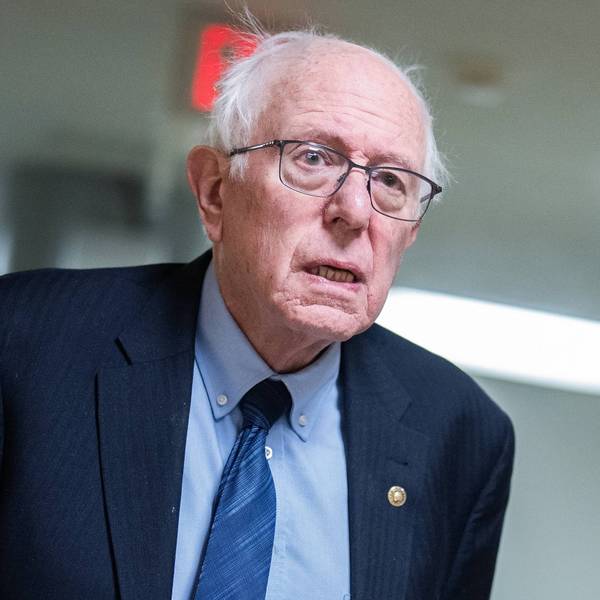

It's not surprising that the Washington Post (owned by billionaire Jeff Bezos) would be unhappy with a presidential candidate running on a platform of taking back the country from the millionaires and billionaires. Therefore the trashing of Sen. Bernie Sanders in an editorial, "Bernie Sanders' Fiction-Filled Campaign" (1/27/16), was about as predictable as the sun rising.

While there is much here that is misleading, it's worth focusing on the central theme. The piece tells readers:

The existence of large banks and lax campaign finance laws explains why working Americans are not thriving, he says, and why the progressive agenda has not advanced. Here is a reality check: Wall Street has already undergone a round of reform, significantly reducing the risks big banks pose to the financial system. The evolution and structure of the world economy, not mere corporate deck-stacking, explained many of the big economic challenges the country still faces. And even with radical campaign finance reform, many Americans and their representatives would still oppose the Sanders agenda.

If we can confront the Post's "reality check" with real-world reality, it is worth noting that the largest banks are in fact much larger than they were before the crisis, as a result of a wave of mergers that was approved at the peak of the panic. Furthermore, the industry as a whole is getting bigger, not smaller. It was under 17.0 percent of national income in 2007; last year it was almost 18.0 percent.

There has been research in recent years from both the Bank of International Settlements and International Monetary Fund showing that a large financial sector is a drag on growth. For this reason, Sanders' proposal for a financial transactions tax, which would be a big step towards downsizing the industry, would be well-received by a more reality-based newspaper.

As far as the rest of the story, longer and stronger patent protections were not just the "evolution of the world economy." They were the result of deliberate policy that had the effect of redistributing income upward to the pharmaceutical companies, the entertainment industry and the software industry. The same is true of a pattern of international trade that was quite explicitly designed to put manufacturing workers in direct competition with low-paid workers in the developing world.

At the same time, we maintained or increased barriers that protect highly educated professionals like doctors and lawyers. The predicted and actual consequence of this pattern of trade was to reduce the pay of the bulk of the workforce, that either work in manufacturing or compete with people who work in manufacturing, to the benefit of the most highly paid workers. This sure looks like stacking of the economy.

Naturally, the Post also gets into its complaints about how Sanders doesn't address the long-term budget deficit, apparently not noticing that if Sanders is successful in reforming health care, then this problem largely goes away. Of course, for most of the country, a hugely underemployed economy that has not produced real wage gains for most workers in the last four decades is a much higher priority than the possibility that somewhere in the next decade or two we might see tax increases of the sort we had in the decades of the '50s, '60s, '70s and '80s. It is understandable that the Post and the millionaires and billionaires would like us to focus on taxes, but the rest of the country is much more worried about their before-tax income.