martin Luther King Day, Presidents' Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans' Day, Thanksgiving, and Christmas. Except of course that in the United States your employer doesn't have to give you a paid day off just because it's a public holiday. Only 76% of American workers get any paid holidays at all. Among part-timers that figure drops to 38%.

Similarly, paid vacation days are the preserve of well-paid full-time workers. Among all workers the proportion receiving paid vacation time is 74%. Among part-timers it is 34%. State and local governments are particularly stingy with paid vacation time. Only two thirds of full-time state and local government workers receive paid vacation days.

All of these figures get worse the farther you go down the pay scale, and all of them are worse for small employers. In the bottom quarter of the economy (those paid at or near minimum wage) only 30% of private sector workers get any paid sick days and slightly less than half get paid holidays and vacation days. And again, these figures apply only to the kinds of employers that get caught up in federal statistical surveys. Your local supermarket is in. Your local unregistered after-hours parking lot cleaning company is almost certainly out.

And that is part of the problem. Big companies now outsource many services that used to be performed by their own employees. The result is that a job with a barely regulated big business has been turned into a job with a completely unregulated small business. Among large private-sector employers of 500 or more workers, 81% offer their workers paid sick days. Among small employers of fewer than 100 employees, the figure is 51%. When jobs are outsourced from big companies to small contractors, benefits like sick pay tend to disappear. The lack of benefits and poor working conditions are the reasons why small private contractors can clean parking lots, mow lawns, and unload trucks more cheaply than big, super-efficient retailers can do these jobs for themselves.

For example, industry bulletin boards report that Walmart pays its contractors and through them its sub-contractors anywhere from $22 to $50 to clean an entire store parking lot in the middle of the night. These rates seem to be typical for other big-box retail stores as well. To put these rates into perspective, a big box retail store can have its parking lot cleaned overnight so that it is litter-free and ready to welcome your car in the morning for roughly the price of a nice shirt. Think how many shirts (toasters, drills) these stores sell in a day and it gives you some idea what a trivial expense cleaning is for a large store. Despite these already super-low rates, industry bulletin boards are full of online posts from contractors complaining about being screwed down from $35 to $30 to $25 a job. Big retailers are always looking for that extra $5. Mind you, that's not an extra $5 per customer or $5 per item sold. That's an extra $5 a day--or a store the size of a Walmart. No one ever got rich throwing away pennies.

In this business-outsourcing sector of the economy if you don't work, you don't get paid. It's as simple as that. And the big businesses that do the outsourcing typically shirk any responsibility for what happens to the outsourced workers, including injuries. Don't even ask about retirement. But then, what's wrong with paying people only for the hours they actually work? Many high-skill professionals work on this principle. Just ask any freelance writer, designer, or architect. Or any small business owner. Freelancers and small business owners have to set aside savings for rainy days all on their own. No one gives them paid sick days, holidays, or vacation days. They rely on their own discipline and planning to pay for time off.

"The 10-10-10 plan ensures that everyone gets the time off that everyone needs. It's the least we can do--and we should do it."

The difference between freelancers and hourly workers is that at the federal minimum wage of $7.25 an hour, or even at President Obama's preferred minimum wage of $10.10 an hour, it is nearly impossible to save for a rainy day. A bare minimum 10-10-10 benefits plan of 10 paid sick days, 10 paid holidays, and 10 paid vacation days a year amounts to 30 days off out of a typical 260-day work year. Roughly speaking, workers have to save 11.5% of their take-home pay every week to fund a 10-10-10 plan through personal discipline and planning alone. Personal discipline is quite a tall order when your total take-home pay is just $268 a week (minimum wage minus payroll taxes) or even $373 a week ($10.10 an hour minus payroll taxes). Planning can be even harder. People who have irregular, poorly paid jobs with no benefits tend to know many other people who have irregular, poorly paid jobs with no benefits. When people do somehow manage to save for a rainy day, more often than not they find themselves saving for someone else's rainy day. That is to say, if it comes to a choice between keeping your savings intact or paying your son's speeding ticket to keep him out of jail, it takes a hard heart to save your savings for your own rainy day.

Research on micro-savings plans confirms this. In 2011 and 2012, low- and middle-income Americans in four cities were recruited for a pilot study on the impact of incentives to save. Participants were offered a 50% bonus (up to $500) if they saved up to $1,000 of their tax refunds for at least one year. Depending on how the results are interpreted, between one quarter and one third of the study participants were unable to keep their pledged savings in the bank for a full year, despite the massive reward of a 50% bonus at the end of the study period. And this study represents a best case scenario: Research subjects got their money in a lump sum (through their tax refunds) instead of having to save money a few dollars a week out of their paychecks. In addition, many of the participants were nowhere near poor (enrollees had taxable incomes of up to $50,000). Even among those who saved for a full year and got their 50% bonuses, more than 60% cashed out and withdrew all their savings immediately after the end of the one-year lock-up period. If people find it difficult to save small sums under such favorable conditions, it is simply unrealistic to expect low-wage workers to save up for their own sick days, holidays, and vacation days.

The progressive solution to the rainy day problem is a federally mandated 10-10-10 plan for all American workers. Most Americans already have at least 10 sick days, 10 holidays, and 10 vacation days. Most Americans take basic benefits like this for granted and consider 10-10-10 (or better) a basic benefit that defines a "real" job. Well, sweeping parking lots, mowing lawns, and unloading trucks for minimum wage (or less) are real jobs too, and Americans who take on these tough tasks rarely get 10-10-10. They are lucky to get any days off at all. Whether working in air-conditioned offices or on sun-baked parking lots, all progressives can agree that 10-10-10 is a basic minimum standard that no one should have to go without. The demand for 10-10-10 should be the rallying cry that unites us all. Everyone needs 10-10-10.

Herman Cain etched 9-9-9 permanently into America's collective political memory. For a while it made him the Republican front-runner in the 2012 primary campaign. In 2016 progressives should do him one better. One, one, and one better. Every progressive Presidential candidate should embrace 10-10-10 from the very start of the 2016 primary season. It is hard to imagine a progressive argument against it. Who doesn't deserve 10-10-10? Everyone deserves a break now and then, and even people who don't deserve a break still need one. The 10-10-10 plan ensures that everyone gets the time off that everyone needs. It's the least we can do--and we should do it. Say it often and say it loud: 10-10-10 in 2016!

The following is an excerpt from the author's new book, Sixteen for '16: a Progressive Agenda for a Better America, and is re-printed with the kind permission of Policy Press publishers.

Far and away the most memorable slogan of the 2012 election campaign was the Republican candidate Herman Cain's "9-9-9" plan. It sure beats "Forward" (Barack Obama) and "Believe in America" (Mitt Romney) and is right up there with "Commerce, Education and the... uh, what's the third one there?" (Rick Perry). Herman Cain and his economic advisor, Cleveland accountant Rich Lowrie, called for a 9% value added tax, a 9% flat income tax, and 9% federal sales tax to replace all existing federal taxes. It has been suggested Cain's campaign copied the 9-9-9 plan from the default tax structure implemented in the computer game Sim City 3. Whether or not this is true, no one believes that 9-9-9 is a practical solution to the problems of contemporary society. No one, that is, outside the Herman Cain campaign team and presumably the still-operating 9-9-9 Fund political action committee.

After dropping out of the Republican nomination battle, Cain was invited to deliver the Tea Party State of the Union response in January 2012. Look for a return of the 9-9-9 plan in 2016, with or without Herman Cain. It might raise taxes on nearly all American households while still somehow managing to decimate overall federal government revenues, but there's no denying that it's a great slogan. Even if Cain doesn't run in 2016, expect someone else to pick it up.

Whether or not Cain makes a comeback in 2016, progressives would do well to up the ante one notch by introducing their own 10-10-10 plan. The 10-10-10 plan would require all employers to provide 10 paid sick days, 10 paid holidays, and 10 paid vacation days a year for all full-time workers, prorated for part-time workers as well. Those with well-paid professional jobs may not realize that other people don't already have 10-10-10, but they don't. Far from it. For many working Americans, 10-10-10 would be a dream come true.

Take sick days. Today just 65%--less than two-thirds--of all American workers have any opportunity to take paid sick days at all, according to official government statistics. This figure covers all workers, both full- and part-time. Hispanic Americans are particularly disadvantaged when it comes to sick leave. Many people expect paid sick days to be an ordinary benefit of a full-time job, but only 74% of full-time private sector workers receive any paid sick days at all. For part-time workers the figures are catastrophic: just 26 % of all workers and 24 % of private sector workers have the opportunity to take paid sick days. And part-time employment is the fastest-growing segment of the labor force.

The real situation for vulnerable parts of the workforce is even worse than these statistics indicate. Government statistics completely ignore the cash economy of illegal and semi-legal employment. Day laborers who wait before dawn in the parking lots of home improvement warehouses every morning looking for work do not get paid sick days--and they are not included in government employment benefits surveys. Accounting for those who fall between the cracks of government record-keeping and those who technically get paid sick days but are afraid to use them, it is likely that slightly less than half of all American workers can feel secure about calling in sick when they come down with the flu, without fear of losing pay--or even their jobs. Fewer still can afford to get seriously ill, be involved in a car crash, or need an operation.

You should at least be able to get sick on a holiday. The United States has 10 federal holidays: New Year's Day, Martin Luther King Day, Presidents' Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans' Day, Thanksgiving, and Christmas. Except of course that in the United States your employer doesn't have to give you a paid day off just because it's a public holiday. Only 76% of American workers get any paid holidays at all. Among part-timers that figure drops to 38%.

Similarly, paid vacation days are the preserve of well-paid full-time workers. Among all workers the proportion receiving paid vacation time is 74%. Among part-timers it is 34%. State and local governments are particularly stingy with paid vacation time. Only two thirds of full-time state and local government workers receive paid vacation days.

All of these figures get worse the farther you go down the pay scale, and all of them are worse for small employers. In the bottom quarter of the economy (those paid at or near minimum wage) only 30% of private sector workers get any paid sick days and slightly less than half get paid holidays and vacation days. And again, these figures apply only to the kinds of employers that get caught up in federal statistical surveys. Your local supermarket is in. Your local unregistered after-hours parking lot cleaning company is almost certainly out.

And that is part of the problem. Big companies now outsource many services that used to be performed by their own employees. The result is that a job with a barely regulated big business has been turned into a job with a completely unregulated small business. Among large private-sector employers of 500 or more workers, 81% offer their workers paid sick days. Among small employers of fewer than 100 employees, the figure is 51%. When jobs are outsourced from big companies to small contractors, benefits like sick pay tend to disappear. The lack of benefits and poor working conditions are the reasons why small private contractors can clean parking lots, mow lawns, and unload trucks more cheaply than big, super-efficient retailers can do these jobs for themselves.

For example, industry bulletin boards report that Walmart pays its contractors and through them its sub-contractors anywhere from $22 to $50 to clean an entire store parking lot in the middle of the night. These rates seem to be typical for other big-box retail stores as well. To put these rates into perspective, a big box retail store can have its parking lot cleaned overnight so that it is litter-free and ready to welcome your car in the morning for roughly the price of a nice shirt. Think how many shirts (toasters, drills) these stores sell in a day and it gives you some idea what a trivial expense cleaning is for a large store. Despite these already super-low rates, industry bulletin boards are full of online posts from contractors complaining about being screwed down from $35 to $30 to $25 a job. Big retailers are always looking for that extra $5. Mind you, that's not an extra $5 per customer or $5 per item sold. That's an extra $5 a day--or a store the size of a Walmart. No one ever got rich throwing away pennies.

In this business-outsourcing sector of the economy if you don't work, you don't get paid. It's as simple as that. And the big businesses that do the outsourcing typically shirk any responsibility for what happens to the outsourced workers, including injuries. Don't even ask about retirement. But then, what's wrong with paying people only for the hours they actually work? Many high-skill professionals work on this principle. Just ask any freelance writer, designer, or architect. Or any small business owner. Freelancers and small business owners have to set aside savings for rainy days all on their own. No one gives them paid sick days, holidays, or vacation days. They rely on their own discipline and planning to pay for time off.

"The 10-10-10 plan ensures that everyone gets the time off that everyone needs. It's the least we can do--and we should do it."

The difference between freelancers and hourly workers is that at the federal minimum wage of $7.25 an hour, or even at President Obama's preferred minimum wage of $10.10 an hour, it is nearly impossible to save for a rainy day. A bare minimum 10-10-10 benefits plan of 10 paid sick days, 10 paid holidays, and 10 paid vacation days a year amounts to 30 days off out of a typical 260-day work year. Roughly speaking, workers have to save 11.5% of their take-home pay every week to fund a 10-10-10 plan through personal discipline and planning alone. Personal discipline is quite a tall order when your total take-home pay is just $268 a week (minimum wage minus payroll taxes) or even $373 a week ($10.10 an hour minus payroll taxes). Planning can be even harder. People who have irregular, poorly paid jobs with no benefits tend to know many other people who have irregular, poorly paid jobs with no benefits. When people do somehow manage to save for a rainy day, more often than not they find themselves saving for someone else's rainy day. That is to say, if it comes to a choice between keeping your savings intact or paying your son's speeding ticket to keep him out of jail, it takes a hard heart to save your savings for your own rainy day.

Research on micro-savings plans confirms this. In 2011 and 2012, low- and middle-income Americans in four cities were recruited for a pilot study on the impact of incentives to save. Participants were offered a 50% bonus (up to $500) if they saved up to $1,000 of their tax refunds for at least one year. Depending on how the results are interpreted, between one quarter and one third of the study participants were unable to keep their pledged savings in the bank for a full year, despite the massive reward of a 50% bonus at the end of the study period. And this study represents a best case scenario: Research subjects got their money in a lump sum (through their tax refunds) instead of having to save money a few dollars a week out of their paychecks. In addition, many of the participants were nowhere near poor (enrollees had taxable incomes of up to $50,000). Even among those who saved for a full year and got their 50% bonuses, more than 60% cashed out and withdrew all their savings immediately after the end of the one-year lock-up period. If people find it difficult to save small sums under such favorable conditions, it is simply unrealistic to expect low-wage workers to save up for their own sick days, holidays, and vacation days.

The progressive solution to the rainy day problem is a federally mandated 10-10-10 plan for all American workers. Most Americans already have at least 10 sick days, 10 holidays, and 10 vacation days. Most Americans take basic benefits like this for granted and consider 10-10-10 (or better) a basic benefit that defines a "real" job. Well, sweeping parking lots, mowing lawns, and unloading trucks for minimum wage (or less) are real jobs too, and Americans who take on these tough tasks rarely get 10-10-10. They are lucky to get any days off at all. Whether working in air-conditioned offices or on sun-baked parking lots, all progressives can agree that 10-10-10 is a basic minimum standard that no one should have to go without. The demand for 10-10-10 should be the rallying cry that unites us all. Everyone needs 10-10-10.

Herman Cain etched 9-9-9 permanently into America's collective political memory. For a while it made him the Republican front-runner in the 2012 primary campaign. In 2016 progressives should do him one better. One, one, and one better. Every progressive Presidential candidate should embrace 10-10-10 from the very start of the 2016 primary season. It is hard to imagine a progressive argument against it. Who doesn't deserve 10-10-10? Everyone deserves a break now and then, and even people who don't deserve a break still need one. The 10-10-10 plan ensures that everyone gets the time off that everyone needs. It's the least we can do--and we should do it. Say it often and say it loud: 10-10-10 in 2016!