SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

This plan would be a catastrophe for most Americans. Exempted from that suffering as usual will be the very wealthy who stand to actively benefit from the sick being sucker-punched by the Republican Party and President Trump. (Photo: Eric Thayer/Reuters)

The Republicans' plan to replace the Affordable Care Act is a disaster for the health of the American people. But that may be nothing more than a byproduct of the bill's main impact: it will increase inequality, and make the rich even richer than they've become in the last few decades.

The Republicans' plan to replace the Affordable Care Act is a disaster for the health of the American people. But that may be nothing more than a byproduct of the bill's main impact: it will increase inequality, and make the rich even richer than they've become in the last few decades.

It's not a "health" plan. It's a wealth grab for the already wealthy. Its benefits will go, first and foremost, to billionaires who make more money from investments than from work. The 400 highest-earning households in the country will get an average tax break of $7 million per year under the Republican plan.

"The middle class is dying all across America. More precisely, it's being murdered. The Republican "health" plan would be one more nail in its coffin."

Who will benefit the least? Teachers, nurses, firefighters... pretty much anyone who works for a living.

If this plan becomes law, the rich will get richer, most other people will lose out, and our nation's already record-high levels of inequality will become even worse.

The middle class is dying all across America. More precisely, it's being murdered. The Republican "health" plan would be one more nail in its coffin.

Four decades ago, the top 1 percent of the nation's earners received about 10 percent of the nation's income, while the bottom 50 percent earned about 20 percent. Today those numbers have been reversed:

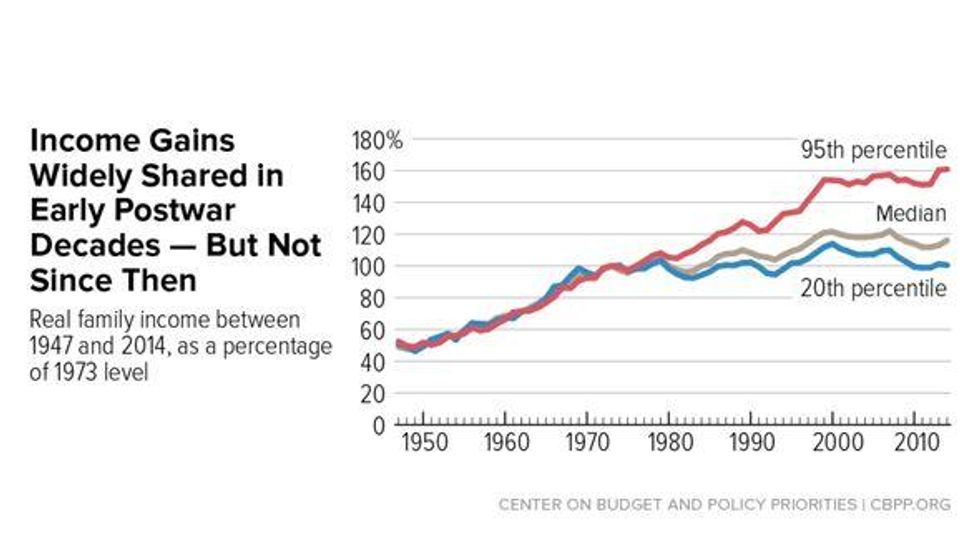

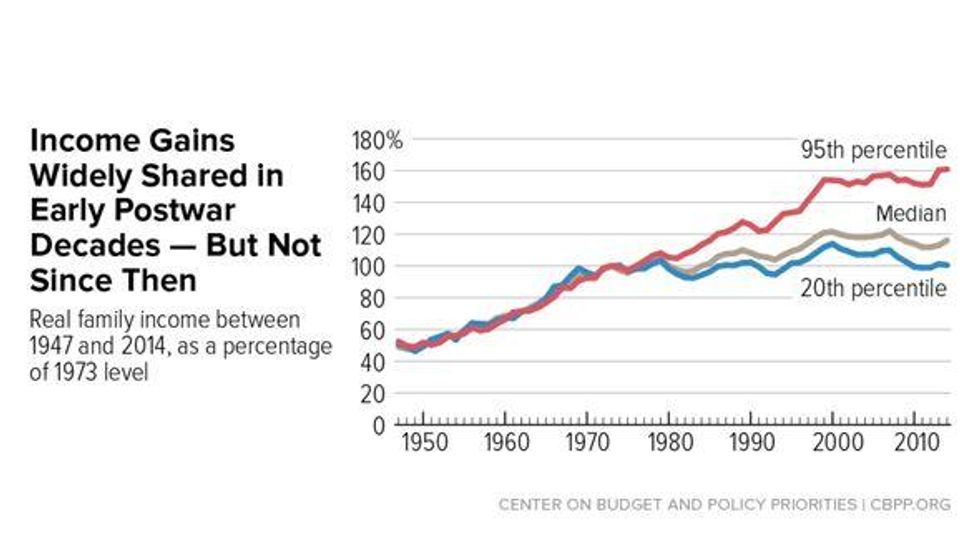

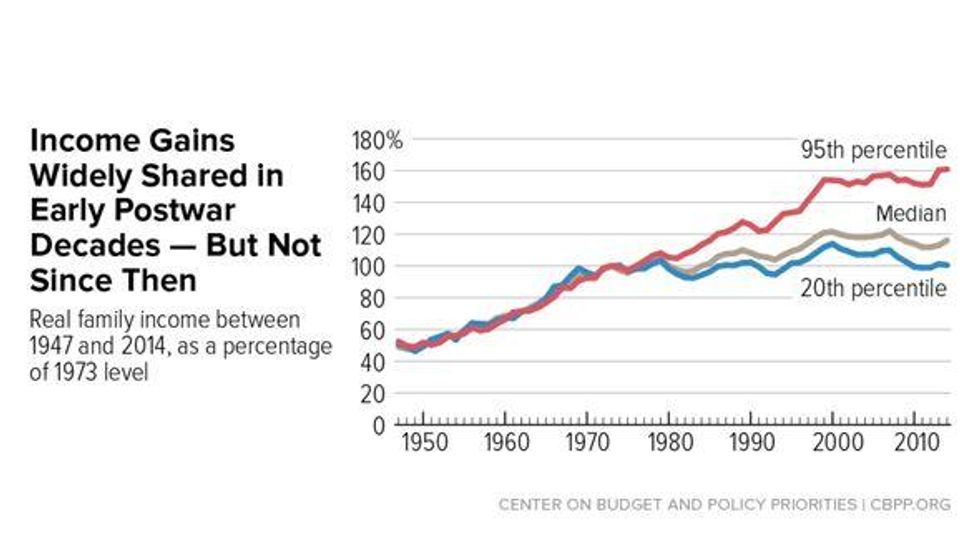

Income gains, which were much more fairly divided in the decades after the Second World War, have been going almost exclusively to the ownership class in recent decades:

Meanwhile, the top marginal tax rate plummeted from 92 percent in the early 1950s to 39.6 percent today.

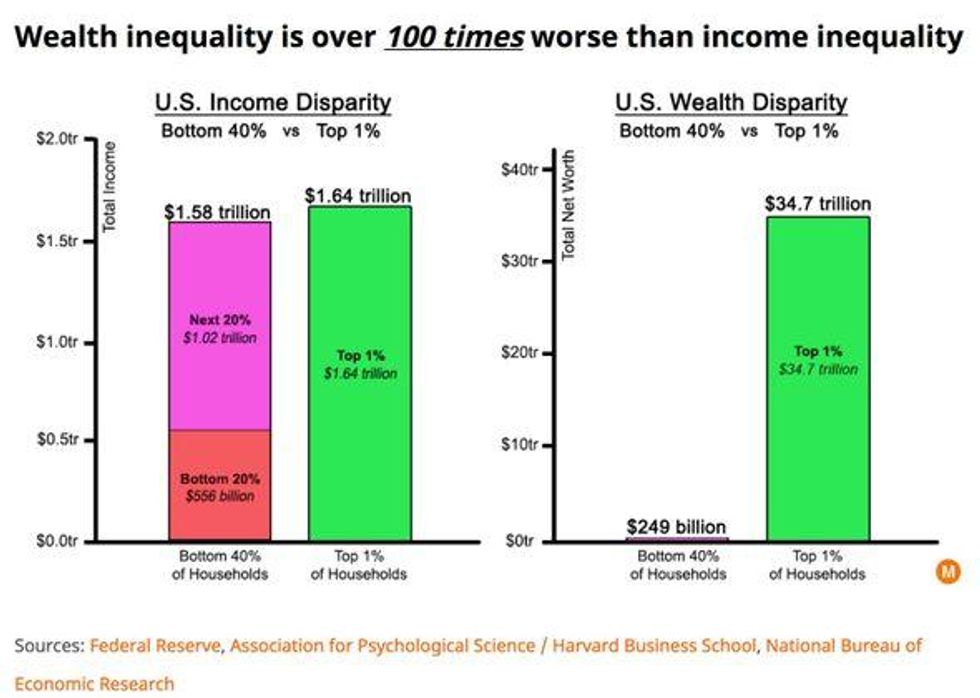

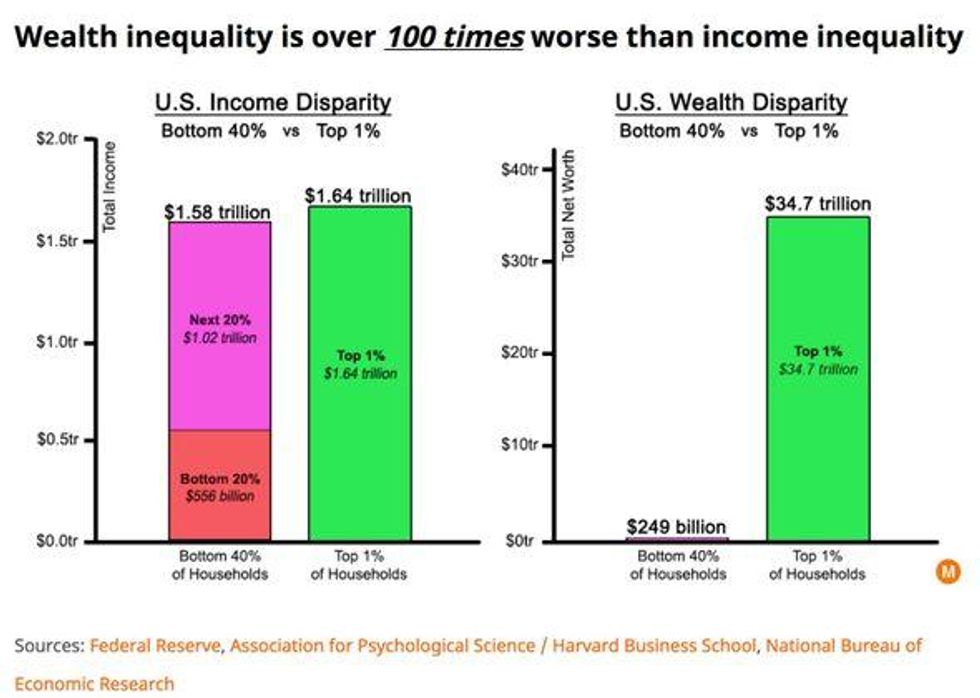

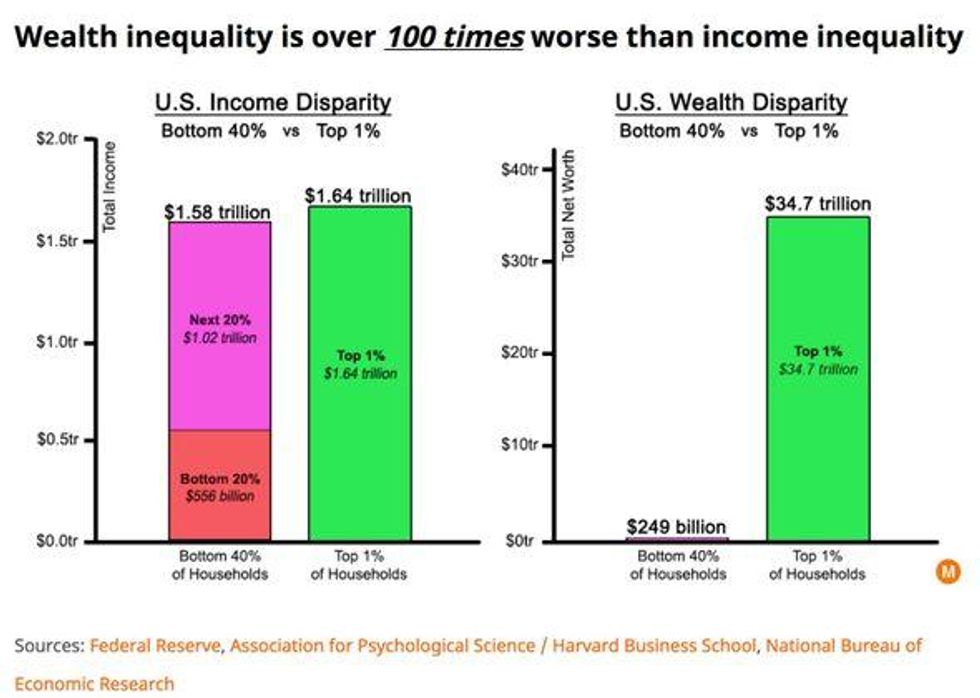

But, as bad as income inequality has become, the inequality in wealth (including assets like real estate, stocks, and other investments) is far worse:

The top 10 percent of Americans makes just over 20 percent of the nation's income, but owns 76 percent of its wealth.

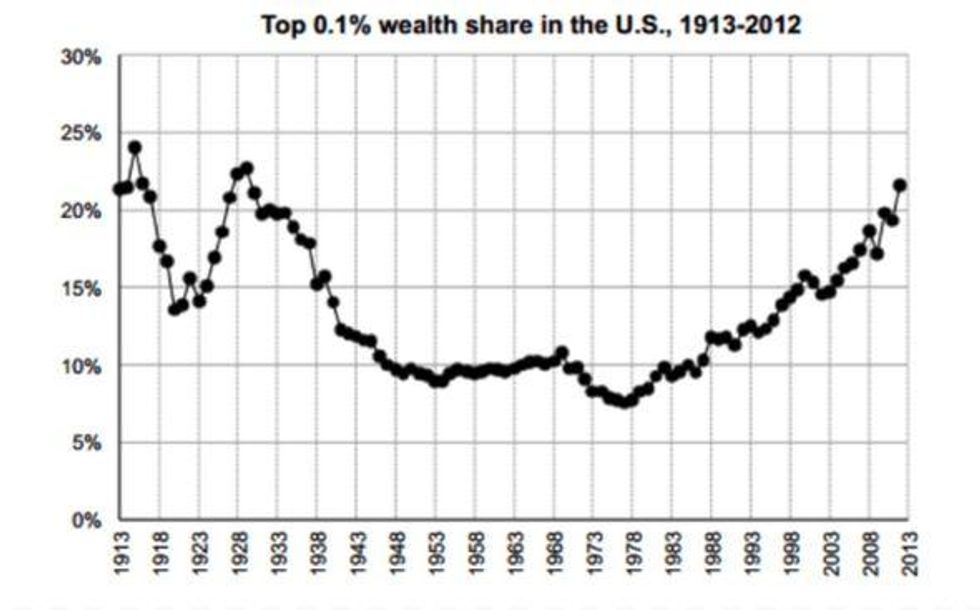

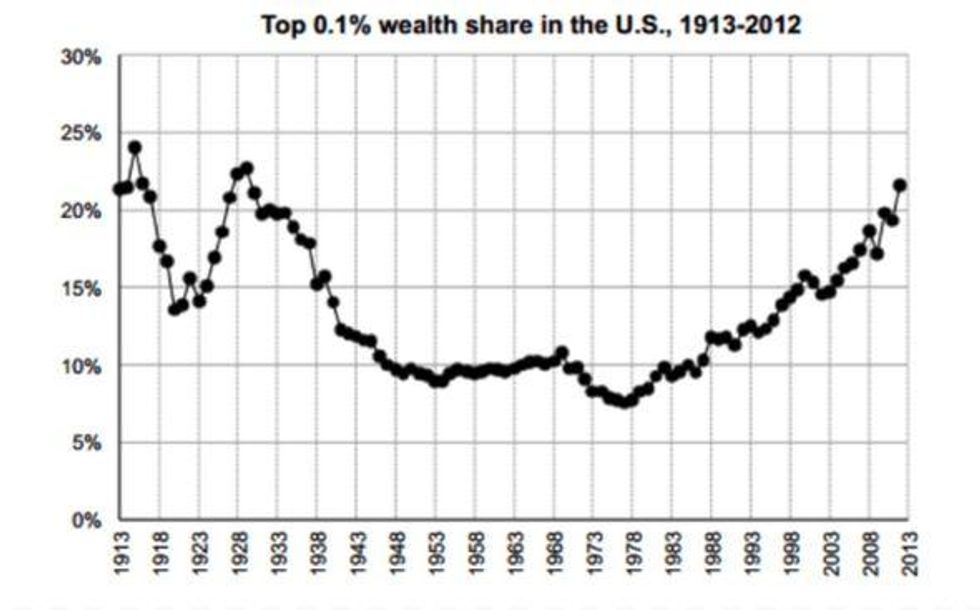

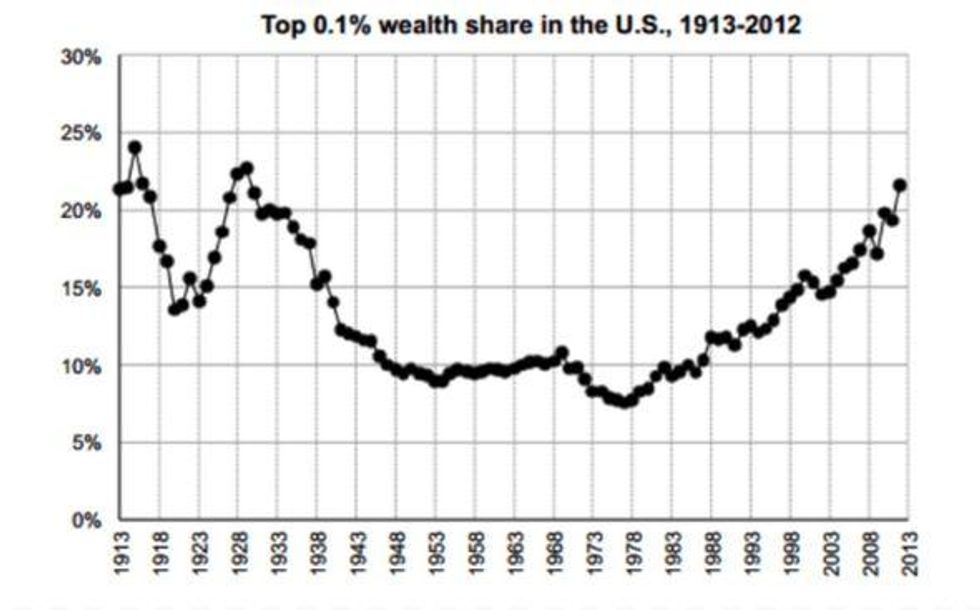

The United States ranks near the bottom in global rankings of wealth inequality. The amount of wealth owned by the top 0.1 percent has reached levels we haven't seen since the Great Depression:

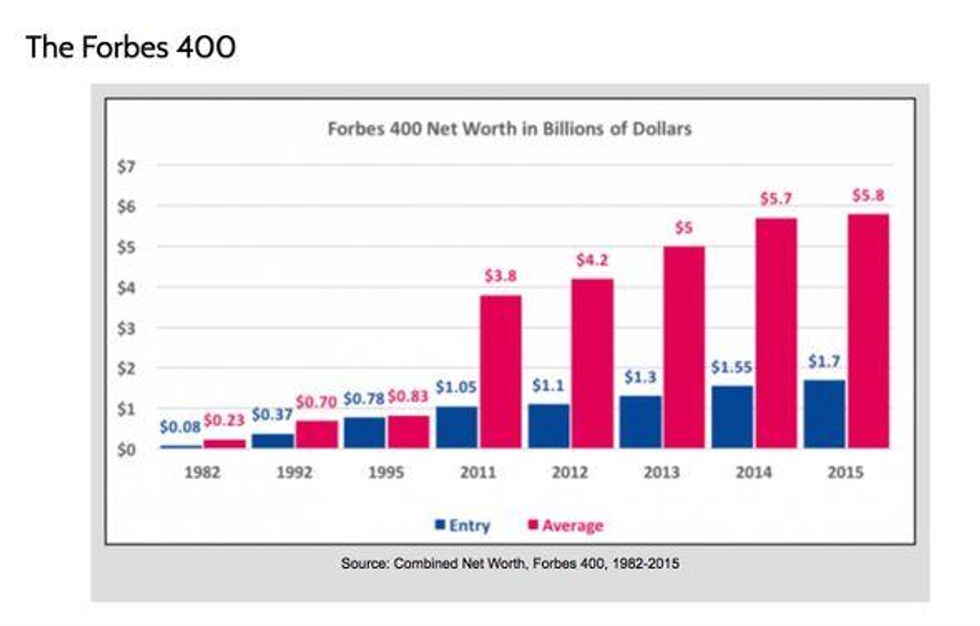

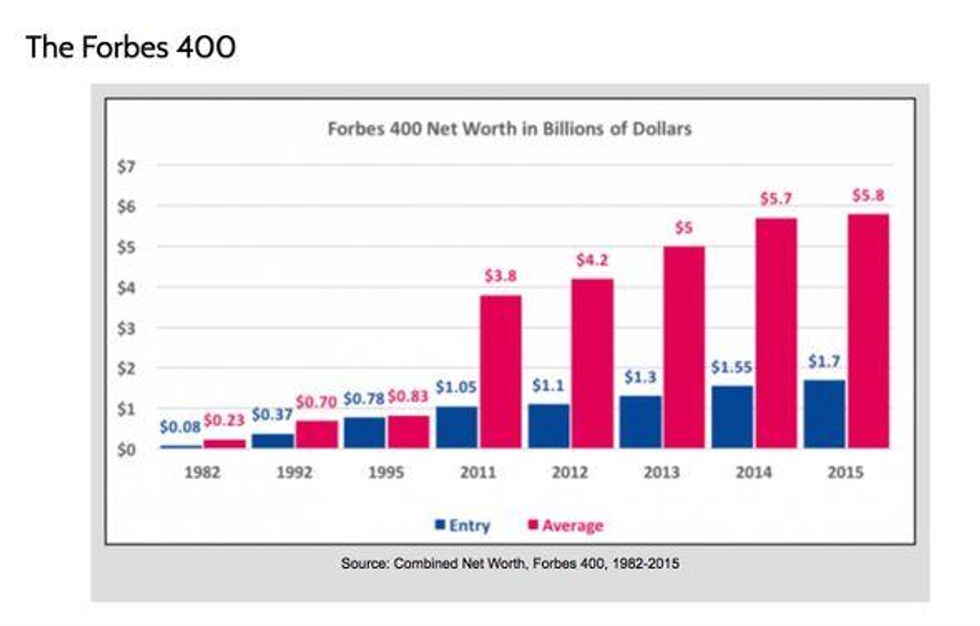

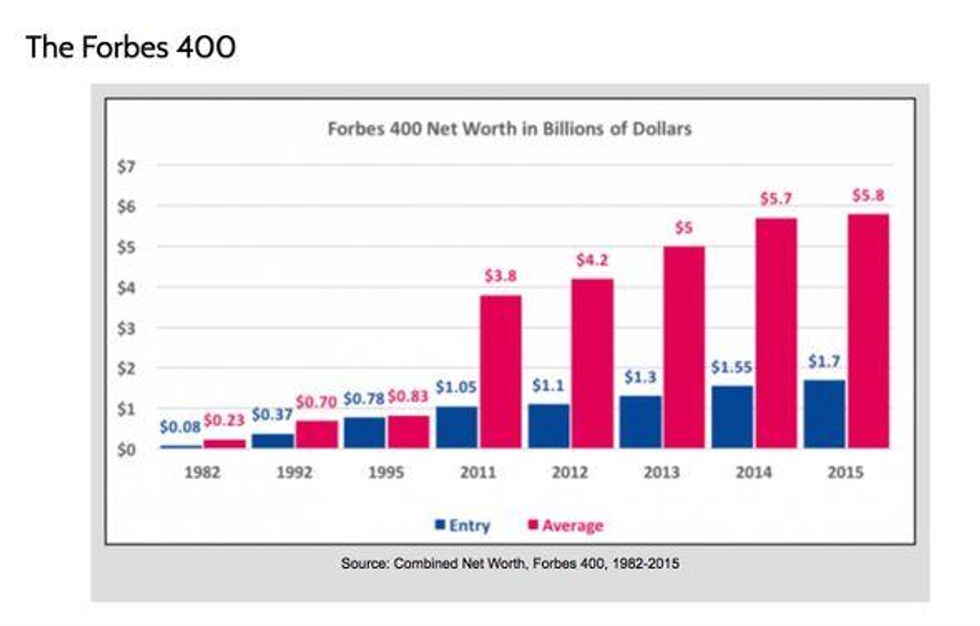

The wealth of the Forbes 400, a list of the nation's richest households, is soaring:

Today, just four American families own as much wealth as 40 percent of the entire population. The Koch Brothers, who provide funding for Republican campaigns and far-right causes, head up two of those four households.

The Koch Brothers invested heavily in efforts to repeal the Affordable Care Act - and now they stand to save a great deal of money from that effort.

The Republicans call their plan the "American Health Care Act," presumably to suggest that the Affordable Care Act was somehow unpatriotic. But what's patriotic about giving hundreds of billions of dollars in tax savings to people who have already hijacked so much of the nation's wealth?

The Republican plan would only cut taxes for individuals making $200,000 or more per year, or $250,000 for couples. The plan removes a surcharge of 0.9 percent on wages above those levels. But it gives its greatest savings to unearned income. The ACA imposed a 3.8 percent tax on investment earnings, which the Republican plan also removes.

This break for unearned income is a tremendous boon for the wealthiest households, who hold much of their assets in money-making passive investments.

Together, these tax cuts constitute an estimated $346 billion giveaway over ten years to households making $200,000 a year or more.

There are other breaks for the rich, too. The Republican plan removes the mandate that requires employers to provide health insurance. The wealthy are more likely to own companies or stock.

The GOP plan lifts the caps on tax-free flexible spending accounts. That benefit is largely used by wealthier Americans, especially at higher income levels, since people on the middle and lower ends of the spectrum often have difficulty setting aside money for future emergencies. Like Trump's proposed child care credit (which is sometimes called the "nanny tax cut"), this provision is a "gift for the rich."

One tax that the Republican plan does not eliminate is the healthcare excise tax on health plans which are costlier than average, or so-called 'Cadillac' plans.The GOP plan retains this tax, but delays its implementation. This tax is based on bad economic theory. It disproportionately targets working Americans, which is why Barack Obama campaigned against it in 2008 before later embracing it.

Despite their nickname, 'Cadillac' plans are not especially generous. Costs are largely driven by the plan's membership, its location, and other factors not related to benefits.

Why was this tax retained? Perhaps because it has little value for wealthy Americans, who aren't likely to depend on employer benefits.

The Republicans have another gift, for a select group of wealthy individuals: healthcare executives. The Affordable Care Act capped the tax deductibility of executive pay at $500,000 per year. Republicans want to remove that provision, although they struggled to rationalize that move. "Unlike Obamacare," an anonymous Republican told Politico, "we do not discriminate against different industries."

The Republican plan would end a number of other taxes, too, including a tax on tanning salons.

Naturally, all these giveaways to the wealthy come with a price tag. Who pays?

Anybody who currently gets healthcare through the ACA exchanges will suffer under the Republican plan. The average enrollee will face more than $2,400 in additional costs by 2020, according to one study,whose authors found that

For families with a head of household age 55 to 64, the bill would increase costs by $7,604. For families with income below 250 percent of poverty, the bill would increase costs by $6,228.

Those figures would get worse over time, because of the GOP plan's design.

Older Americans who don't yet qualify for Medicare will certainly suffer. The Republican bill allows insurers to charge up to five times as much in premiums for people who are approaching age 65. The AARP found that premiums would rise by as much as $3,600 for a 55-year old earning $25,000 per year, $7,000 for a 64-year old earning the same amount, and up to $8,400 for a 64-year old earning $15,000 a year. Out-of-pocket costs would probably rise "significantly," too.

Medicare recipients would be hurt by the GOP plan, as Nancy Altman points out, since those tax cuts for the wealthy would deprive it of funds.

Seniors, lower-income Americans, and others who depend on Medicaid would be badly hurt by spending caps on that program.

Young people who are ill, injured, or disabled could find themselves struggling to pay high out-of-pocket costs under this plan. In fact, sick and injured people of all ages will pay a steep price, since the Republican plan lifts the ACA's requirements for minimum coverage. People who undergo medical treatment often find themselves with shockingly high out-of-pocket costs today. Under this plan, that would get much worse.

Lower-income Americans will be hurt by the Republican plan's weaker subsidies. So will middle class families whose earnings are too high to qualify for the plan's tax credits, but who still struggle to make ends meet.

While the individual mandate is removed under the GOP plan, anybody who experiences an interruption in coverage will pay a 30 percent surcharge for one year in insurance premiums. That will hurt households that are already fighting to stay above water financially, since they're more likely to find it necessary to go without insurance in the first place.

This plan would be a catastrophe for most Americans. How can it be resisted?

First, it's important to remember that the Affordable Care Act was not the ideal solution. Millions of people remain uninsured. Health care costs are still far too high, and they keep rising.

The best way to resist the Republican plan is by defending what we have - and fighting for healthcare that works for all the American people.

In the meantime, it's important to remember that Trump and his fellow Republicans haven't really created a "health" plan. They've created a "wealth" plan for their rich benefactors. This plan won't just make people sicker. It will make the economy sicker, too, and we'll all pay the price.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Richard (RJ) Eskow is a journalist who has written for a number of major publications. His weekly program, The Zero Hour, can be found on cable television, radio, Spotify, and podcast media.

The Republicans' plan to replace the Affordable Care Act is a disaster for the health of the American people. But that may be nothing more than a byproduct of the bill's main impact: it will increase inequality, and make the rich even richer than they've become in the last few decades.

It's not a "health" plan. It's a wealth grab for the already wealthy. Its benefits will go, first and foremost, to billionaires who make more money from investments than from work. The 400 highest-earning households in the country will get an average tax break of $7 million per year under the Republican plan.

"The middle class is dying all across America. More precisely, it's being murdered. The Republican "health" plan would be one more nail in its coffin."

Who will benefit the least? Teachers, nurses, firefighters... pretty much anyone who works for a living.

If this plan becomes law, the rich will get richer, most other people will lose out, and our nation's already record-high levels of inequality will become even worse.

The middle class is dying all across America. More precisely, it's being murdered. The Republican "health" plan would be one more nail in its coffin.

Four decades ago, the top 1 percent of the nation's earners received about 10 percent of the nation's income, while the bottom 50 percent earned about 20 percent. Today those numbers have been reversed:

Income gains, which were much more fairly divided in the decades after the Second World War, have been going almost exclusively to the ownership class in recent decades:

Meanwhile, the top marginal tax rate plummeted from 92 percent in the early 1950s to 39.6 percent today.

But, as bad as income inequality has become, the inequality in wealth (including assets like real estate, stocks, and other investments) is far worse:

The top 10 percent of Americans makes just over 20 percent of the nation's income, but owns 76 percent of its wealth.

The United States ranks near the bottom in global rankings of wealth inequality. The amount of wealth owned by the top 0.1 percent has reached levels we haven't seen since the Great Depression:

The wealth of the Forbes 400, a list of the nation's richest households, is soaring:

Today, just four American families own as much wealth as 40 percent of the entire population. The Koch Brothers, who provide funding for Republican campaigns and far-right causes, head up two of those four households.

The Koch Brothers invested heavily in efforts to repeal the Affordable Care Act - and now they stand to save a great deal of money from that effort.

The Republicans call their plan the "American Health Care Act," presumably to suggest that the Affordable Care Act was somehow unpatriotic. But what's patriotic about giving hundreds of billions of dollars in tax savings to people who have already hijacked so much of the nation's wealth?

The Republican plan would only cut taxes for individuals making $200,000 or more per year, or $250,000 for couples. The plan removes a surcharge of 0.9 percent on wages above those levels. But it gives its greatest savings to unearned income. The ACA imposed a 3.8 percent tax on investment earnings, which the Republican plan also removes.

This break for unearned income is a tremendous boon for the wealthiest households, who hold much of their assets in money-making passive investments.

Together, these tax cuts constitute an estimated $346 billion giveaway over ten years to households making $200,000 a year or more.

There are other breaks for the rich, too. The Republican plan removes the mandate that requires employers to provide health insurance. The wealthy are more likely to own companies or stock.

The GOP plan lifts the caps on tax-free flexible spending accounts. That benefit is largely used by wealthier Americans, especially at higher income levels, since people on the middle and lower ends of the spectrum often have difficulty setting aside money for future emergencies. Like Trump's proposed child care credit (which is sometimes called the "nanny tax cut"), this provision is a "gift for the rich."

One tax that the Republican plan does not eliminate is the healthcare excise tax on health plans which are costlier than average, or so-called 'Cadillac' plans.The GOP plan retains this tax, but delays its implementation. This tax is based on bad economic theory. It disproportionately targets working Americans, which is why Barack Obama campaigned against it in 2008 before later embracing it.

Despite their nickname, 'Cadillac' plans are not especially generous. Costs are largely driven by the plan's membership, its location, and other factors not related to benefits.

Why was this tax retained? Perhaps because it has little value for wealthy Americans, who aren't likely to depend on employer benefits.

The Republicans have another gift, for a select group of wealthy individuals: healthcare executives. The Affordable Care Act capped the tax deductibility of executive pay at $500,000 per year. Republicans want to remove that provision, although they struggled to rationalize that move. "Unlike Obamacare," an anonymous Republican told Politico, "we do not discriminate against different industries."

The Republican plan would end a number of other taxes, too, including a tax on tanning salons.

Naturally, all these giveaways to the wealthy come with a price tag. Who pays?

Anybody who currently gets healthcare through the ACA exchanges will suffer under the Republican plan. The average enrollee will face more than $2,400 in additional costs by 2020, according to one study,whose authors found that

For families with a head of household age 55 to 64, the bill would increase costs by $7,604. For families with income below 250 percent of poverty, the bill would increase costs by $6,228.

Those figures would get worse over time, because of the GOP plan's design.

Older Americans who don't yet qualify for Medicare will certainly suffer. The Republican bill allows insurers to charge up to five times as much in premiums for people who are approaching age 65. The AARP found that premiums would rise by as much as $3,600 for a 55-year old earning $25,000 per year, $7,000 for a 64-year old earning the same amount, and up to $8,400 for a 64-year old earning $15,000 a year. Out-of-pocket costs would probably rise "significantly," too.

Medicare recipients would be hurt by the GOP plan, as Nancy Altman points out, since those tax cuts for the wealthy would deprive it of funds.

Seniors, lower-income Americans, and others who depend on Medicaid would be badly hurt by spending caps on that program.

Young people who are ill, injured, or disabled could find themselves struggling to pay high out-of-pocket costs under this plan. In fact, sick and injured people of all ages will pay a steep price, since the Republican plan lifts the ACA's requirements for minimum coverage. People who undergo medical treatment often find themselves with shockingly high out-of-pocket costs today. Under this plan, that would get much worse.

Lower-income Americans will be hurt by the Republican plan's weaker subsidies. So will middle class families whose earnings are too high to qualify for the plan's tax credits, but who still struggle to make ends meet.

While the individual mandate is removed under the GOP plan, anybody who experiences an interruption in coverage will pay a 30 percent surcharge for one year in insurance premiums. That will hurt households that are already fighting to stay above water financially, since they're more likely to find it necessary to go without insurance in the first place.

This plan would be a catastrophe for most Americans. How can it be resisted?

First, it's important to remember that the Affordable Care Act was not the ideal solution. Millions of people remain uninsured. Health care costs are still far too high, and they keep rising.

The best way to resist the Republican plan is by defending what we have - and fighting for healthcare that works for all the American people.

In the meantime, it's important to remember that Trump and his fellow Republicans haven't really created a "health" plan. They've created a "wealth" plan for their rich benefactors. This plan won't just make people sicker. It will make the economy sicker, too, and we'll all pay the price.

Richard (RJ) Eskow is a journalist who has written for a number of major publications. His weekly program, The Zero Hour, can be found on cable television, radio, Spotify, and podcast media.

The Republicans' plan to replace the Affordable Care Act is a disaster for the health of the American people. But that may be nothing more than a byproduct of the bill's main impact: it will increase inequality, and make the rich even richer than they've become in the last few decades.

It's not a "health" plan. It's a wealth grab for the already wealthy. Its benefits will go, first and foremost, to billionaires who make more money from investments than from work. The 400 highest-earning households in the country will get an average tax break of $7 million per year under the Republican plan.

"The middle class is dying all across America. More precisely, it's being murdered. The Republican "health" plan would be one more nail in its coffin."

Who will benefit the least? Teachers, nurses, firefighters... pretty much anyone who works for a living.

If this plan becomes law, the rich will get richer, most other people will lose out, and our nation's already record-high levels of inequality will become even worse.

The middle class is dying all across America. More precisely, it's being murdered. The Republican "health" plan would be one more nail in its coffin.

Four decades ago, the top 1 percent of the nation's earners received about 10 percent of the nation's income, while the bottom 50 percent earned about 20 percent. Today those numbers have been reversed:

Income gains, which were much more fairly divided in the decades after the Second World War, have been going almost exclusively to the ownership class in recent decades:

Meanwhile, the top marginal tax rate plummeted from 92 percent in the early 1950s to 39.6 percent today.

But, as bad as income inequality has become, the inequality in wealth (including assets like real estate, stocks, and other investments) is far worse:

The top 10 percent of Americans makes just over 20 percent of the nation's income, but owns 76 percent of its wealth.

The United States ranks near the bottom in global rankings of wealth inequality. The amount of wealth owned by the top 0.1 percent has reached levels we haven't seen since the Great Depression:

The wealth of the Forbes 400, a list of the nation's richest households, is soaring:

Today, just four American families own as much wealth as 40 percent of the entire population. The Koch Brothers, who provide funding for Republican campaigns and far-right causes, head up two of those four households.

The Koch Brothers invested heavily in efforts to repeal the Affordable Care Act - and now they stand to save a great deal of money from that effort.

The Republicans call their plan the "American Health Care Act," presumably to suggest that the Affordable Care Act was somehow unpatriotic. But what's patriotic about giving hundreds of billions of dollars in tax savings to people who have already hijacked so much of the nation's wealth?

The Republican plan would only cut taxes for individuals making $200,000 or more per year, or $250,000 for couples. The plan removes a surcharge of 0.9 percent on wages above those levels. But it gives its greatest savings to unearned income. The ACA imposed a 3.8 percent tax on investment earnings, which the Republican plan also removes.

This break for unearned income is a tremendous boon for the wealthiest households, who hold much of their assets in money-making passive investments.

Together, these tax cuts constitute an estimated $346 billion giveaway over ten years to households making $200,000 a year or more.

There are other breaks for the rich, too. The Republican plan removes the mandate that requires employers to provide health insurance. The wealthy are more likely to own companies or stock.

The GOP plan lifts the caps on tax-free flexible spending accounts. That benefit is largely used by wealthier Americans, especially at higher income levels, since people on the middle and lower ends of the spectrum often have difficulty setting aside money for future emergencies. Like Trump's proposed child care credit (which is sometimes called the "nanny tax cut"), this provision is a "gift for the rich."

One tax that the Republican plan does not eliminate is the healthcare excise tax on health plans which are costlier than average, or so-called 'Cadillac' plans.The GOP plan retains this tax, but delays its implementation. This tax is based on bad economic theory. It disproportionately targets working Americans, which is why Barack Obama campaigned against it in 2008 before later embracing it.

Despite their nickname, 'Cadillac' plans are not especially generous. Costs are largely driven by the plan's membership, its location, and other factors not related to benefits.

Why was this tax retained? Perhaps because it has little value for wealthy Americans, who aren't likely to depend on employer benefits.

The Republicans have another gift, for a select group of wealthy individuals: healthcare executives. The Affordable Care Act capped the tax deductibility of executive pay at $500,000 per year. Republicans want to remove that provision, although they struggled to rationalize that move. "Unlike Obamacare," an anonymous Republican told Politico, "we do not discriminate against different industries."

The Republican plan would end a number of other taxes, too, including a tax on tanning salons.

Naturally, all these giveaways to the wealthy come with a price tag. Who pays?

Anybody who currently gets healthcare through the ACA exchanges will suffer under the Republican plan. The average enrollee will face more than $2,400 in additional costs by 2020, according to one study,whose authors found that

For families with a head of household age 55 to 64, the bill would increase costs by $7,604. For families with income below 250 percent of poverty, the bill would increase costs by $6,228.

Those figures would get worse over time, because of the GOP plan's design.

Older Americans who don't yet qualify for Medicare will certainly suffer. The Republican bill allows insurers to charge up to five times as much in premiums for people who are approaching age 65. The AARP found that premiums would rise by as much as $3,600 for a 55-year old earning $25,000 per year, $7,000 for a 64-year old earning the same amount, and up to $8,400 for a 64-year old earning $15,000 a year. Out-of-pocket costs would probably rise "significantly," too.

Medicare recipients would be hurt by the GOP plan, as Nancy Altman points out, since those tax cuts for the wealthy would deprive it of funds.

Seniors, lower-income Americans, and others who depend on Medicaid would be badly hurt by spending caps on that program.

Young people who are ill, injured, or disabled could find themselves struggling to pay high out-of-pocket costs under this plan. In fact, sick and injured people of all ages will pay a steep price, since the Republican plan lifts the ACA's requirements for minimum coverage. People who undergo medical treatment often find themselves with shockingly high out-of-pocket costs today. Under this plan, that would get much worse.

Lower-income Americans will be hurt by the Republican plan's weaker subsidies. So will middle class families whose earnings are too high to qualify for the plan's tax credits, but who still struggle to make ends meet.

While the individual mandate is removed under the GOP plan, anybody who experiences an interruption in coverage will pay a 30 percent surcharge for one year in insurance premiums. That will hurt households that are already fighting to stay above water financially, since they're more likely to find it necessary to go without insurance in the first place.

This plan would be a catastrophe for most Americans. How can it be resisted?

First, it's important to remember that the Affordable Care Act was not the ideal solution. Millions of people remain uninsured. Health care costs are still far too high, and they keep rising.

The best way to resist the Republican plan is by defending what we have - and fighting for healthcare that works for all the American people.

In the meantime, it's important to remember that Trump and his fellow Republicans haven't really created a "health" plan. They've created a "wealth" plan for their rich benefactors. This plan won't just make people sicker. It will make the economy sicker, too, and we'll all pay the price.