SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"Consolidation in the oil and gas industry, like this proposed Enbridge-Spectra merger, will only increase the industry's power to influence politicians and regulators, and generate profit over the public interest." (Image: Food & Water Watch)

In case you hadn't heard, resistance to the now-infamous Dakota Access oil pipeline project isn't letting up. It's only growing stronger. For months, the Standing Rock Sioux and allied indigenous tribes throughout the country have been actively but peacefully resisting construction of the pipeline, which would threaten the safety and sanctity of their sacred tribal lands.

More recently, activists across the country standing in solidarity with affected indigenous communities have demonstrated against Dakota Access and other harmful fossil fuel pipeline projects from coast to coast. In the meantime, state authorities have shamefully filed criminal charges against journalists covering the pipeline resistance.

Last month, in support of all those opposing the Dakota Access pipeline, Food & Water Watch released a widely-disseminated profile of the major American and international banking entities that are bankrolling the pipeline - and expecting to profit heavily off of it. The report, Who's Banking on the Dakota Access Pipeline?, illuminated the deep stake our country's financial corporations have in maintaining society's dependence on dirty, antiquated fossil fuels.

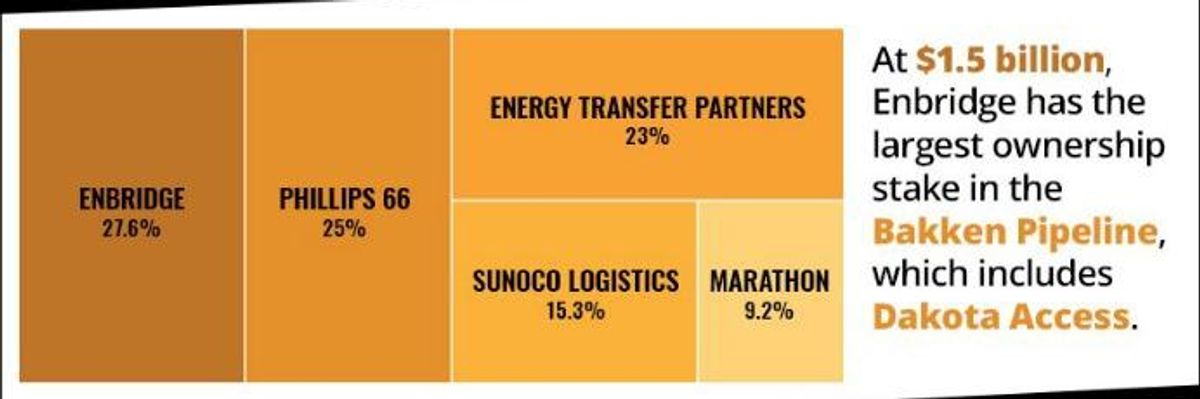

Now we're taking a look at the companies building the pipeline - with huge support from those big banks. We're shedding light on who owns Dakota Access and connected pipelines leading to regional refineries and export terminals. Not surprisingly, our profile features powerful multinational fossil fuel companies, including Phillips 66, Sunoco Logistics, Marathon and Energy Transfer Partners. But the Canadian tar sands oil and pipeline giant Enbridge has the largest individual stake in Dakota Access.

In September, Enbridge announced a proposed merger with Spectra, a U.S. gas pipeline giant with a record of accidents and mishaps rivaling that of Enbridge itself. It was Enbridge that sent hundreds of thousands of barrels of oil into the Kalamazoo, and it was a Spectra gas pipeline that exploded in Pennsylvania last April, severely burning a man.

The presidents of Enbridge and Spectra met with 11 bankers to announce the merger, the day after private security guards led a widely-reported dog attack on indigenous demonstrators at the pipeline site. Someone from Credit Suisse asked about the demonstrations, and Enbridge's president told the bankers not to worry: "There is difference of views on these projects, and I actually think Energy Transfer... has done a good job of ensuring that people have had input into the project."

This is the Frackopoly at work, trumping public safety and local opposition in the false name of energy security. It's false because there won't be energy security without climate stability. True energy security requires meeting our energy needs without destabilizing the climate, and without sacrificing people's health and welfare along the way. It means an energy future free of fossil fuels.

Consolidation in the oil and gas industry, like this proposed Enbridge-Spectra merger, will only increase the industry's power to influence politicians and regulators, and generate profit over the public interest.

Political revenge. Mass deportations. Project 2025. Unfathomable corruption. Attacks on Social Security, Medicare, and Medicaid. Pardons for insurrectionists. An all-out assault on democracy. Republicans in Congress are scrambling to give Trump broad new powers to strip the tax-exempt status of any nonprofit he doesn’t like by declaring it a “terrorist-supporting organization.” Trump has already begun filing lawsuits against news outlets that criticize him. At Common Dreams, we won’t back down, but we must get ready for whatever Trump and his thugs throw at us. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. By donating today, please help us fight the dangers of a second Trump presidency. |

In case you hadn't heard, resistance to the now-infamous Dakota Access oil pipeline project isn't letting up. It's only growing stronger. For months, the Standing Rock Sioux and allied indigenous tribes throughout the country have been actively but peacefully resisting construction of the pipeline, which would threaten the safety and sanctity of their sacred tribal lands.

More recently, activists across the country standing in solidarity with affected indigenous communities have demonstrated against Dakota Access and other harmful fossil fuel pipeline projects from coast to coast. In the meantime, state authorities have shamefully filed criminal charges against journalists covering the pipeline resistance.

Last month, in support of all those opposing the Dakota Access pipeline, Food & Water Watch released a widely-disseminated profile of the major American and international banking entities that are bankrolling the pipeline - and expecting to profit heavily off of it. The report, Who's Banking on the Dakota Access Pipeline?, illuminated the deep stake our country's financial corporations have in maintaining society's dependence on dirty, antiquated fossil fuels.

Now we're taking a look at the companies building the pipeline - with huge support from those big banks. We're shedding light on who owns Dakota Access and connected pipelines leading to regional refineries and export terminals. Not surprisingly, our profile features powerful multinational fossil fuel companies, including Phillips 66, Sunoco Logistics, Marathon and Energy Transfer Partners. But the Canadian tar sands oil and pipeline giant Enbridge has the largest individual stake in Dakota Access.

In September, Enbridge announced a proposed merger with Spectra, a U.S. gas pipeline giant with a record of accidents and mishaps rivaling that of Enbridge itself. It was Enbridge that sent hundreds of thousands of barrels of oil into the Kalamazoo, and it was a Spectra gas pipeline that exploded in Pennsylvania last April, severely burning a man.

The presidents of Enbridge and Spectra met with 11 bankers to announce the merger, the day after private security guards led a widely-reported dog attack on indigenous demonstrators at the pipeline site. Someone from Credit Suisse asked about the demonstrations, and Enbridge's president told the bankers not to worry: "There is difference of views on these projects, and I actually think Energy Transfer... has done a good job of ensuring that people have had input into the project."

This is the Frackopoly at work, trumping public safety and local opposition in the false name of energy security. It's false because there won't be energy security without climate stability. True energy security requires meeting our energy needs without destabilizing the climate, and without sacrificing people's health and welfare along the way. It means an energy future free of fossil fuels.

Consolidation in the oil and gas industry, like this proposed Enbridge-Spectra merger, will only increase the industry's power to influence politicians and regulators, and generate profit over the public interest.

In case you hadn't heard, resistance to the now-infamous Dakota Access oil pipeline project isn't letting up. It's only growing stronger. For months, the Standing Rock Sioux and allied indigenous tribes throughout the country have been actively but peacefully resisting construction of the pipeline, which would threaten the safety and sanctity of their sacred tribal lands.

More recently, activists across the country standing in solidarity with affected indigenous communities have demonstrated against Dakota Access and other harmful fossil fuel pipeline projects from coast to coast. In the meantime, state authorities have shamefully filed criminal charges against journalists covering the pipeline resistance.

Last month, in support of all those opposing the Dakota Access pipeline, Food & Water Watch released a widely-disseminated profile of the major American and international banking entities that are bankrolling the pipeline - and expecting to profit heavily off of it. The report, Who's Banking on the Dakota Access Pipeline?, illuminated the deep stake our country's financial corporations have in maintaining society's dependence on dirty, antiquated fossil fuels.

Now we're taking a look at the companies building the pipeline - with huge support from those big banks. We're shedding light on who owns Dakota Access and connected pipelines leading to regional refineries and export terminals. Not surprisingly, our profile features powerful multinational fossil fuel companies, including Phillips 66, Sunoco Logistics, Marathon and Energy Transfer Partners. But the Canadian tar sands oil and pipeline giant Enbridge has the largest individual stake in Dakota Access.

In September, Enbridge announced a proposed merger with Spectra, a U.S. gas pipeline giant with a record of accidents and mishaps rivaling that of Enbridge itself. It was Enbridge that sent hundreds of thousands of barrels of oil into the Kalamazoo, and it was a Spectra gas pipeline that exploded in Pennsylvania last April, severely burning a man.

The presidents of Enbridge and Spectra met with 11 bankers to announce the merger, the day after private security guards led a widely-reported dog attack on indigenous demonstrators at the pipeline site. Someone from Credit Suisse asked about the demonstrations, and Enbridge's president told the bankers not to worry: "There is difference of views on these projects, and I actually think Energy Transfer... has done a good job of ensuring that people have had input into the project."

This is the Frackopoly at work, trumping public safety and local opposition in the false name of energy security. It's false because there won't be energy security without climate stability. True energy security requires meeting our energy needs without destabilizing the climate, and without sacrificing people's health and welfare along the way. It means an energy future free of fossil fuels.

Consolidation in the oil and gas industry, like this proposed Enbridge-Spectra merger, will only increase the industry's power to influence politicians and regulators, and generate profit over the public interest.