The website Vox (3/25/16) has what editor-in-chief Ezra Klein describes as an "excellent tax calculator" that, in its headline's promise, "Tells You How Each Presidential Candidate's Tax Plan Affects You."

Actually, it does no such thing; it's a gimmick that is entirely useless except as a deceptive advertisement for Hillary Clinton.

As a gimmick, it's pretty simple. You put in your annual income (actually, your "expanded cash income," which you probably don't know even if you know what it is), whether you're single or married and whether you have no kids, one kid, or two or more kids. And then it tells you what Donald Trump's, Ted Cruz's, Hillary Clinton's and Bernie Sanders' "plans mean for your federal tax liability."

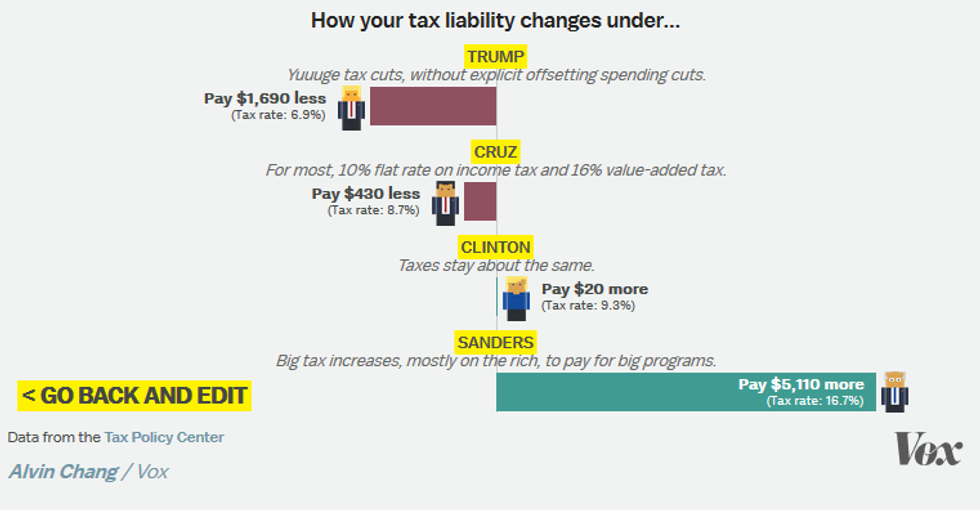

Let's try it out with the US median household income ($43,585), married, two kids. You get a graphic that looks like this:

"Pay $5,110 more"--holy smokes! Stop the revolution, I want to get off! Why didn't someone (besides Vox's Alvin Chang) tell me that "Sanders wants to implement massive increases across the board, including on the poor"?

Maybe because he doesn't--and you wouldn't pay $5,110 more, or anything like it.

Mostly, that big number you get for the Sanders tax hike when you plug in your income is the payroll tax that employers will pay to cover the cost of a single-payer healthcare system. As the Tax Policy Center, which worked with Vox to create the calculator, explains:

We're including payroll taxes, excise taxes and corporate income taxes as well as individual income taxes.... Most economists think employers pass their share of the tax on to workers in the form of lower wages.

With all due respect to most economists, this is dubious. Unless you work at the rare enterprise that does not have profit as its primary goal, your bosses are already paying you as little as they think they can get away with. If they get a new cost associated with your employment, they may try to raise their prices. They may look for other areas where they can cut costs. They may even decide that they can no longer afford to employ you. But what they won't do is suddenly realize that they could have been paying you thousands of dollars less all along without you quitting. (They may even be forced to accept a lower profit rate, though that's something "most economists" seem to exclude a priori.)

But that's not even the real problem with Vox's calculator. Sanders' plan is based on using a new payroll tax to pay for a single-payer healthcare system, which will relieve businesses of the considerable burden of paying for employee healthcare. Since just about everyone agrees that single-payer is cheaper than what we have now (including Ezra Klein, before Sanders started running against Clinton on a single-payer platform), in theory business as a whole should come out ahead. But certainly you need to take into account that business would be getting a big break on expenses at the same time that it's getting a new tax, right?

No, Vox thinks you don't need to take that into account. From the calculator's FAQ: "The Tax Policy Center's model does not include spending programs and thus can only show the effects of tax changes."

Imagine a website--maybe one that seems to have a pronounced pro-Sanders tilt--creating a "Benefits Calculator" that promises to tell you how each candidate's benefits plan affects you. The calculator guesstimates how much your employer will save with a single-payer plan and, using the same dubious economics, implies that that savings is money in your bank account. What about your employer's big tax hike? It's a benefits calculator--it can't show the effect of tax changes!

Ezra Klein would be the first to say that a website that constructed a machine for telling people that Bernie Sanders would give them thousands of dollars was engaging in partisan hackery. Yet when Vox does the same thing in reverse, it's data-driven journalism. Or something.